Deep Dive: Chainalysis 2024 Crypto Adoption Index for Southeast Asia and India

A Comparative Analysis of Growth, Regulatory Developments, and Emerging Trends from 2023 to 2024

TL;DR

India maintains its leadership in global crypto adoption, driven by robust institutional engagement and regulatory adjustments despite challenges like high taxes and temporary exchange bans.

Indonesia surged from 7th to 3rd place in global crypto adoption. This was fueled by increased decentralized exchange usage, institutional trading, and local regulations encouraging blockchain innovation.

Southeast Asia showcases diverse crypto use cases. Singapore is leading in stablecoin adoption and merchant services, the Philippines is focusing on play-to-earn games and remittances, and Vietnam is prioritizing P2P exchanges.

1. Introduction: A Dynamic Shift in Cryptocurrency Adoption

Southeast Asia and India have emerged as a global leader in cryptocurrency adoption. The region has become a focal point for blockchain activity, driven by 1) grassroots engagement, 2) professional trading, and 3) rising institutional interest. As DeFi and CEX expand globally, SEA is not only keeping pace but often at the forefront of the developing crypto landscape.

The Global Crypto Adoption Index by Chainalysis underscores the region’s impact on the Web3 industry. Malaysia and Singapore are still falling behind other SEA countries, while Cambodia has advanced by 13 positions. Indonesia now ranks third, reflecting a rapid rise in adoption, while Vietnam, the Philippines, and Thailand have experienced slight declines.

2. Comparison of Key Changes between 2023 and 2024

Chainalysis calculates this index based on four core factors: 1) centralized service value received ranking, 2) retail centralized service value received ranking, 3) DeFi value received ranking, and 4) retail DeFi value received ranking.

This report explores the four factors of the Global Crypto Adoption Index, along with our insights on the shifting crypto landscape across SEA and India. It compares key changes between 2023 and 2024 and examines the underlying influences driving these movements in the adoption index.

2.1. India: The Crypto Behemoth

India has retained its #1 position in the 2023 and 2024 Global Crypto Adoption Index, solidifying its leadership in cryptocurrency adoption. While India’s centralized service metrics have remained stable, DeFi factors have seen a slight decline, primarily due to rising activity in other countries. Notably, Indonesia and Nigeria have experienced rapid adoption, with Nigeria recording over $30 billion in DeFi transactions last year.

Additionally, there have been some changes related to centralized service metrics, though they appear to have had minimal impact. For instance, in December 2023, India’s Financial Intelligence Unit notified nine offshore exchanges, including Binance, of impending regulatory actions. Shortly afterward, the Ministry of Electronics and Information Technology (MeitY) began implementing URL blocks to restrict access for Indian users.

However, the Esya Center reported that the impact of these blocks was short-lived. Users continued accessing exchanges through pre-downloaded apps, with some apps still available for download after the government ban. Tax conditions have also stayed the same, with a 30% tax on capital gains from cryptocurrency and a 1% withholding tax (TDS) on all transactions, yet trading activity appears to remain robust.

India’s position in the blockchain landscape could evolve by 2025, led by the National Blockchain Framework (NBF) launched by MeitY in 2024. This government-backed initiative leverages permissioned blockchains to enhance security, transparency, and trust in public services.

This support remains focused on structural applications rather than investment incentives, as the tax policy is expected to remain unchanged. Consequently, participants in India’s crypto market are pressing for tax reductions in the 2024-25 Annual Budget to foster a more favorable investment environment. Nonetheless, the outcome of these measures on the crypto adoption index—especially as it emphasizes investment factors—remains uncertain.

2.2. Indonesia: A Surge in Crypto Engagement

Indonesia has made a significant leap in the Global Crypto Adoption Index, advancing from 7th place in 2023 to 3rd in 2024, with notable improvements in both centralized services and DeFi rankings. Continued growth in centralized services this year could further elevate its adoption ranking in the coming year.

Indonesia shows fast growth compared to other CSAO countries. Source: Chainalysis

Indonesia marked significant growth in 2023, achieving a 207.5% increase. According to Bappebti (Indonesia's Commodity Futures Trading Regulatory Agency), this growth is primarily driven by centralized exchanges such as Indodax and Tokocrypto. This growth is primarily driven by stricter listing rules now imposed on traditional stock exchanges. User sentiment has shifted away from conventional markets to alternative trading options like cryptocurrency.

The following characteristics emerge when examining transaction sizes at local exchanges in detail. Over a third (43.0%) of the value received by local exchanges consists of transfers between $10,000 and $1 million. Plus, Indonesia also holds a higher share of $1,000 to $10,000 transfers than any other top country in terms of cryptocurrency value received. The high proportion of these mid-to-large transactions suggests that professional traders play a leading role in Indonesia's cryptocurrency market.

In terms of the DeFi surge, this growth is largely driven by Indonesia's youthful, tech-savvy population. The Millennial and Gen Z demographics are particularly keen to explore decentralized financial solutions. This younger demographic’s engagement with DeFi platforms has propelled decentralized exchanges to account for 43.6% of transaction volume in the country, emphasizing the growing preference for financial systems that offer autonomy from traditional banking.

To achieve a higher adoption rate in the future, it is analyzed that improvements to the current tax regime are urgently needed. Indonesia has imposed a 0.1% income tax with a 0.11% VAT on all domestic cryptocurrency transactions. These high tax rates have constrained growth within the centralized services sector, prompting a shift toward DeFi, which is harder to monitor. Adjusting the tax system to a more reasonable level could significantly boost Indonesia's cryptocurrency adoption rate.

2.3. Vietnam: Sustained Growth Amidst Economic Uncertainty

Vietnam saw a drop in its overall ranking, moving from 3rd in 2023 to 5th in 2024 on the Global Crypto Adoption Index. This decline is primarily due to increasing competition from regional players like Indonesia, which has accelerated institutional adoption and introduced clearer regulatory frameworks. While Vietnam has managed to slightly increase the rankings in centralized service value, its position in DeFi has stagnated, indicating a slower pace of Web 3 development compared to its peers.

The key factors contributing to Vietnam's lower ranking are 1) intensified competition from neighboring SEA countries, 2) a lack of large-scale institutional engagement within the Vietnamese market, and 3) slower regulatory progress to support the crypto sector. Unlike Indonesia, which has implemented proactive regulatory measures to foster blockchain and crypto innovation, Vietnam has been more hesitant in developing new policies and relaxing strict regulations to encourage sector growth.

Strict policies include restrictive regulations on crypto-related advertisements and the lack of clear licensing frameworks for crypto exchanges. This lack of regulatory clarity has led to an outflow of capital and talent to countries with more favorable crypto environments, which has affected Vietnam's standing in the global index.

Despite these regulatory and institutional challenges, grassroots crypto adoption in Vietnam remains strong. This growth is largely driven by high levels of engagement in peer-to-peer (P2P) exchanges and DeFi platforms. According to a report by Triple-A, around 21.2% of the Vietnamese population owns cryptocurrency. This places the country second globally in terms of crypto ownership. Vietnam's high DeFi usage, accounting for 28.8% of transaction volume, underscores the country’s reliance on decentralized platforms for financial transactions—a crucial approach for navigating restrictive capital controls. This grassroots engagement emphasizes the role of crypto in bridging the gaps in financial services for individuals and small businesses.

While Vietnam’s strong retail adoption showcases a vibrant crypto community, the lack of supportive regulations remains a barrier to sustainable growth. Without clearer policies to attract institutional participation and nurture DeFi developments, Vietnam risks slipping further down the rankings as regional competitors advance. However, with its large crypto-owning population and high DeFi engagement, Vietnam holds substantial potential to remain a significant player in the crypto ecosystem if it accelerates regulatory progress.

Recognizing this need, Vietnam's Ministry of Information and Communications and NEAC recently launched a national blockchain strategy to accelerate digital transformation across sectors. This initiative positions Vietnam as a potential regional leader in blockchain innovation by 2030, signaling a strategic commitment to long-term growth.

2.4. Philippines: Play-to-Earn and Remittances Drive Adoption

The Philippines, despite its consistent engagement with cryptocurrency, saw a slight decline in the Global Crypto Adoption Index, moving from 6th place in 2023 to 8th in 2024. This drop is largely due to the country’s continued reliance on CEX, which accounted for 55.2% of transaction value in 2024, a slight increase from the previous year. While the Philippines has maintained a strong focus on structured CEX solutions, other countries are advancing in DeFi and institutional trading—areas where the Philippines has yet to gain significant traction. As countries like Indonesia advance with stronger institutional adoption and regulatory clarity, the Philippines has faced challenges in keeping pace.

The country also remains focused on P2E gaming and remittances as primary crypto applications. In 2023, P2E gaming and gambling accounted for 19.9% of total web traffic, emphasizing a niche approach rather than broader DeFi adoption. This specialization has positioned the Philippines as a leader in P2E gaming and remittance use cases but limits its growth potential compared to countries diversifying their crypto ecosystems.

Additionally, the regulatory environment in the Philippines lacks comprehensive policies for DeFi and institutional crypto growth. Nonetheless, the Philippines’ unique strengths in P2E gaming and remittance-focused adoption continue to support its position as a key player in Southeast Asia’s crypto landscape, albeit with room for improvement in regulatory and institutional dimensions.

2.5. Thailand: Stable Regulation but Declining Adoption

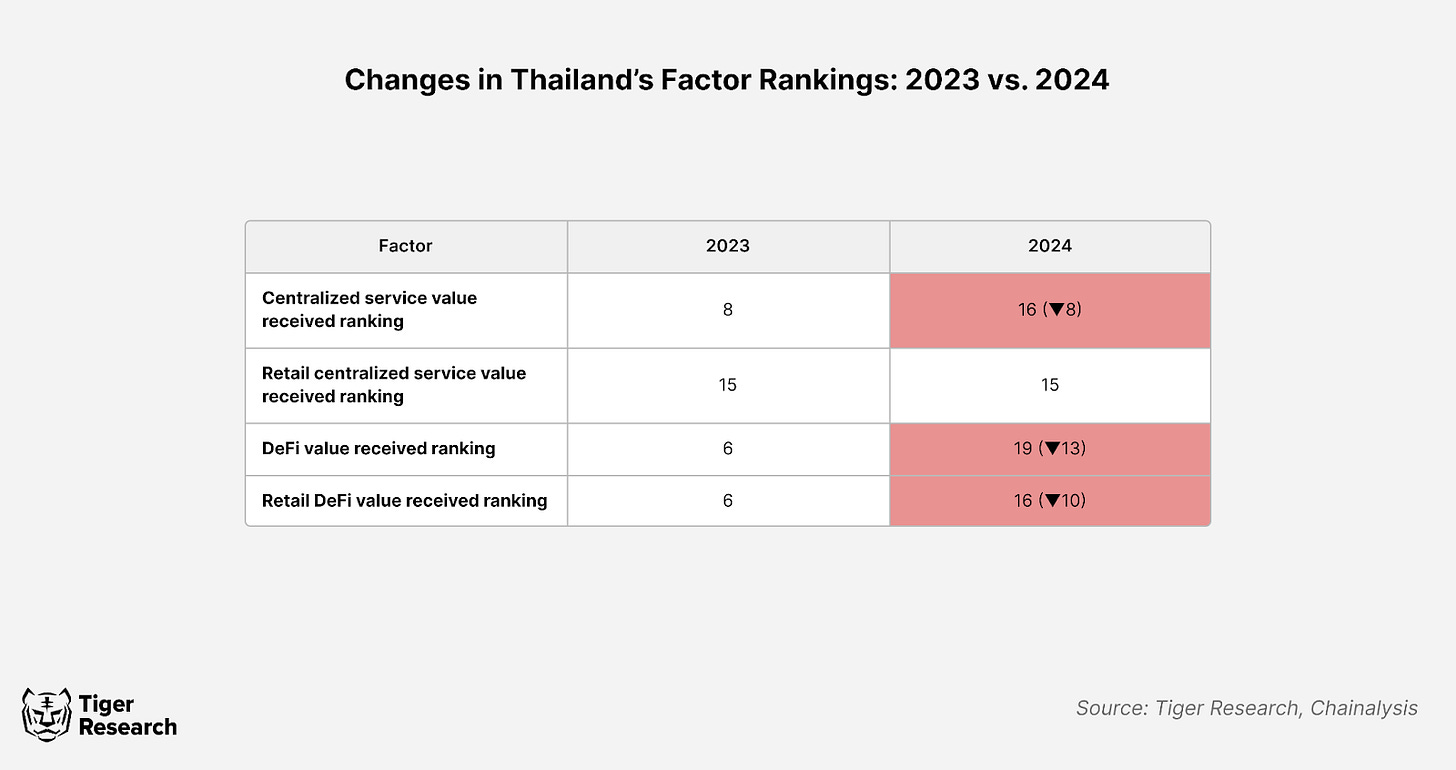

Thailand’s crypto market continues to evolve despite a drop in the Crypto Adoption Index ranking from 10th place in 2023 to 16th in 2024. This decline is mainly due to a reduction in centralized service value received, while retail activity remained stable, suggesting a decrease in institutional participation. Furthermore, DeFi metrics also showed a significant downturn. Thailand's drop in ranking is especially concerning, given its low GDP per capita PPP growth rate of 1.4%, the lowest among regional peers except Singapore.

This decline in ranking is primarily due to a decrease in active crypto trading accounts following the Terra-Luna incident, which also impacted DeFi participation. Additionally, the political ban on Pita Limjaroenrat—a crypto-friendly figure—raises questions about his future influence on Thailand’s crypto market, potentially impacting the regulatory landscape and sentiment toward crypto adoption.

It's important to note that Chainalysis ranks are adjusted based on GDP per capita PPP. Without this adjustment, Thailand’s crypto market size would appear larger than several other countries. Thailand’s strong regulatory foundation and recent efforts to encourage institutional participation underscore the government’s dedication to the industry. Programs like the digital asset Sandbox initiative represent a significant step toward integrating digital assets under a structured regulatory framework.

2.6. Cambodia, Singapore, and Malaysia

As countries outside the top 20 in the index, Cambodia, Singapore, and Malaysia show differing ranking changes based on each country's approaches to the crypto industry.

Cambodia rose 13 places to rank 17th on the Global Crypto Adoption Index in 2024 primarily due to its ranking in centralized service usage. Although the exact reasons remain unclear, a possible explanation may lie in the growing local interest in crypto with possible illicit activities. In late August 2024, Chainalysis researchers highlighted that Hun To’s platform, Huione, was not only linked to crypto scams but was also allegedly involved in over $49 billion worth of crypto black-market transactions since 2021. This persistent involvement in the gray areas of crypto may have drawn substantial funds into the country.

Singapore moved up from 77th to 75th in 2024, reflecting its focus on regulatory clarity, institutional adoption, and crypto-friendly merchant services. The stablecoin XSGD saw over $1 billion in transactions in Q2 2024, facilitated by platforms like dtcpay and Grab. Regulatory advancements from the Monetary Authority of Singapore (MAS), including a stablecoin framework and enhanced crypto custody rules, have strengthened Singapore’s appeal as a secure, regulated environment for crypto.

Malaysia dropped from 38th to 47th in the index due to increased competition in Southeast Asia, yet remains committed to Web3 and blockchain. Despite slower institutional adoption and DeFi scaling, Malaysia has pursued initiatives to position itself as a Web3 gaming hub. Notably, partnerships like the one between MDEC, EMERGE Group, and CARV announced at the IOV2055 Symposium, align with the country’s digital transformation goals.

3. Conclusion: Shifts in SEA and India's Crypto Landscape

The SEA region and India continue to lead the world in grassroots crypto adoption. While India remains at the forefront, driving innovation and institutional engagement despite regulatory hurdles, countries like Indonesia are rapidly catching up. The surge in DeFi activities in Indonesia, combined with its favorable regulatory landscape, highlights a shift in the crypto power dynamics in the region.

The Philippines and Vietnam remain crucial crypto markets, albeit with different focuses. The former is driven by gaming and remittance applications, while the latter relies on P2P exchanges and decentralized trading. Singapore’s shift towards retail and merchant crypto applications further emphasizes the diversity of use cases in the region. In contrast, the declines in rankings for Thailand and Malaysia highlight the competitiveness of the landscape.

Looking ahead, the ongoing regulatory developments in these countries will play a pivotal role in shaping the future of cryptocurrency adoption in Southeast Asia and India. The growing institutional adoption and strong grassroots engagement highlight the region’s role as a pivotal global hub for digital assets.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.