What are the major changes expected in Korean VASP regulation

The next step in South Korea's cryptocurrency market regulation

TL;DR

The Virtual Asset User Protection Act will be enforced in the Korean virtual asset market from July this year, and is expected to help protect domestic virtual asset investors and establish a healthy market.

The bill includes: 1) scope of virtual assets; 2) payment of interest on customer deposits; 3) insurance and reserve for damages caused by hacking, failures, and other accidents; and 4) regulation of unfair trade practices related to virtual assets.

In particular, it defines clear penalties for unfair trade behavior. The 'Virtual Asset Investigation Business Regulations' will also be enacted, which will stipulate relevant details and procedures, and it is expected that the soundness of the virtual asset market will be greatly improved based on these legal bases.

Introduction

In July of this year, the Virtual Assets User Protection Act (hereinafter referred to as the Virtual Asset Act) will be enforced in the Korean virtual asset market. This legislation seeks to instill a proper order within the virtual asset market, aiming to rectify the issues stemming from previously unclear regulations. There is anticipation of improvement in the regulatory framework and investment protection. This report delves into crucial aspects that cryptocurrency businesses and investors need to be aware of before the Act's implementation.

1. Who is subject to regulation under the Virtual Assets Act

The Virtual Assets Act and its accompanying Enforcement Decree, scheduled to take effect in July of this year, defines virtual assets as follows: A virtual asset is "an electronic representation (including any rights in respect thereof) that possesses economic value and can be transacted or transferred electronically."

The definition of virtual assets outlined in the Virtual Assets Act aligns with that specified in the Act on the Reporting and Utilization of Specified Financial Transaction Information (hereinafter referred to as the Special Money Act). However, the Virtual Assets Act goes further to delineate additional categories of assets that are expressly excluded from being classified as virtual assets.

The exclusions specified within the Act encompass: 1) electronic bonds, 2) mobile vouchers, 3) Central Bank Digital Currencies (CBDCs), 4) deposit tokens linked to CBDCs, and 5) Non-Fungible Tokens (NFTs) that are unique and not interchangeable. These exclusions clarify the scope of what constitutes a virtual asset under this legislation, ensuring certain asset types are explicitly outside its purview.

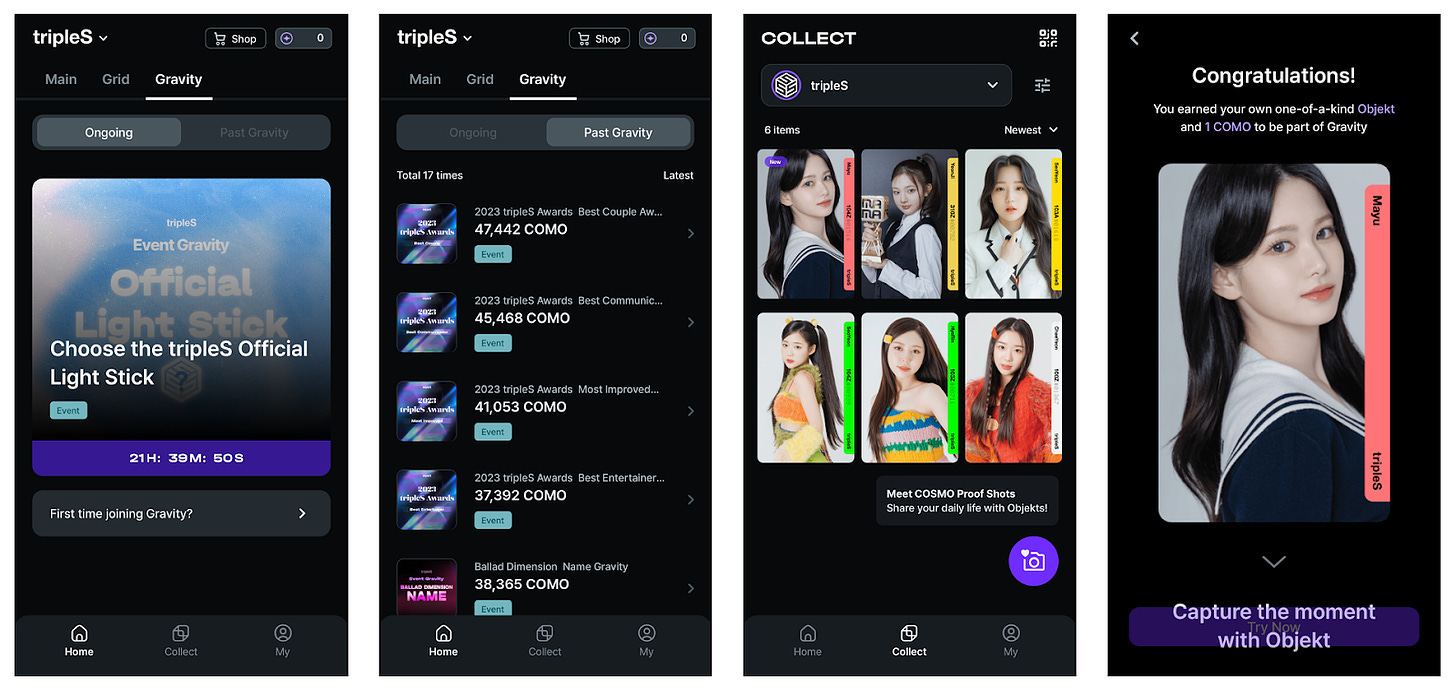

Regarding NFTs, an interesting distinction arises as they might fall under the category of virtual assets according to the Special Money Act, yet are expressly excluded from the scope of the Virtual Assets Act. This delineation is likely attributed to the diverse applications of NFTs, which render their categorization challenging. Furthermore, NFTs are predominantly traded for collectible purposes, leaving a minimal impact on the broader financial system.

The Financial Services Commission has clarified that the classification of NFTs under the Virtual Assets Act hinges on their intrinsic characteristics rather than simple designation. This is reflected in the Enforcement Decree of the Virtual Assets Act, which doesn't broadly exclude NFTs but instead specifies them as being "unique and non-substitutable." Consequently, NFTs could fall within the realm of virtual assets if they are mass-produced, capable of being traded interchangeably, or utilized as a means of payment.

This interpretation explains why Modhaus, a web3-based idol operator's NFT-based idol photo card, is currently eligible for card payments, given its collectible nature and the limited scope of transactions between holders. Furthermore, NFTs that serve authentication and proof purposes may be considered exempt from the virtual assets category.

It is also noteworthy that the DeFi sector is not explicitly included in the cryptocurrency law. The core issue lies in DeFi's decentralized nature, which makes it difficult to identify its operators and makes regulation enforcement ambiguous. For the same reason, the European Union's MiCA excludes DeFi from its regulation of virtual asset markets.

However, DeFi platforms with identifiable operational entities that offer financial services akin to traditional institutions—such as deposits, loans, and staking using virtual assets—may still fall under the scope of the Act. Nonetheless, given DeFi's critical role in the broader cryptocurrency ecosystem, it is anticipated that targeted regulatory frameworks may evolve through continued dialogue and analysis, aiming to address the unique characteristics and risks associated with decentralized finance.

2. KRW deposit payments

An important amendment introduced by the Act is the requirement for virtual asset operators to pay customers with 'interest income' on their fiat deposits. This is similar to how securities firms are obligated to pay 'depository fees' to their customers for the deposits they hold with them. Historically, the absence of clear regulations in this domain has led to disputes. There have been instances of cryptocurrency operators retaining interest income derived from customer deposits and certain banks refraining from distributing interest income on deposits made by cryptocurrency investors.

The amount of interest income from customer deposits cannot be understated. For instance, Dunamu, the operator of South Korea's largest cryptocurrency exchange, Upbit, reported having KRW 3.9 trillion (approx. USD 2.8 billion) in customer deposits by the end of 2023. While the specific details of Dunamu's financial arrangements with K-Bank, the provider of its real-name accounts, remain undisclosed, it is plausible to estimate the potential interest income based on general banking practices. If these deposits were held in a corporate depository account at a conservative interest rate of 0.1%, it would result in an interest income of at least KRW 3.9 billion (approx. USD 2.8 million). Conversely, applying a more typical domestic benchmark interest rate of 3.5% would substantially increase the interest income to KRW 136.5 billion (approx. USD 101.2 million).

After the enforcement of the Virtual Asset Act, virtual asset operators will be obligated to pay interest income generated from customer deposits to customers. This regulatory change is poised to usher in a new era for the domestic cryptocurrency exchange market. The amount of interest revenue available for distribution will likely depend on the operational practices of the banks issuing real-name accounts and the specific terms outlined in contracts between these banks and the exchanges. This aspect of interest revenue is anticipated to emerge as a new competitive factor within the cryptocurrency exchange landscape.

3. Damage control for cryptocurrency businesses

With the implementation of the Virtual Asset Act, a new obligation falls upon virtual asset operators to secure insurance or deductibles and to build up reserves. This requirement aims to ensure they can adequately respond to incidents like hacking or system failures. In July 2023, the Korean Banking Association had already established minimum safeguards by requiring the mandatory accumulation of reserves through the 'Guidelines for the Operation of Virtual Asset Real Name Accounts'.

However, this initiative was critiqued for offering limited protection, primarily because its application was restricted to exchanges dealing in Korean won. The introduction of the Virtual Asset Act marks a significant enhancement in regulatory measures, offering a more comprehensive coverage that extends beyond Korean won exchanges to encompass the entirety of virtual asset businesses, including coin markets, wallets, and custodial services.

Currently, the amount of reserves required by the Banking Federation is a minimum of KRW 3 billion (approx. USD 2.2 million) to a maximum exceeding KRW 20 billion (approx. USD 14.8 million). The Virtual Asset Act requires insurance or reserves that cover at least 5% of the economic value of virtual assets held in hot wallets, with a minimum reserve of KRW 3 billion for exchanges dealing in Korean won, and a minimum of KRW 500 million (approx. USD 371 thousand) for other virtual asset operators.

Despite this, the recent incidents involving Haru Invest, Delio, and GOPAX's GOFi suggest that the prescribed compensation limits and reserve amounts may be inadequate. Although the legislation is an important step towards establishing baseline safeguards within the virtual asset sector, there's a growing consensus that a reassessment is necessary to ensure they align more closely with the evolving industry landscape and potential risk exposure.

4. Regulating unfair trading behavior

The most significant change following the implementation of the Act is the initiative to foster a healthier market through the stringent regulation of unfair trading practices. This is especially important as the Korean cryptocurrency market has previously been affected by numerous allegations of rotational trading and price manipulation. As of 22:00 on April 3, 2024, of the 274 cryptocurrencies listed on Bithumb Exchange, the top 10 cryptocurrencies accounted for more than 40% of the trading volume. Moreover, scenarios where the top 10 holdings and trading volumes comprise approximately 80-90% or more are not rare.

Similar to the Capital Market Act, the Virtual Asset Act introduces stringent measures against unfair trade behaviors such as insider trading and market manipulation through the use of undisclosed material information. A notable feature of the new legislation is the specification of clear penalties, such as criminal charges and fines, for engaging in these unfair practices. Additionally, the enactment of the 'Virtual Asset Investigation Business Regulations' will outline details and procedures for addressing such offenses.

The absence of a legal framework for prosecuting crimes in the virtual asset market has historically hindered investigations into these illicit activities. However, with the implementation of the Virtual Asset Act, there is an optimistic outlook for the establishment of a healthier trading environment, marked by enhanced regulatory oversight and enforcement capabilities.

In addition, the Act prohibits virtual asset operators from unjustly blocking users' deposits and withdrawals of virtual assets. This is expected to reduce some of the abnormal transaction behaviors such as revolving transactions and fringe pumping that often occur when deposits and withdrawals are suspended Despite these intentions, the criteria defining legitimate grounds for suspending transactions leave room for improvement, signaling a potential area for future regulatory refinement.

Furthermore, the Virtual Asset Act mandates virtual asset operators to implement digitized infrastructures, including systems for monitoring abnormal transactions and reporting mechanisms, which are expected to help strengthen market integrity.

Closing thoughts

The South Korean cryptocurrency market, known for its high liquidity, has garnered significant interest. This attention has been a double-edged sword, fostering market development while also making it susceptible to crimes like unfair trade practices and fraud.

Previously, the expectation was for a self-regulatory organization focused on virtual asset exchanges to enhance market integrity. However, the effectiveness of such self-regulation has been hindered by a conflict of interests and the lack of clear regulations. With the upcoming enforcement of the Virtual Asset Act, there is an optimistic outlook for the fortification of the Korean virtual asset market. Observers are keenly watching to see if South Korea can navigate these challenges to achieve sustainable growth, leveraging its notable market liquidity.

Get 20% off your SEABW ticket today!

Join us at the biggest blockchain event of the year in Southeast Asia! This is your chance to connect with industry leaders, explore innovative blockchain solutions, and engage in valuable networking opportunities. The event runs from April 22nd to 28th in Bangkok.

Exclusive Offer for Our Readers: Use code TIGERR20 to receive 20% off your general admission tickets. Tickets are limited — secure yours now to ensure your spot at this event. (Discount automatically applied through the link below).

Get 30% off the biggest SEABW side event: ONCHAIN 2024

Tiger Research is a proud media partner of ONCHAIN 2024.

As Asia’s first Real-World Asset conference, the event will feature speakers including leaders from global financial institutions, leading RWA protocols and regulators.

Get a glimpse into the future of RWA tokenisation at ONCHAIN 2024: April 26th, Bangkok!

Enter code “tiger30off” to receive 30% off your tickets to the event.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.