How to travel your crypto in Korea & Japan

Introduction to Travel Rule Regulation in Korea & Japan

TL;DR

Many countries have started adopting the "travel rule", a regulatory requirement aimed at combating money laundering and terrorist financing. Among them, Korea and Japan are actively implementing the travel rule in crypto industry due to strong governmental interest.

In the short term, it is expected that travel rule solutions will primarily adopt a centralized alliance structure.

Having numerous centralized alliance structures could lead to another inefficient system. In the long run, it is predicted that a single global standard system, similar to SWIFT in the traditional financial market, will emerge.

Introduction

In 2019, the Financial Action Task Force (FATF) agreed to extend its existing anti-money laundering "Travel Rule" requirements to include the realm of crypto assets. Since the revision of these recommendations, nations within the FATF have been steadily adopting this Travel Rule for virtual assets, with Asian countries leading the initial implementation.

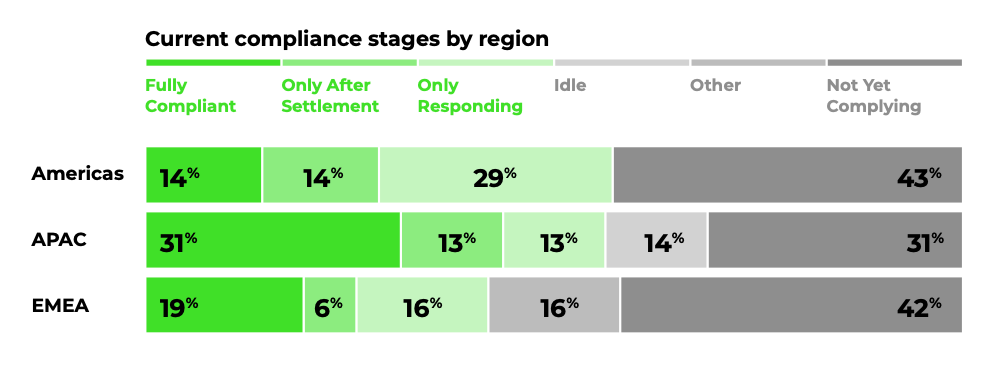

South Korea, for instance, was the first nation worldwide to officialize the Travel Rule, post its final FATF guideline issuance in October 2021. This legislative development took place in March 2022. Japan followed suit by announcing a policy requiring virtual asset businesses to adopt the Travel Rule in June 2023. These actions highlight the proactive efforts in Asian countries to foster a healthy virtual asset market. According to a study by Travel Rule solution provider, Notabene, Asian countries also show a higher rate of Travel Rule implementation or plans of implementation compared to other regions.

So, what is the Travel Rule?

The Travel Rule, proposed by the FATF, is one of several regulations targeting traditional financial institutions like banks, aimed at preventing money laundering. It refers to rules that must be adhered to when transferring assets across borders. In simple terms, it's like attaching a name tag to money (e.g., "This $1 is from Jessica to Eugene").

The need to apply the Travel Rule to virtual assets emerged in 2019 because 1) virtual asset transactions, which are based on anonymity, could be highly susceptible to various forms of misuse, and 2) the increasing volume of these transactions made it an asset class that can no longer be ignored. In the virtual asset market, the Travel Rule mandates that each virtual asset business must record and share the information of both sender and receiver during transactions. The implementation methods and application scopes vary from country to country and among virtual asset businesses.

Centralized Travel Rule Alliance

Most Travel Rule solutions are developed around a centralized alliance structure. This structure aims to minimize the developmental fatigue of setting up new connections every time individual virtual asset businesses link. For example, in South Korea, VerifyVASP operates as a central node, and other businesses just need to develop connections to this node. This structure minimizes connection costs, enables prompt regulatory responses, and ensures stable and consistent connections. In fact, this centralized alliance structure is the preferred choice in many Asian countries, including South Korea and Japan.

Travel Rule Adoption in APAC

To date, six FATF-member Asian nations have adopted the Travel Rule. Among them, South Korea and Japan stand out for their active legislation of mandatory Travel Rule adoption, driven by government initiatives.

In South Korea, virtual asset exchanges develop and use their solutions following government recommendations. Notable examples include Dunamu Upbit's VerifyVASP and the CODE solution from the Bithumb/CoinOne/Korbit trio. Initially, these two solutions competed fiercely to attract virtual asset businesses. However, competition cooled following mutual integration recommended by the Financial Services Commission on April 25, 2022. However, as VerifyVASP transitioned to a paid service, domestic virtual asset operators have also integrated the CODE solution as a pre-emptive measure.

Japan, unlike South Korea, opted to use commercial solutions since validated Travel Rule solutions were already in the market. Taiwan-based Sygna and American Coinbase's TRUST solutions are the dominant players. The choice between the two was largely influenced by the location of exchanges' overseas branches and main business areas. For instance, BitFlyer, which has offices in regions like the United States and Europe, would have likely needed an alliance centered in the Western world. Meanwhile, other exchanges, whose main business areas are in Asia, were presumably required to establish alliances focused on the Asian region.

Conclusion

South Korea and Japan share commonality in their preemptive adoption and legislation of the Travel Rule in the virtual asset market, and centralized structure of their Travel Rule solutions.

Most virtual asset businesses are expected to adopt solutions with a centralized alliance structure. The likelihood of multiple alliances emerging is low due to issues such as high connection costs and potential regulatory issues. Long-term prospects point to a high probability of the virtual asset Travel Rule solution market integrating into a single global standard system, akin to the traditional financial market's SWIFT system.