TL;DR

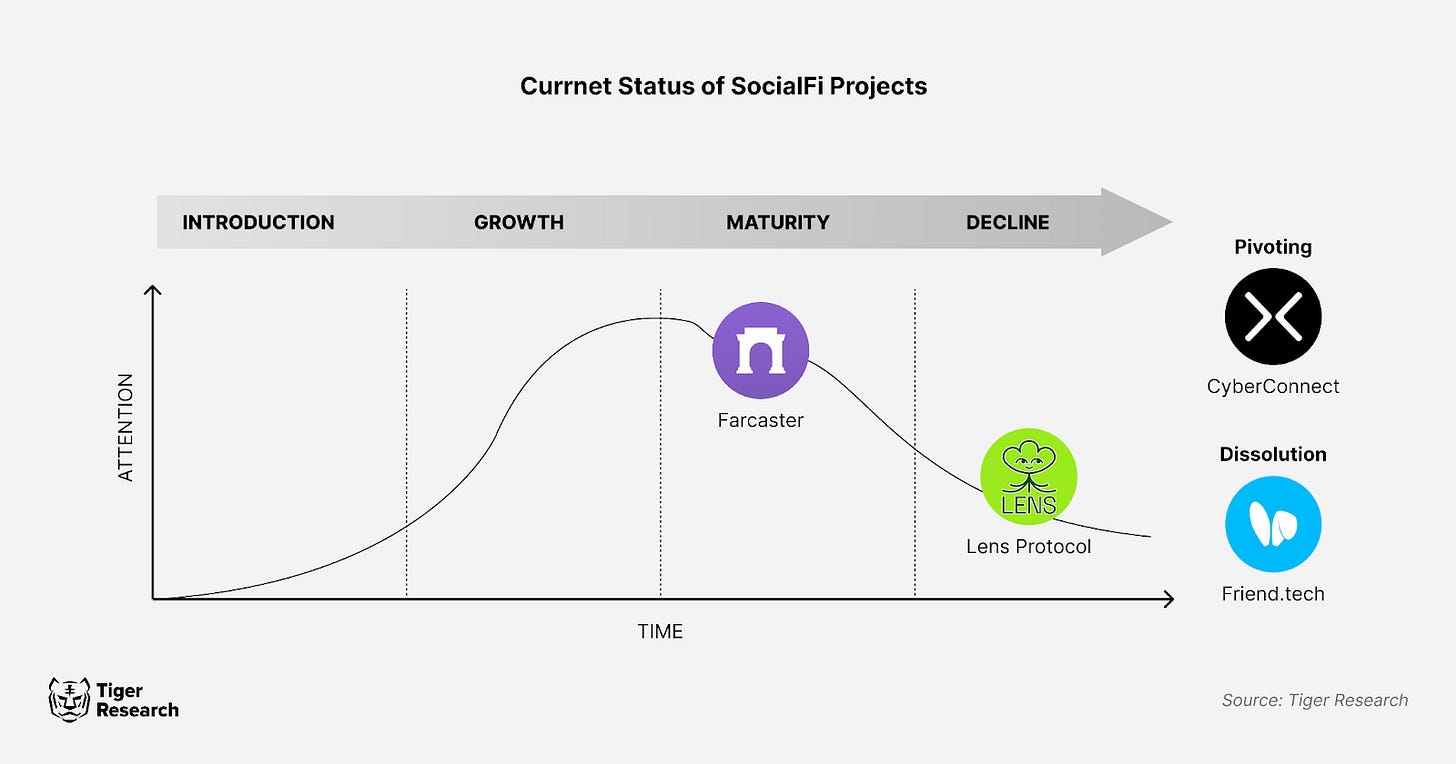

SocialFi initially garnered excitement by blending decentralized finance with social media, allowing users to monetize content and control their data. However, the sector's initial boom was short-lived. Platforms struggled to maintain user engagement and deliver innovative experiences beyond token speculation.

Platforms like Friend.tech highlight the pitfalls of relying heavily on initial FOMO. It saw rapid user declines after failing to provide continuous updates, fresh content, or unique user experiences, leading to a sharp decrease in daily active users and platform relevance.

For SocialFi to recover and thrive, businesses must go beyond replicating traditional social media models on the blockchain. Sustainable success will require integrating innovative user experiences, fostering genuine engagement, and offering real value beyond speculative investments, along with partnerships that bridge Web2 and Web3 platforms.

1. From Hype to Reality

For a time, SocialFi was hailed as the next big thing, blending the worlds of decentralized finance and social media to create platforms where users could 1) monetize content, 2) control their data, and 3) actively participate in governance.

This concept, merging blockchain with the social experience, promised a paradigm shift similar to what we saw with groundbreaking platforms like WeChat and TikTok in the APAC region. Just as platforms like ZEPETO and Roblox have captivated younger generations with immersive digital worlds, SocialFi aimed to revolutionize how people interact, trade, and create value online.

Despite its potential, the initial excitement around SocialFi has fizzled due to declining user engagement, fading interest, and unsustainable project models. As a result, major projects that once promised to revolutionize social interaction have seen sharp drops in user activity and participation.

Understanding why this decline has happened is crucial—not to pinpoint mistakes, but to identify opportunities that could lead to a resurgence. This report delves into the rise and fall of key SocialFi platforms and their business lifecycle, analyzing the trends and challenges companies must consider as they move forward to align with it.

2. Lessons from the Frontier SocialFi Projects

2.1. Dissolution: Relinquished Control

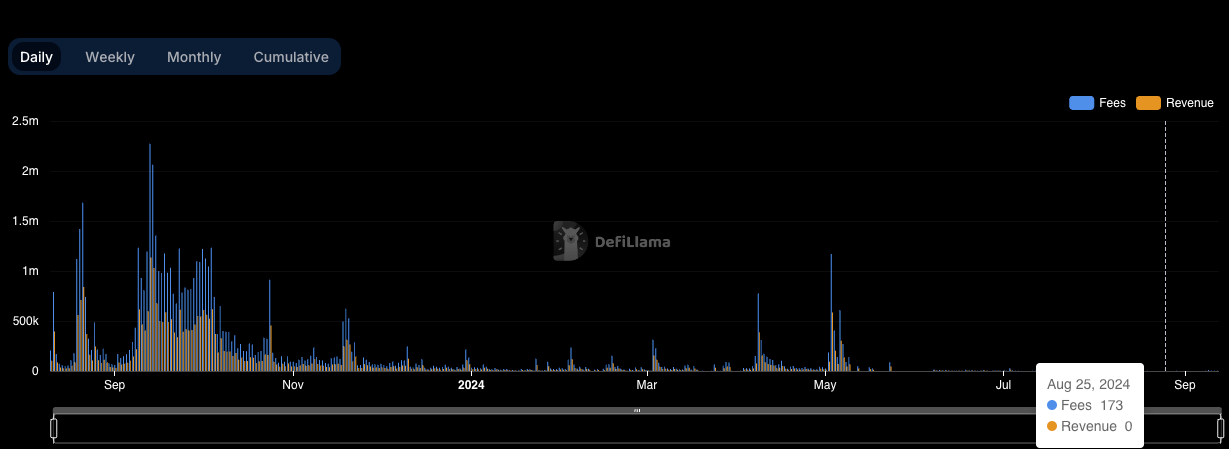

Friend.tech launched with a significant buzz, quickly attracting users through airdrops and its second version update (V2). Users were excited by the platform's unique model, which tokenized social media interactions. This created an instant market for users to trade social clout and engagement. Early adopters rushed in, generating massive user activity and token speculation.

However, things suddenly changed for the Friend.tech team after the initial sucess. Following the release of V2, the team relinquished control of the smart contract on September 8 and transferred control to a null Ethereum address. This decision effectively prevented any future updates or new features from being implemented.

While the platform remained operational, the lack of new functionalities caused the platform to lose its novelty, and user engagement dwindled rapidly. This stagnation directly affected user loyalty, as the absence of continuous updates led many early adopters to abandon the platform.

With the platform became increasingly stagnant, the FRIEND token lost its utility and was reduced to just another memecoin in the SocialFi ecosystem. By September 2024, Friend.tech’s revenue had collapsed, dropping from over $2 million in fees generated on September 14, 2023, to a mere $71 in fees a year later. With no practical use case remaining, the FRIEND token's value plummeted. This marked the effective end of Friend.tech’s relevance in the market.

The fall of Friend.tech demonstrates the risks of early decentralization when platform sustainability hasn’t been secured. This is especially risky in emerging markets like SocialFi, where user interest can fade quickly. Businesses should balance decentralization and control to avoid stagnation. User retention requires continuous innovation and updates to maintain interest in the product even if it is out of a decentralization regime.

2.2. Stagnation: The Decline of SocialFi Platforms

Despite its initial promise, SocialFi has faced significant challenges in sustaining long-term growth. Much like the short-lived excitement seen with other trends in the blockchain space, many SocialFi platforms found themselves struggling after the early hype faded. Lens Protocol, which made waves during the 2024 boom, serves as a prime example.

Lens Protocol recorded a massive surge in handle registrations, driven by Fear of Missing Out (FOMO) and the early excitement surrounding its decentralized social features. The platform's growth appeared promising, with thousands of new users flocking to create accounts. However, once the novelty wore off, growth stagnated dramatically. In recent months, new registrations plummeted to just 142 handles, a stark contrast to the vibrant activity seen in the early days.

Another clear indicator of Lens Protocol's decline is the drastic drop in the price of Lens Profiles. At its peak, a Lens Profile could cost over $200, reflecting the platform's high demand and excitement. Today, that same profile is valued at less than a dollar. This highlights the platform's sharp decrease in both user interest and perceived value.

This sharp drop in value showcases how quickly SocialFi platforms can lose their relevance if they fail to provide consistent value for their users. For SocialFi businesses to thrive, they must focus not just on attracting users but on continuously engaging them through meaningful content, community interaction, and practical applications.

While Lens Protocol’s early performance excited the market, its sharp decline serves as a cautionary tale for businesses in the space. Without a clear strategy for long-term growth, even the most promising platforms can fail.

2.3. Mature: But too fast

Farcaster, along with its application Warpcast, initially gained significant attention when the project raised over $150 million in funding in May 2024. Also, The initial wave of FOMO led to a surge in daily active users, and the platform appeared poised for success.

Despite continuous infrastructure updates and the potential of decentralization, the platform could not expand its user base, which points to a broader issue within SocialFi—retaining interest beyond initial hype. New user registrations plummeted, from over 15,000 signing up on February to only 545 on September.

Farcaster’s loyal user base eventually faced a content shortage. Although the number of daily users remained relatively stable, user engagement plummeted by 60% from its peak. The primary cause was the lack of engaging content. As a social platform, Farcaster struggled to provide enough compelling material to maintain long-term user interest.

Farcaster’s journey reveals a critical truth for blockchain-based platforms: content and service quality matter far more than decentralization features. The essentials for any successful social application are continuous content generation and user interaction. Blockchain-based social networks must invest heavily in content creation and incentivize meaningful user contributions. Regarding the business insight, this is when they should prioritize creating a diverse and engaging ecosystem where users feel compelled to return daily, rather than depending on airdrop speculation.

2.4. Pivoting: Turn into New Business Model

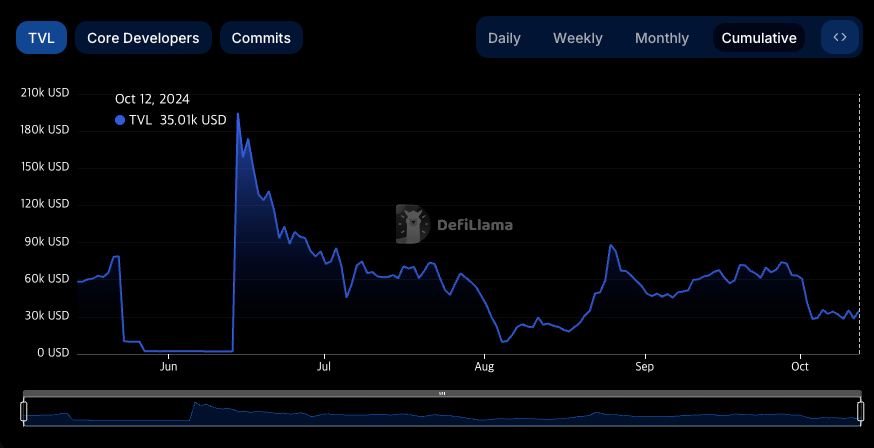

Faced with declining user engagement and fading relevance, some SocialFi platforms have attempted to pivot to new business models in hopes of regaining momentum. A notable example is CyberConnect. It recently rebranded as Cyber and shifted its focus toward Layer 2 blockchain solutions.

While the pivot seemed strategic, it did not result in the renewed user interest that Cyber had hoped for. The platform's Total Value Locked (TVL) dropped dramatically to just $35,000, far below its previous highs. Despite the attempt to shift focus and rebrand, Cyber’s challenges illustrate that merely adapting to new technology or trends is not enough to reignite long-term user engagement.

This highlights another important lesson for SocialFi businesses: pivoting to new models or technologies must be accompanied by innovative, engaging user experiences. Without continuous innovation, even strategic shifts like Cyber’s rebrand can struggle to succeed.

3. What is left for the future of SocialFi?

The rise and fall of platforms like Friend.tech have exposed critical flaws in the SocialFi sector. While initial excitement and FOMO can drive early adoption, long-term success requires more than speculative hype. Meaningful, engaging experiences are essential for sustaining user interest. Unfortunately, many projects have failed to deliver on their promises, resulting in disillusionment and a steep decline in user engagement.

SocialFi projects face several core challenges that have hindered their growth. These include 1) a lack of sustained user engagement, 2) an over-reliance on decentralization, and 3) gaps in content and innovation. Moreover, additional issues emerge during the service planning stage, which further exacerbate these problems:

The inconvenience of wallet use: Wallet usage introduces additional steps that increase service complexity and is often accompanied by unfriendly terminology. This makes the user experience less seamless, creating friction for new users unfamiliar with decentralized systems.

Lack of competitive differentiation: Many decentralized social media platforms closely resemble their Web2 counterparts, offering little differentiation. Without a compelling advantage, they are often viewed as merely "inconvenient alternatives," limiting their ability to attract active users. Similar to how TikTok revolutionized social media with short-form content and viral challenges, decentralized platforms must find a strong competitive edge to stand out.

Absence of native influencers: The success of platforms like TikTok and Instagram is largely due to the rise of native influencers. Influencers like the D'Amelio sisters, who built their following on TikTok, attracted new users and boosted engagement. The emergence of such influencers is essential for driving growth on new platforms. However, decentralized social media platforms have yet to foster native influencers, which stunts their potential for organic growth.

The key takeaway from SocialFi's struggles is clear: replicating Web2 models on blockchain technology is not enough. Success in this space requires providing genuinely new experiences and tangible value to users. Only platforms that innovate and adapt will thrive in the long term.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.