TL;DR

With the world's fourth-largest population, Indonesia is a country primarily composed of a young demographic, with a median age of 31.1 years. This factor contributes to its potential as a highly promising global gaming market, currently ranking 16th in terms of size.

Indonesian government is implementing favorable policies for innovative startups, including those in the blockchain industry. The nation boasts a higher understanding and proactive attitude towards blockchain and cryptocurrency compared to other Southeast Asian countries, actively striving to advance the Web3 industry.

Starting in 2021, Indonesia began to develop projects with significant growth potential within the Web3 industry. These efforts align with the government's agenda to revitalize the gaming industry, and the market is expected to experience substantial growth in Web3 gaming when the crypto summer returns.

At present, international gaming companies from the United States and South Korea are scrambling to enter Indonesia's massive market of 280 million people. However, due to their inherent competitiveness, smaller-scale Indonesian game projects are also expected to emerge and compete effectively within their domestic market.

Introduction

Interest in Southeast Asia's blockchain gaming market has surged. This is due, in part, to (1) the region's success in establishing Play-to-Earn (P2E) games such as Vietnam's Axie Infinity, and (2) the significant presence of users with minimal resistance to Web3 games.

Until recently, Southeast Asian countries were perceived as major consumption regions for gaming and media content, yet their low per capita spending power and ARPU (Average Revenue Per User) were seen as drawbacks in terms of investment efficiency.

However, the Web3 market has rekindled interest and optimism, with expectations that the situation may change. This newfound optimism stems from several factors: (1) The majority of the region's population ar GenZs, the end-users of blockchain games like P2E; in Indonesia and Vietnam, the median age is 31. (2) The rapidly evolving educational and industrial environment, which now supports the inception of globally competitive startups (e.g., Singapore's Grab and Indonesia's Gojek). (3) The region's population has a more positive perception and acceptance of blockchain and cryptocurrency compared to other countries. These favorable conditions have placed Southeast Asia's blockchain gaming market in the spotlight, setting the stage for its continued growth and development.

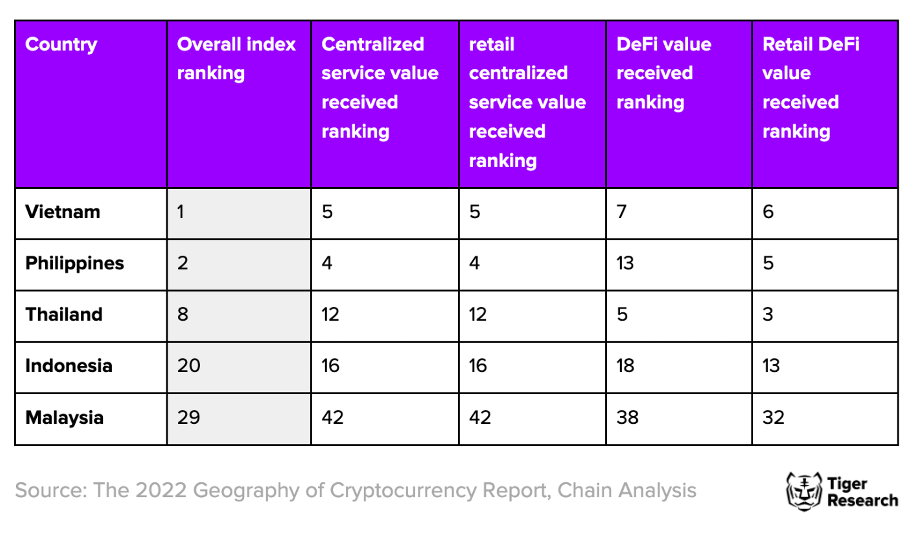

In fact, according to the Global Crypto Adoption Index released by Chain Analysis, the majority of Southeast Asian countries rank highly in adoption rates. In an interview with Kin Wai Lau, the founder of iCandy Interactive, it was revealed that most young people in Southeast Asia are more familiar with NFTs than stocks or real estate, indicating an optimal environment for blockchain mass adoption.

Furthermore, through independent analysis by Tiger Research, it has been found that Indonesia, the Philippines, Vietnam, and other key Southeast Asian countries demonstrate the potential to play a pivotal role in the Web3 industry across various metrics.

In conclusion, the Southeast Asian region's unique combination of a young, tech-savvy population, high levels of crypto and blockchain adoption, and growing economic development positions it as a prime location for the expansion and success of the Web3 gaming market.

Narrowing the focus to Web3 gaming, Vietnam and the Philippines are mentioned as the largest markets in the region. However, Indonesia has recently gained attention as (1) Asia's third-largest market after China and India, and (2) a rising nation with positive market perception and regulations regarding crypto. Additionally, (3) the shift in perspective from consumers to producers aligns with changing trends, generating even greater expectations for the country's growth in this sector. For instance, the prominent Korean gaming company 'NEOPIN' chose Indonesia as its base for expansion into Southeast Asia.

In this context, it is essential to analyze the rapidly emerging Indonesia as a new player in the blockchain gaming market and explore whether it can keep up with neighboring countries like Vietnam and the Philippines in the future. By investigating the unique factors contributing to Indonesia's potential in the Web3 gaming market, we can better understand its role as a major player in the industry alongside other key Southeast Asian nations.

Indonesia's Government Focusing on Promoting the Gaming Industry

The Indonesian government has been actively pursuing crypto-friendly policies overall. One notable example is their strong interest in issuing a Central Bank Digital Currency (CBDC) and even considering launching a government-led cryptocurrency exchange. In addition, they have announced regulations for cryptocurrency and exchange operations, leading to the emergence of 28 legal exchanges within the country. Friendly gesture has resulted in significant tax revenue for the Indonesian government, with a total of $18M collected in value-added and income taxes from cryptocurrencies since May 2022.

When it comes to regulations related to Play-to-Earn (P2E) games, there are rules stating that in-game currency cannot be used as real-world assets, and the use of cryptocurrencies in traditional transactions is prohibited. However, these rules do not directly regulate P2E games, suggesting that alternative methods of monetization may be possible. There are no specific regulations regarding NFT trading, implying that it is permissible as long as it is not used as a substitute for everyday transactions.

Furthermore, the Indonesian government is dedicated to fostering the gaming industry as the next growth sector. Consequently, it is reasonable to expect a positive outlook for future blockchain gaming-related legislation. The Indonesian state-owned telecommunications company, Telkom Indonesia, actively supports the gaming industry through its content distribution subsidiary, Melon, by leading the publishing of domestically produced games and organizing E-Sports gaming tournaments.

In a recent interview with an Indonesian government relations expert, it was mentioned that "the Indonesian government welcomes the growth of innovative startups and their confrontation with traditional industries. They believe that Indonesia can leap forward amidst such conflicts and tensions." This statement leaves a hopeful message for the future of the gaming and crypto industries in Indonesia.

Indonesia's Blockchain Gaming Landscape

Up until recently, various genres of games have been launched and gained popularity in the Indonesian blockchain gaming market. However, unlike Vietnam's Axie Infinity, no representative game has yet dominated the domestic market. As a result, the competition between game companies has intensified, transforming Indonesia into a battleground for blockchain gaming.

Web 3 Games launched in Indonesia

As of now, the Indonesian blockchain game market is mostly driven by foreign game companies from countries like South Korea and the United States, which have released P2E (Play to Earn) games. This is due to foreign game companies (1) utilizing famous IPs with a proven track record to increase their competitiveness, and (2) adopting the F2P2E (Free To Play To Earn) model, which allows new gamers to easily access the games.

Additionally, the relatively nascent Indonesian gaming ecosystem may have influenced this situation. Although Indonesia is the largest game market in Southeast Asia, its domestic game development studios are still in their early stages, with only a few players in the market. This has led to a relatively low level of self-reliance in the gaming industry compared to the market size. In fact, as of 2021, only about 1.4% of game developers in Indonesia had annual revenue exceeding 2 billion Rupiah (approximately $130,000 USD). Furthermore, Indonesian game studios have (1) primarily worked as subcontractors for foreign companies rather than independently developing games and (2) faced an educational environment that makes it difficult to train the necessary talent for game development.

Despite the currently weak performance of Indonesia's blockchain game industry, it is expected to improve in the future. This is due to (1) the Indonesian government's efforts to promote the domestic gaming industry, (2) the high familiarity of Indonesian gamers with blockchain technology, and (3) the active utilization of blockchain infrastructure for purposes such as in-game payments and asset management, especially by indie game companies that have struggled with inadequate financial infrastructure.

Indonesia-built Web 3 Games

Indonesia's gaming industry is making waves as it sets its sights on breaking out of the casual gaming sphere. With 'Mythic Protocol,' created by the founder of Indonesian game development company Agate, and 'Avarik Saga,' which attracted investment from Indonesia's largest venture capital group, the country's gaming scene is showing promising potential for upgrading to the next level.

Both game companies have received praise for their ability to elevate the quality of Indonesian games, fueling optimism for the industry's future. As these innovative developers continue to push boundaries and redefine what's possible in the world of gaming, the Indonesian market is poised for significant growth and increased global recognition.

Blockchain Games Gain Traction Among Indonesian Gamers

According to a study conducted by global cryptocurrency exchange Crypto.com, Indonesian gamers show a higher rate of participation in blockchain games than their counterparts in the United States and the United Kingdom. Furthermore, the level of resistance towards blockchain gaming is significantly lower in Indonesia.

This can be attributed to the fact that, similar to other Southeast Asian countries with lower average wages, Indonesian gamers are utilizing blockchain games as a means of economic activity. Play-to-earn (P2E) models have been particularly appealing in this regard, offering additional incentives and opportunities for financial gain.

In addition to serving as a means of livelihood, blockchain games are also gaining traction among players who simply seek “fun”. In the 2022 Indonesian Presidential Cup E-Sports tournament, the local blockchain game "Battle of Guardians" was selected as one of the featured games, garnering significant public interest. The YouTube video of the game's competition received over 150,000 views, demonstrating that blockchain games are not solely regarded as tools for profit, but also as a source of entertainment for many users.

This serves as a positive example of how leveraging the additional content offered by blockchain games can help drive their adoption and popularity among the general public. The success of "Battle of Guardians" showcases the potential for blending blockchain technology with engaging gameplay, creating an attractive and accessible gaming experience for users.

Conclusion

The Web3 industry is just beginning to take off, offering equal opportunities to countries beyond the traditional global market leaders such as the United States, Japan, and South Korea. In particular, Indonesia shows a very positive outlook from a macro perspective, given its (1) sizable young population, (2) impressive advancements in education and industry environments compared to the past, boasting an abundant pool of talent capable of undertaking global-level projects, and (3) clear national recognition of the Web3 industry as a driving force for growth.

While the current self-sufficiency of Indonesia's domestic gaming industry leaves room for improvement, there is ample opportunity for a turnaround in the future. In fact, the entrance of foreign gaming companies into the Indonesian market will likely have a positive impact by expanding the market's overall size. The government's active stance on the Web3 and gaming industry, combined with the Indonesian population's familiarity with mobile games, suggests that casual indie game developers can be competitive in this landscape.

As the market continues to grow, a battle between established players and new entrants vying for control is expected. However, the overall trend is predicted to be positive, with the market size expanding and providing more opportunities for innovation and growth.