What does Web Traffic tell us about the Blockchain Market?

Is the market truly reliving its past glory?

TL;DR

Analyzing web traffic in the blockchain market: Web traffic is a neglected analytical factor in blockchain market analysis. When looking at the market through web traffic, there is no explosive increase in traffic in the current period like the past boom period, which raises questions about the market's vibrancy.

Crypto Prices and Web Traffic: While web traffic is flat for both CEX and DeFi, overall crypto prices are rising significantly. Unlike past markets that were driven by retail investors, this is likely due to the influx of external institutions such as ETFs.

Differences in web traffic of DeFi analytics tools and DeFi: While analytics tools like DEX screeners see steady traffic, web traffic for typical DeFi services is relatively low. This suggests that investors are more selective when it comes to actual trading or investment decisions, as opposed to constantly visiting analytics tools for market information.

The recent surge in cryptocurrency prices has led many to believe that the market is back on the bull cycle. However, a rise in cryptocurrency price does not equate to a rise in market activity. Many additional factors must be considered to accurately determine the market activity.

These include common market metrics such as DAU and MAU, and blockchain-specific metrics such as cryptocurrency trading volume, number of active wallets, and TVL. Much of the market analysis utilizes these factors. The news that Solana Network's TVL surpassed $4 billion, a two-year high, is one such example.

'Web traffic' is rarely utilized as an analytical factor. Due to the nature of blockchain services where real user activity is important, web traffic, including visitors, is used as an internal reference indicator for a project, but not as an analytical factor.

However, web traffic analysis can help analyze the market in-depth, as it can reveal the public's interest in services and their detailed nationalities. In this report, we will analyze the state of the blockchain market in 2024 by sector using web traffic to provide a different perspective from other reports and help you understand the market from a realistic angle.

1. CEX

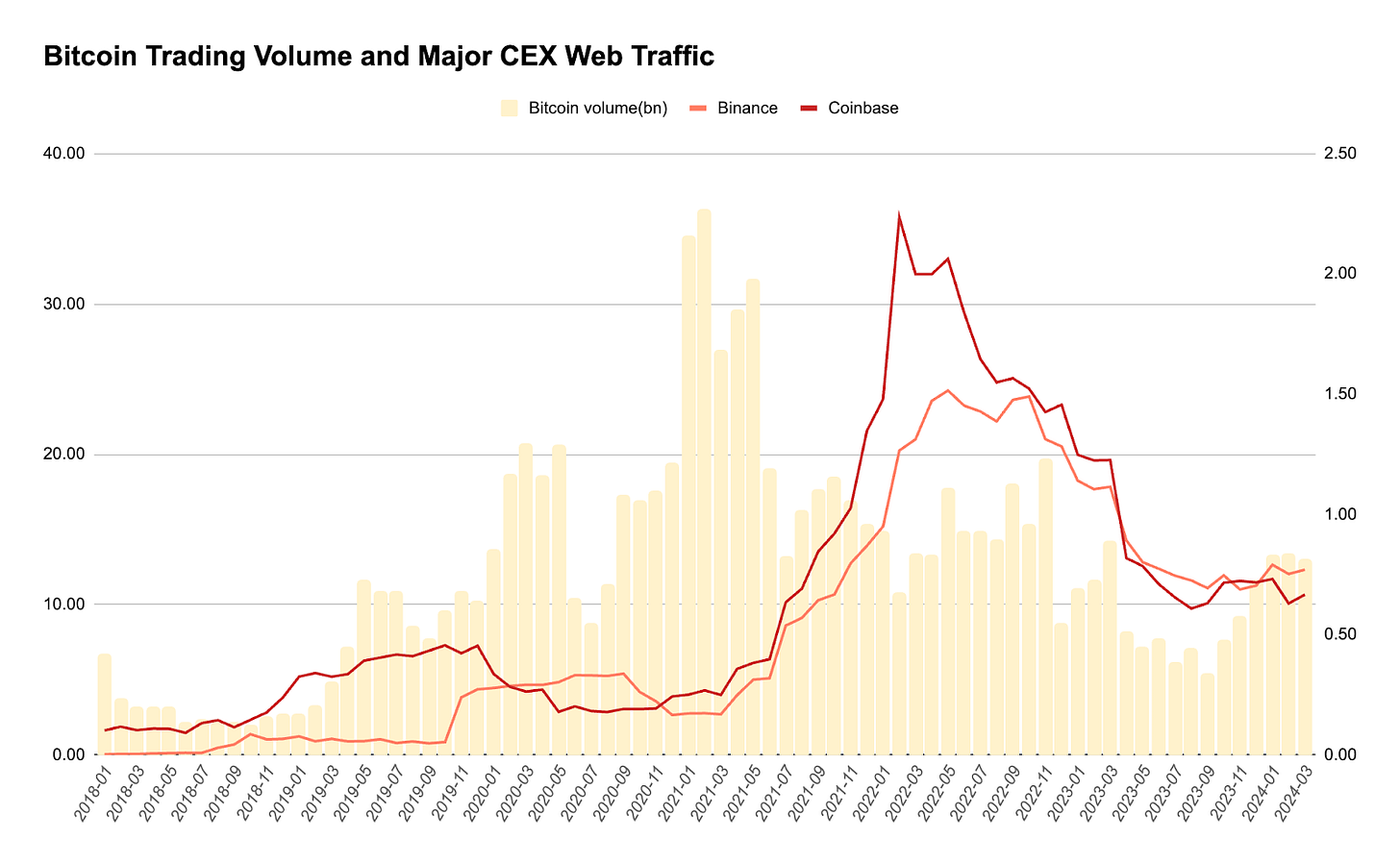

With the recent surge in cryptocurrency prices, the sector that has garnered the most attention is undoubtedly cryptocurrency exchanges (CEXs). Analyzing web traffic on leading crypto exchanges like Binance, we can see that the current market boom is not as dramatic compared to the previous period.

Comparing Bitcoin price and trading volume to web traffic on each exchange further illustrates the differences from past booms. Bitcoin price has risen significantly while trading volume and exchange web traffic have remained low, suggesting that trading outside of crypto exchanges, such as the impact of ETFs, may be driving the price increase.

If this trend accelerates, we believe that retail investors will play a smaller role in this period than they have in the past, with ETFs and other traditionally traded financial products likely to play a bigger role.

2. Crypto Ranking Site

CoinMarketCap dominates the web traffic ranking of cryptocurrency ranking portals, which mainly show the ranking and trading volume of listed cryptocurrencies, followed by Coingecko. The difference in web activity between CoinMarketCap and Coingecko is found to be surprisingly substantial.

Web traffic on all cryptocurrency ranking portals is flat, rather than rising, which is also different from the previous market boom period.

3. DeFi

When looking at the web traffic of the major DeFi players, PancakeSwap dominates, followed by Uniswap, Raydium, and others. PancakeSwap's high numbers are likely due to a variety of features, including games and NFTs. These are not core features, but they are the ones that bring back the users, something hard to find in other DeFi platforms.

In the case of Solana DeFi, which has recently been rising in popularity, Raydium leads the pack, followed by Jup and Orca. After the FTX bankruptcy, we can see that trading volumes have dropped and then rebounded, which is in line with real-world volume trends.

4. DeFi Screening Tool

With so many tokens being launched every day, it's essential to have a tool that can see and analyze them at a glance. Currently, DEX screener dominates web traffic, while DexGuru has seen a declining trend since its peak in early 2022.

When comparing the average web traffic of DeFi screening tools and each of the major DeFi projects, the gap is driven by differences in usage flows. Typical DeFi investors use analytics tools to track their crypto assets and visit them frequently. general DeFi tools lack additional features, so traffic is likely only concentrated at the time of investment decisions. It is also true that some DeFi analytics tools also support trading, such as swaps, adding more reason for users to stay.

Conclusion

In this report, we examined the blockchain market using web traffic, which is often overlooked among the various factors used to analyze the blockchain market. The most impressive finding is that, unlike in the past, the market is not currently experiencing an explosion of traffic. Even taking into account the evolution of services and the fact that many services have been released as apps, the numbers are low, so it is difficult to conclude that the cryptocurrency market has reached a boom period based on this metric alone.

We hope that this analysis will allow many market participants to gain a more comprehensive understanding of the blockchain market by viewing it through the lens of web traffic activity.

Take a quick, 1-minute survey to enhance the weekly insights we provide. In return, get immediate access to the updated "2024 Country Crypto Matrix" by Tiger Research, featuring the latest global virtual asset market trends. Your participation helps us provide valuable content while you gain cutting-edge analysis.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.