TL;DR

Web 3.0 companies focusing on profitability align with Philip Fisher's investment principles.

Web 3 projects that achieve worthwhile profit margins will likely have better long-term sustainability

This shift towards profitability may signal a brighter future for the Web 3.0 market.

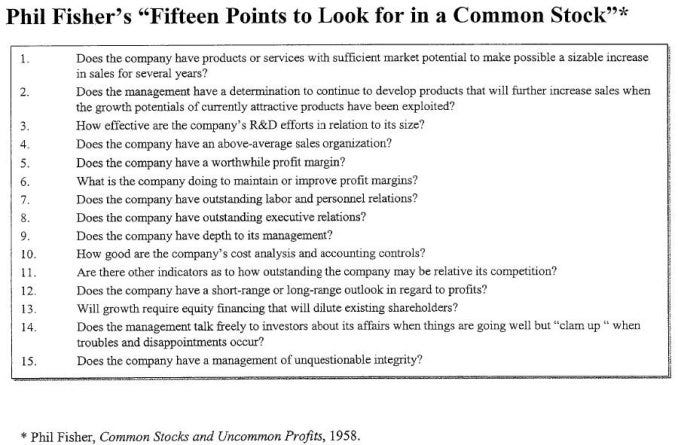

Philip Fisher's classic, "Common Stocks & Uncommon Profits," remains a valuable guide for evaluating businesses, even in the rapidly evolving landscape of the Web 3.0 era. Although some may consider it outdated, Fisher's 15 points still offer crucial insights for investors navigating this new market.

One key question is whether Fisher's principles can apply to the Web 3.0 market.

From 2020 to 2022, many Web 3.0 companies emerged with impressive marketing slogans and grand investments, but their contributions to the world's GDP were minimal. With Bitcoin's market cap of $521 billion paling in comparison to Apple's $2,710 billion, skepticism was understandable.

Entering 2023, as Crypto Winter took hold, the market's focus shifted toward anticipating the return of the Bull market. Despite the volatility, the current situation feels strangely normal. Uncertain asset classes are naturally prone to fluctuations, and regulatory frameworks remain elusive. For instance, in South Korea, the number of people employed full-time in the Web 3.0 sector (around 10,000 maximum) is significantly smaller than the thriving 🐔fried-chicken market, which boasts 61,000 stores in the country.

However, a recent shift in focus among many Web 3.0 companies toward profitability is an optimistic sign. Major industry players are increasingly concentrating on areas with clear operating profits, such as transaction fees, OTC trading, market making, and liquidity pools. While profitability is not the only important factor, it's a good way to rethink Web 3's progress. Some critics argue that this focus on profit betrays Web 3.0's original spirit, but it can be seen as a beacon of hope. Both traditional corporations and decentralized autonomous organizations (DAOs) need to generate operating profits to survive. Investors and market participants are not mere volunteers; their support depends on the long-term sustainability of the companies they invest in.

As we move beyond companies leveraging concepts like Community Driven to evade scrutiny over lackluster sales and operational losses, a genuine shift toward direction and purpose is taking place. Web 3.0 enterprises that can answer Philip Fisher's Point 5—"Does the company have a worthwhile profit margin?"—are poised to become the true victors in the next Bull market or the impending crypto renaissance. In this ever-changing landscape, Fisher's insights continue to demonstrate their enduring relevance.