[Special Report] Can the Japan Web3 Market take the Global Lead?

Expectations and Realities for the Japan Web3 Market

Research Methodology

This report is based on interviews conducted by the TigerResearch team at the TEAMZ Web3/AI Summit 2024 event in Japan with a number of industry experts and leaders in the Japanese Web3 market. The main purpose of this report is to provide a first-hand understanding of how the Japanese government's aggressive policy easing is influencing the Web3 industry. Although the interviews do not include all perspectives and views on the Japanese Web3 market, we believe that the diverse opinions of various experts will provide a more three-dimensional understanding of the Japanese Web3 market.

1. Introduction

The Japanese Web3 market has recently become one of the most dynamic globally, experiencing rapid changes largely due to significant governmental support. Recognizing the strategic importance of the Web3 industry, the Japanese government has been actively pursuing measures to revitalize this sector. Since the Mount Gox hack in 2014, Japan has adopted a conservative view of the Web3 industry and enforced stricter regulations. However, this is rapidly changing. With the country relaxing its policies on cryptocurrencies from 2023 onwards, there is growing potential for further market development.

While deregulation has indeed expanded the potential and raised expectations for Japan's Web3 market, true market revitalization encompasses far more than regulatory adjustments. Market activation is an intricate mix of factors that include 1) the practical application of the technology, 2) an increase in the number of users adopting the technology, and 3) integration across various industries. Although government policies significantly impact the market, the prerequisites for a truly active market extend beyond mere regulatory considerations.

This report aims to provide a comprehensive analysis of the current state of the Japanese Web3 industry. We will delve into the specifics of Japan's Web3 revitalization policy, examining its implications for participants within the local Web3 ecosystem and identifying the tangible changes that have occurred as a result. Additionally, the report will explore business opportunities within the Japanese Web3 market, assessing potential short-term gains and long-term growth prospects.

2. Japan is back! Market shifts beginning with industrial revitalization

The deregulatory measures promoted by the Kishida cabinet and the Liberal Democratic Party (LDP) could significantly transform the Japanese Web3 market. As regulatory uncertainties diminish and clear guidelines establish the "rules of the game," the market is poised to evolve dramatically. In this section, we will explore the impact of three major policies introduced by the Kishida government regarding the Web3 industry.

2.1. Japanese conglomerates enter the Web3 industry

As noted in our previous report, "Major Asian Enterprise Entry into Web3 Market," the involvement of large Japanese enterprises in the Web3 space is particularly noteworthy. At this summit, major conglomerates such as SBI, NTT, KDDI, and Hakuhodo were present, where they expressed their expectations and outlined their visions for the future of the Web3 industry.

The active engagement of large Japanese corporations in the Web3 space plays a crucial role in the development of the ecosystem as they bring substantial capital and research and development capabilities that are essential for advancing Web3 technologies.

For instance, NTT Digital, a subsidiary of the prominent telecommunications company NTT DoCoMo, has made significant investments in developing the Web3 wallet Scramberry. During this development, NTT Digital collaborated with a major consulting firm, Accenture Japan. It is believed that some large companies have gained momentum to enter the Web3 market through a trickle-down effect from this partnership.

The involvement of large Japanese companies is anticipated to propel the development of the Web3 market in Japan significantly. Despite the market's nascent stage, these major players' active investment and research and development efforts are crucial in establishing a strong foundation that not only enhances the current market but also paves the way for the emergence and growth of more Web3-native companies.

2.2. Greenlight on stablecoin issuance

June 2022, guidelines for issuing and brokering stablecoins published

June 2023, amendments to the Money Settlement Act allow money movers, banks, trust companies, etc. to issue stablecoins

The Japanese government's decision to permit the issuance of stablecoins is a significant step in fostering the development of the Web3 industry. This policy change has sparked a growing interest in stablecoin-related businesses within the Japanese market, leading many companies to venture into this area amidst growing regulatory clarity.

For instance, the digital asset platform Progmat is actively exploring stablecoin opportunities. Binance Japan has revealed plans to collaborate with Mitsubishi UFJ to launch a new stablecoin. Additionally, Circle, the issuer of USDC, is looking to expand the distribution of USDC in Japan in partnership with SBI Holdings. These developments are particularly noteworthy given the vast potential of Japan’s B2B payment market, which is valued at approximately KRW 1 trillion (approx. USD 7.2 trillion) annually. The integration of stablecoins into this market could dramatically scale business opportunities.

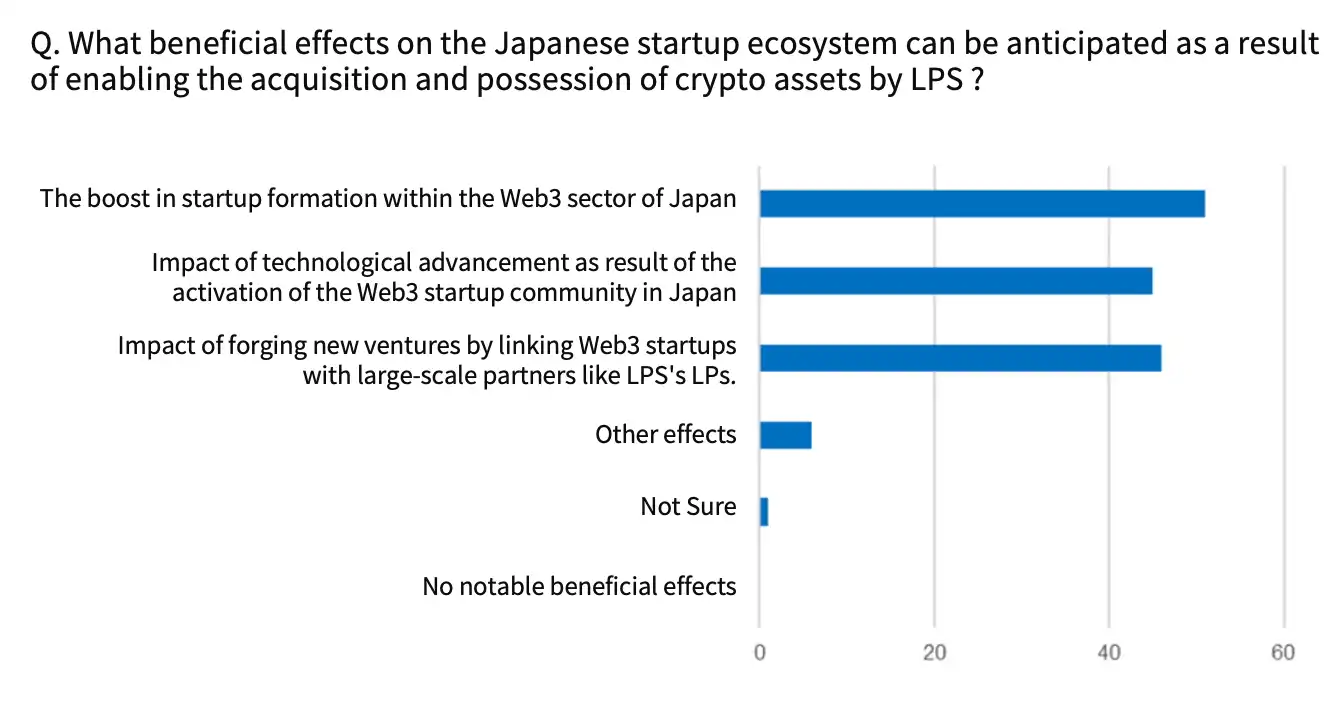

2.3. Allowance of Venture Capital to Invest in Cryptocurrency

February 2024, Limited Partnerships (LPS) and Investment Trusts will be able to invest directly in crypto, and legal entities will be able to raise funds from VC funds in exchange for non-stock tokens.

Japan's Ministry of Economy, Trade and Industry recently voted to allow venture capitalists to invest directly in crypto assets. This move is aimed at stimulating investment in Web3 startups within Japan and ensuring that the most promising projects can flourish domestically rather than moving abroad. The resolution is set to be submitted to the Diet in June of this year.

June 2023, decision not to tax the year-end appreciation on a company’s token holdings.

April 2024, decision not to tax appreciation gains when technical disposition restrictions exist for third-party-issued tokens

The Japanese government has also made strides in easing the taxation on virtual assets held by corporations. Previously, the high tax rates on crypto assets held by Japanese Web3 companies prompted many to relocate their headquarters to countries with more favorable tax regimes, such as Singapore and Dubai. A notable example is Sota Watanabe, founder of Astar Network, who cited prohibitive corporate taxes—amounting to tens of billions of yen—as the reason for establishing his corporation in Singapore.

This taxation issue has been widely criticized for pushing Japanese Web3 companies to expand abroad rather than fostering growth domestically. In response, the government has gradually relaxed the taxation rules on corporate holdings of virtual assets. These policy adjustments are expected to invigorate the market by facilitating a smoother inflow of funds within Japan, thus encouraging local growth and development of Web3 companies.

3. Is Japan really back?

Too early to tell, more to come

3.1. Excessive taxation of cryptocurrency investors

Japan is gradually easing restrictions on corporate entities investing in and holding cryptocurrencies. However, the taxation regime for individual investors remains stringent. Japanese retail investors face a progressive tax rate of up to 55% on gains from crypto trading profits, which is among the highest rates in Asia. This heavy taxation significantly deters retail investment and active trading of cryptocurrencies.

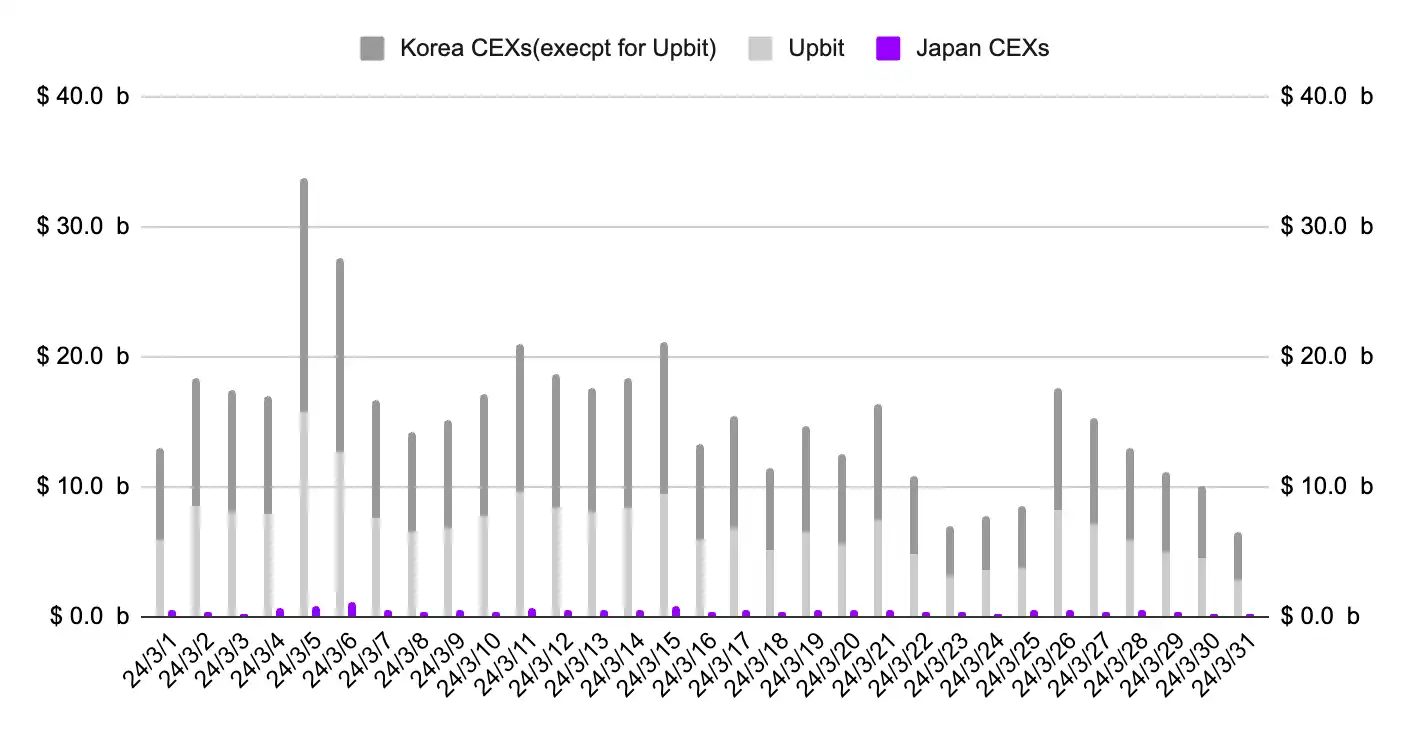

Despite efforts to rejuvenate the cryptocurrency market, these tax policies have led to stagnation in the retail segment. This is evident when comparing trading volumes; for instance, in March, Japan's cryptocurrency trading volume was 18 times lower than that of South Korea.

For the cryptocurrency market in Japan to truly thrive, deregulation efforts need to extend beyond corporate entities to include individual investors as well. A balanced approach, fostering both supply and demand, is essential for a flourishing market. Despite this, there are currently no indications that Japan plans to ease regulations for individual investors in the near future. This lack of regulatory flexibility has prompted many Japanese Web3 startups and developers to relocate to more regulatory-friendly environments like Dubai, which offer greater business opportunities and liquidity.

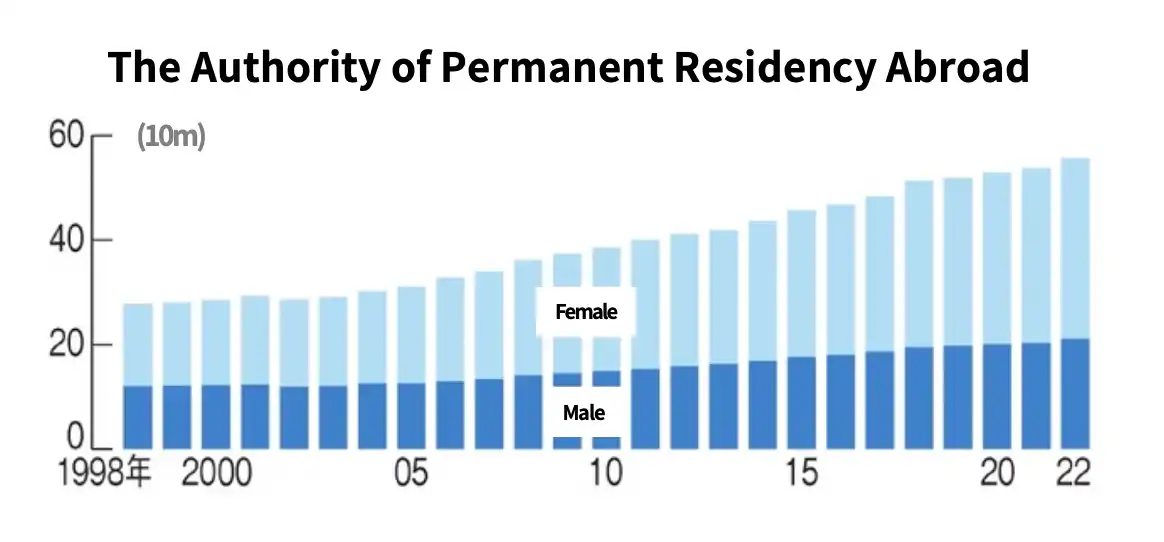

This trend is underscored by data from the Ministry of Foreign Affairs, which shows an increase in the number of Japanese citizens moving abroad. Specifically, the immigration rate to the Dubai region has risen by approximately 4% compared to last year. This migration highlights the broader implications of Japan's strict regulatory framework on its talent and entrepreneurial ecosystem, potentially leading to a brain drain in the sector if current policies remain unchanged.

3.2. An isolated market environment

The Japanese Web3 market exhibits a "Galapagos-like" environment, a term that describes a highly localized business ecosystem that is somewhat isolated and has limited scalability to the global market. This stems from a conservative regulatory framework that evolved in response to the Mount Gox hack in 2014, which greatly influenced the development of Japan's approach to cryptocurrency regulation.

One distinct aspect of this localized approach is the process for listing virtual assets in Japan. The Japanese Virtual Currency Exchange Association (JVCEA), a self-regulatory organization approved by the government, manages the listing of cryptocurrencies through a white/green list system.

The Japanese Web3 ecosystem is predominantly oriented towards serving local needs. Traditional companies, local governments, and banks are leveraging blockchain technology primarily to benefit domestic consumers, and entities like Astar Network are similarly focusing on the domestic rather than the global market. This inward-looking approach creates significant barriers for international Web3 companies looking to enter the Japanese market and limits the diversity within the sector, stifling dynamic growth and innovation.

Consequently, for Japan's Web3 industry to achieve substantial growth and become a significant player on the world stage, it is crucial to transition away from this "Galapagos" market environment. Adopting a more open and globally oriented perspective will not only facilitate the entry of global companies but also encourage a richer diversity of ideas and practices.

3.3. Shortage of tech talent

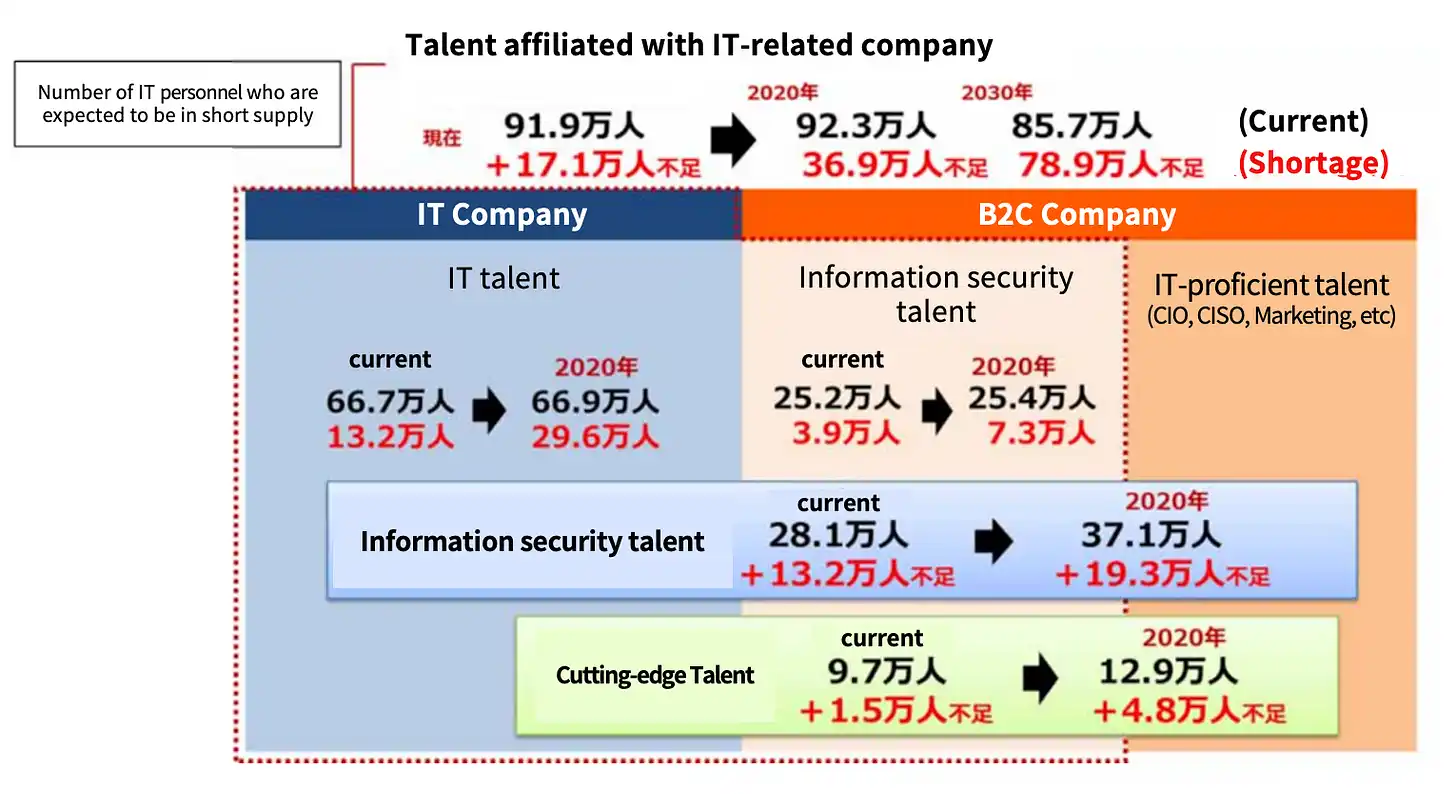

One significant barrier to the growth of the Japanese Web3 market is the acute shortage of IT talent. This issue is intensifying over time; in 2020, Japan faced a shortfall of approximately 370,000 IT professionals, and projections suggest this could double to around 790,000 by 2030.

Even Japan's large telecommunications companies, which are typically at the forefront of technological advancements, are finding themselves in the early stages of Web3 industry development, with significant progress yet to be made. The Web3 sector is inherently high-tech, requiring substantial manpower and technical expertise to drive innovation and development effectively. Currently, Japan faces a notable deficiency in the number of Web3 builders, and the projects dedicated to developing Web3 infrastructure are even fewer. This shortage not only hampers the ability to innovate within the space but is also a critical factor limiting the growth of Japan's Web3 market.

4. What can we expect from the Japanese Web3 market in the future?

4.1. Globalization capabilities

Recently, the global capabilities of Japanese Web3 project founders has come under the spotlight, highlighting a significant shift in their approach to business. From the outset, these entrepreneurs are incorporating a global perspective into their strategies, actively pursuing international expansion. A key element of this globalization effort is the enhancement of English language skills. At the TEAMZ Summit 2024, this shift was evident, as many Japanese leaders confidently presented and engaged in discussions in fluent English.

The current dynamism within the Japanese Web3 industry is a product of the young generation's outlook and the inherently global nature of the Web3 sector. Many Web3 projects in Japan are being designed with a global market in mind right from inception. This marks a significant cultural shift, the first of its kind since the Meiji Restoration over a century ago, wherein Japanese entrepreneurs are proactively seeking opportunities beyond their national borders.

4.2. Expectations of market revitalization due to capital injection by companies and others

As previously noted, Japan's decision to relax regulations concerning the holding and investment of crypto assets by corporate entities is poised to boost the Japanese Web3 market. With substantial investments already being made, such as NTT DoCoMo and SBI Holdings raising Web3 funds totaling 600 billion yen (approx. USD 3.8 billion) and 100 billion yen (approx. USD 647 million) respectively, this deregulatory shift is expected to stimulate financial inflows.

Furthermore, Japan's Government Pension Investment Fund (GPIF), the largest pension fund in the world, has recently announced plans to invest in Bitcoin. While it may take time for the implications of new regulations to materialize and for substantial investments to be made, the GPIF's move is a positive indicator for the Japanese Web3 market.

4.3. Use case accumulation

In the broader context of the global Web3 industry, where tangible applications and meaningful outcomes of blockchain technology are often scarce, the Japanese market is beginning to showcase impactful examples. Notably, JPYC, a stablecoin pegged to the Japanese yen, is being integrated into the "hometown tax system," a unique approach to local funding. Additionally, some local governments in Japan are exploring the use of DAO (Decentralized Autonomous Organization) and NFT (Non-Fungible Token) technologies to rejuvenate underdeveloped areas. These initiatives are valuable to the growing body of knowledge and expertise necessary for effective real-world implementation.

Furthermore, Japan is proactively sharing its accumulated expertise and technological know-how internationally. By educating others and exporting its innovations, Japan is positioning itself as a pivotal player in shaping the future of this industry.

Given these factors, the Japanese Web3 industry holds significant promise for future development. Despite the current trend of many Japanese Web3 founders relocating to Dubai in pursuit of immediate business opportunities and a more accommodating regulatory environment, there remains long-term optimism about the potential of the Japanese market. Many founders express a desire to engage in business within the Japanese Web3 sector over the next decade, indicating a strong belief in its future growth.

5. Marketable sectors of the Japanese Web3 industry

5.1. Short-term outlook: Research, Consulting, and Investment Business

The rapidly evolving regulatory landscape of Japan's Web3 industry contrasts with the inherently cautious approach Japanese companies typically take toward decision-making. This caution often results in slower business progressions, as companies invest considerable time in thorough market research and project validation before moving forward. Consequently, in the short term, there is likely to be an increased demand for research and consulting services within the Web3 market. This trend is exemplified by the entry of Messari, a U.S.-based data analysis and research company, into the Japanese market. Domestic research entities like Hash Hub and Next Finance Tech are becoming increasingly active.

As investment regulations relax and venture capital firms begin to hold crypto assets, the investment landscape within the Japanese Web3 market is poised for revitalization. A notable player in this emerging field is Hyperithm, which has distinguished itself with various strategic investments, including in the stablecoin issuer JPYC and the Web3-based live streaming company Palmu. These investments are indicative of a broader trend and growing confidence in the potential of Web3 technologies.

5.2. Long-term outlook: Stablecoins, Web3 Gaming

In the long term, stablecoins and Web3 games represent the most promising sectors within the Japanese Web3 industry. The stablecoin market, in particular, is poised for significant growth. As the framework for institutional involvement solidifies and regulatory uncertainties diminish, expectations for this sector are rising. The Japanese yen-based stablecoin, JPYC, stands at the forefront of this potential expansion.

Currently in Japan, stablecoins can only be utilized for on-ramping as a prepaid payment method and not for off-ramping. This limitation has constrained the broader use of stablecoins within the financial ecosystem. However, JPYC, a yen-based stablecoin issuer, is seeking to acquire an EPISP (Electronic Payment Instrument Service Provider) license, which will enable the release of a new version of JPYC that supports off-ramping. This version is scheduled for release this summer.

The off-ramping capabilities for JPYC are anticipated to significantly boost the utility of stablecoins in Japan, making them more versatile and integrated into everyday financial transactions. Over the long term, stablecoins may become a viable alternative for all transactions that currently rely on cash or bank deposits.

Although stablecoins are not currently listed on Japanese cryptocurrency exchanges, there is movement from several exchanges to obtain the necessary licenses to do so. This development suggests a promising future for stablecoin accessibility and utility in Japan.

Japan holds a prominent position as the third-largest market in the global gaming industry, and its foray into the Web3 gaming sector is equally noteworthy. Major industry players such as Square Enix, SEGA, and Gumi are actively engaging in Web3 projects, showcasing innovative approaches to gaming.

Notably, Gumi recently launched its Web3 project 'OSHI3,' and it features a game that utilizes a major IP from their original WEB2 game. Additionally, 'double tokyo.jump,' the developers behind Oasis, have created a Web3 game titled 'Battle of Three Kingdoms' using SEGA's Three Kingdoms IP. These developments highlight the dynamic and experimental nature of the Japanese Web3 gaming market where companies are leveraging their substantial IPs and expertise as a competitive advantage.

Unfortunately, the current user base for Web3 games in Japan remains relatively small, and market liquidity is limited. This is largely due to the high taxes imposed on virtual asset investors, which can discourage participation and investment in this emerging sector. Consequently, substantial growth in the near term may be challenging to achieve. Yet, Japan holds clear advantages that could drive long-term growth and development in the Web3 gaming market. The country's robust gaming industry and rich content creation capabilities provide a strong foundation for the evolution of Web3 gaming.

6. Closing thoughts

During our visit to the TEAMZ Summit 2024 in Japan, we observed the burgeoning state of the Japanese Web3 market. It's evident that the market is still in its early stages, yet it possesses significant potential for growth. This potential is driven by several key factors: proactive efforts by Japanese government authorities to invigorate the industry, the increasing global orientation of Japanese founders, and the strong content intellectual property (IP) that Japan is known for. These elements are anticipated to catalyze further development in the market.

While challenges such as high taxes on individual investors remain, the long-term outlook for Japan's Web3 market is promising. It will be interesting to see whether the collective efforts of the government, companies, and investors will culminate in Japan establishing itself as a leader in the global Web3 arena. The developments in this space are certainly worth watching.

Get 20% off your SEABW ticket today!

Join us at the biggest blockchain event of the year in Southeast Asia! This is your chance to connect with industry leaders, explore innovative blockchain solutions, and engage in valuable networking opportunities. The event runs from April 22nd to 28th in Bangkok.

Exclusive Offer for Our Readers: Use code TIGERR20 to receive 20% off your general admission tickets. Tickets are limited — secure yours now to ensure your spot at this event. (Discount automatically applied through the link below).

Get 30% off the biggest SEABW side event: ONCHAIN 2024

Tiger Research is a proud media partner of ONCHAIN 2024.

As Asia’s first Real-World Asset conference, the event will feature speakers including leaders from global financial institutions, leading RWA protocols and regulators.

Get a glimpse into the future of RWA tokenization at ONCHAIN 2024: April 26th, Bangkok!

Enter code “tiger30off” to receive 30% off your tickets to the event.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.