Decoding Carry Trades: Their Influence on the Crypto Market

How Do Carry Trades Shape The Cryptocurrency Market?

TL;DR

Carry Trades in Finance and Crypto: Carry trades involve borrowing in low-interest currencies to invest in higher-yield assets. This is a commonly employed trading strategy in both traditional and crypto markets, where traders drive liquidity and impact currency valuations. In crypto, this often involves borrowing stablecoins to invest in DeFi, which offers high rewards along with significant risks due to volatility.

Market Dynamics and Risks: Carry trades enhance market liquidity. However, it can also trigger rapid shifts during crises that increase volatility. In the crypto market, this can result in speculative bubbles. Hence, risk management is crucial for investors and businesses that employ this trading strategy.

Future Trends and Challenges: Innovations like yield tokenization and decentralized liquidity are shaping the future of carry trades in crypto. However, the potential rise of an anti-carry regime presents challenges. This necessitates creating opportunities for developing resilient financial products.

1. Carry Trade Effects on the Market

Carry trades are a fundamental strategy in global finance, where investors borrow in low-interest-rate currencies and invest in higher-yielding assets. The primary objective is to profit from the interest rate differential, which can be substantial depending on the currencies and assets involved.

For example, an investor can borrow yen at approximately 0.1 percent interest rate and secure a Mexican bond investment at around 6.5 percent yield, resulting in roughly 5 percent gain without using any of their own capital. Carry traders provide liquidity by borrowing and investing in different markets, which helps in price discovery and stabilizing financial markets.

However, this liquidity provision comes with risks, especially when market conditions change unexpectedly, such as during financial crises or sudden shifts in monetary policy. In times of market stress, such as the 2008 Global Financial Crisis, carry trades can unravel quickly. This can lead to sharp currency value reversals and significant losses for investors.

When foreign exchange rates are stable, carry trades can be highly profitable. Otherwise, market instability can trigger a rapid unwinding of these trades. During these times, investors rush to cover their positions by selling higher-risk assets and buying back the funding currencies, which leads to sharp market corrections. This cascading effect can amplify market volatility. Large-scale sell-offs increase realized volatility and create a vicious cycle of declining asset prices and forced liquidations.

2. How Carry Trade Applies to the Crypto Market

A typical strategy might involve borrowing USDT at a 5.7% APY (annual percentage yield) and investing in a DeFi protocol offering a 16% yield. This results in a 10% profit margin, assuming asset values remain stable. Compared to an around 6% gain from the Mexican bonds example, profit rates in crypto tend to be higher due to their volatile nature.

Stablecoins have become central to crypto carry trades as they provide a stable and low-cost borrowing option. For example, in 2021, DeFi protocol offered annual yields over 20%, making stablecoins a low-cost borrowing option that is attractive to carry traders.

Even so, the market is not without risks. The collapse of the Terra/Luna ecosystem in 2022 serves as a cautionary tale. Many carry traders had borrowed in stablecoins to invest in Terra’s Anchor Protocol, which promised a 20% yield. However, when the underlying assets ($LUNA) devalued rapidly, the carry trades unwound violently. This led to massive liquidations and significant losses across the market.

This example highlights the inherent risks of carry trades in the cryptocurrency sector, where borrowing stablecoins to invest in higher-yielding assets has become a prevalent strategy. The volatility of crypto assets can amplify the impact of these trades to degrees rarely seen in traditional finance.

At the same time, this challenge presents a significant opportunity. There is potential to develop innovative financial products and services tailored to the demands of the crypto-carry trade market, such as advanced risk management tools and yield optimization platforms. However, businesses must adopt a flexible approach that can swiftly respond to market fluctuations to account for the high volatility of crypto assets.

3. What are the Differences Between Traditional and Crypto Carry Strategies?

While both traditional and crypto carry trades center around exploiting interest rate differentials, they differ significantly in investor profiles, focus assets, and risk levels. Traditional carry trades are typically reserved for institutional investors, such as funds and financial institutions. Crypto carry trades open opportunities for retail investors as well.

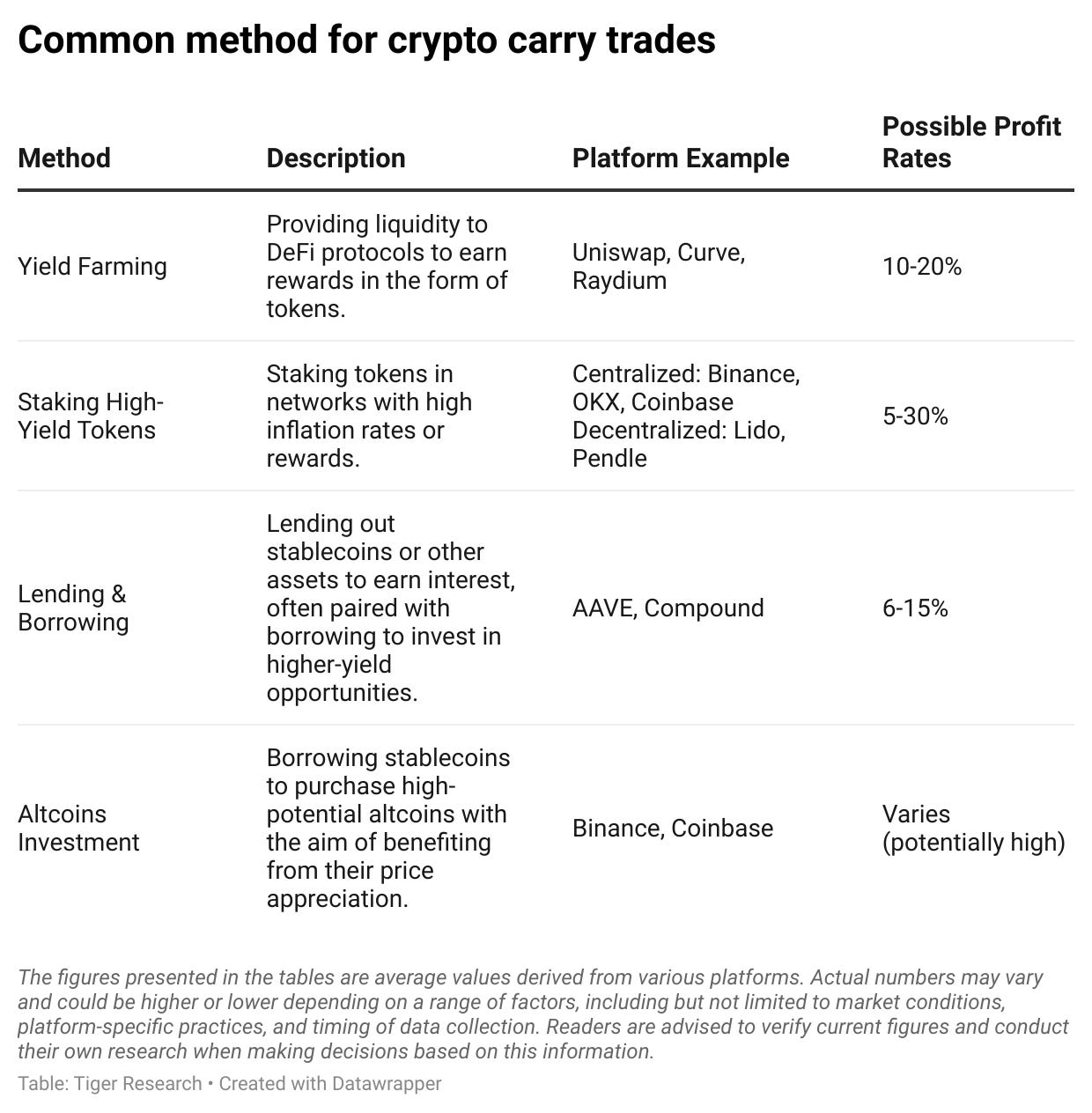

In terms of assets, traditional carry trades focus on currency pairs within regulated markets. They generally offer stable returns with moderate risk. In contrast, crypto carry strategies to leverage a broader range of platforms that provide greater flexibility and higher potential returns along with significantly increased risk. The inclusion of leverage, yield farming, and staking rewards adds layers of complexity to crypto carry trades, making them a lucrative but risky investment strategy.

Decision-makers must carefully weigh these factors when considering carry trades in the rapidly evolving cryptocurrency landscape.

4. How does Carry Trade Impact the Crypto Market?

4.1. Self-Reinforcing Mechanism with Upward Market Momentum

Carry trades create a self-reinforcing mechanism that drives the market upward. As mentioned, carry trades occur when borrowers take on low-interest assets to invest in higher-yield opportunities. If the market appears positive, this can lead to a cycle where rising prices attract more traders, further amplifying the trade's profitability as detailed below:

More investors attempt to profit by borrowing stablecoins and investing in the market.

Increased stablecoin borrowing rate drives up prices.

Price rise, more investors will participate and a self-reinforcing cycle emerges

However, this cycle introduces significant risks in the volatile crypto market. Sudden market shifts—like a drop in the value of the invested asset or a spike in borrowing costs—can trigger a rapid unwinding of these trades. This mass exit can lead to liquidity issues and sharp price declines, exacerbating market instability. While carry trades can enhance liquidity and offer profits, they also carry the potential for abrupt and severe market disruptions.

4.2. Enhancing Crypto Market Liquidity

Crypto carry trades, particularly those involving stablecoins, have significantly enhanced market liquidity. Stablecoins such as USDT, USDC, and DAI are frequently employed in carry trades. This provides essential liquidity to DeFi platforms, including lending protocols. This influx of liquidity facilitates smoother trading operations and enables more efficient price discovery, which in turn benefits the broader crypto market.

In 2023, the average daily trading volume of stablecoins exceeded $80 billion, underscoring their vital role in maintaining liquidity across various crypto markets. Furthermore, this increased liquidity has attracted the participation of institutional investors, who are typically more inclined to engage in markets with higher liquidity. This, in turn, has led to greater capital inflows and contributed to market stability.

5. New Narratives in Carry Trade

5.1. The Rise of Yield-Bearing Token

As the crypto market evolves, new trends in carry trades are emerging. One such trend is the yield-bearing token, as seen on platforms like Pendle, which allows investors to trade future yields separately from the principal. This innovation enables more sophisticated carry strategies that allow for hedging or speculation on future yields.

5.2. The Potential for an Anti-Carry Regime in Crypto

An anti-carry regime refers to market conditions where future volatility is expected to exceed current levels. This creates specific challenges for the crypto market, particularly for carry trades. As price volatility increases, the effectiveness of carry trades—where low-interest assets are borrowed to invest in higher-yielding ones—diminishes. Rising liquidity costs and leverage-related risks make this strategy not only less profitable but also potentially dangerous.

However, certain crypto assets, such as Bitcoin, may thrive in an anti-carry regime due to their deflationary nature (i.e., limited supply). As fiat currencies are subject to inflation, Bitcoin and similar crypto assets could serve as a store of value and a hedge against the devaluation of traditional investments. In this context, they may emerge as a compelling alternative to conventional carry trading strategies.

6. Conclusion

Carry trades have long been a driving force in global finance, and their application in the crypto market represents a significant evolution of the strategy. The future of carry trades in finance will be shaped by innovation, regulatory developments, and the ongoing interplay between traditional and crypto markets. As more crypto ETFs enter the market, the line between traditional and digital finance continues to blur. This offers institutional investors a gateway into the high-yield potential of crypto markets. This shift could lead to an influx of capital from traditional finance players, further legitimizing and expanding the crypto market's reach.

Nevertheless, businesses and investors in the crypto space must carefully navigate the risks and rewards of carry strategies by staying attuned to emerging trends that could redefine the market landscape. The potential for an anti-carry regime, driven by regulatory changes or shifts in market dynamics, adds another layer of complexity. This complexity will challenge traditional approaches and offer new opportunities for agile players. By recognizing these evolving trends and remaining flexible, market participants can position themselves to capitalize on the unique opportunities presented by the fusion of traditional and crypto finance.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.