Korea Exodus: The Migration of Capital, Talent, and Companies

The State of Korea's Web3 Industry at the Crossroads

This report was written by Tiger Research, analyzing the Korea's Web3 industry status and its future in a shifting global landscape, as Trump's administration plans new regulations in 2025.

TL;DR

South Korea's high cryptocurrency trading volume has drawn global attention, but unclear regulations and the lack of guidelines have stalled industry development.

The government prohibits issuing real-name accounts to corporations for crypto trading. This restriction, along with a vague regulatory framework, has driven the migration of talent, capital, and companies, weakening the Web3 ecosystem's competitiveness.

As the global Web3 industry is expected to grow rapidly under the Trump administration, South Korea must reform its regulations to ensure the industry’s long-term sustainability.

1. Introduction

The inauguration of Crypto President Trump and the launch of the SEC's Crypto 2.0 TF will accelerate structural changes in the global Web3 market. This marks a key inflection point. Talent, capital, and companies will likely migrate to countries with robust regulatory frameworks, while the exodus from countries with uncertain regulations will intensify.

South Korea is part of this trend. Henry & Partners' Private Wealth Migration Report 2024 reveals that South Korea leads Asia in high-net-worth (HNW) emigration. Economic, social, and cultural factors drive this migration. Although not directly linked to the Web3 industry, these individuals often signal shifts in a country's business environment, much like canaries in a coal mine.

In this context, reexamining South Korea's Web3 industry is crucial. This report explores the movement of capital, companies, and talent in the Korean Web3 market and identifies key challenges the industry must address.

2. Capital Outflow: Offshore Exchanges and Accelerating On-Chain Movement

Korea's crypto market is rapidly growing. There are 15.6 million crypto investors, with total assets amounting to $73 billion. The average daily trading volume of crypto exchanges now matches the combined volume of KOSPI and KOSDAQ. This reflects the enthusiasm of Korean investors for crypto assets, driven by low stock market returns and political instability linked to martial law.

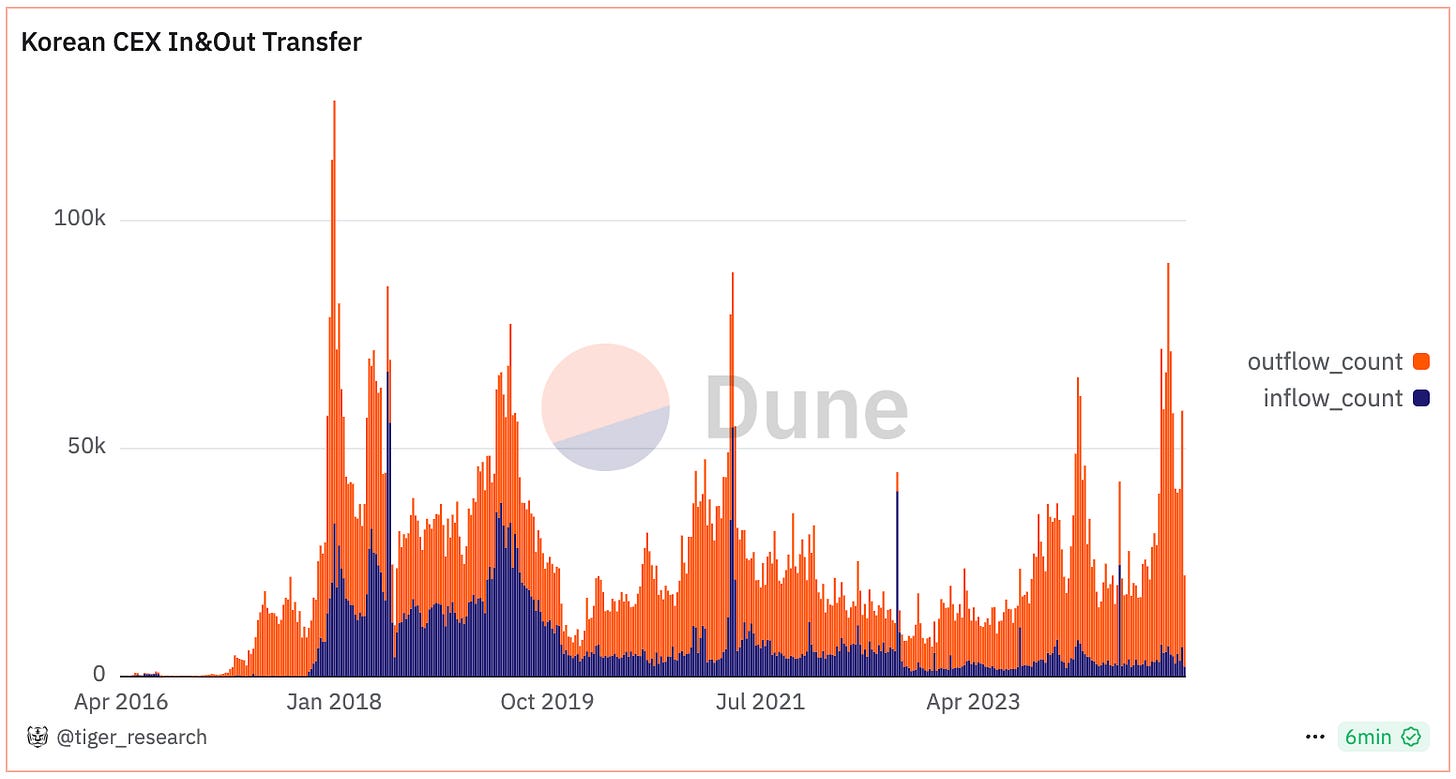

However, the recent offshore outflow of crypto assets has reached concerning levels. Service outages on major local exchanges during martial law diminished trust in the stability of these platforms. Meanwhile, the diverse investment opportunities offered by foreign exchanges and DeFi have further driven this capital migration.

The Financial Services Commission's 2024 first-half VASP survey revealed a 2.3-fold year-on-year increase in fund transfers to non-local VASP wallets. On-chain data confirms this trend, indicating a consistent rise in asset transfers from local exchanges to foreign platforms.

Capital migration will likely harm South Korea’s Web3 industry in the long term. Transaction fees and service revenues flow out of the country, weakening the local ecosystem's competitiveness and reducing investor protection. It also raises concerns about lower demand for the Korean won and increased volatility in its value.

3. Offshore Relocation: Moving Headquarters to Crypto-Friendly Countries

Korean Web3 firms are accelerating their offshore relocation. In 2024, Nexon's blockchain division Nexpace as well as Klaytn and Line Finschia’s Kaia Foundation moved to Abu Dhabi. WeMade’s Wemix moved to Dubai. The Web3 industry is wasting no time moving to countries with clearer and more favorable regulations.

South Korea faces several obstacles in promoting Web3-related businesses. Companies cannot issue corporate accounts for crypto trading, which makes using acquired assets difficult. This complicates the off-ramping of crypto assets and creates issues in accounting, taxation, and business operations. For example, in cryptocurrency payment businesses, Business A may receive crypto assets from a consumer and need to settle payments with a seller in KRW. Without a corporate account, off-ramping the assets becomes nearly impossible.

Despite South Korea's established regulatory framework, the absence of specific guidelines for stablecoins, DeFi, and Web3 gaming limits industry growth. The country's positive regulatory approach restricts businesses that are not explicitly permitted. In contrast, global markets benefit from regulatory sandboxes that support a variety of demonstration projects.

The Trump administration’s stance on crypto will likely highlight this disparity, emphasizing the favorable regulatory environment overseas and accelerating the relocation of Web3 companies.

4. Talent Outflow: Weakening Technical Competitiveness of Web3 Industry

The relocation of Korean Web3 companies abroad could negatively impact the domestic Web3 talent pool. As companies move to countries with clearer and more favorable regulations, domestic job opportunities may shrink, leading to a talent outflow. This could hinder the development of the domestic Web3 ecosystem.

Talent migration is not just a Web3 issue for South Korea. The country has one of the highest rates of key talent migration to the United States, especially among those with master's and doctoral degrees. This trend is particularly strong in the Web3 industry, which relies on technology, and could harm the industry’s competitiveness.

In contrast, countries like the United States and UAE foster their Web3 industries with clear regulations and supportive policies. Korea's unclear regulatory environment has accelerated the brain drain, which poses a long-term threat to Korea's technological competitiveness and industrial ecosystem.

5. Challenges and Opportunities for Korea's Web3 Market in 2025: Regulatory Reform and Industry Growth

South Korea has drawn global attention due to its cryptocurrency trading volume. However, this volume has not fostered industry development, leaving the country as a liquidity gateway for global traders. This structure does not support sustainable growth. South Korea urgently needs to make business and technological advancements to strengthen its Web3 ecosystem.

South Korea stands marginalized in global Web3 development, hampered by insufficient local innovation and regulatory uncertainty. This overreliance on trading volume rather than ecosystem building has led to a 'Korea discount' in international markets.

In 2025, significant global industrial changes are expected with the new administration. Amid these changes, South Korea stands at a critical crossroads. Positive steps include allowing corporate accounts for crypto operators, setting up stablecoin regulations, and advancing crypto legislation. However, these efforts are just scratching the surface.

To move forward, South Korea must address risks, analyze global policy shifts, and develop a regulatory framework tailored to domestic conditions. The country must pivot from focusing solely on transaction volume to establishing a sustainable innovation hub distinguished by business excellence and technological leadership.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.