TL;DR

Regional blockchain projects evolve within the economic, social, and technological foundations of their countries and play to their strengths, reflecting their unique needs and industry structure.

Regional blockchains have a strategic advantage in the local market based on 1) a deep understanding of the local market, 2) strong local networks, 3) low language barriers, and 4) responsiveness.

However, their regionalized nature can also act as a limitation: 1) it is difficult to achieve true decentralization from a global perspective, and 2) their regional bias makes it difficult for them to enter the global market

Introduction

While the blockchain industry has seen a large number of global, cross-border projects emerge, it is equally impressive to see regional blockchains evolving to meet the unique interests of each region. Regional blockchain projects evolve within the economic, social, and technological foundations of their respective countries and play to their strengths, reflecting each market’s unique needs and industry structure.

In particular, the Asian market is home to a significant number of regional blockchain projects. In this article, we will analyze regional blockchain projects in the Korean, Japanese, and Vietnamese markets and provide insights into their strengths and limitations.

The status quo of regional blockchains

Regional blockchains are deeply rooted in their geography and have distinct strengths in localization. They are essentially part of the same culture as other regional Web3 projects, which means they have close relationships, low language barriers, and operate in the same time zone. This in turn is conducive to business development and technical support between regional blockchains and projects. There are many other advantages of regional blockchains, and we'll take a closer look at them through the examples in South Korea, Japan, and Vietnam.

Korean regional blockchains

Korean regional blockchains share a commonality in that they all started as subsidiaries of large Korean companies. They are growing rapidly mainly due to the strong influence of the parent company in their region mainly by:

Expanding their business by utilizing the already well-established infrastructure and resources of the parent company

Utilizing the influence of the parent company to partner with other leading companies

Leveraging the technological advantage of the parent companies, which are mainly successful tech companies.

Klaytn has been able to onboard successful domestic projects such as DeFi Kingdom and Superwork. Major game companies such as Kakao Games' “Bora” and Netmarble's “MarbleX” have also utilized Klaytn as their mainnet. As such, regional blockchain projects can gain a strategic advantage by leveraging their deep understanding of the regional market and extensive local networks.

Japanese regional blockchains

Astar Network (Astar), a leading regional blockchain project in Japan, has developed rapidly within the country's cautious and conservative business culture. A key factor in this growth is that Astar has been able to build strong relationships with the Japanese government and private enterprises based on a deep understanding of the regional market. In addition, through the establishment of Astar Japan Lab and Startale Labs, Astar has been able to develop Web3 use cases in Japan and expand its influence in the Japanese market by fostering long-term relationships.

Japan's gaming-specific regional blockchain, Oasis, also shows significant progress in the area. Like Astar, Oasis seems to have strengthened its position with a strong understanding of the Japanese market. In addition, the founders' backgrounds may also have played a role, as the founding members include the COO of SEGA, the CEO of Bandai Namco Research, the founder of Gumi, and the founder of Double Jump Tokyo. Their backgrounds are likely to have had a significant impact on their participation in governance and partnerships with major Japanese AAA game companies.

Vietnamese regional blockchains

Finally, there is Vietnam's leading regional blockchain, Viction (formerly TomoChain). With a deep understanding of the regional market, Viction has made significant progress in Vietnam. In 2020, it partnered with the Vietnamese Ministry of Education to launch a blockchain-based diploma issuance project. This is believed to be due to the company's ability to quickly detect and respond to changes in the regional market, which is why it has been selected for national projects where reliable operation is key. In addition, information security is also a sensitive issue for state-led projects, so a regional blockchain would have had an advantage. As such, regional blockchains have a strategic advantage in local markets and can be relied upon more than global blockchain projects in a competitive situation.

Advantages of regional blockchains

Regional blockchains can have a strategic advantage in local markets based on four factors:

Understanding of the local market: A deep understanding of the local market and cultural familiarity can help you gain a deeper understanding of the regional business.

Strong regional networks: Regional blockchains can quickly scale their business based on strong regional networks and partnerships.

Low language barrier: It is relatively easy to build a regional community (users, developers) due to the low language barrier.

Responsiveness: Regional blockchains are rapidly improving through technological development and innovation to meet regional market characteristics and requirements, creating new business opportunities.

The ability for regional blockchain technology to be customized to the respective market characteristics can be an important factor in certain markets. This is especially the case when the storage and processing of data is geographically restricted. The Vietnamese government's cybersecurity law limits the storage and processing of Vietnamese user data within Vietnam, which may limit the entry of foreign blockchain projects. In addition, the Korean government also imposes geographical restrictions on the data of public institutions and financial institutions to be processed only within the country. This tricky regulatory landscape can be where regional blockchains shine.

Limitations of regional blockchains

As can be seen, regional blockchains have a number of strategic advantages in local markets. However, its characteristics can also be a double-edged sword.

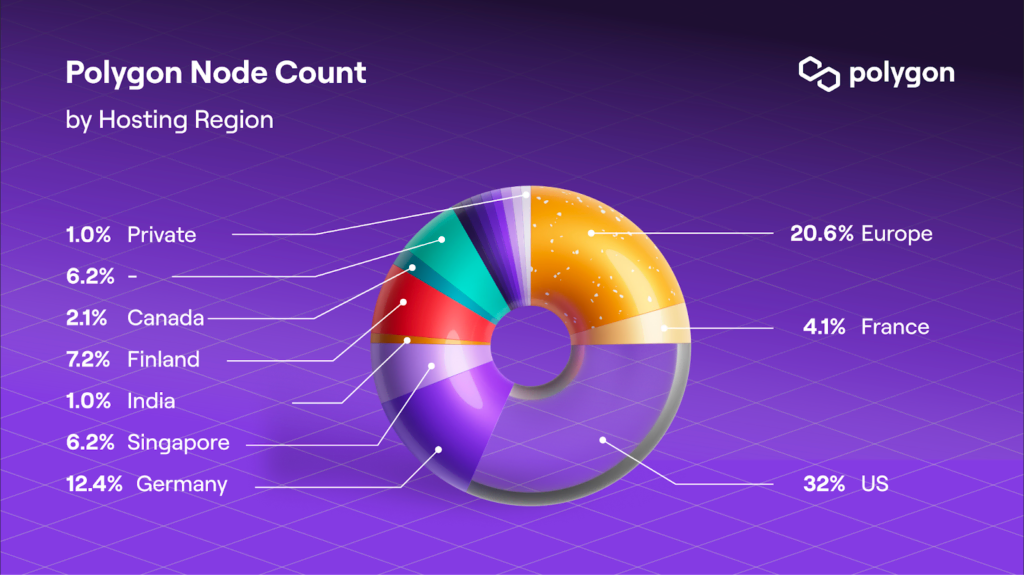

First, regional projects may have difficulty achieving a high level of decentralization. Nearly half of Klaytn's node validators are currently based in Korea, and about 30% of the total staking of node validators are Kakao affiliates. On the other hand, Polygon, a global project, has a relatively wide geographic distribution of node validators, which contrasts with the low decentralization of regional blockchains.

The second limitation is that regional blockchain projects may have a harder time scaling globally. This is because the existing community and documentation may be predominantly in a specific language, making it difficult to engage with global users who speak different languages. This further reinforces the regional bias. In fact, the traffic of many regional blockchain websites shows that the majority of visitors come from the region where the project is based.

Conclusion

While regional blockchain projects have their unique strengths, there are also clear limitations. Local strategies and networks can be advantageous for capturing regional markets. However, they can also be a barrier to global expansion, creating new challenges in overcoming various regulations and cultural differences. Therefore, regional blockchain projects need a broader perspective and an innovative approach to compete in the global market. They should also spend a lot of time devising strategies to harmonize the various requirements between global and regional markets.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.