2024 Asia Cryptocurrency Market Report: A closer look

Analyzing key Asian countries with Kyros Ventures

TL;DR

Young demographic in Asia are investing in crypto: Young people between the ages of 18 and 39 make up about 90% of the crypto investing population in Asia.

Differences in crypto investment expectations between Thailand and South Korea: Crypto investors in Thailand expect a return of $10.4 for every $1 invested. South Korean investors take a more conservative approach and expect a return of $2.6 for every $1 invested.

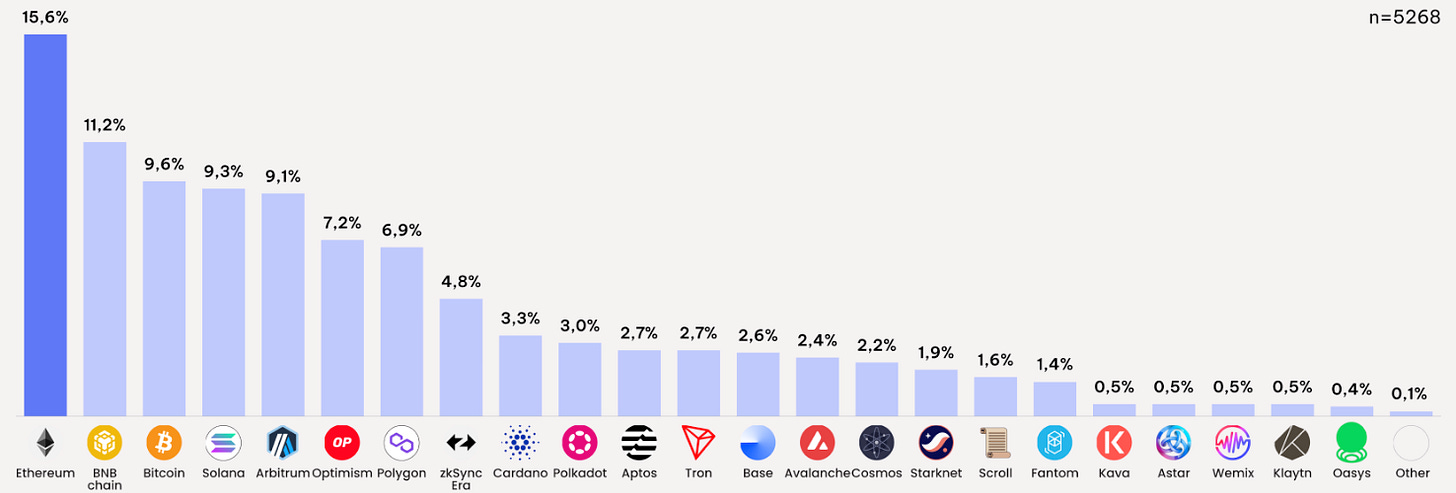

Blockchain ecosystem trends and outlook: Ethereum and BNB chains continue to maintain high interest. In mid-2023, the resurgence of the inscription trend and the rise of NFTs and meme coins pushed Bitcoin and Solana to the forefront of the market.

Tiger Research recently published the Asia Cryptocurrency Market Report in collaboration with Kyros Ventures, Vietnam's largest crypto VC. The document provides insights into the Asian cryptocurrency market based on surveys from five countries including Greater China, and reflects the deep industry knowledge of Kyros Ventures and Tiger Research.

This report aims to provide a deeper understanding of the key findings of the Asia Cryptocurrency Market Report by adding supplementary insights and commentary. For more information on the Asia Cryptocurrency Market Report, please follow the link provided.

Crypto investment fever among the younger generation

If we look at the age distribution of people investing in the crypto market in Asia, young people between the ages of 18 and 39 account for about 90% of the total. Compared to the U.S. market, this indicates a higher proportion of young investors in Asia. According to data from research firm Morning Consult, in the US, investors under the age of 40 make up about 70% of total crypto investors. This phenomenon of a high percentage of young people investing in cryptocurrencies in Asian markets is closely related to their social and economic background.

There is relatively low trust in the traditional banking system and limited access to financial services in many of Asia's major developing economies. These limitations contribute to the growing interest in financial transactions and investments through cryptocurrencies.

Economic inequality and limited opportunities for upward mobility create a strong motivation for economic independence and wealth accumulation in many Asian countries, especially among the younger generation. The high volatility of the cryptocurrency market carries risks, but it also offers the potential for high returns in a short period of time. This can be particularly appealing to younger Asian populations who are open to change and innovation and seek to gain wealth rapidly.

Contrasting investment expectations between Korea and Thailand

Crypto investors in Thailand have higher return expectations than in other countries. For every $1 invested, they expect a return of $10.4, a 10x return. This significantly exceeds the average expectation of global crypto investors, which is $6.7. In contrast, crypto investors in South Korea are much more conservative, with an expected return of $2.6 on a $1 investment. These expectations are likely due to differences in prior investment experience between Thai and Korean investors.

In Thailand, the cryptocurrency market has developed in the absence of a fully developed securities market. This may have played a crucial role in the high expected returns on cryptocurrencies among Thai investors. The number of securities accounts in Thailand is about 8% of the population, and there are about half as many crypto accounts as securities accounts. This is a much higher ratio compared to South Korea, which suggests that the crypto market is developing alongside the securities market.

Considering that the stock market is relatively more stable than the crypto market with lower expected returns, investors in Thailand may have seen the crypto market as a better opportunity to generate revenue as it emerged before the traditional financial market was sufficiently developed. In South Korea, the cryptocurrency market developed after the traditional financial market was sufficiently developed, as evidenced by the number of securities accounts outnumbering the population.

The high level of activity in the gambling market also seems to have played a part in the high expected returns in Thailand. According to a report published by the Center for Gambling Studies (CGS), 30.42 million people, or 42% of the Thai population, were found to be gambling as of 2019. This includes government-issued lotteries but shows the country has a high level of expected returns nonetheless.

Solana's rise in an Ethereum- and BNB-driven ecosystem

Ethereum and the BNB chain continue to be two of the leading ecosystems that have steadily garnered high interest among cryptocurrency investors. In particular, the Ethereum developer community is the largest among its competitors in Vietnam, which has a trickle-down effect on related EVM chains. BNB chain continues to grow due to its high visibility and largest number of users.

Until mid-2023, Arbitrum and Polygon were the top 3 and 4 ecosystems, but with 1) the resurgence of the inscription trend, and 2) the rise of NFTs and memecoin Bitcoin and Solana have taken their place.

Conclusion

The investment frenzy in Asia is unlike any other region, and it's expected to get even stronger as the market recovers in 2024. This report is a compilation of the three main points of the original "Asia Cryptocurrency Market Report" with additional commentary for a deeper understanding. Access to the full report is available here.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.