TL;DR

Axie Infinity is an iconic Web3 game, but some consider it a failure.

Nonetheless, Axie Infinity is committed to continuous improvement and reinvention, with a particular focus on expanding its IP-based gaming ecosystem.

The company still faces a number of challenges, including stable tokenomics operations and network security.

Introduction

Axie Infinity is an iconic name in Web3 gaming. It was the first to introduce the Play-to-Earn (P2E) model, marking a new chapter on the gaming industry. Axie Infinity introduced a new paradigm of gaming where players can create real value and earn financial rewards. This is considered to have played an important role in expanding the potential of Web3 technology and broadening its application.

However, all has not been smooth sailing for Axie Infinity. External factors such as token deflation, massive hacking incidents, and crypto winters constrained its growth. The subsequent sharp decline in token prices gradually removed the project from public interest. Nevertheless, Axie Infinity has continued building. With the recent recovery of the cryptocurrency market, it has begun to regain traction. In this report, Tiger Research takes a look at the current state of the Axie Infinity to gauge its comeback potential.

Why did Axie Infinity struggle?

As a leader in P2E gaming, Axie Infinity has garnered a lot of attention from the public. It was popular in Southeast Asia, especially in the Philippines and Vietnam, as the money earned from playing the game far exceeded the average monthly salary in those countries.

At the peak of its popularity in 2021, Axie Infinity had 2.7 million daily active users (DAUs). The game's developer, Sky Mavis, was valued at around $3 billion. This is a huge valuation, comparable to that of South Korean gaming giant Kakao Games. Moreover, the token prices within the Axie Infinity ecosystem had risen significantly with the revitalization of the crypto market, which further accelerated the influx of users.

After 2022, the situation reversed sharply, with all of Axie Infinity's metrics plummeting sharply. DAUs dropped from 2.7 million to 350,000, a drop of about 90%. The price of AXS plummeted by about 99% from its peak.

Three major reasons can be attributed to why Axie Infinity experienced such a steep decline.

Tokenomics lacking in long-term stability

Losses from large-scale hacks

Loss of token value due to macroeconomic headwinds

First, Axie Infinity operated on a tokenomics model that lacked sustainability over the long term. In Axie Infinity, players nurture a virtual life form, Axie, and earn SLP tokens as rewards for gameplay. These tokens are spent within the game ecosystem and can be used to purchase and breed Axies. The tokens can be easily cashed out through exchanges, which was a huge incentive for people to join in.

However, the situation began to reverse when a combination of factors led to an increasingly large number of players cashing out. This led to overselling and a sharp drop in token prices. With reduced profitability, which is the core of any healthy P2E model, this created a "death spiral" for Axie Infinity that led to a drastic decline in new player inflows.

The second reason is a massive hack affecting the overall trust in the ExInfinity ecosystem. In March 2022, Sky Mavis' Ethereum sidechain, the Ronin Network (Ronin), was attacked. In the process, $700 million in ETH and USDC was stolen. The root cause of the problem was that Ronin had limited the number of validator nodes to improve performance, without ensuring that they were secure enough.

At the time, Ronin consisted of nine validator nodes, and withdrawals could only be made if five or more nodes authorized them. This made it easy for hackers to steal the funds. The incident was a major blow to the network's reliability and hurt the ecosystem as a whole, causing the token price to plummet.

Finally, the worsening macroeconomic conditions and the bear market negatively impacted token prices. Since 2022, various bad news in the crypto market, such as the Terra-Luna incident and the FTX bankruptcy, as well as the macroeconomic downturn, have led to worsening token prices. Since the majority of P2E users and investors were aiming to monetize the token, this change had a greater impact on the Axie Infinity ecosystem and may have accelerated the "death spiral" phenomenon.

Can Axie Infinity rise to the challenge?

Currently, the token price, trading volume, and DAU for Axie Infinity have not recovered to even half of their previous levels. This is a common problem for most P2E games. Many that fail to overcome this problem have faced shutdowns. However, Axie Infinity has been making continuous efforts to overcome the challenges it faces.

Expanding the Axie Infinity IP-based gaming ecosystem

Granting commercial rights to Axie Infinity NFT owners

Evolving to an e-sports-friendly game

① Expanding the Axie Infinity IP-based gaming ecosystem

Axie Infinity plans to attract more players by expanding its game ecosystem based on the Axie Infinity IP. Going beyond the traditional genre of turn-based strategy games, the team is focused on developing games in a variety of genres, including racing, fighting, and MMORPGs, utilizing the Axie Infinity IP. This approach was likely aimed at attracting a broader fan base and further strengthening the sustainability of the IP.

Another important feature is that these games are organically connected. Players will be able to evolve their Axie NFTs with experience gained from playing games developed by Sky Mavis utilizing the Axie Infinity IP, such as Axie Infinity Origin and Project T. This diversification of genres shows the teams’s commitment to providing players with a richer and more expansive experience through organic connections between games.

In addition to developing its own games, Axie Infinity is also actively partnering with external game developers. In 2023, it announced a collaboration with Bali Games, the team behind the popular South Korean mobile game Anipang, to develop Axie Champions. This new title is a casual game based on Axie IP. The game will utilize Axie NFTs to integrate seamlessly with the Axie Infinity ecosystem and is expected to contribute to IP expansion and ecosystem diversification.

Axie Infinity’s ecosystem expansion is further bolstered by its support for indie game developers and the community. The company has provided direct support for game development through measures such as the Axie Builder Program and the Axie Game Jam. It has also open-sourced the Axie Infinity character creation toolkit to encourage community-driven game development. There are currently more than 100 games in development that utilize the Axie Infinity IP, demonstrating its infinite scalability.

② Granting commercial rights to Axie Infinity NFT owners

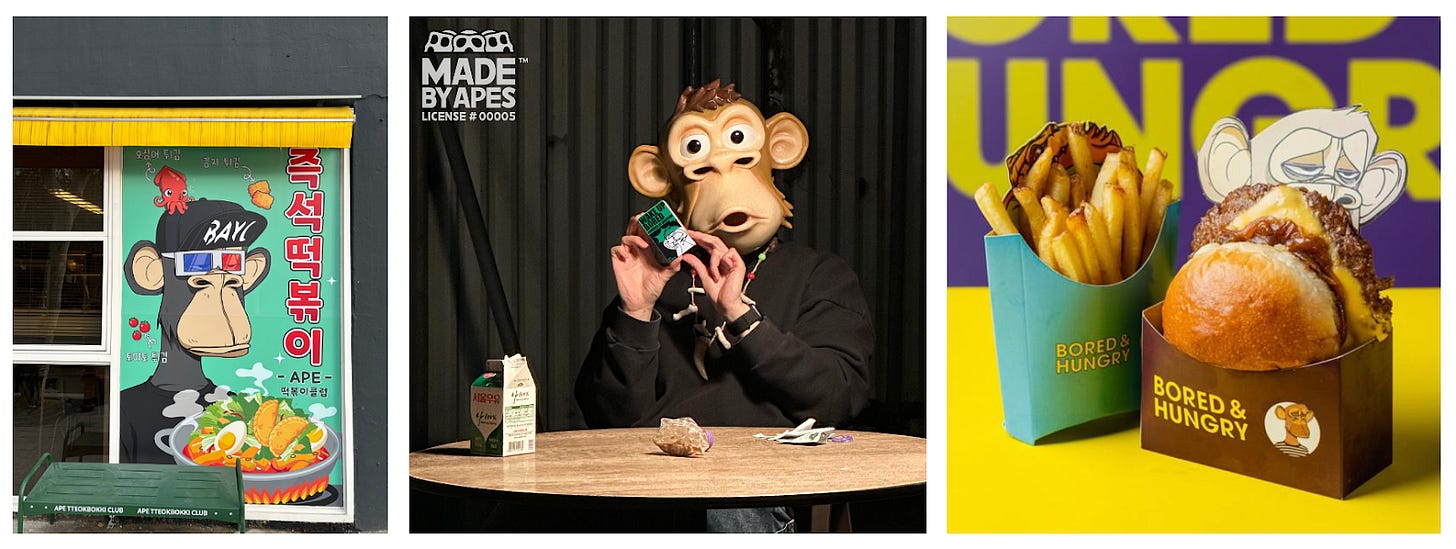

Another notable measure is that Axie Infinity has granted commercial rights to the owners of the Axie NFTs. Instead of limiting the IP to just games, they expanded its reach and possibilities as a content IP. The company recently released official Axie Infinity merchandise to promote the commercialization of the characters and allow certain Axie NFT owners to create and sell their own merchandise.

This strategy is similar to the commercial use case of images from the global NFT project Bored Ape Yacht Club (BAYC), and demonstrates the potential for Axie Infinity IP to broaden its reach beyond the gaming realm. It is also an innovative attempt to provide additional value-creation opportunities for users, and suggests that Axie Infinity is open to expanding beyond a simple P2E model to a Create-to-Earn (C2E) model.

③ Evolving into an e-sports-friendly game

Finally, Axie Infinity is looking to popularize its IP through e-sports. By incorporating an in-game "e-sports mode" and hosting a variety of Axie Infinity tournaments, the team is working to attract not only game players but also e-sports fans.

This strategy is expected to broaden the fan base and create additional monetization opportunities. By utilizing esports as media content, Axie Infinity can widen its engagement with audiences who do not play the game directly. The eSports feature is also significant because it adds dynamic gameplay to casual games that can otherwise feel monotonous.

Is there anything else Axie Infinity needs to address?

Despite the team’s efforts, there are still several issues surrounding the project. In particular, it is questionable whether the tokenomics of Axie Infinity is sustainable in the long run. To date, AXS, SLP, and Axie NFTs are still suffering from deflation in the ecosystem.

Axie Infinity is experimenting with various methods to find a solution. For instance, the team is trying methods such as limiting the token supply or updating new token-burning mechanisms like Ascend. They have also adopted a free-to-play (F2E) model, offering free starter packs to lower the entry barrier users face with rising token prices. As there is no proven formula to creating a successful X2E model yet, Axie Infinity is also expected to continue to evolve based on their past experiences and ongoing trial and error.

The security of the Ronin network is also an issue that needs to be addressed. While the number of validator nodes has increased from 9 to 22 and the number of nodes required for minimum consensus has also increased, it is still low compared to other mainnets. This is further illustrated in Solana's “Validator Health Report Oct 2023”, which shows the low number of Ronin validators compared to Ethereum. Of course, there is a tradeoff between performance and security, but it is also important to ensure that the network is secure enough to be trusted.

Conclusion

Axie Infinity has become a monumental project in the field of Web3 gaming but also considered by some to be a failed endeavor. Nevertheless, Axie Infinity has been working tirelessly to continuously improve and reinvent itself. In particular, it has been actively updating its tokenomics operations and releasing new content such as Axie Infinity: Homeland. In May 2023, Axie Infinity games were approved for release on Apple's App Store in Latin America and Southeast Asia, improving its accessibility.

Centered around the Ronin ecosystem led by Sky Mavis, Axie Infinity aims to realize significant synergies. Recently, Sky Mavis has been making great efforts to revitalize the ecosystem by onboarding new Web3 games and various dApp services. These efforts are expected to further expand the world of Axie Infinity and provide gamers with a richer gaming experience. Sky Mavis has also been on an active recruitment drive recently, demonstrating their commitment to further accelerate the expansion of their ecosystem. It will be interesting to see if their actions in 2024 can help Axie Infinity meet a 2nd Golden Age.

Take a quick, 1-minute survey to enhance the weekly insights we provide. In return, get immediate access to the updated "2024 Country Crypto Matrix" by Tiger Research, featuring the latest global virtual asset market trends. Your participation helps us provide valuable content while you gain cutting-edge analysis.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.