TL;DR

The expansion of the Oasys Network in Japan has resulted in a positive business outlook, despite the nascent Japanese Web 3 market environment. Notably, renowned game developers such as Sega and Bandai Namco have announced their onboarding to the network, and leading tech companies have participated as node operators, while the network has successfully raised $20M in funds.

However, current on-chain data analysis has failed to reveal significant evidence of expansion and growth in the user pool, including transactions, active wallets, and dApps. This could be attributed to the relatively small size of the Japanese blockchain gaming market, which has yet to demonstrate significant activity.

It is crucial for the Oasys Network to create a flywheel effect by encouraging more user participation.

Introduction

In the previous article on the status of blockchain games in Japan, we provided a general overview of the interest and utilization of blockchain games among Japanese game companies. In Japan, the blockchain game market has begun to show signs of becoming more active with the launch of the "Oasys" mainnet. The reasons for this are as follows: (1) the onboarding of several AAA game companies, (2) the participation of Softbank and Gumi as node validators, and (3) the recent $20M investment round that attracted investments from Crypto.com, Huobi, and others. As a result, it is highly anticipated that Oasys will become a leading Web3 game specialized mainnet in Japan.

However, these expectations are based on a mere business outlook and may not be the same for users who play blockchain games. In fact, from the perspective of users who play blockchain games, it may be the opposite. In reality, the playable games on Oasys are predominantly casual games that are easy to play, rather than AAA games, and there are no visible games with significant achievements. Therefore, in this article, we aim to investigate whether the Oasys mainnet is generating interest among users who play blockchain games.

Blockchain Transactions & Wallet Data

Comparison of transaction trends by mainnet

To determine the level of chain activation on the Oasys mainnet, we would like to compare the recent transaction trends with the Klaytn and Astar mainnets. Through this comparison, we estimate the relative activity level of the Oasys mainnet.

As shown in the [Comparison of transaction trends by mainnet] chart, we can observe that the recent transaction trend on the Oasys mainnet is relatively low compared to other mainnets. This result may be somewhat disappointing considering the recent trend where several AAA game companies are participating in Oasys Network.

Number of dApps per mainnet

It can be confirmed that the number of dApps per mainnet is also relatively low. However, it's worth noting that the Oasys mainnet (1) launched relatively recently in October 2020, and (2) operates in a relatively closed structure compared to other mainnets that have a more universal approach. This could be a factor contributing to the difference in the absolute number of dApps.

Comparison of transaction trends across Oasys Network mainnets.

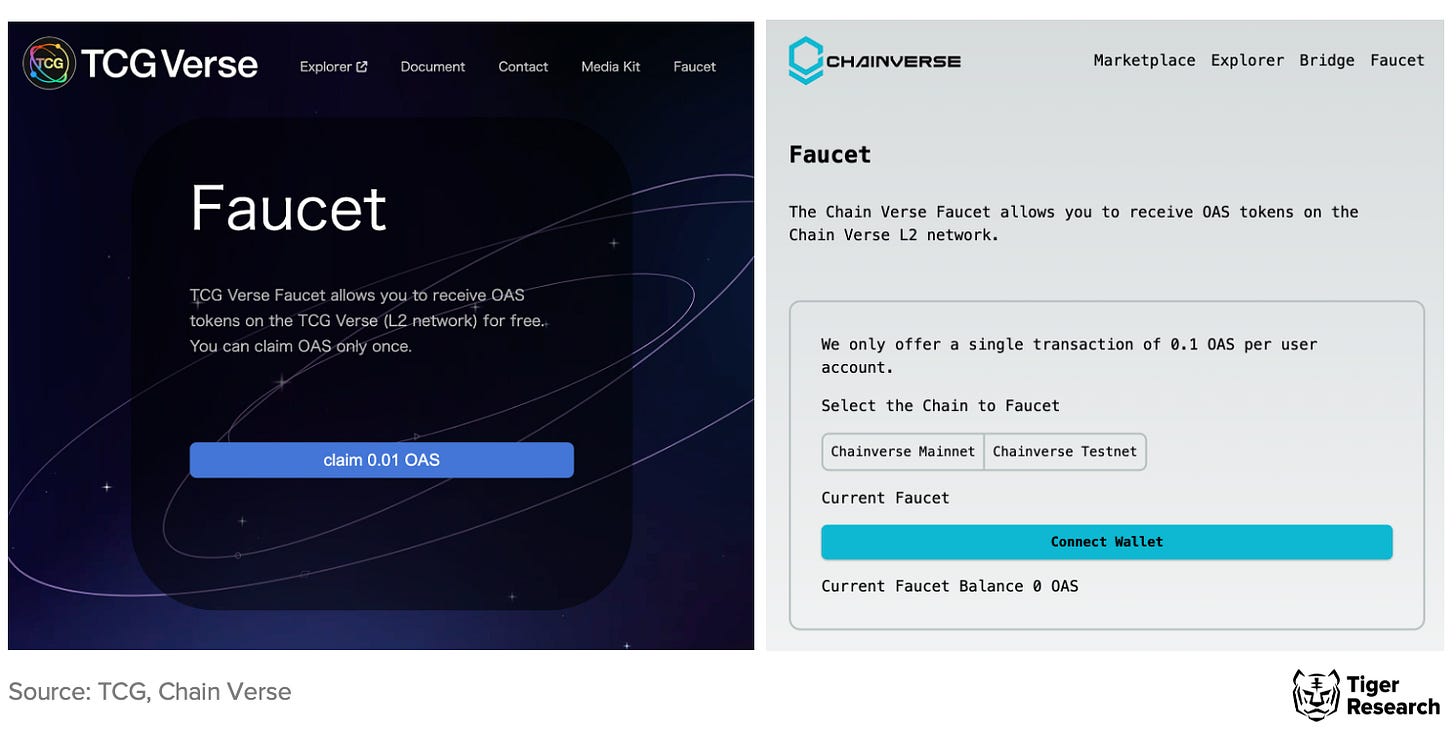

In addition, when we looked at the Verse Layer (L2), which is expected to have the most active transactions within the Oasys ecosystem, we found a unique case. Specifically, it was the abnormal increase in transactions in the Chain and TCG Verse of the Verse Layer, which was due to the impact of the "Faucet" event that distributed a certain amount of OAS tokens for free. Chain Verse temporarily generated three million transactions in a day, but the record showed a relatively low number the next day after the event was finished, decreasing to single digit transactions. It is believed to be a result of a temporary marketing promotion for attracting new users.

Comparison of transaction trends across Oasys Network mainnets (excluding Chain Verse)

If we exclude Chain Verse and look at the Verse Layer within the Oasys ecosystem, we can see that the place with the most transactions is "MCH Verse". This is a dedicated L2 for the game "My Crypto Heroes Series", which was once the number one game on Ethereum mainnet. It is presumed that MCH Verse has the highest number of playable games (5 types, accounting for about 30%) within the Oasys ecosystem.

Next, we aim to analyze the presence of actual in-game users and the level of activity within the Oasys ecosystem by examining the token holdings and transaction frequency of wallets within the ecosystem.

Token holdings within the Oasys ecosystem vs. transaction frequency

Looking at the [Distribution of OAS Token Holdings and Transaction Frequency by Wallet in the Oasys Ecosystem] chart above, we can see that the majority of users hold a significantly small amount of OAS tokens and have a low transaction frequency.

In fact, among the OAS token-holding wallets in the Oasys ecosystem (a total of 265,006), approximately 98% of users hold 0-100 OAS tokens, and around 90% of users have recorded one or fewer transactions. This suggests that most wallets in the Oasys ecosystem may be inactive (in contrast, approximately 51% of wallets in the Astar mainnet are active)

Takeaways

Given the nascent state of the Japanese Blockchain Gaming market, it is very positive to see the successful launch of the Oasys Network in Japan. The Oasys mainnet was well-anticipated to drive adoption and growth, and it has achieved significant progress in attracting major companies like Sega and Bandai Namco to its platform. The recent $20M fundraising announcement is a testament as well.

However, it is disappointing to see that there is no concrete on-chain data to support the future growth as of now. The absolute number of transactions and wallets in the Oasys ecosystem is relatively low compared to other mainnets. It is also challenging to determine the level of activity that can be considered significant. Many wallets in the Oasys ecosystem hold the same amount of tokens but have no transaction records. Many transactions were related to Faucet events, which were used for marketing purposes, and we can assume that many users who tried Oasys may have been FOMO-driven and had no intention of continuing to play blockchain games. Thus, we can predict that the number of actual blockchain game players may be small.

There may be two main reasons why the Oasys ecosystem has not yet been fully activated. First, blockchain games may have a negative image and face resistance from existing gamers. Second, the size of the Japanese blockchain game market itself can be relatively small. To address these issues, it is crucial to increase the size of the market and user base through collective efforts among developers, the community, and content creators. When the market grows, more development and investment will follow, leading to a virtuous cycle. As a result, more AAA game companies will onboard Oasys, and we can look forward to a rosier future for blockchain games in Japan.