Same goal, different path for Asian powerhouses

Our previous three reports discussed the proactive approaches these Asian powerhouses - namely, 1) Hong Kong, 2) Singapore, and 3) Dubai - are taking towards the blockchain market, offering guidelines for entry into these burgeoning areas. These countries are all eager to unlock new opportunities in the digital asset market and are racing to open their doors to innovation.

However, on closer examination, there are unique regulatory and policy differences in each country. These necessitate Web3 projects to strategically choose their bases to best suit their circumstances and objectives. This report will distill the key points from our investigations in Hong Kong, Singapore, and Dubai to assist Web3 projects that are contemplating an Asian base of operations.

Recap of key takeaways

History

Each country is embracing the digital asset market for varying reasons, but Hong Kong stands out. Despite the so-called 'China Risk' due to its relationship with mainland China, Hong Kong also serves as a stepping-stone into the Chinese market. In other words, it’s a territory where market regulations can change abruptly but also offers access to a much larger market opportunity.

License Requirements

The prerequisites to acquire a license in these regions are generally similar to those for obtaining typical financial licenses; there aren’t expected to be significant peculiarities. There are, however, some distinct differences to note. Hong Kong, for example, sets clear standards for tokens that can be listed. Singapore has spent considerable time fine-tuning its regulations, resulting in reduced uncertainty. Dubai, on the other hand, goes beyond the usual functions of a stock exchange and includes a wider range of businesses, like margin trading.

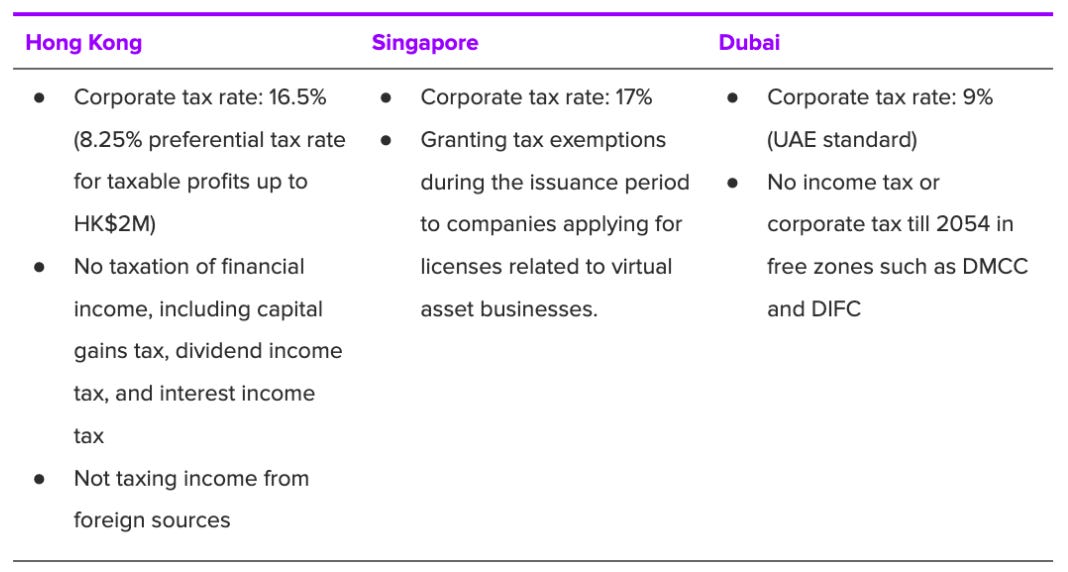

Tax benefits, including corporate taxes

On the surface, Dubai appears to have an edge with its corporate tax policies. However, the company's income, expenses, and other factors need to be classified and recorded in accordance with specific laws to determine the actual tax payable, so these figures should only be used as a reference.

Identify by purpose of project

Hong Kong: The gateway to mainland China

Historically, Hong Kong has served as the gateway to the Chinese market. Most believe that the recent changes in Hong Kong's digital asset regulations are influenced by China, and there is a prevailing expectation that Hong Kong will act as a testing ground for digital asset transactions on the Chinese mainland.

Therefore, if a Web3 project is targeting the Chinese market, it could strategically develop its global operations in Hong Kong. While building relationships and monitoring regulatory changes, it might consider an eventual entry into China. However, the ongoing 'China Risk' tied to Hong Kong's complex relationship with mainland China remains, with higher uncertainties stemming from geopolitical risks.

Singapore: Smooth Business Development Amidst Regulatory Clarity

Singapore has rapidly established and consistently improved its digital asset regulations, enhancing the certainty for projects. For businesses looking to operate with the lowest possible risk in these uncertain times, Singapore appears to be an excellent choice.

Dubai: Business Operations Based on Significant Tax Benefits

For any business, net income is more important than revenue. While cost-cutting is important, corporate tax can significantly influence net income, making it an indispensable element. Dubai offers unparalleled tax benefits through its free zones, outshining other nations in this regard. However, it is important to note that Dubai is known for its complex process and many preconditions for acquiring licenses for digital asset businesses. There may be obstacles in obtaining a license, and the corporate tax amount can vary depending on the structure of each corporation.