How Do Vietnamese Cryptocurrency Investors Trade?

Active Market Participation Through P2P Trading

TL;DR

Vietnam is an active country in cryptocurrency trading, but regulatory uncertainties limit retail investor participation.

Despite this, the government has not explicitly banned trading and ownership. Most transactions use P2P services, with platforms like Binance P2P, communities, and individual/group-based services facilitating these trades.

However, the government has not legalized P2P transactions and scrutinizes them strictly, posing potential risks.

1. Introduction

Vietnam stands out in the global cryptocurrency market. In 2023, it ranked fourth in monthly trading volume on Binance, the largest cryptocurrency exchange, with a total volume of approximately $20.8 billion. Additionally, Chainalysis reports Vietnam ranks third globally in cryptocurrency investment returns, with nearly $1.2 billion in gains. These figures highlight the enthusiasm of Vietnamese investors for the crypto market.

Despite this active market, Vietnam's crypto regulations remain uncertain, creating a gray zone that limits retail investor participation. However, Vietnamese investors continue to engage actively in the crypto market. To understand the unique dynamics of the Vietnamese market, it is essential to examine how they participate and trade in the crypto market.

2. How does Vietnam trade cryptocurrency?

Currently, the Vietnamese government does not officially recognize cryptocurrencies, leading to significant regulatory uncertainty. The State Bank of Vietnam does not recognize cryptocurrencies as legal tender, and the government has issued warnings about the risks associated with crypto trading. However, there is no explicit ban on trading or owning cryptocurrencies, which leaves investors in a state of confusion.

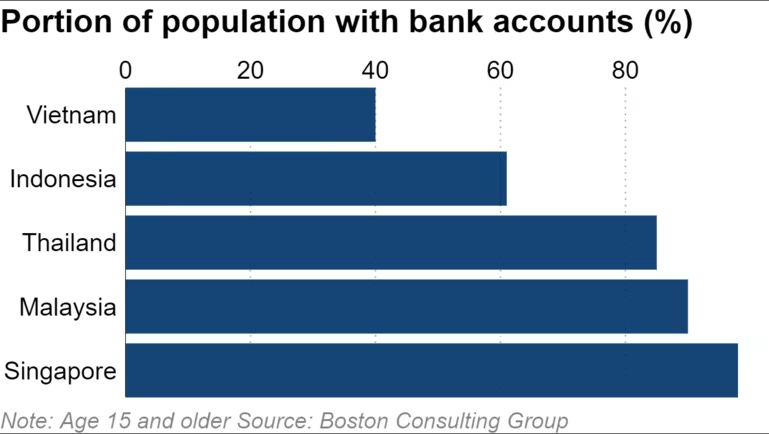

This lack of clarity, along with limited access to traditional financial services, has driven Vietnamese investors towards peer-to-peer (P2P) trading. Only 40% of Vietnamese people have a bank account, a lower percentage compared to other Southeast Asian countries like Indonesia and Thailand. Consequently, many people without access to traditional banking services turn to P2P trading to trade cryptocurrencies directly.

The advantage of P2P trading is that it allows individuals to buy and sell cryptocurrencies directly with each other without a centralized intermediary, offering a more flexible trading method. Vietnamese investors prefer P2P trading for several reasons:

Accessibility: It makes it easy for users who have difficulty accessing traditional financial services, such as bank accounts, to trade cryptocurrency.

Flexibility: Users can choose their trading partners and negotiate terms such as price and payment method.

Censorship Resistance: P2P platforms enable direct transactions between users without reliance on centralized authorities, ensuring that trades cannot be easily restricted or controlled.

3. How do Vietnamese trade P2P?

Cryptocurrency trading is mainly conducted through CEXs and DEXs. However, due to uncertain regulations and the fact that many Vietnamese people do not have bank accounts, they primarily enter the crypto market through peer-to-peer (P2P) transactions. P2P trading is mainly used for on/off ramp purposes, such as exchanging Vietnamese dong (VND) for stablecoins (mainly USDT and USDC) and vice versa. Additionally, P2P trading is often facilitated by P2P platforms or intermediary sellers.

3.1. P2P platforms

In Vietnam, the most common platforms for P2P trading are Remitano and Binance P2P. These platforms feature a wide variety of sellers who have already completed KYC (Know Your Customer) procedures to enhance their credibility. Each seller offers a range of prices and cashing amounts. The buying and selling processes on these platforms are quite similar. Let’s take Binance P2P as an example.

Exchanging VND to USDT:

First, select a seller offering a price that suits you. Then, deposit the corresponding amount of VND into the seller's bank account. Once the seller receives the money, they will deposit the USDT into your Binance account, completing the transaction.

Exchanging USDT to VND:

The process begins similarly. The seller first transfers VND to your bank account. Once you confirm receiving the correct amount of VND, you release the USDT, which Binance then transfers to the seller.

These steps are straightforward and typically take less than five minutes to complete. However, the transaction's success depends on the seller's integrity to avoid any issues with the authorities. Otherwise, you could also find yourself in trouble.

3.2. Local P2P options

Some sellers prefer not to share fees with a platform and choose to run their own P2P service. Before Binance P2P, this was the primary option for every crypto user. These sellers can be representatives of crypto communities, self-established P2P individuals, or owners of P2P services. Let's explore each of these seller types.

Community representatives

First, peer-to-peer transactions are conducted by cryptocurrency community representatives. They represent the community, and their trust is based on their credibility. The trading process is simple: you send a message to the community representative indicating you want to trade USDT. The seller offers an exchange rate, and if you agree, the trade proceeds similarly to Binance P2P. However, unlike on P2P platforms, the buyer must initiate all steps. If you want to buy USDT, you must first send Vietnamese Dong to the seller, and vice versa.

Self-established P2P

Second, sellers are individuals and organizations who do not represent any community or external platform but support their own P2P trading services. They can be identified as either a single individual or a group of sellers operating a service together.

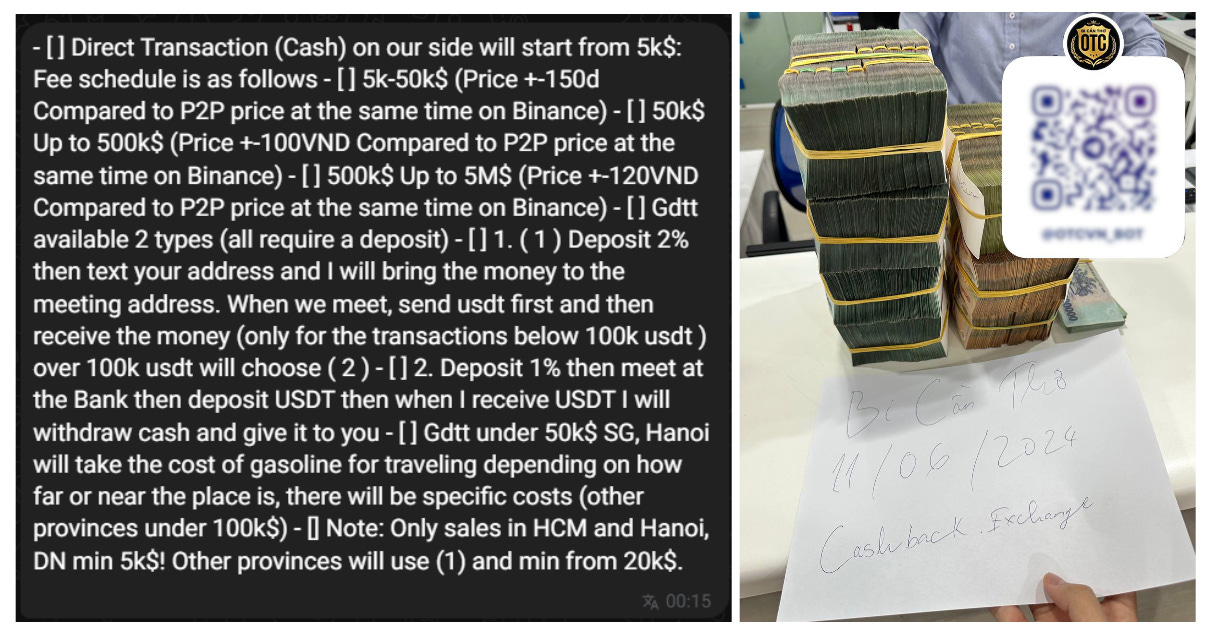

They usually have their own pool of customers and market through social media. This type typically handles large transactions, with minimum amounts around $5,000 and up to $5 million. They support P2P transactions via cash and bank transfers. For example, Bi Cần Thơ is a popular P2P trader who runs a P2P cash service. His cash P2P cash service mainly takes place 1) in front of the bank and 2) at the buyer's residence. After agreeing on the price and amount, the buyer and seller meet in front of the bank, where the bank withdraws Vietnamese Dong and delivers it to the customer (a small traveling fee may apply). If meeting at the buyer's residence, the process is similar.

At first glance, they may seem similar to self-established P2P individuals or community representatives. However, these owners do not represent any specific community and operate their own P2P services with a network of subordinate sellers. This allows them to serve multiple communities that may not have their own dedicated P2P facilitators. One prominent example is a service where, after initial contact, a new Telegram group is created for you, including 10+ sellers working under the service owner's name. Essentially, you have access to multiple sellers who are ready to assist you at any time. You simply ping the group, and a seller will respond. The rest of the process remains the same. The owner shown above is among the most well-known in the P2P service sector, providing a highly efficient and credible service.

4. Possible risks

Scams may be a significant concern. However, P2P platforms require all sellers to complete KYC (Know Your Customer) procedures, which helps mitigate the risk of scams. Additionally, having an intermediary platform provides a mechanism to resolve any issues that may arise during transactions.

Transferring messages containing sensitive keywords can get you and the seller into trouble. During a P2P transaction, a bank transfer message must avoid sensitive crypto-related keywords. Failure to comply can lead to the seller halting your transaction. Consequently, the bank may lock both accounts and initiate an investigation.

The third risk you may encounter is receiving dirty money. In P2P transactions, there's always a chance that your seller possesses illicit funds. If the seller gets into trouble with authorities, you might receive a call from the police for investigation.

5. Conclusion

Vietnam's cryptocurrency market is growing rapidly, driven by youth participation and the need for alternative financial technologies. However, the uncertain regulatory landscape has led to widespread adoption of P2P trading, which offers flexibility, convenience, and censorship resistance. In particular, Vietnamese investors frequently use platforms like Binance P2P, Remitano, and other local P2P trading platforms, providing various options for trading cryptocurrencies. However, P2P trading in Vietnam is not legalized and is under strict government surveillance, posing potential risks.

Nevertheless, understanding how peer-to-peer trading works in Vietnam and the predominant channels utilized can be very helpful for those looking to enter the market. This unique market characteristic, unlike other typical Asian countries, often serves as the first gateway for Vietnamese investors to enter the cryptocurrency market. Additionally, staying informed about regulatory changes and market trends in Vietnam amidst an uncertain regulatory landscape is crucial.

🐯 More from Tiger Research

Read more reports related to this research.

[Special Report] APAC Web 3 Powerhouse : Inside Vietnam's Blockchain Market

Vietnamese Crypto Community 101: Tailoring Your Crypto Project for Success

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo, and 3) incorporate the original link to the report. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.