TL;DR

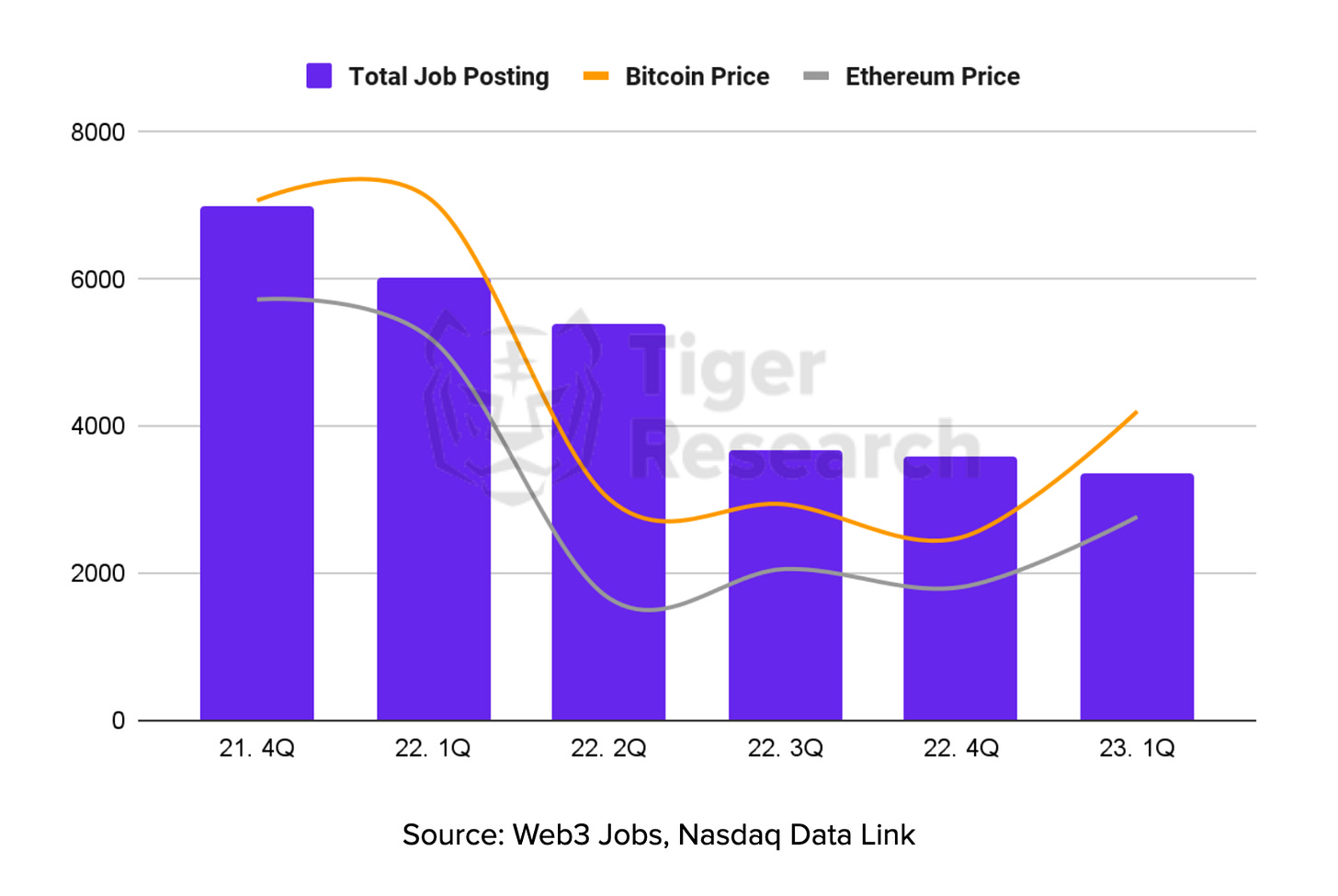

In the first quarter of 2023, global Web 3 job postings saw a 52% decrease (3,366 openings) compared to the fourth quarter of 2021. The primary factors for this decline can be attributed to 1) a stagnant global economic situation, 2) the arrival of the crypto winter, and 3) challenges in the profitability of Web 3 projects leading to structural adjustments.

The sectors with the highest number of job openings during this period were 1) global centralized exchanges (CEX), 2) decentralized finance (DeFi), and 3) non-fungible tokens (NFTs), in that order. CEX and DeFi experienced declines of 70% and 98% from their peak, respectively. In contrast, the NFT sector saw a relatively modest decline of around 20%, with hiring activity still ongoing. The drop in overall cryptocurrency trading volume has led to reduced revenue and profitability for CEX and DeFi, prompting them to restructure and halt new business opportunities. Meanwhile, the entry of Web 2 enterprises such as Amazon, Starbucks, and Nike into the NFT space has softened the decline in job openings.

Despite the challenging circumstances, job postings in the Artificial Intelligence (AI) and Zero-Knowledge (ZK) fields have been steadily increasing. Notably, job openings combining AI and blockchain technologies are thriving, indicating that the future Web 3 market will likely see a surge in AI-powered services in line with global trends.

Introduction 2023 Web 3 Job Report

Job postings are an essential measure to gauge the actual execution of a company's strategy. They also serve as an indicator to compare a company's intentions and real-world actions during the valuation and due diligence processes of public & private companies. With this in mind, we aim to provide insights into the future of the Web 3 industry by examining global Web 3 job posting trends. In this report, we will analyze #1 the current state of job openings by Web 3 sector, and in the next report, we will discuss #2 the regional and occupational status of Web 3 job openings.

This research is based on publicly available data from the Web3 Jobs site, a service providing job information in the Web 3 field. The analysis focuses on data from the fourth quarter of 2021, when the Web 3 industry was most active, through the first quarter of 2023.

Web 3 Job Market Trends

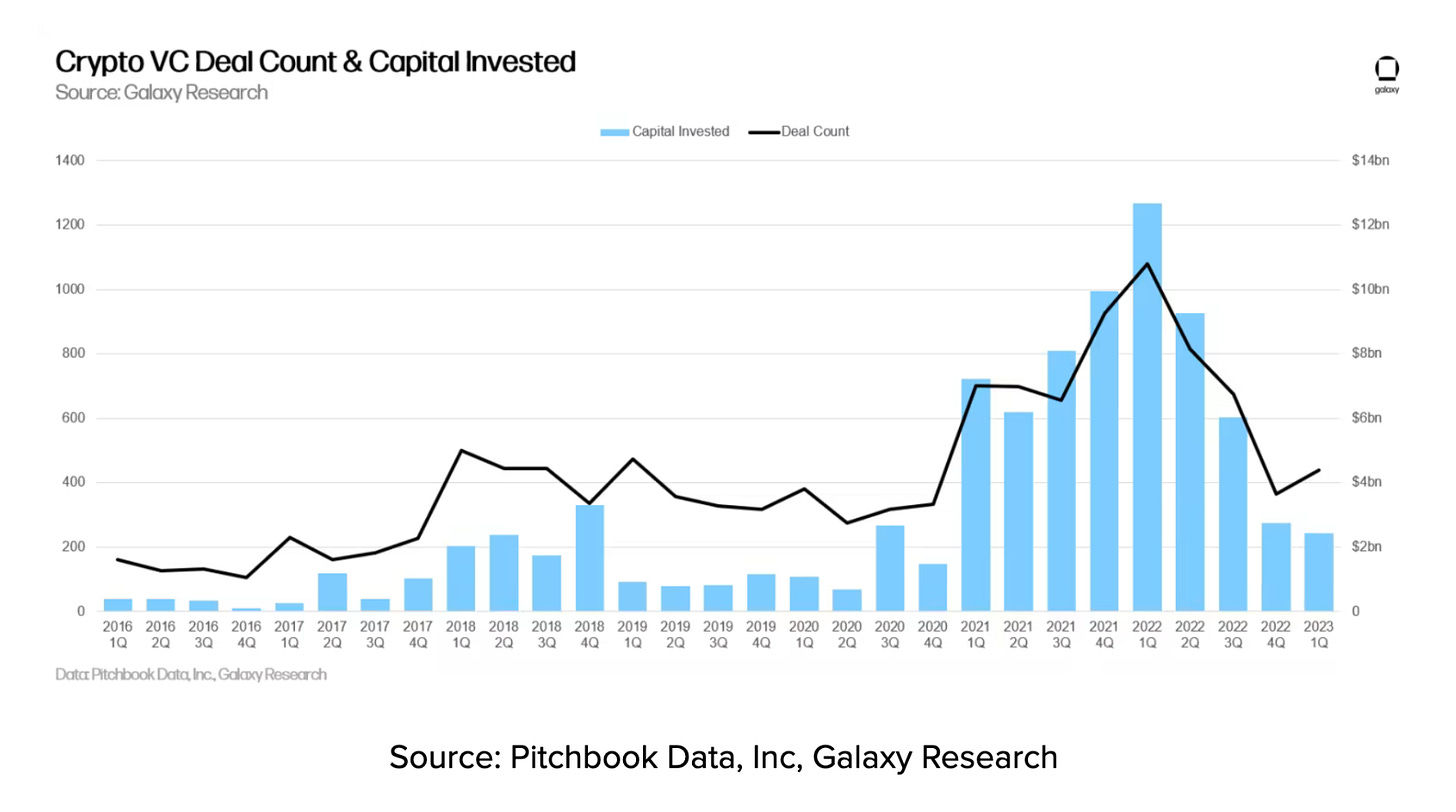

The Web 3 market has largely frozen, with most Web 3-related companies facing structural adjustments and cost-cutting measures. This trend has been triggered by 1) a stagnant economic situation and interest rate hikes by major central banks, and 2) significant crypto events in 2022 that will be remembered in history. For the surviving Web 3 companies, these measures were necessary to ensure continued business operations and viability. In fact, the Web 3 market lost approximately 2,000 jobs during the first two months of 2023 alone. Some argue that this outcome is due to excessively optimistic projections during the boom times, leading to hasty hiring and expanding unproven businesses.

In line with the trend of structural adjustments, Web 3 job postings have also significantly decreased. Compared to the fourth quarter of 2021, known as the "crypto summer" when cryptocurrency prices peaked, the number of job postings in the first quarter of 2023 has fallen by around 52% to 3,366.

Who is hiring in Web 3 ?

Web 3 hiring trends can also provide insights into the outlook for various Web 3 subsectors. During the data collection period, the sectors with the highest number of job postings were 1) CEX, 2) DeFi, and 3) NFT, in that order. However, it should be noted that job postings in the DeFi sector have dramatically decreased since the first quarter of 2023 (-98%).

CEX has recorded the highest number of job postings throughout the entire data collection period. This can be attributed to the fact that, compared to other sectors, 1) CEX has been proven to be a relatively-stable and legally compliant business within the regulatory framework of various countries, and 2) many large companies within the sector have a clear business model based on transaction fees. For instance, the global leading exchange, Binance, saw a trading volume of around $7.29 billion on a “day” basis, while the DeFi project Uniswap v3 experienced a trading volume of approximately $0.74 billion.

Although the CEX sector has a higher number of job postings compared to other sectors, it has also experienced a decrease in hiring. From the fourth quarter of 2021 to the first quarter of 2023, the number of job postings in the CEX sector has dropped by nearly 70%. In fact, companies like CoinBase and Crypto.com, which previously had aggressive hiring practices, now have virtually no job openings. However, some exchanges like Binance and OKX continue to actively recruit talent, maintaining the overall hiring trend in the industry.

Next, the NFT sector has the second-highest number of job postings throughout the entire data collection period. The number of job postings has decreased by about 20% from the fourth quarter of 2021 to the first quarter of 2023, showing relatively stable hiring activity. Strength in NFT sector job hiring has been possible due to the entry of global Web 2.0 companies like Amazon, Starbucks, and Nike into new businesses using NFT technology, in addition to Web 3-native NFT exchanges like OpenSea, Blur, and SoRare. The data confirms that NFTs represent a "low hurdle" Web 3 field that can be applied first and most easily across various industries in relation to blockchain technology.

Lastly, the DeFi sector has seen the most significant decrease in job postings, with a drop of around 98% from the fourth quarter of 2021 to the first quarter of 2023. This decline can be attributed to 1) the collapse of Terra-Luna in the third quarter of 2022, and 2) continuous incidents of harm within the DeFi sector, leading to a reduction in overall market interest. Furthermore, as countries are tightening regulations on DeFi, there is a more conservative approach to new business development through hiring.

Despite the dismal situation in the DeFi sector, there is a glimmer of hope. Notably, established DeFi projects like Uniswap Labs, Aave, and CakeDeFi continued to recruit talent until the fourth quarter of 2022. Additionally, the number of unique users in the DeFi sector has been increasing on a quarterly basis. Consequently, although the decreased market interest in DeFi has affected the creation of some new projects, well-established and proven DeFi projects are still carrying on with their business operations and hiring to some extent, which is an optimistic sign.

What is leading the hiring trend in Web 3 ?

Recent web3 hiring trends can also help identify sectors that are likely to experience growth in the near future. As seen in the data, job postings related to AI (Artificial Intelligence) and zK (Zero Knowledge) sectors are steadily increasing. Among these, the AI sector appears to be gaining significant popularity, aligning with global megatrends. In fact, even before the first half of the second quarter of 2023, around 23 new AI-related job postings were observed, and the number is expected to surpass the previous quarter. It can be speculated that various products incorporating AI technology will emerge in the web3 market in the future.

Moreover, the number of job postings in the zK sector is also consistently increasing. This trend is likely due to the ongoing discussions and the importance of zK technology in addressing blockchain scalability issues, which have been a hot topic until recently. The growing interest in and significance of zK technology are expected to further drive hiring in this sector.

Conclusion

We have analyzed the web3 market by focusing on the hiring status of web3-related companies. The number of job postings has decreased by nearly half compared to the past when aggressive business expansion and investment took place. This decline seems to reflect the current market situation, known as the "crypto winter."

However, although the number of job postings has decreased by nearly half compared to the boom times, a closer look at the recent period from the third quarter of 2022 to the first quarter of 2024 shows that the decreasing trend seems to be reaching a bottoming-out phase. This could be an indicator that we can anticipate bold moves from companies aggressively hiring talent while focusing on the utility of blockchain technology in preparation for the upcoming boom period. Moreover, the increasing number of companies attempting new ventures by combining global mega trends like AI provides a somewhat optimistic outlook. In the next part, we plan to go beyond industry analysis and discuss the current state of web3 job postings by region and job function.