TL;DR

Korean Financial Services Commission (FSC) repeatedly emphasizes that tokenized securities essentially share the same nature as traditional securities through recently announced token securities guidelines.

New business opportunities emerge, such as issuer account management institutions, but challenging regulatory requirements make it more advantageous for existing financial institutions to win in the market.

The limited access for retail investors and the small deal size value may hinder the expansion of the tokenized securities market.

Introduction

Not only securities firms but also companies with intellectual property (IP) are showing great interest in tokenized securities as a new source of revenue. In particular, major securities firms are actively establishing partnerships, while IP-holding companies are preparing through meetings or MOUs with blockchain technology companies. However, the regulatory direction for security token offerings (STOs) has been somewhat unclear so far, and it has been necessary to infer based on overseas regulations. In this context, in February, the Financial Services Commission (FSC) provided a visible guideline through the "Token Securities Issuance and Distribution Regulatory System Improvement Plan," emphasizing the definitions of securities once again.

This STO series will consist of three parts, covering the overall South Korean STO market. In the first part, we will open the discussion by outlining the general content of the token securities guidelines. Many reports have already covered this topic, so we will focus on the important aspects, limitations from a business perspective, and growth potential. In the second part, we will examine the status of domestic companies' market entries and the assets they are paying attention to. Finally, in the last part, we will present possible businesses that can be considered in the domestic market.

Regulatory Announcements

Since the Financial Services Commission (FSC) announced the "Guidelines for New Securities Businesses such as Fractional Investment" last April, there have been continuous major announcements related to STO. Through each major announcement, we could partly predict the direction of STO, and with the "Token Securities Issuance and Distribution Regulatory System Improvement Plan" announced by the FSC in February, we have been able to predict foresseable furture.

Key highlights

In this guideline announcement, the most emphasized part is the "fundamentals of securities." The guidelines metaphorically describe securities as "food" and the form of issuing securities as the "container" that holds the food, reiterating that the fundamentals of securities remain the same regardless of the issuance form. In other words, the traditional issuance forms, such as income securities and investment contract securities, were simply unsuitable for holding newly emerged non-standard securities, necessitating new issuance forms. However, the fundamentals remain the same, and the relationship between the issuance forms is identical.

1. K-STO

According to the guidelines, a security token is a digitized security under the Capital Markets Act, based on distributed ledger technology. The crucial part is that disclosure, business, and market regulations under the Capital Markets Act all apply equally, meaning that all securities regulations are applicable.

2. Defenition of Securities in Korea

The guidelines provide examples of cases where the likelihood of being a security is high or low, but ultimately, stakeholders need to independently assess the applicability of the capital market laws and regulations. In other words, individual judgment is required. Among them, investment contract securities are a concept designed to supplementarily include cases that do not fall under the existing typical securities, and the application scope is widely recognized. Investment contract securities can be defined as contractual rights indicating that a specific investor invests money or other assets in a joint venture with others, and mainly receives the profit or loss attributed to the results of the joint venture carried out by others. Most businesses using new assets may fall under this category, and careful examination is required.

3. Token Securities Issuance and Distribution Regulatory System

Previously, issuers could only electronically register securities through banks and securities firms, but with token securities, issuers can directly register them as well. However, the issuer must meet the requirements of the Issuer Account Management Institution, which will be newly introduced in the Electronic Securities Act. The requirements for the financial market are generally not lenient, so it is expected that regulatory requirements similar to those of the existing securities market will apply. In other words, the structure will be more conducive to the entry of existing financial companies with the necessary infrastructure, such as securities firms, rather than existing issuers obtaining an account management institution license.

Additionally, to facilitate the formation of small-scale over-the-counter (OTC) markets, the establishment of a multilateral counter-trading platform system is being promoted, and Alternative Trading System (ATS) companies are expected to emerge. To enter this business, one must satisfy the requirements for an OTC trading brokerage, and considering the level of bond-specialized brokerage firms, it is likely that existing financial companies will have a higher chance of dominating the market early on.

Business Opportunities from the New Guidelines

1. Issuer Account Management

As mentioned earlier, the law is expected to be amended to allow issuers that meet certain requirements to become account management institutions for their own token securities. The biggest advantage of this change is that it can reduce securities issuance fees and allow issuers to structure their securities in a way that best suits the nature of their assets.

Additionally, the change is encouraging because it allows many companies to perform a portion of financial services tasks. The financial industry is one of the most challenging sectors to enter due to strict regulations, and this change is expected to bring some changes to the market by enabling more companies to participate.

2. Chain Providers (Distributed Ledger)

The guidelines mentioned several aspects related to the chain, and it is anticipated that a dedicated private chain for STOs will be required, different from the existing chain structures. In particular, the node configuration and transparency of transaction records are expected to be the main issues, so a chain that meets all the requirements and ensures user convenience is needed. Especially considering the characteristics of the financial market, the chain that takes majority share in the market first is likely to become the standard and dominate the market, making it necessary to secure a leading position.

3. Issuance Brokerage

Many issuers may not meet the requirements due to reasons such as 1) licensing requirements, 2) lack of expertise, and 3) the absence of an issuance system. Therefore, it is likely that many issuers will need to rely on issuance brokerages, such as securities companies, to issue security tokens and receive commissions through an issuance agency business.

4. Distribution Platform (i.e. ATS)

The platform for trading tokenized securities on the OTC market, such as tZero and Securitize in the US, is a benchmark business opportunity in the STO market. However, to pursue this business, companies need to meet regulatory requirements similar to those of existing financial institutions, making it difficult for startups and new companies to enter the market. Nevertheless, as a newly formed market, this business model can charge higher fees, and depending on its activity level, it is expected to generate the most revenue.

Conclusion

Through the guidelines, we were able to see a clear direction and major business opportunities. However, there are some concerns as follows.

1. Limited investment opportunities for retail investors

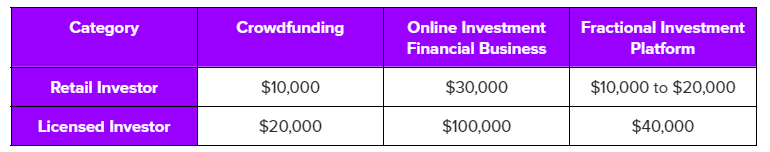

The Financial Services Commission has announced that using crowdfunding as an example, small investments will be limited in order to protect investors. The exact amount has not been disclosed, but compared to other restricted industries, it is likely that retail investors will find it difficult to invest more than $30,000 annually. Investment limitations are likely to reduce investment attractiveness and make it difficult to attract retail investors, so liquidity may also be a concern.

2. Unattracted deal size

The Financial Services Commission (FSC) has introduced a "Tier 2 small-scale offering" with a cap of $10M to protect investors. Token securities, which are highly liquid, could be used as a way to bypass offering regulations, hence the cap. However, finding deals under $10M that are attractive is challenging.

In summary, while there are new business opportunities, they are limited by restrictions on small-scale investments and low deal sizes. Companies could find success by identifying assets that appeal to and convince investors, and distributing them. In the next part, we will explore what assets Korean companies are focusing on and the strategies they are employing in this context.