Introduction

When analyzing the regional characteristics of the Web3 industry, country-level analysis is often used to provide a balanced width and depth of perspective. Yet even within the same country, each city has different regional characteristics such as major industry clusters, infrastructure, and business environment. Therefore, taking a step further and understanding the unique characteristics and environment of each city can add next-level depth to a project’s business and investment decisions.

In this report, we will analyze the status quo of Web3 companies by city in major Asian countries. The main data source for the report is publicly available data on the startup database Crunchbase.

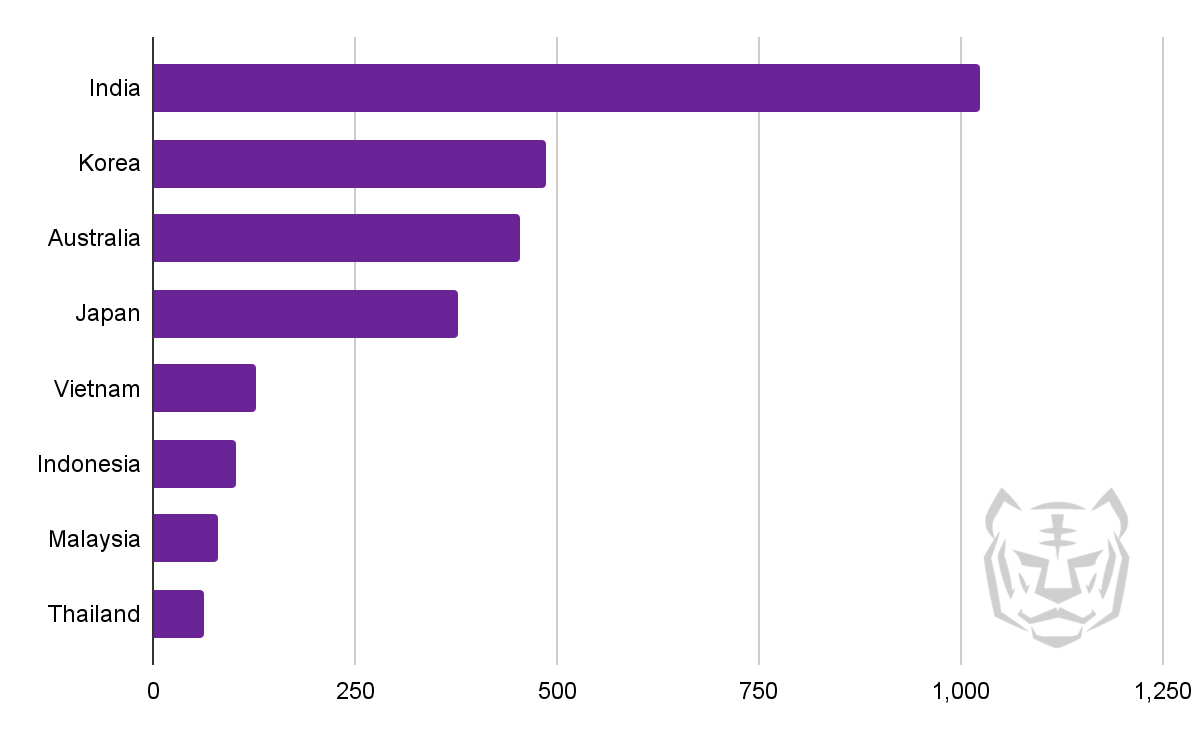

Web3 companies in major Asian countries

The table above shows the current state of Web3 companies in eight major Asian countries. India has the largest number of Web3 companies, followed by South Korea and Australia. While most countries have a "clustering" phenomenon where companies are concentrated in one city, countries like India show a relatively even distribution. Below are insights into each country's Web3 hubs, notable Web3 companies, and what the business environment is like in each region.

1. Bangalore: India’s Silicon Valley

The Web3 market in India is developing rapidly in Bangalore, also known as India's Silicon Valley. Bangalore is the center of India's IT industry and a strategically important base for many of the world's leading IT companies. About 20% of all Web3 companies in India are located in Bangalore, and the city is home to global Web3 projects such as Kratos Studio, Arcana Network, Bitbns, and CropBytes. Recently, India's largest blockchain event, India Blockchain Week (IBW) 2023, was held in Bangalore, further emphasizing its importance as the center of India's Web3 industry.

In addition to Bangalore, India's Web3 companies appear to be evenly distributed across the country, including cities such as New Delhi and Mumbai. This is a markedly different phenomenon compared to other major Asian countries, where most Web3 companies are concentrated in specific cities. This distribution may be attributed to the fact that India is geographically vast and each city has its unique economy and culture.

The presence of the Indian Institute of Technology (IIT), the world's largest and most prestigious engineering school, being spread out across the country may also have had an impact. The Web3 industry relies heavily on the availability of IT talent, and the spread of IIT has contributed to an even distribution of IT talent across the country, rather than concentrating it in specific regions. Success stories of global Web3 projects such as Polygon are also expected to have sparked the desire to enter the Web3 market across India.

2. Seoul: Korea’s megacity

South Korea has a high concentration of Web3 companies centered in Seoul. This is due to Seoul's unrivaled concentration of both population and infrastructure compared to other Korean cities. Seoul is home to about 18% of South Korea's total population, and the IT development workforce is also largely concentrated there. According to a 2023 survey by South Korean IT bootcamp Programmers, 70.7% of South Korean developers work in Seoul. In particular, Web3 companies are concentrated in Gangnam Teheran-ro, which is known as the Silicon Valley of Korea. The area is home to major global Web3 companies such as Dunamu, Bithumb, and Hashed.

In addition, Pangyo, located in a suburb of Seoul called Seongnam, is also on the rise, with the second largest number of Web3 companies in Korea. Pangyo is an important area where major Korean tech companies are located, and it's also home to some of the biggest names in Korean Web3 gaming, including Nexon, Netmarble, and WeMade. The city's geographical proximity to Seoul makes it a prime candidate to lead the Korean Web3 market alongside Seoul.

3. Sydney and Melbourne: Eastern metropolis in Australia

Australia has a large concentration of Web3 companies centered around its three largest cities, Sydney, Melbourne, and Brisbane. These cities account for more than half of Australia's GDP and are considered important markets for the country, with continued population growth.

Sydney and Melbourne, in particular, are home to about 57% of all Web3 companies in Australia, a result of the Australian government's desire to foster a fintech industry centered in these regions. As such, these cities are home to a large amount of research and innovation utilizing fintech, especially blockchain technology. These regions are rich in IT development talent and are considered to have a good environment for Web3 companies to grow.

Here's a look at the top Web3 companies in each city. Sydney is home to Web3 gaming companies such as Immutable and Sunflower Land, as well as Australia's largest cryptocurrency exchange, Independent Reserve. Melbourne is home to Australia's first cryptocurrency exchange, CoinJar and CoinTree. Brisbane is home to the cryptocurrency exchange Swyftx.

4. Tokyo: Largest economic city in Japan

Japan's Web3 market is centered in Tokyo. Approximately 77% of all Web3 companies in Japan are located in Tokyo, especially in the Roppongi, Shibuya, and Shinjuku areas of Tokyo. Major Web3 companies such as SBI VC Trade, CoinCheck, and Binance Japan are also located here.

Japan was expected to have a relatively balanced distribution centered on the four major cities (Tokyo, Osaka, Nagoya, and Fukuoka). However, it shows a high concentration in certain cities much like in Korea. This is likely because Tokyo, like Seoul, has a high concentration of financial infrastructure and human capital. The GDP of the Tokyo region is at least four times larger than that of other regions such as Kanagawa and Osaka, and it also has the largest population.

5. Ho Chi Minh and Hanoi: Vietnam’s twin peaks

Vietnam's Web3 companies are mainly centered in Hanoi in the north and Ho Chi Minh City in the south. Hanoi is home to the offices of Kyber Network and Icetea Labs, while Ho Chi Minh City is home to global Web3 companies such as Axie Infinity, Coin98, and Ancient8.

While both cities have a high level of population density and economic development, Ho Chi Minh City has a slight edge in terms of Web3 company activity. This is due to the environmental characteristics of each city. First of all, Hanoi is the capital of Vietnam, where most government departments are located. As such, it has a more conservative environment.

Ho Chi Minh City, on the other hand, is the economic center of Vietnam. It is a market where many multinational companies have entered, and a city that is active in blockchain technology development. According to data released by TopDev, a Vietnamese IT recruitment platform, the distribution of developers in Vietnam is dominated by Ho Chi Minh City (56.7%), and it seems that this dominance also applies to the Web3 industry.

6. Jakarta: Indonesia’s largest city

Although Indonesia is a country with a large territory consisting of various islands, the activities of Web3 companies are mainly concentrated in Jakarta. This is because the island of Java, where Jakarta is located, is a strategically important location, accounting for more than half of the population and more than ¾ of the consumer market. In addition, Indonesia is composed of several islands. With a lack of interconnectivity between the islands, so the market has developed rapidly around the capital city of Jakarta.

Jakarta is the financial center of Indonesia and is home to major financial infrastructure such as the Indonesia Stock Exchange and the national cryptocurrency exchange. Major Web3 companies such as Reku, Indodax, NOBI, and Avarik Saga are also located in the area, so it is expected that Web3 companies will continue to be centered in Jakarta.

7. Kuala Lumpur: SEA hub of Malaysia

Malaysia's Web3 industry is centered around the capital city of Kuala Lumpur and metropolitan areas such as Selangor. Kuala Lumpur has a startup-friendly environment, ranking 11th in the global startup climate, and its location as an aviation hub for the Southeast Asian region makes the city home to many Web3 companies. Ho Chi Minh City in Vietnam, Bangkok in Thailand, and Jakarta in Indonesia are all within two hours of Kuala Lumpur.

Kuala Lumpur is also a city with high expectations in the Web3 market, as it is known to be the birthplace of successful global projects such as blockchain analytics companies Etherscan and Coingecko.

8. Bangkok: Most dynamic industrial center in Thailand

Except for tourism, most industries in Thailand are centered in the capital city of Bangkok, and the Web3 industry is no different. About 80% of all Web3 companies in Thailand are based in Bangkok. In addition, Gulf Energy, Siam Commercial Bank, Kasikorn Bank, and crypto-asset licensees are all located in Bangkok.

Chiang Mai has also emerged as a center for digital nomads, and it was expected that the Web3 market would be active. However, it was difficult to find any Web3 company activity in the city. This is because Chiang Mai itself has a small population, a tourism-centric industry structure, and is geographically far from Bangkok, the largest city and economic center.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.