TL;DR

Since 2021, the NFT market has entered a slump. However, in contrast, the NFT finance (NFTfi) market, which offers services such as loans, fractionalization, and rentals based on NFTs, is showing signs of growth. Notable frontrunners in this market are NFTfi and Blend Protocol (Blur). Recently, Binance has entered this market as well.

In the NFTfi sector, there are 1) P2P methods, which are financial transactions directly between individuals, and 2) P2Pool methods that utilize deposited liquidity. More diverse strategies are expected to emerge, addressing the limitations of the early models.

The activity around NFTs, which had been confined to basic levels such as minting, selling, owning, and trading, seems likely to evolve with the integration of decentralized finance (DeFi) in the form of NFTfi.

Introduction

Non-fungible tokens, or NFTs, have shaken the world of digital assets. Essentially, an NFT is a unique token that cannot be replaced with something else, meaning even within the same project, each token possesses distinct attributes and values. For instance, token number 1 and token number 200 from the 'Doodles' NFT collection may carry different prices. These unique qualities, however, make NFTs harder to trade than fungible tokens (FTs) like $ETH, leading to liquidity issues.

To tackle these issues, we are now witnessing the convergence of NFTs and Decentralized Finance (DeFi) functionalities, a movement that has given birth to a new concept – NFT finance or NFTfi. The main functions of NFTfi include NFT-collateralized loans, fractionalization, and rental services, among others. The NFTfi platform is a prominent example of this new wave, and with the recent entry of the NFT exchange Blur and Binance into the NFTfi market, interest is rapidly growing.

So you can lend NFT and earn interests?

Surprisingly, with NFTfi, it's possible to secure a loan using your NFT as collateral. These DeFi functionalities integrated into NFTs open up a whole range of financial utilities as mentioned above. Among these, NFT collateralized loans have gained the most popularity.

The scale of NFTfi loans has grown significantly since 2022, contrasting with the declining NFT trading volume post-2021. As revenues from selling NFTs became inconsistent, the market size of NFTfi, which provides alternative ways to earn a profit, expanded.

P2P method

Generally, NFT collateralized loans involve a lender and a borrower, operating peer-to-peer (P2P), facilitated by a particular lending protocol. The process begins with the borrower listing an NFT as collateral, then multiple lenders can offer their loan terms. Once the borrower accepts the most suitable offer, they lock their NFT and receive the fungible tokens, such as $ETH, from the lender. The borrower then repays the loan plus interest according to the terms defined in the protocol.

Despite its popularity, the P2P model carries inherent complexities. Both the lender and the borrower need to have a comprehensive understanding of the NFT’s value and the fairness of the loan terms. Furthermore, numerous interactions are required before the loan process can be completed, which can act as a barrier to entry.

P2Pool method

An alternative method to the P2P model is the Peer-to-Pool (P2Pool) model, where individual borrowers draw loans from a single lending pool. The value of an NFT used as collateral in this model is determined by the floor price of the project it belongs to, so NFTs from the same project are all evaluated at the same market price.

The P2Pool model offers convenience as borrowers can execute loans without complex calculations. It is also attractive to NFT holders who hold NFTs valued near the floor price. However, a unilateral evaluation goes against the spirit of NFTs, which are inherently unique assets. Additionally, there can be capital inefficiency issues as funds remain idle except when loans are taken. Moreover, a sharp drop in the floor price of collateral can trigger a mass liquidation of many NFTs tied to the pool, leading to a chain reaction of price drops.

Main services of P2P method

NFTfi

NFTfi is a prominent NFT collateralized loan service with over $420 million in loans executed to date. Borrowers list their NFT, and lenders propose loan conditions, enabling rational choices for both parties. NFTfi provides information regarding the average loan amount, APR, and loan history of the listed NFT, enabling borrowers and lenders to make informed decisions. To provide credibility for the listed assets, the NFTfi DAO runs a whitelist process to verify projects that are qualified for loans.

Blend Protocol (Blur)

Blend, launched by NFT exchange Blur on May 2, differs from other lending protocols in that it allows indefinite loan extensions until a replacement lender is found. This unique feature is possible because Blend finds a new lender to take over the loan automatically through a Dutch auction.

Blur also incorporates a point system. When a user lists NFTs or makes a loan, they are rewarded with points that can be redeemed into their native token $Blur. This is similar to Blur’s expansion strategy by refunding a part of the transaction fees back to the user with $Blur. It seems that the Blur team also used the successful growth formula for Blend.

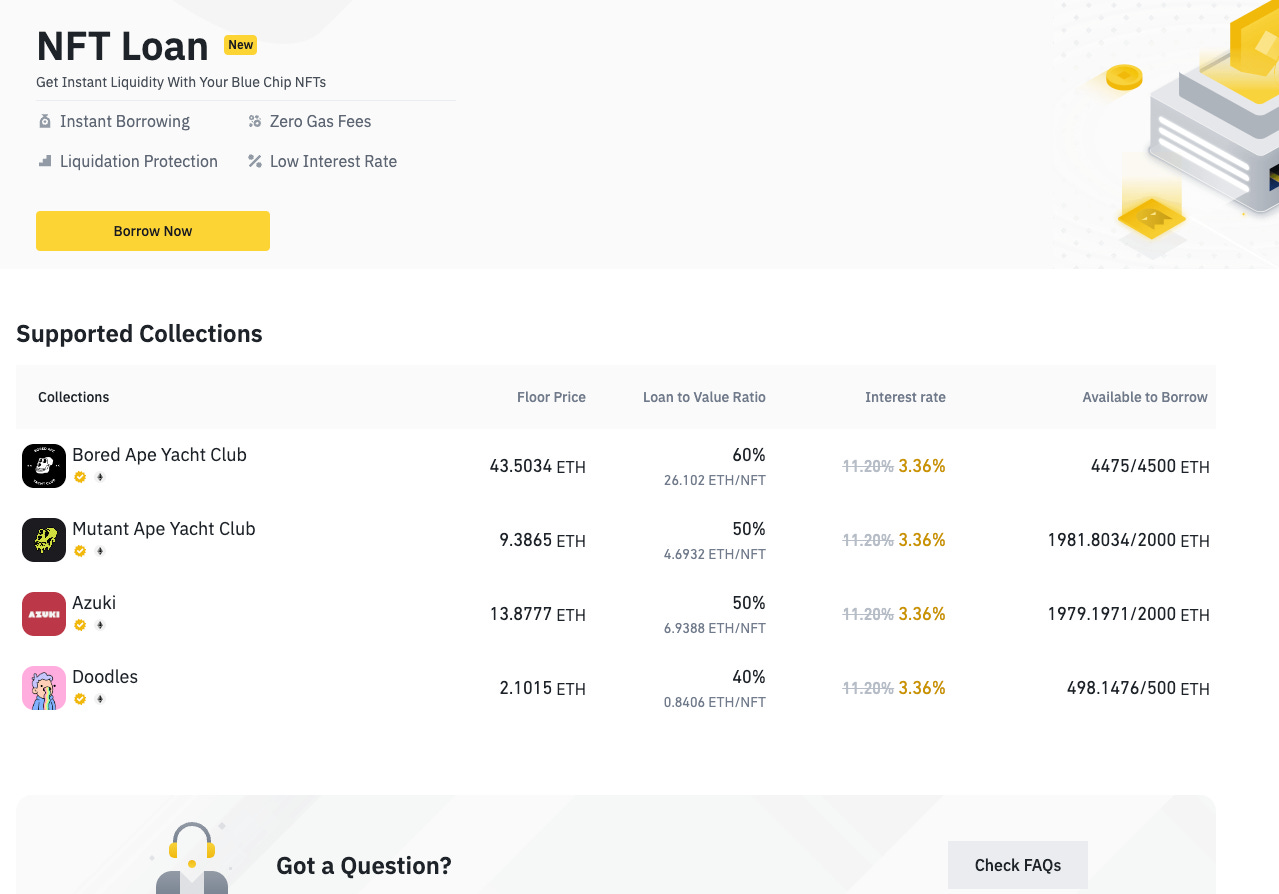

Binance NFTfi

Binance, a heavyweight in the cryptocurrency market, has launched its own NFT loan service. Binance uses a peer-to-pool (P2Pool) model, where Binance itself acts as the lending pool. The service currently supports only 4 blue-chip NFTs; BAYC, MAYC, Azuki, and Doodles, for loan collateral. However, it is expected that Bitcoin NFTs could also become eligible for collateral after the May announcement.

Conclusion

Just one week after its launch, Blend demonstrated its potential by facilitating loans worth around 47,757 ETH (equivalent to $88M USD). This success story reaffirms the effectiveness of Blur's proven strategies, propelling them to the top of the NFT collateral loan market. Binance, on the other hand, has carved out a different path, creating a P2Pool structure where Binance itself provides the loans.

As of now, there isn't sufficient data to compare the loan volumes of Binance and Blur. However, given the unique characteristics of the NFT market and Blur’s closer alignment with "Web3" culture, it is expected to continue leading the market for the time being.

As for Korea, Blockchain research company Fingerlabs launched a product called Favor Station. As of now, it allows limited staking options, and there seems to be significant room for improvement and growth.