TL;DR

The selection of a blockchain wallet is a critical decision for blockchain game developers, as it can significantly impact the user experience of the entire blockchain game experience.

The Korean blockchain games market is characterized by diverse needs that are intertwined with regulatory considerations, demanding a more nuanced approach to choosing a blockchain wallet.

Most game companies that have ventured into this space tend to adopt self-built platforms and wallets. However, small and medium-sized game companies typically opt for 3rd party wallets such as MetaMask, Kaikas, and Wemix Play.

Intro

In the same way that we need to log in to use Google services, blockchain services also require a login process for service usage. The blockchain wallet is the element necessary for this login process, and unlike traditional logins, it is responsible for various functions such as token storage and contract execution, with a significant impact on the overall service usability and security. Additionally, the blockchain wallet can determine the entire target user pool of the blockchain service depending on the chains it supports and the existing user base. Therefore, careful consideration is necessary when selecting a blockchain wallet.

In particular, blockchain games are services that involve various interactions occurring frequently and target not only existing Web3 users but also Web2 users as a mass adoption service. Therefore, a thorough review of the blockchain wallet is essential, taking into account numerous decision-making factors, including those specific to the blockchain game industry.

South Korean Blockchain Game Market

According to the "2022 Korea Game White Paper" published by the Ministry of Culture, Sports, and Tourism and the Korea Creative Content Agency, Korea ranks fourth in the global game market with a market share of 7.6%, and the domestic game industry's sales revenue amounts to around $15bn, indicating significant market potential. However, despite President Yoon Seok-yeol's emphasis on fostering the overall media & entertainment market, strengthened regulations have resulted in a market that is essentially prohibited for P2E games, leading to game developers who wish to release blockchain games in Korea to primarily seek overseas opportunities or find ways to comply with domestic regulations. As a result, the Korean blockchain game market is complex and characterized by diverse needs, making the selection of a blockchain wallet a critical decision that requires careful consideration.

Hence, we intend to provide an in-depth analysis of this topic in three parts. The first part will focus on comprehensively understanding the present state of the Korean blockchain game market. In the second part, we will scrutinize the platforms and wallets released by Korean blockchain game companies like Wemade, examining their current state and distinctive features. Drawing upon this evaluation, the third and final part will offer insights into the crucial decision-making factors that game developers need to consider while selecting and developing a blockchain wallet.

Who are the early adopters?

Currently, the majority of Korean game companies are venturing into the blockchain game market to improve profitability and explore new business opportunities. Among the small and medium-sized game companies, many have already launched blockchain game services. The level of Korean blockchain game services can be broadly divided into three stages based on the degree of review and execution, as follows:

Stage 1: Review

Game companies in the first stage have already signed MOUs, but they are looking to create their own platforms to address the issue of being dependent on a single platform. NHN and Webzen, in particular, have signed MOUs with Wemade, but it is expected that their major IPs will be released through their own blockchain platforms.

Stage 2: Test

Game companies in the second phase are also showing efforts to build their own platforms, and are in the process of development. Among them, Nexon is actively promoting the blockchain game ecosystem, focusing on its own IP, MapleStory, and plans to present detailed information at the upcoming GDC (Game Developers Conference) 2023.

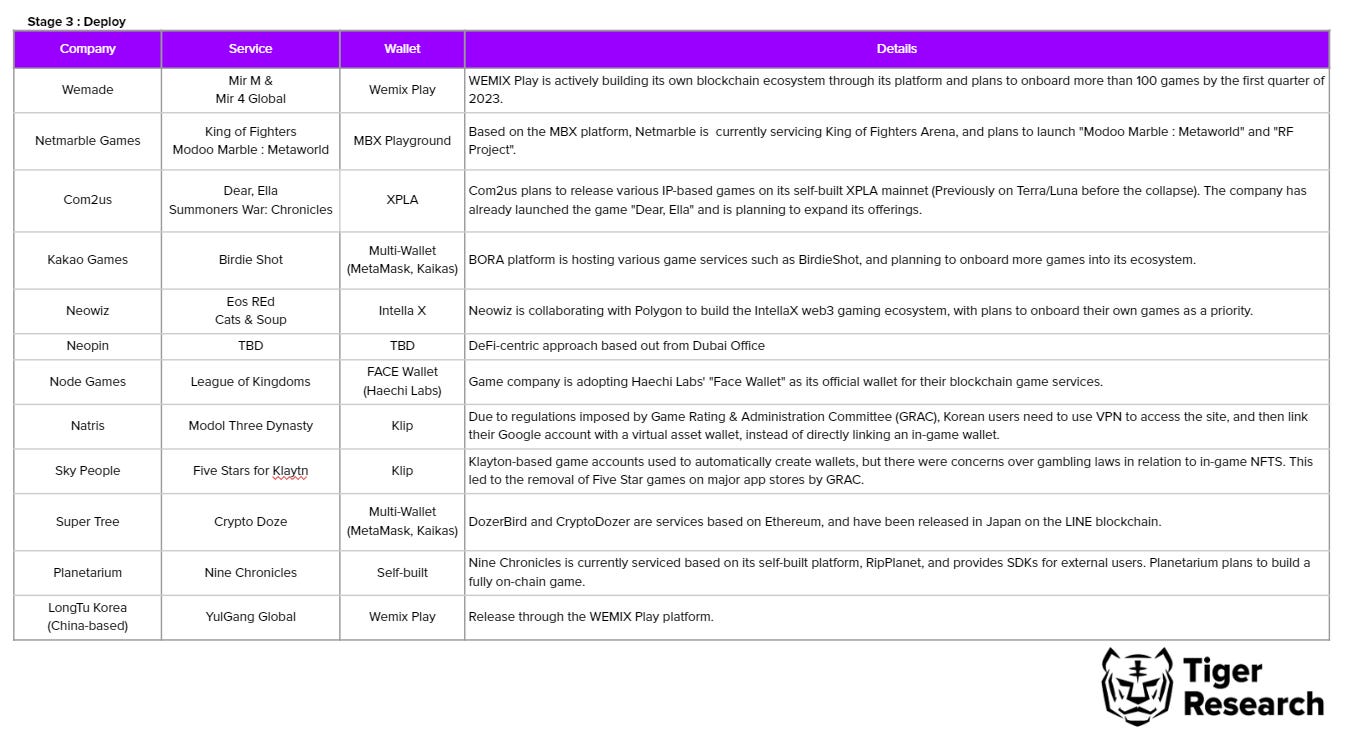

Stage 3: Deploy

Game developers in the third stage, such as Wemade, Netmarble, Com2us, Kakao Games, and Neowiz, have already launched their own platforms and are offering blockchain services - independently. It's interesting to note that Neowiz is not only offering its IntellaX platform, but also its Neopin wallet, which has a focus on Defi features. This split structure allows for separate focus on both gaming and finance.

Conclusion

Many small and medium-sized game companies in Korea, such as Gravity, Actoz Soft, and Ring Games, are also entering the blockchain gaming market. What is notable is that the majority of them are choosing to build their own platform services. Also Krafton and NHN will most likely develop their own platforms as well.

In rough estimation, 42% of the companies that have announced plans to enter the blockchain gaming market, are aiming to launch self-built blockchain platforms. This effort to establish self-built platforms can be seen as an attempt to break away from their dependence on 3rd party platforms ; perhaps a learning from Google Play and Apple AppStore behaviors in the Web 2 era.

With the exception of Kakao Games' Bora (currently adopting Klip), each company has or in progress of developing its own self-built wallet services. For some smaller sized studios, WeMade Play Wallet and Metamask is a widely used selection.

In the upcoming section, we will conduct a more detailed comparison of these wallets.