Will Web3 Smartphones Drive Blockchain Mass Adoption?

Moves of Mainnets and Traditional Smartphone Manufacturers

TL;DR

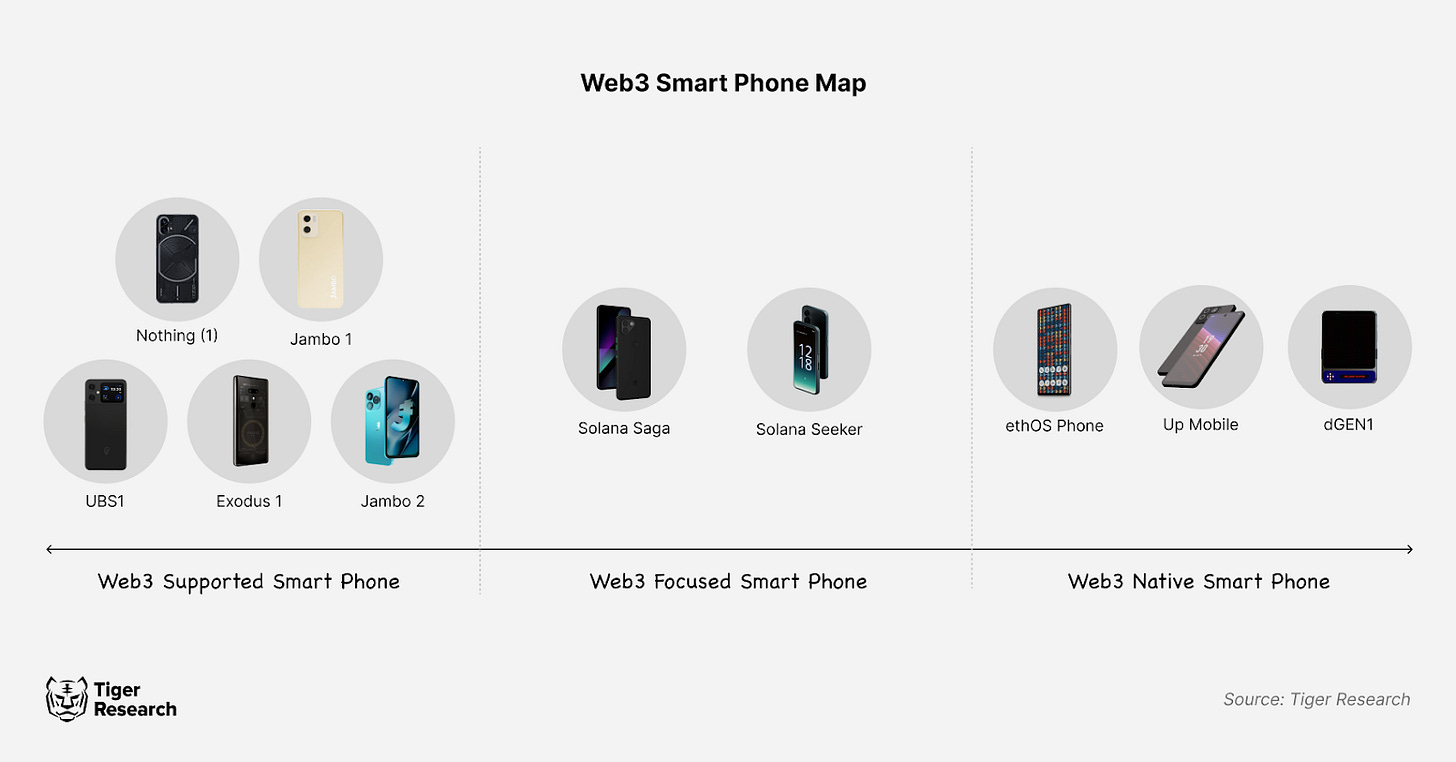

Recently, Web3-enabled smartphones have been released in large numbers and are attracting attention. These phones are categorized based on their Web3 integration as 1) Web3 supported, 2) Web3 focused, and 3) Web3 native smartphones.

Web3 smartphones are expected to improve access to Web3 services and address high fees in the mobile market. However, a focus on airdrop marketing rather than innovation, along with weak hardware performance, remains a concern.

Traditional smartphone makers like Samsung have used Web3 technology for one-off promotions. Yet, the potential for broader Web3 integration on their devices continues to grow.

1. Introduction

Web3-enabled smartphones have been making a splash in the industry recently. These devices serve as the last-mile endpoint where the public interacts with new technology. This positions them as a strong tool to push Web3 into the mainstream. This report will examine the current state of Web3 smartphones and explore their future development.

2. Classification of Web3 Smartphone Projects

Web3 smartphone projects are differentiated by their degree of Web3 technology utilization., Tiger Research has grouped Web3 smartphones released until October 2024 into three categories: 1) Web3 Supported Smartphones, 2) Web3 Focused Smartphones, and 3) Web3 Native Smartphones. These classifications are based on the degree of Web3 technology integration.

2.1. Web3 Supported Smartphone

Web3 supported smartphones offer similar functionality to traditional smartphones but support Web3 technology at a basic level. They primarily feature Web3 wallet apps like Metamask and Petra and cryptocurrency exchange apps. These devices aim to expand their ecosystem by introducing Web3 elements through experimental partnerships with blockchain mainnets.

In most cases, no special Web3 technology is applied. Users can create a similar experience by installing Web3 applications on regular smartphones. As a result, these devices failed to offer distinct value, and user interest dropped quickly. A notable example is the smartphone manufacturing startup Nothing, which partnered with Polygon to introduce NFT communities and Polygon-based IDs but has recently discontinued most of these services.

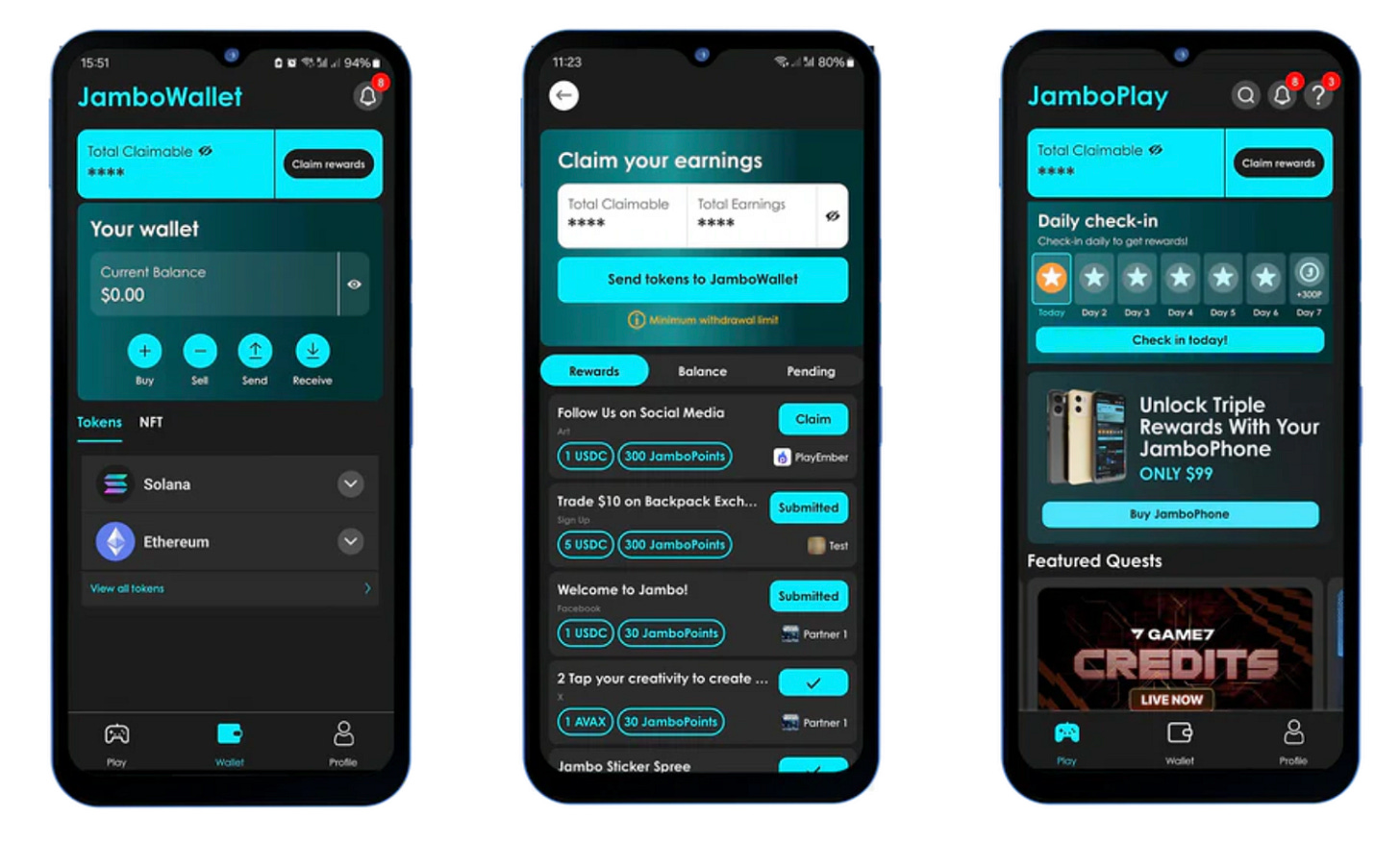

Recent cases show a more active adoption of Web3 elements. Jambo Phone, for example, provides pre-installed apps like the Web3 wallet Petra and cryptocurrency exchange OKX. It also introduces users to the Web3 ecosystem through its own app, Jambo Play. This app lets users participate in Web3 project quests and earn cryptocurrency rewards. This method serves as a lightweight testbed and cooperation model for projects. We expect to see more examples like this in the future.

2.2. Web3 Focused Smartphone

Web3-Focused smartphones integrate Web3 technology into the device’s system to a partial extent. These phones run on a traditional mobile OS with added Web3 features. They offer an intermediate level of integration instead of full Web3 capabilities. Examples include Solana’s first-generation Saga and the recently announced second-generation Seeker.

These Web3-focused smartphones connect the traditional mobile environment with the Web3 ecosystem through a dedicated programming interface. Solana provides the Solana Mobile Stack (SMS) to help developers build Web3 services. The phones come with Web3-optimized tools like the Solana Pay system. It utilizes Android's NFC feature and QR codes, as well as a seed vault for enhanced security.

However, these Web3-focused smartphones are still far from providing a fully Web3-native experience. Users need to install a separate Web3 wallet or use a dedicated browser like Brave to access Web3 services. The Seeker, developed with Solflare, will include the Seed Vault Wallet as a built-in feature. There are still many undisclosed features that could make it a truly Web3-native smartphone.

2.3. Web3 Native Smartphone

This is done either by using its own Web3 operating system or by offering native support for core Web3 technologies like the P2P distributed file system (IPFS), Web3 messaging protocol (XMTP), and blockchain-based naming system (CNS). These smartphones also include an on-device light node client, enabling users to verify transactions themselves.

A notable example is Freedom Factory's ethOS. In 2023, with support from NounsDAO, ethOS released its first prototype smartphone. This device introduced an Ethereum-based Web3 OS for full system-level integration. Recently, the company launched the dGEN1 smartphone, enhancing its Web3-native capabilities. The built-in ethOS browser supports IPFS and ENS. Its light client node feature lets users run on-chain dApps without depending on external RPC nodes. The Web3 wallet, integrated into the OS, allows users to sign transactions without switching apps or using in-app browsers. The device also offers advanced features, such as SMS-based cryptocurrency transfers and the option to mint gallery images as NFTs.

Similarly, Up Mobile, developed in collaboration with Movement Labs and Up Network, shows a high level of Web3 integration. Its proprietary Web3 OS, Up OS, offers system-level integration. The device includes a built-in Web3 wallet that supports light node functionality and headless signing technology.

3. What Advantages Do Web3 Smartphones Offer?

Interest in Web3 smartphone projects is steadily growing, with various experiments in progress. This rise is driven by the expectation that Web3 smartphones will play a crucial role in mass adoption of Web3 technologies while addressing challenges in existing industries. The benefits of Web3 smartphones can be analyzed in the following three ways.

First, Web3 smartphones can dramatically improve accessibility to Web3 services by leveraging the advantage of being portable devices. With built-in Web3 wallets, private key management, and dApp services, users can easily access Web3 services anytime, anywhere. This synergy between Web3 technology and financial services is particularly noteworthy. Through these devices, users can access crypto asset-based financial services without the limitations of time and place, which could also make financial services more accessible in developing countries with limited infrastructure.

Second, Web3 smartphones are expected to address longstanding issues in the mobile market. Centralized app stores currently charge up to 30% in fees. This reduces developers' profits and limits market growth. Web3 smartphone projects aim to fix these problems with decentralized alternatives. For example, Solana Mobile and Up Network are developing decentralized dApp stores on blockchain infrastructure. Their goal is to create a fee-free and decentralized app ecosystem.

Lastly, the combination of these two advantages is expected to generate powerful synergies in the Web3 industry. The Web3 space has a growing demand for consumer apps but lacks device environments that support everyday use. Web3 smartphones are poised to overcome this limitation and foster the development of new consumer apps. Just as the shift from PC to mobile led to a surge in innovative services, the rise of Web3 smartphones could trigger similar innovation. With the portability and various sensor capabilities of mobile devices enhancing IT service applications, Web3 smartphones could bring significant disruption to the space. In particular, A fee-free dApp store environment is expected to create a more dynamic development ecosystem compared to the current Web 2 industry.

4. What Are the Challenges Facing Web3 Smartphones?

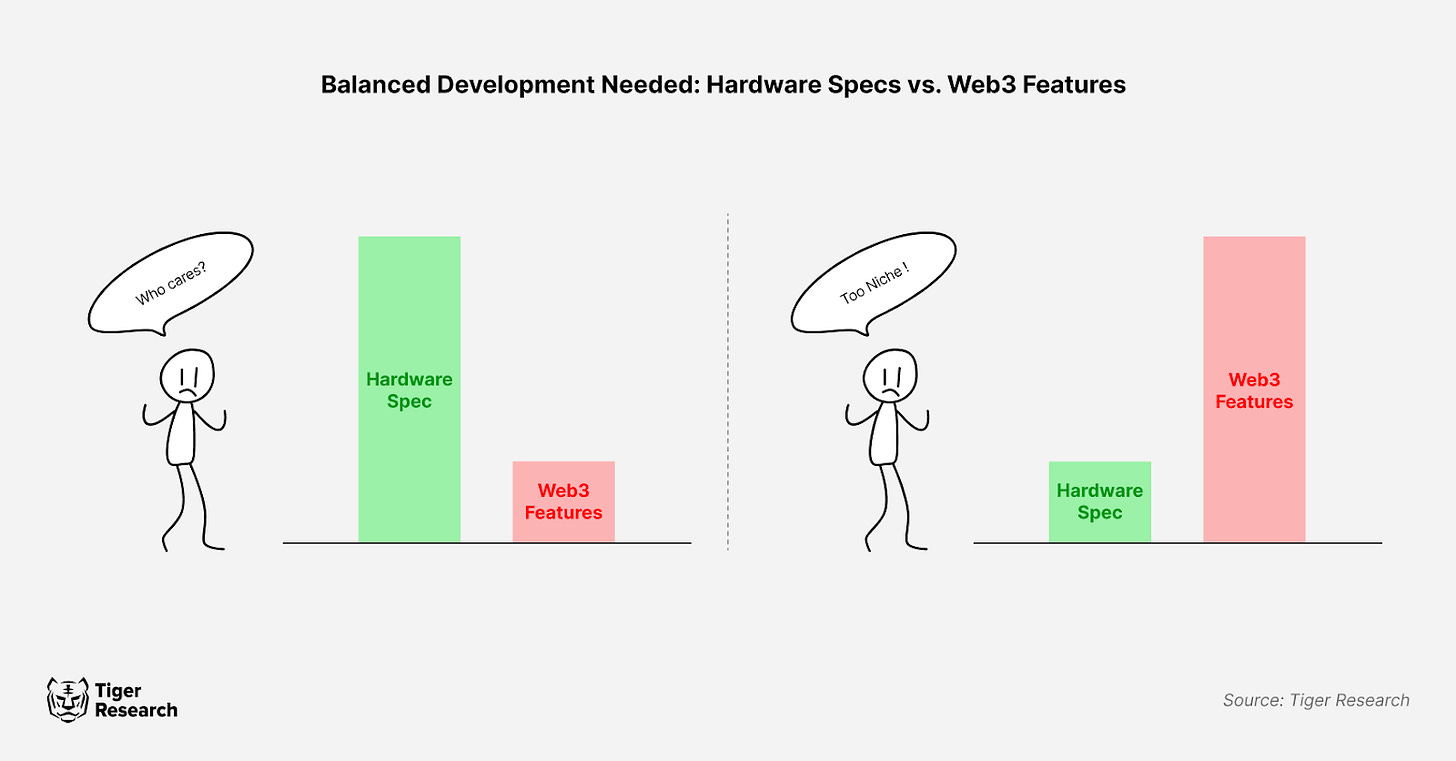

Despite the potential of Web3 smartphones, there are several challenges to overcome. First, the hardware specifications are inferior compared to mainstream smartphones. Most Web3 smartphones lag in camera performance and screen refresh rates. This makes them unsuitable for mainstream use. Additionally, prices over $500 are too expensive for the specs offered. This makes it difficult for average consumers to choose them. The phased pre-order system also causes uncertainty about delivery times and reduces accessibility. As a result, Web3 smartphones face issues in hardware competitiveness, sales, and operational improvements.

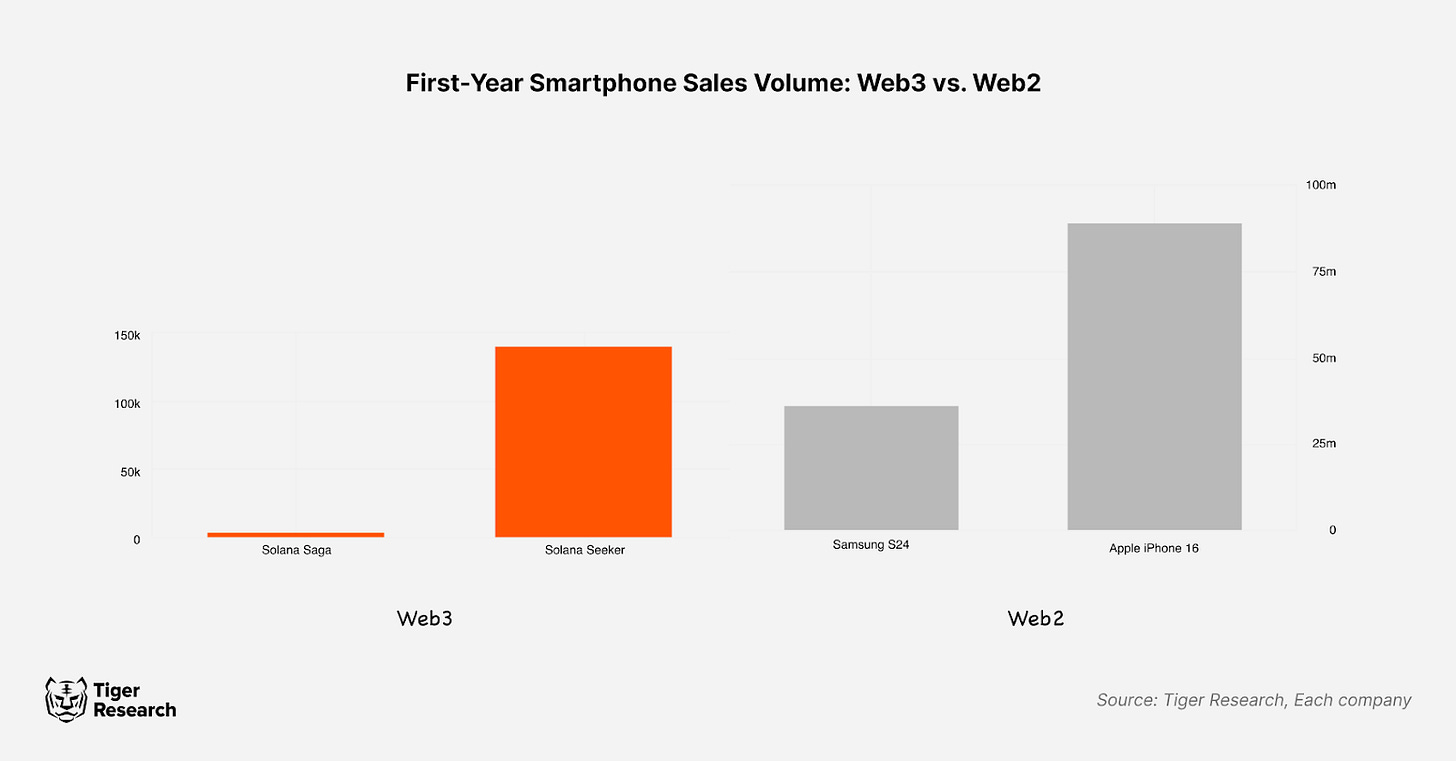

The second concern is that interest in Web3 smartphones focuses more on rewards like airdrops than on technical innovation. Solana’s first Web3 smartphone project, the Saga, shows this clearly. Initially, Saga's price was lowered due to low sales. Demand surged when the meme coin $BONK, paid to users, increased in value. This pushed Saga's resale value up to $5,000. Pre-orders for its successor, the Seeker, have now exceeded 140,000. Similarly, the Jambo Phone attracted attention by offering Gui Inu ($GUI), a meme coin based on Aptos, for free. These examples show that the Web3 smartphone market is driven by speculative factors like free tokens and resale value. This raises concerns that Web3 smartphones could become a short-term trend instead of a sustainable ecosystem.

Finally, Web3 smartphones present operational challenges. One issue is that the decentralized operations of Web3 smartphones may be too radical and might not fully replace the real value provided by traditional centralized platforms. While Google Play and the Apple App Store charge up to 30% in fees, they offer essential services. These include preventing abuse and illegal activities, maintaining app service infrastructure like payments, and providing customer support. Web3 smartphone-specific dApp experiences can also introduce new user experience challenges. Similar to how pre-installed apps by manufacturers or telecom providers frustrated users in the past, the pre-installed blockchain infrastructure and dApp configurations on Web3 smartphones could push specific Web3 environments based on the interests of the manufacturers and partners onto users. Web3 smartphones must focus not only on technical integration but also on creating comprehensive operational plans to address these challenges.

5. How Are Traditional Smartphone Manufacturers Responding?

Traditional smartphone manufacturers have also shown interest in incorporating Web3 technology into their devices. Initially, most efforts were limited to one-off promotional campaigns with minimal differentiation. For example, Samsung partnered with WeMade Tree (now merged with WeMade) and GroundX(formerly the developer of Klaytn) to release a Web3 smartphone series that featured pre-installed dApps from each mainnet. But aside from installing basic wallet apps and offering cryptocurrency to buyers, there were no significant distinguishing features.

However, more recent practical applications of Web3 technology have shown promising potential. For example, Circle announced that it will launch a Tap to Pay feature. This will allow users to pay with USDC stablecoin on iPhones using Apple's NFC technology. Although Apple did not develop this feature directly, it shows that Web3 payments can work on devices like the iPhone.

Samsung, on the other hand, has supported external Web3 wallet integrations like MetaMask and Coinbase Wallet through its Blockchain Keystore since 2019. It also continues to support blockchain wallet apps on its latest models. Recently, Samsung partnered with the South Korean Ministry of the Interior and Safety to enable blockchain-based mobile IDs for use with Samsung Pay. The potential adoption of Web3 technology by leading smartphone manufacturers could signal a new turning point in the mainstream adoption of Web3.

6. Conclusion

Web3 smartphones are a revolutionary concept, but the market is still in its early stages. Some projects offer token rewards and attract attention, but their scale remains small compared to traditional smartphone shipments. Global smartphone penetration stands at 6.4 billion, which represents 76% of the population. In contrast, only 10 million Web3 users exist, which accounts for just 0.156% of all smartphone users. Given that the Web3 industry itself has yet to reach mainstream adoption, the Web3 smartphone market remains even more limited.

Moreover, the technological limitations of Web3 smartphones are evident. There is a significant gap in hardware performance and production capabilities compared to traditional smartphone manufacturers. In this context, it is expected that Web3 smartphone projects will inevitably seek long-term partnerships with established smartphone makers. By leveraging their strengths in operating systems and software interfaces, Web3 smartphone projects may complement the hardware expertise of traditional manufacturers—similar to the relationship between Android and Samsung. Although challenges such as building a user-friendly dApp ecosystem remain, the combination of traditional manufacturers' hardware capabilities and Web3 projects' software expertise is likely to accelerate the development of Web3 smartphones.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.