Borrowing Against Bitcoin? How Coinbase and Vield Are Making It Mainstream

How Crypto Lending Is Reshaping Finance

This report was written by Tiger Research, analyzing Bitcoin-backed lending models, their potential in Asian markets, and associated regulatory challenges.

TL;DR

Bitcoin-backed loans offer liquidity without selling crypto, with firms like Vield and Coinbase leading innovation in lending models.

Despite benefits, volatility risks, forced liquidations, and regulatory uncertainty remain significant challenges for borrowers and lenders.

Asia presents strong growth potential for Bitcoin lending, but success depends on clear regulations, institutional adoption, and risk management.

1. Introduction

Bitcoin-backed lending has emerged as a financial tool that allows crypto holders to access liquidity without selling their assets. This lending model is gaining traction as specialized lenders such as Vield in Australia and Coinbase in the U.S. introduce crypto collateral loans.

These loans enable borrowers to use their Bitcoin as collateral while maintaining exposure to potential price gains. As digital asset adoption grows, Bitcoin-backed lending is emerging as a viable alternative to traditional financing.

Despite its appeal, Bitcoin-backed lending carries significant risks due to the high volatility of cryptocurrencies. Unlike conventional collateral such as real estate, Bitcoin’s price can experience sharp fluctuations, leading to forced liquidations and financial losses for borrowers.

Furthermore, the regulatory landscape for crypto lending remains uncertain. Governments and financial institutions are debating how to integrate these services within existing financial frameworks. As such, lenders and borrowers alike must navigate an evolving market that presents both opportunities and challenges.

This report examines key case studies in Bitcoin-backed lending, explores their potential impact on the Asian market, and evaluates associated risks and regulatory challenges.

2. Case Studies From Western: Coinbase and Vield’s Crypto Lending Models

2.1 Vield: Integrating Bitcoin Lending with Traditional Finance

Vield, an Australian-based lender company, is positioning itself as a crypto-native bank. The company offers Bitcoin-backed loans and hybrid mortgages that combine digital assets with real estate collateral. The company aims to establish Bitcoin as a legitimate asset class within the financial system, similar to traditional mortgage securities. Unlike traditional banks that lend primarily against property, Vield is creating a new asset class for lending by using Bitcoin and Ethereum as security.

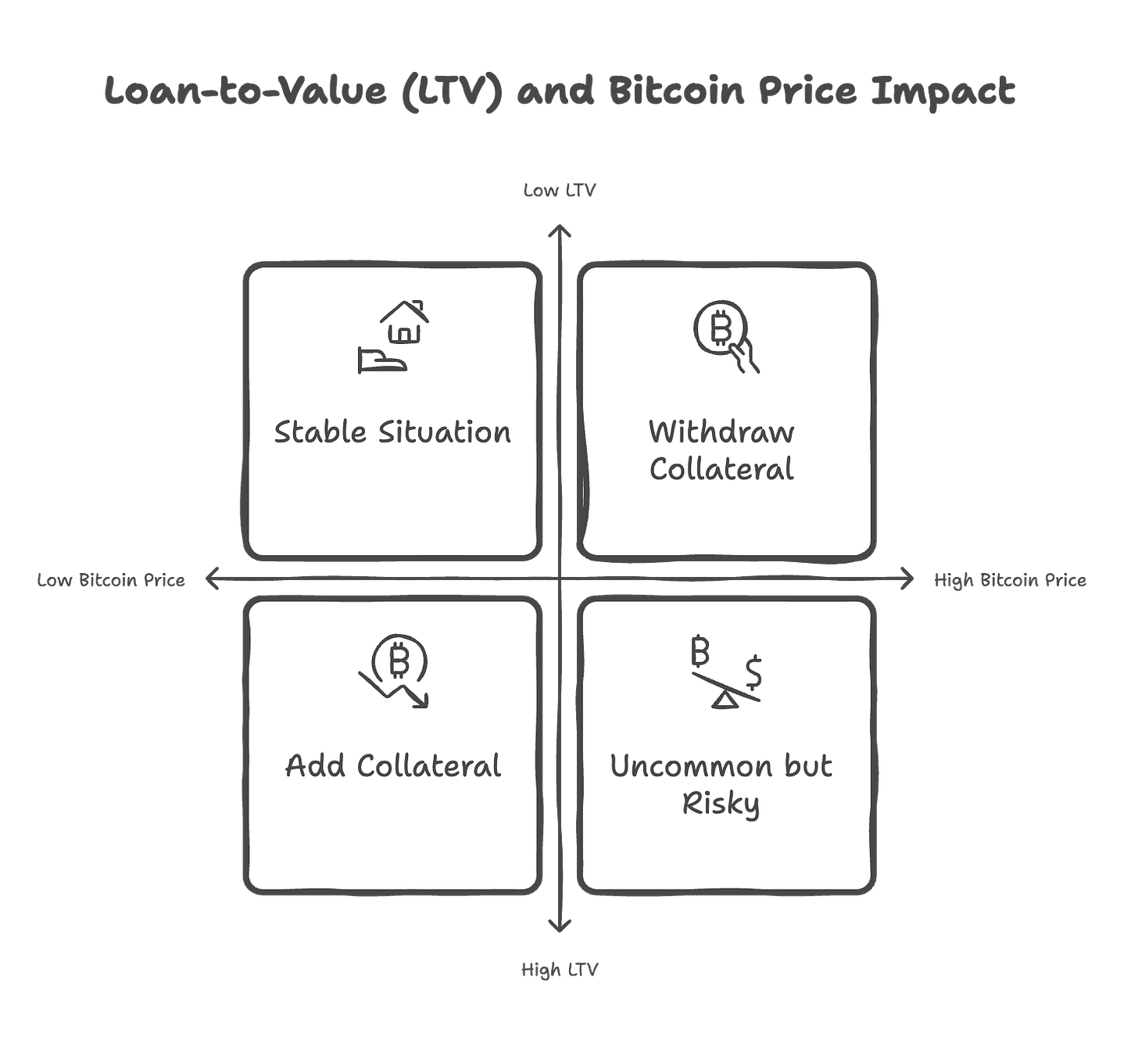

The firm offers loans ranging from $2,000 to $2 million with a 12-month term, charging a 13% annual interest rate and a 2% origination fee. Borrowers must deposit 1.5 Bitcoin—approximately $240,000—as collateral for an average loan of $120,000. If Bitcoin’s price drops and the LTV ratio reaches 75%, borrowers must deposit additional collateral to maintain the required 65% LTV. If Bitcoin appreciates in value, borrowers can request to withdraw a portion of their collateral.

Vield stores borrowers' collateral in separate secure digital wallets. They never co-mingle assets or use this collateral for other purposes. Vield makes all collateral transactions traceable through blockchain, enhancing lending transparency. They currently manage about $35 million in loans with zero defaults. This proves Bitcoin-backed loans offer real potential as financial services despite cryptocurrency market volatility.

However, skepticism remains among traditional lenders. Many refuse to lend against crypto due to its price fluctuations and perceived lack of intrinsic value. Economist Saul Eslake warns Bitcoin-backed loans may worsen financial instability during market stress, forcing borrowers into costly liquidations.

This divide illustrates the challenge of integrating crypto into the mainstream, as some institutions embrace digital assets while others remain cautious.

2.2 Coinbase: DeFi-Powered Bitcoin Lending

Coinbase has adopted a decentralized approach to Bitcoin-backed lending, integrating with the Morpho protocol on its Base blockchain. This service allows users to borrow up to $100,000 in USDC stablecoins by pledging Bitcoin as collateral, eliminating the need for credit checks or fixed repayment schedules. Instead, borrowing capacity is determined by an enforced LTV ratio, ensuring collateral remains sufficient to cover outstanding debt.

Coinbase's lending model uses Coinbase Wrapped Bitcoin (cbBTC), a tokenized Bitcoin locked in Morpho's smart contracts. While this enhances liquidity and decentralization, it adds risks from potential smart contract vulnerabilities and exploits.

The primary risk for borrowers is liquidation. If the LTV ratio exceeds 86% due to Bitcoin price declines, collateral is automatically liquidated, and a penalty fee is charged. This mechanism protects lenders but exposes borrowers to forced liquidation during market downturns. Unlike traditional loans, which offer repayment flexibility, Coinbase’s automated liquidation model requires borrowers to actively manage their collateral to avoid asset loss.

Regulatorily, Coinbase's lending structure offers mixed implications. Using Morpho's decentralized system improves transparency and reduces counterparty risk, but cbBTC's classification remains unclear, raising tax concerns. While avoiding centralized lending risks that doomed BlockFi and Genesis, this model still faces regulatory, security, and market stability challenges.

Concerns about financial stability risks persist. Economists warn that the widespread adoption of Bitcoin-backed loans could introduce systemic vulnerabilities. Sudden price crashes may trigger mass liquidations, leading to market sell-offs. Lenders relying on private funding may face liquidity crunches if Bitcoin’s volatility causes sustained downturns. Regulatory issues may increase, with policymakers emphasizing the need for investor protections and clear risk disclosures. If Bitcoin-backed loans continue gaining traction, they could reshape traditional lending structures. However, their long-term sustainability will depend on effective risk management and regulatory oversight.

3. Case Study in Asian Market: Fintertech

Fintertech, a subsidiary of Japan's Daiwa Securities, offers cryptocurrency-backed loan services. This represents a major cryptocurrency lending case in Asia. Fintertech provides yen and dollar loans using Bitcoin or Ethereum as collateral. Their interest rates range from 4.0% to 8.0% annually. Borrowers can obtain up to 500 million yen (about $3.3 million) within 4 business days. This gives cryptocurrency holders a quick and flexible funding alternative.

Japan's tax structure makes Bitcoin-backed loans particularly attractive as an efficient funding method. Japanese authorities tax cryptocurrency investment profits up to 55%. Bitcoin-backed loans enable users to access necessary liquidity without selling coins. This minimizes tax burdens. Companies and individuals utilize this approach for various purposes. This demonstrates that Bitcoin-backed loans serve as an efficient tool in highly-taxed markets.

Fintertech's model faces sustainability challenges compared to traditional financial products. Cryptocurrency price volatility creates significant risks. Lending institutions must develop robust risk management frameworks and better collateral valuation systems. Bitcoin-backed loans could become innovative financial products. They might bridge traditional and digital finance if other Asian financial institutions adopt similar models.

4. Benefits from Bitcoin Lending Service in Asia

Bitcoin-backed lending offers promising revenue for financial institutions (FIs) as crypto adoption grows in Asia. The global crypto lending market is projected to reach $45 billion by 2030 (26.4% CAGR), as investors and businesses increasingly seek liquidity without selling Bitcoin.

Financial institutions in Singapore and Hong Kong hold advantageous positions to introduce these services. Pioneering regulatory frameworks support this advantage. These include Singapore's Payment Services Act and Hong Kong's VASP license framework. Ledn achieved $1.16 billion in cryptocurrency-backed loans as of early 2024. This suggests similar services in the Asian market could also achieve significant results.

By partnering with crypto exchanges and fintech firms, traditional banks can attract a growing base of crypto-savvy customers while generating revenue through interest rates, loan origination fees, and fiat conversion charges.

5. Key Risks and Regulatory Challenges

The following table summarizes key concerns and provides real-world or hypothetical examples to better understand the risks and regulatory challenges of Bitcoin-backed lending.

5.1. Risk Factor: Regulatory Compliance

The regulatory landscape for Bitcoin-backed lending remains fragmented. Different governments take varying stances on crypto collateralization. Japan integrates crypto lending within existing financial frameworks. China bans such activities entirely. Businesses must comply with AML, KYC, and VASP regulations to prevent illicit activities.

Example: South Korea implemented stricter AML policies for crypto lenders due to regulatory concerns. This required extensive compliance documentation and rigorous due diligence. Some companies struggled to meet these requirements. Several abandoned their cryptocurrency-based lending models.

5.2. Risk Factor: Volatility and Liquidation Risks

Bitcoin's price volatility presents a challenge for lenders and borrowers. A sudden price drop can trigger margin calls and forced liquidations. Lenders require over-collateralization and real-time monitoring to protect investments.

Example: A borrower in Singapore secured a $100,000 loan using Bitcoin as collateral. After a sudden 30% BTC price drop, the lender liquidated their holdings to cover losses, leaving the borrower with a significant financial deficit.

5.3. Risk Factor: Custody and Security Considerations

Securing Bitcoin collateral requires specialized custody solutions to prevent hacking and fraud. Financial institutions must partner with trusted custodians and ensure assets are protected.

Example: A DeFi lending platform suffered a security breach due to smart contract vulnerabilities, leading to $50 million in stolen Bitcoin collateral.

5.4. Risk Factor: Market Liquidity

Large-scale Bitcoin lending operations require deep market liquidity. Market instability forces lending institutions to liquidate large collateral holdings. Limited liquidity crashes asset values. This triggers cascading liquidations and damages the entire market.

Example: Genesis and BlockFi went bankrupt after the FTX collapse. They faced collateral value drops alongside mass withdrawal requests. They couldn't sell cryptocurrency holdings at reasonable prices. This spread throughout the industry and caused widespread disruption.

6. Conclusion and Future Outlook

Bitcoin-backed lending represents a transformative innovation in the financial sector, offering crypto holders a way to access liquidity without selling their digital assets. However, Bitcoin's volatility, regulatory uncertainties, and security risks pose significant challenges to sustainable industry growth.

Bitcoin-backed loan models will likely develop around Singapore and Hong Kong where crypto regulations remain friendly. These countries offer systematic regulatory frameworks and high cryptocurrency adoption rates. This creates an environment for innovation and new revenue opportunities for financial institutions. These institutions can leverage Bitcoin-backed lending to expand their market presence and diversify their portfolios.

For businesses and financial institutions, the key to success lies in adopting risk management practices, such as conservative LTV ratios, over-collateralization, and secure custody solutions. Additionally, collaboration between traditional financial institutions, crypto platforms, and regulators will be essential to build trust and ensure the long-term viability of Bitcoin-backed lending.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.