TL;DR

The five major domestic cryptocurrency exchanges in Korea are understood to coordinate their actions regarding listing procedures through DAXA guidelines, but closer inspection found exchanges acting under individual interests.

Recent trends show a fierce competition for new listings as exchanges aim to increase their market share in the saturated domestic market. At the same time, with increasing calls for stronger government regulation, there has also been a considerable increase in delistings.

So far, listing procedures have been conducted under the nominal standards of voluntary guidelines. However, with consecutive negative incidents in the virtual asset industry, there is a growing momentum for introducing regulations. Following Japan's example, there is an increasing likelihood the domestic crypto self-regulatory body's authority will be strengthened, leading to more stable trading support procedures.

Introduction

Current Korean Cryptocurrency Exchanges (CEXs) assert that they are unifying the standards for listing and delisting digital assets through the launch of the Digital Asset Exchange Association (DAXA). This is in response to investor protection, standardization of transaction criteria, and intensified government regulation However, according to our research, the reality reveals a different picture - the criteria for listing and delisting digital assets vary significantly across South Korean exchanges, with WeMade's Wemix delisting serving as a prime example.

DAXA, in December 2022, began delisting Wemix Coin due to the coin's excess circulation, far exceeding its whitepaper's proposals. But, by February, Coinone, a DAXA member, controversially relisted the coin. This action exposed DAXA's guideline enforcement as more symbolic than substantial. In reality, each exchange independently dictates its listing and delisting standards, prioritizing its own interests over a collective approach.

DAXA's main directives revolve around 'investor protection measures', emphasizing cryptocurrency transparency and risk reduction. However, with each exchange's business performance tethered closely to their supported assets, synchronized action appears daunting. This difficulty becomes even more apparent when examining the listing and delisting trends across DAXA's five major Korean exchanges.

What were the consequences following the Terra-Luna crisis?

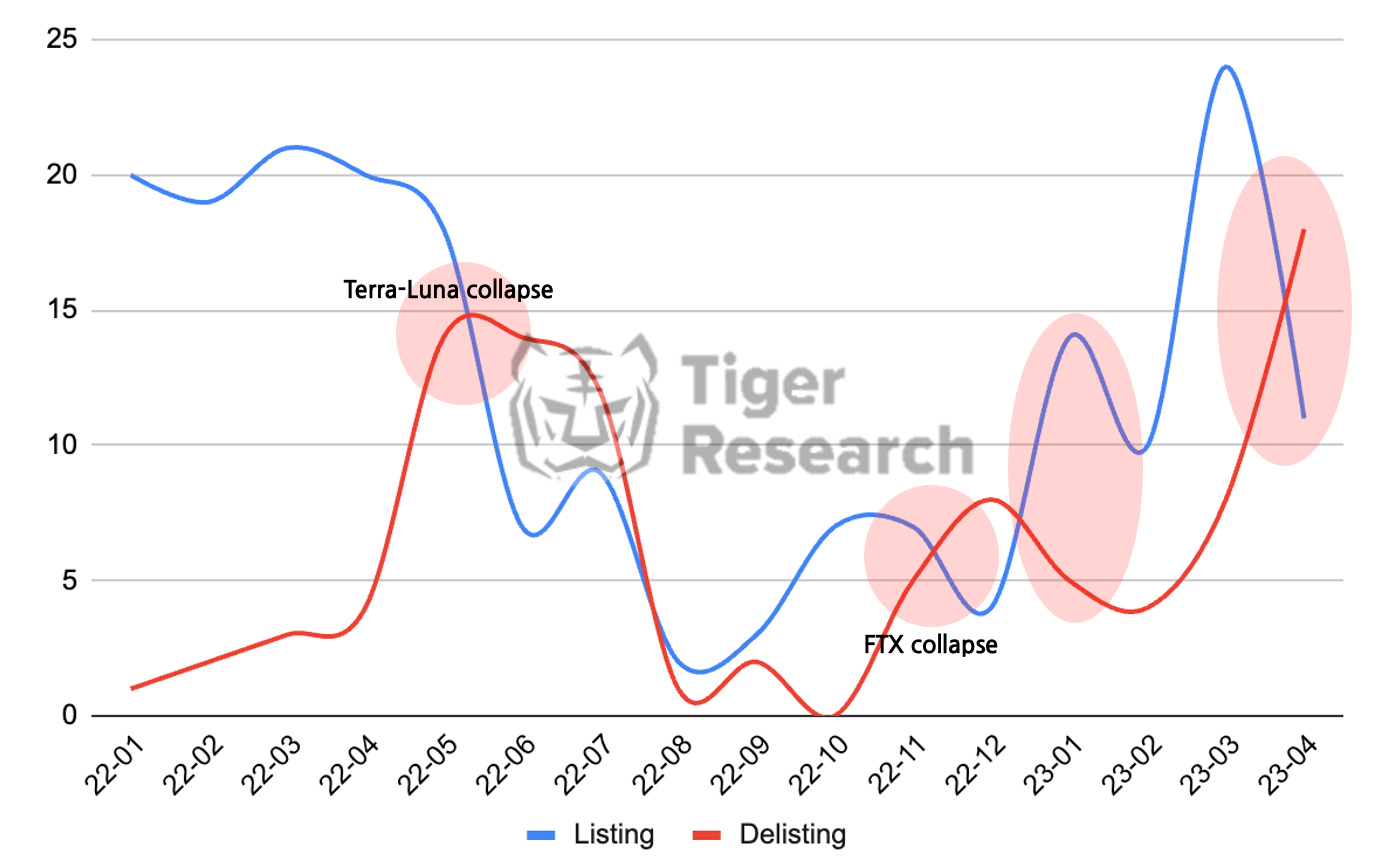

The chart beneath illustrates the flux in new listings and delistings among DAXA members. From January to April 2022, new listings flourished with no delistings. Yet, post the Terra Luna crisis in May - a precursor to the crypto bear market - a notable shift happened. New listings took a steep downturn, and delistings, after a brief spike, soon mirrored this decline.

After the FTX crisis, both new listings and delistings surged. This can be attributed to two seemingly contradictory factors:

Increase Market Share amid increasing competition among exchanges.

Increased regulatory pressures leading to an acceleration in delistings.

The ongoing battle for listings to expand market share

[Monthly listing statistics from the 5 major exchanges]

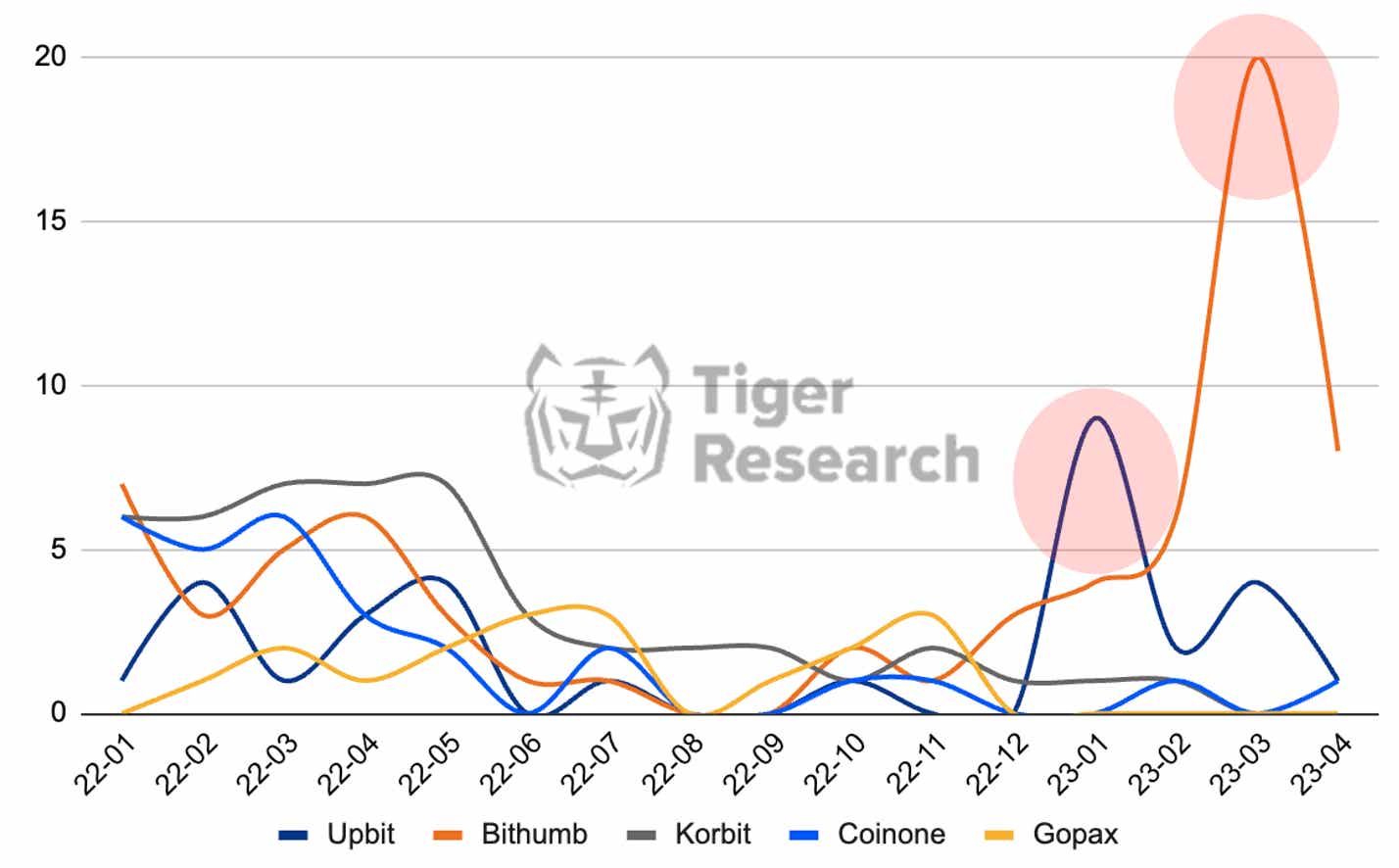

In December 2022, despite the shock of the FTX incident, the crypto industry saw a surge in new digital asset listings, reversing the slump since the Terra Luna event. This was mainly due to Upbit, Korea's top digital asset exchange, which listed nine cryptocurrencies in a row, followed by a significant number of listings from its rival, Bithumb.

Key highlights from Upbit:

Upbit added seven types of cryptocurrencies to its roster. This included the popular meme coin Shiba Inu ($SHIB) and fan tokens from globally renowned football clubs such as Napoli ($NAP), Manchester City ($CITY), and Barcelona ($BAR).

This move was seen as a strategic attempt to ride the global trends and effectively enhance its market share.

A key part of this strategy was leveraging football club fan tokens with the dual purpose of creating synergy with the 2022 World Cup season, and maximizing marketing effectiveness as the official sponsor of the Italian football team, Napoli.

This strategy clearly worked, as Upbit saw its market share in Korea grow by about 8% from one month to the next.

As of March 2023, Bithumb continues to lead in the crypto listing race with a significant number of new listings. It has listed approximately five times as many digital assets compared to Upbit in the same period.

Key highlights from Bithumb:

Bithumb's mass listing strategy appears to be an effort to maximize the effectiveness of its BTC market remodeling event.

This can be seen as a strong countermeasure against the widening gap with top competitor Upbit and the aggressive pursuit from the third-placed Coinone, further emphasizing the fierce competition for the second spot in the market.

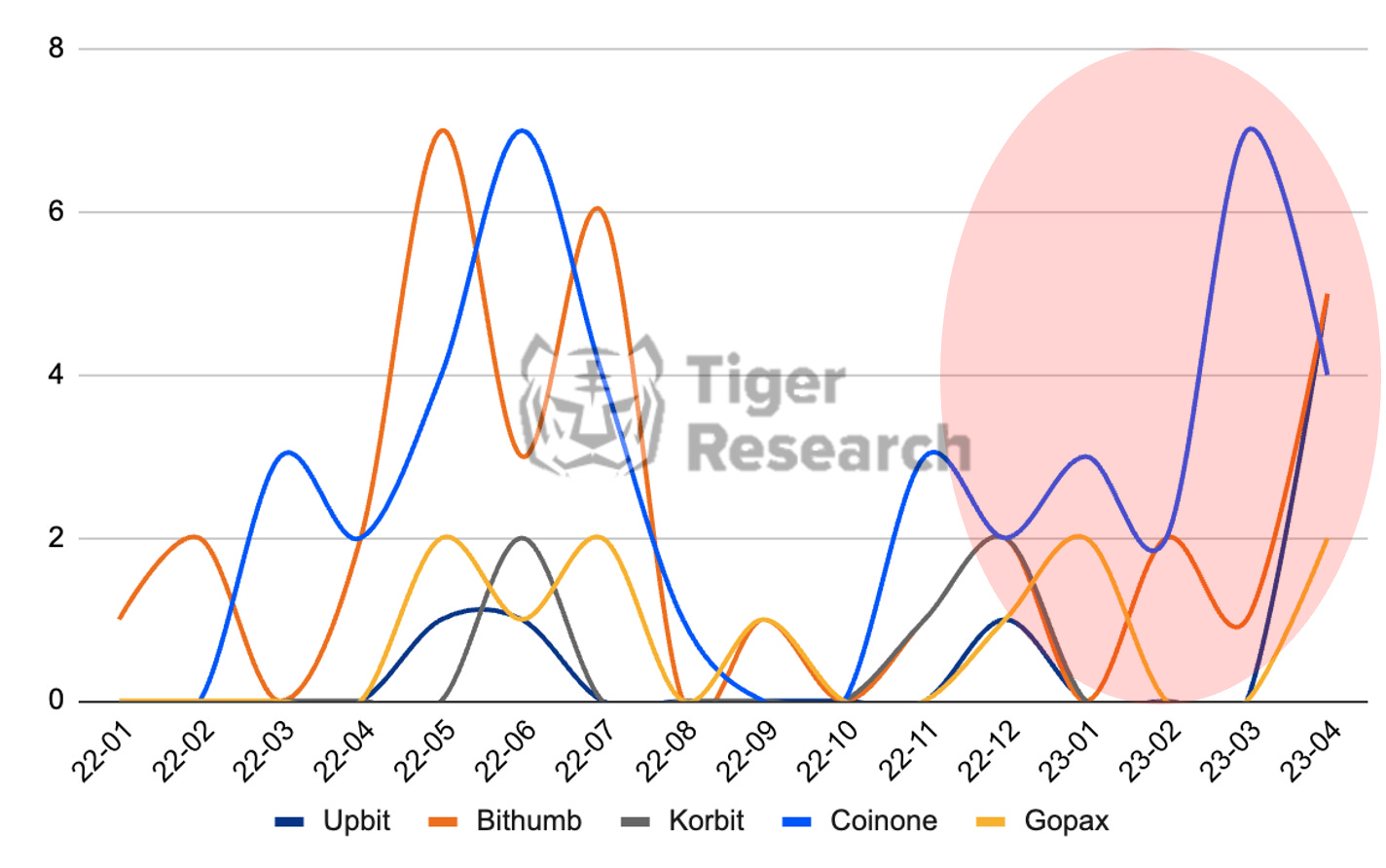

What is the impact of increasing regulatory pressure?

From the first quarter of 2023, delistings within exchanges began to rise. This uptick aligns with the start of the prosecution's probe in January 2023 into listing corruption and market manipulation by cryptocurrency exchanges. When clear evidence of these allegations emerged, exchanges began delisting tokens deemed risky as a corrective action.

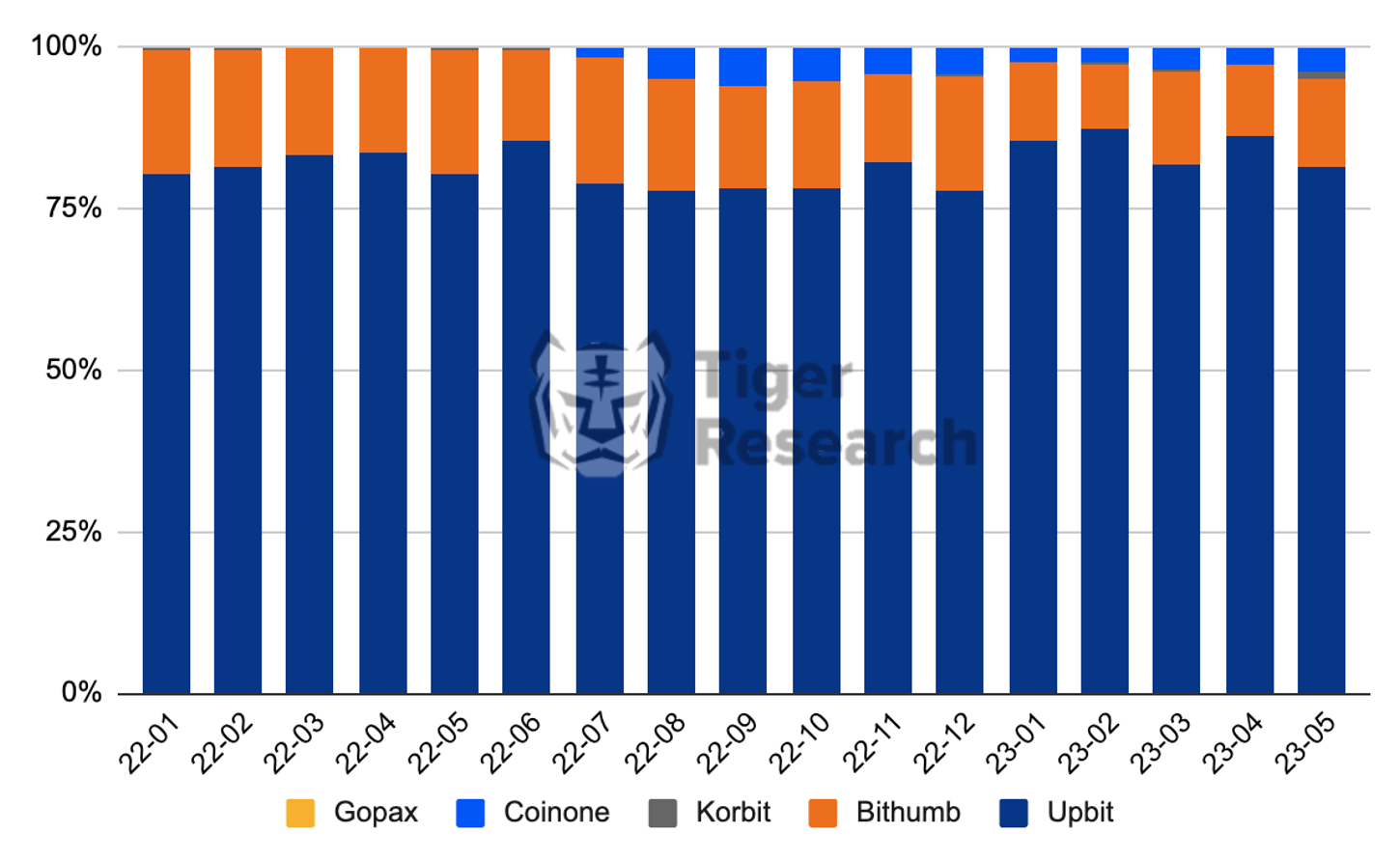

An intriguing pattern emerged from listing and delisting trends: since January 2022, about 52% of listed tokens have been exclusive to single exchanges. Bithumb, the second-largest domestic exchange, hosted about 37% of these unique listings.

The fact that over half of the tokens are listed exclusively on one exchange challenges the idea of a universally applied listing guideline. This situation reflects the voluntary nature of these common guidelines, which offer basic risk and stability regulations but lack any legal enforcement power. Moreover, the diversity in listings across exchanges hints at the unique evaluation criteria each exchange employs.

Conclusion

Cryptocurrency listing and delisting trends on domestic exchanges are often swayed by market conditions. However, individual exchanges often exhibit unique patterns driven by their own strategic calculations. This is a result of DAXA's limited authority, which provides basic, voluntary guidelines, and doesn't directly intervene in each exchange's listing decisions. The re-listing of Wemix ($WEMIX) by Coinone, against a joint DAXA delisting decision, is a prime example of this.

Yet, with recurring issues such as listing corruption and market manipulation tarnishing the crypto industry, there's growing demand for more regulation of exchanges' listing and delisting processes. Some propose giving DAXA a legal basis and a more defined role, hoping to achieve more consistent listing and delisting practices in the domestic crypto industry, rather than it being overly reactive to external shocks or market responses.

Looking ahead, there's an expectation that, following Japan's example, the domestic crypto self-regulatory body's authority will be expanded and its evaluation procedures systematized, leading to more stable trading support procedures.