Setting the Standard: How Hong Kong New Index Series is Transforming Crypto in Asia

Can Hong Kong New Benchmarks Bring Stability and Confidence to Asia’s Crypto Market?

This report was written by Tiger Research, examining Hong Kong's new crypto index initiatives and their potential impact on Asia's cryptocurrency market.

TL;DR

Establishing a Benchmark for Asia: Hong Kong’s HKEX Virtual Asset Index Series introduces standardized Bitcoin and Ethereum pricing to address regional price discrepancies and improve transparency for investors in the Asia-Pacific market.

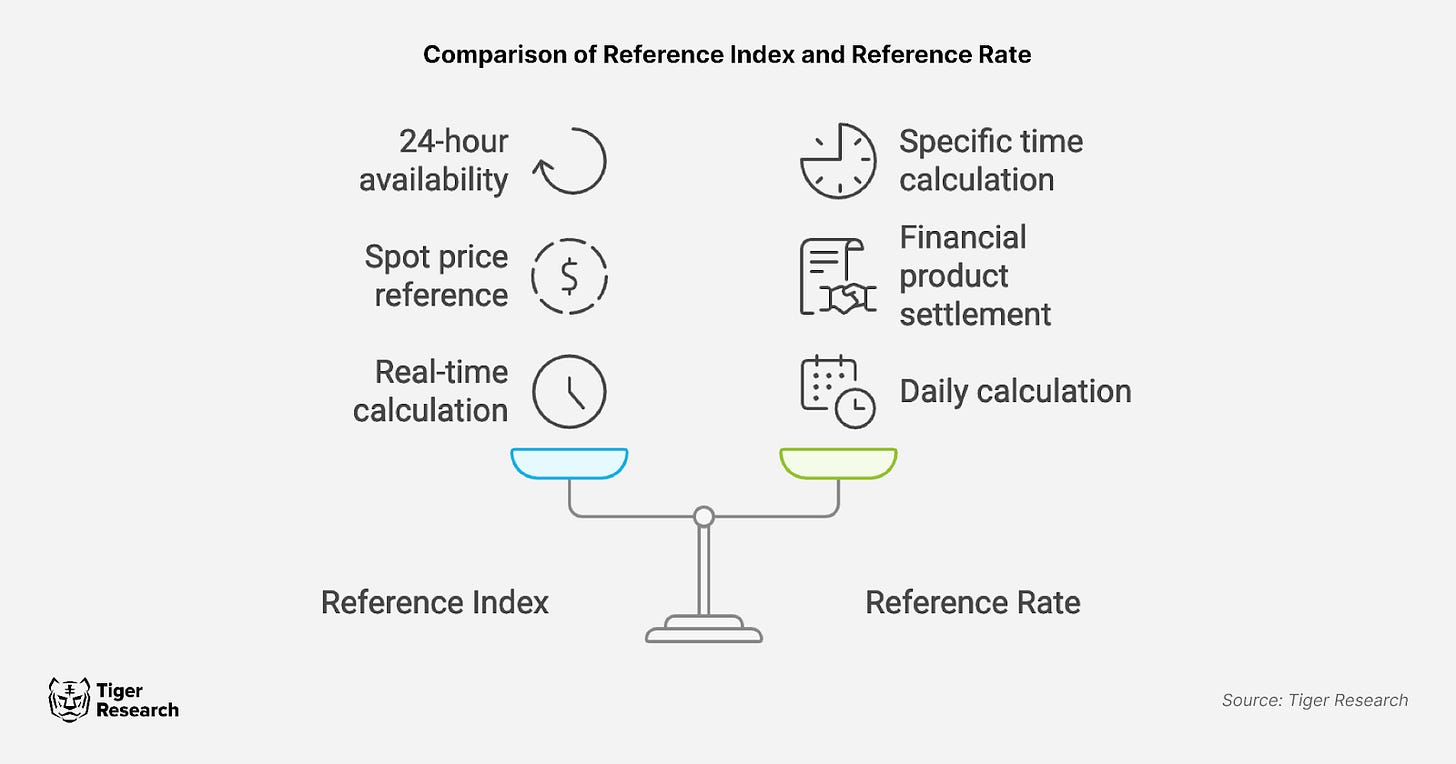

Dual Tools for Flexibility and Stability: The HKEX Index Series includes both a real-time Reference Index for immediate trading decisions and a daily Reference Rate for consistent settlement in financial contracts, catering to a range of trading and investment needs.

A Step Toward Institutional Integration: By aligning with EU standards and providing reliable data, HKEX’s index aims to attract institutional investors, supporting the growth of structured crypto products and advancing crypto’s integration into mainstream finance.

1. Introduction

On October 28th, Hong Kong took a decisive step in establishing itself as a leader in the crypto markets with the launch of the Hong Kong Exchanges and Clearing Limited (HKEX) Virtual Asset Index Series. This initiative establishes a reliable benchmark for Bitcoin and Ethereum prices in the region.

Until now, cryptocurrency indices have largely been developed by private firms. The lack of institutional-grade benchmarks has led to price discrepancies across trading platforms, creating uncertainty and posing risks for investors. This has hindered seamless integration between cryptocurrency markets and traditional finance.

In traditional finance, indices are essential for price discovery, risk management, and performance evaluation. The HKEX Virtual Asset Index Series aims to bring these advantages to the cryptocurrency sector by providing real-time, volume-weighted reference prices. This effort seeks to enhance trust, transparency, and alignment between traditional and crypto markets.

This report explores the methodology of the HKEX Index Series, its potential to build market trust, and its implications for trading and investment strategies in Asia's dynamic cryptocurrency landscape.

2. HKEX Virtual Asset Index Series

The HKEX Virtual Asset Index Series was launched on November 15, 2024. It introduces two essential tools: the Reference Index and the Reference Rate for Bitcoin and Ethereum, providing standardized pricing that aligns with the Asian time zone.

2.1. Reference Index

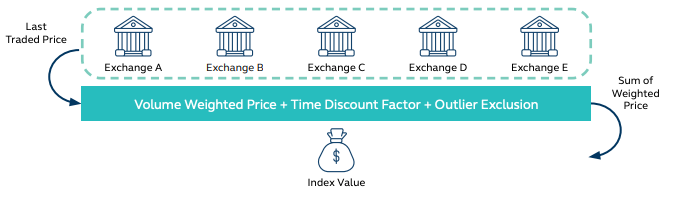

The cryptocurrency market has consistently struggled with price discrepancies across exchanges. To tackle this issue, HKEX has developed a volume-weighted average index, starting with Bitcoin and Ethereum as the initial assets.

This methodology reduces distortions caused by low-volume or irregular trades by assigning weights based on trading volumes. By prioritizing higher-volume transactions, the index more accurately represents the collective consensus of market participants.

A volume-weighted approach is particularly effective in mitigating market manipulation. In markets with significant liquidity disparities across exchanges, a simple average can be easily swayed by low-volume trades. By assigning greater weight to trades on liquid exchanges, the volume-weighted average significantly lowers the risk of manipulation.

While this methodology is particularly critical for volatile altcoins with greater price variability across exchanges, HKEX has strategically chosen to focus on Bitcoin and Ethereum first. These assets exhibit smaller price differences, providing a stable foundation for building credibility and ensuring a smooth adoption of the index.

This approach is expected to serve as a testing ground for future expansion into altcoins. By validating the methodology with Bitcoin and Ethereum, HKEX is creating a scalable framework that can be extended to more volatile assets, enhancing both reliability and market inclusivity.

2.2 Reference Rate

The Reference Rate is a daily price index designed to facilitate standardized settlement for financial products such as derivatives and futures.

Calculated once daily at 4:00 PM Hong Kong time, the Reference Rate is derived from a one-hour data window between 3:00 PM and 4:00 PM. During this window, HKEX Reference Index values are recorded every five minutes and averaged to ensure a fair and representative market price, minimizing discrepancies across exchanges.

The Reference Rate complies with the EU Benchmark Regulation (BMR), ensuring robust governance, transparency, and data accuracy. By addressing challenges such as price manipulation and inconsistent benchmarks, it strengthens trust and reliability in the cryptocurrency market. This benchmark supports the development of advanced financial instruments, including futures and ETFs, fostering increased institutional adoption of digital assets.

As cryptocurrencies become more integrated into traditional finance, the HKEX Reference Rate is set to play a pivotal role in decision-making and market stability. This initiative further positions Hong Kong as a global leader in the digital asset ecosystem.

3. Strategic Impact of the Index Series on the Crypto Market

3.1 The Impact of the HKEX Index on the Crypto Ecosystem

The HKEX Virtual Asset Index Series introduces much-needed transparency, standardization, and reliability to the cryptocurrency market. By providing real-time, volume-weighted pricing for Bitcoin and Ethereum, the Index addresses the long-standing issue of price discrepancies across exchanges. These indexes serve as a critical tool for instilling confidence among investors, particularly institutions that have hesitated to engage with crypto due to concerns over fragmented and unreliable pricing data.

Transparent indexes like the HKEX Index have the potential to stabilize market volatility by offering consistent reference points. This aids in risk assessment and supports more informed investment decisions, creating a more structured environment for market participants. As regulatory clarity in Hong Kong and the region advances, the HKEX Index could become a key enabler for developing structured financial products that rely on stable, reference-based pricing.

3.2 Unlocking Financial Product Innovation through Crypto Index

Building on their role in providing pricing consistency, indices like the HKEX Virtual Asset Index Series pave the way for a wide array of financial products. ETFs tailored to regional investors, Equity-Linked Securities (ELS), and Deposit-Linked Securities (DLS) are just some of the instruments that could be developed using this Index as a foundation. Furthermore, the inclusion of derivatives, such as futures and options, expands opportunities for hedging, speculative trading, and risk management.

These innovations mark a significant step toward integrating the crypto market with traditional financial systems. As indexes evolve, they may also support DeFi protocols, enabling tokenized loans, yield-bearing instruments, and other sophisticated products that rely on accurate, real-time price references.

3.3 Lessons from Traditional Finance: Benchmarks as Cornerstones

Traditional financial markets have long relied on benchmarks like the S&P 500 and Dow Jones to provide consistency and trust for pricing, performance tracking, and portfolio management. Commodity markets similarly use indices to stabilize pricing for goods like crude oil and gold. Crypto indices can adopt this proven model, offering institutional investors a trusted framework for asset allocation, performance measurement, and portfolio rebalancing.

Beyond traditional applications, benchmarks also enable the adoption of algorithmic trading and other advanced strategies that depend on precise, real-time data. By bridging the principles of traditional finance with the innovations of blockchain technology, indices like the HKEX Virtual Asset Index Series are poised to redefine the integration of digital assets into the broader financial ecosystem.

4. Conclusion and Future Outlook

The HKEX Virtual Asset Index Series represents a landmark move in Hong Kong’s effort to position itself as a digital finance hub. By introducing standardized benchmarks for Bitcoin and Ethereum, HKEX has laid the groundwork for more transparent, stable, and investor-friendly crypto markets in Asia. The Series addresses the need for consistent pricing in crypto while also laying the groundwork for potential expansion into structured products and risk management tools, akin to those in traditional finance.

The HKEX Index Series could encourage other Asian markets to adopt similar standards, potentially leading to a more unified, regulated framework for cryptocurrency across the region. This standardization could attract more institutional investors, driving liquidity and stability in the market. For stakeholders and investors, the Index Series offers an opportunity to engage with a more transparent and structured crypto environment, aligning with traditional finance principles and advancing the maturity of the crypto ecosystem.

In conclusion, the HKEX Index Series represents an important step toward integrating crypto into the financial system. It holds the potential to reshape the crypto investment landscape by providing valuable insights and tools for both retail and institutional participants. The adoption of reliable benchmarking could signal a pivotal moment for crypto markets, establishing new standards for transparency, security, and growth in Asia’s evolving crypto economy.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.