This report was written by Tiger Research, analyzing Bitcoin's infrastructure layer with examining key projects

TL;DR

Bitcoin L1 as the Anchor of Trust: BTCFi infrastructure builds around Bitcoin’s secure, conservative base layer, using it for final settlement and verification while keeping complex logic off-chain. Concepts like BitVM could expand Bitcoin’s smart contract capabilities without altering consensus.

Multi-Layer Ecosystem for Execution: From Bitcoin-anchored blockchains like Stacks, to BTC-staked chains like Botanix and BounceBit, to rollup-inspired systems such as Merlin and Bitlayer, each approach balances scalability, programmability, and trust in different ways while keeping Bitcoin central to security and value.

Complementary Systems like Lightning: While Lightning excels at fast, low-cost payments rather than DeFi, its liquidity and routing yield potential to connect Bitcoin’s transactional layer with BTCFi’s capital markets, opening hybrid use cases as bridging technology matures.

As explored in Part 1, BTCFi is about unlocking Bitcoin’s dormant capital and transforming it into a productive asset. However, to achieve that, infrastructure is crucial.

In this section, we examine the infrastructure layer that powers Bitcoin DeFi — from Bitcoin’s base layer to emerging Layer 2s, sidechains, and novel execution environments. These infrastructure components enable DeFi applications to build around Bitcoin without compromising its core principles.

1. Bitcoin L1: Settlement, Finality, and Trust

At the heart of BTCFi lies Bitcoin’s Layer-1 blockchain — the most secure and decentralized financial ledger in existence. With over a decade of near-zero downtime and a deliberately conservative upgrade history, Bitcoin L1 is widely regarded as crypto’s ultimate source of truth and final settlement.

This foundational strength gives Bitcoin a unique role: in a multi-layered DeFi system, it serves as the bedrock of trust. BTCFi protocols anchor to Bitcoin L1 not to compute, but to settle, using it as the “court of final appeal” for verifying transaction outcomes.

Crucially, BTCFi generally avoids modifying Bitcoin’s base layer to enable DeFi logic. The prevailing design philosophy is to build around Bitcoin’s simplicity and permanence, implementing execution off-chain or on Layer-2s and sidechains, while always returning to Bitcoin L1 for settlement and security.

That said, some experimental designs, particularly certain zk-rollup implementations, may benefit from new opcodes (such as OP_CAT) that would require a soft fork. These proposals remain speculative, and the majority of BTCFi infrastructure is focused on extending Bitcoin’s utility without altering its core consensus rules.

Looking ahead, proposals like BitVM take this idea even further. BitVM is an early-stage concept that could enable complex programs to run off-chain (outside the Bitcoin network) while still allowing Bitcoin to verify the results. Think of it like doing a complicated math problem on paper and announcing the answer; it’s considered valid unless someone challenges it. If it is challenged, then within a set time window, you must prove it on-chain, with Bitcoin enforcing the result.

This could enable the execution of full-featured smart contracts on Bitcoin without modifying the core system. While it’s still experimental, it reflects a broader trend: keeping Bitcoin as the foundation of trust, while moving advanced features and logic to external layers.

Overall, Bitcoin L1 remains deliberately simple and conservative, and that’s exactly why it works. It serves as the settlement layer and value anchor for a growing modular ecosystem. Rather than turning Bitcoin into Ethereum, BTCFi is about extending Bitcoin’s utility while preserving its integrity.

The following sections explore how the execution layers are structured, how they differ in design, and how they enable Bitcoin to support a broader range of financial applications.

2. Bitcoin-Anchored Blockchains

Bitcoin-anchored blockchains are independent execution environments that derive part of their legitimacy or security from Bitcoin, either through its hash power or on-chain transactions. These chains operate their own consensus, but they “anchor” to Bitcoin in ways that let them benefit from its security without directly executing logic on Bitcoin L1.

Think of it like building a gated community next to a well-protected national reserve. The gated community (the sidechain) has its own roads and houses (smart contracts and consensus). Still, it secures itself by proximity to Bitcoin's infrastructure — using the reserve’s surveillance system (Bitcoin miners or block hashes) to ensure no tampering occurs. You’re not altering the reserve, but you’re benefiting from its authority.

There are several anchoring methods:

Merge mining, where Bitcoin miners validate blocks on the sidechain at the same time

Proof of Transfer (PoX), where Bitcoin transactions are used as input to elect block producers

Time-stamping or checkpointing, where the state of the chain is recorded to Bitcoin periodically

These chains are not trustless by default. Some require federated custodians to manage BTC deposits or withdrawals. Others create indirect economic or timestamp-based links to Bitcoin.

2.1. Stacks: PoX Sidechain with Bitcoin Finality

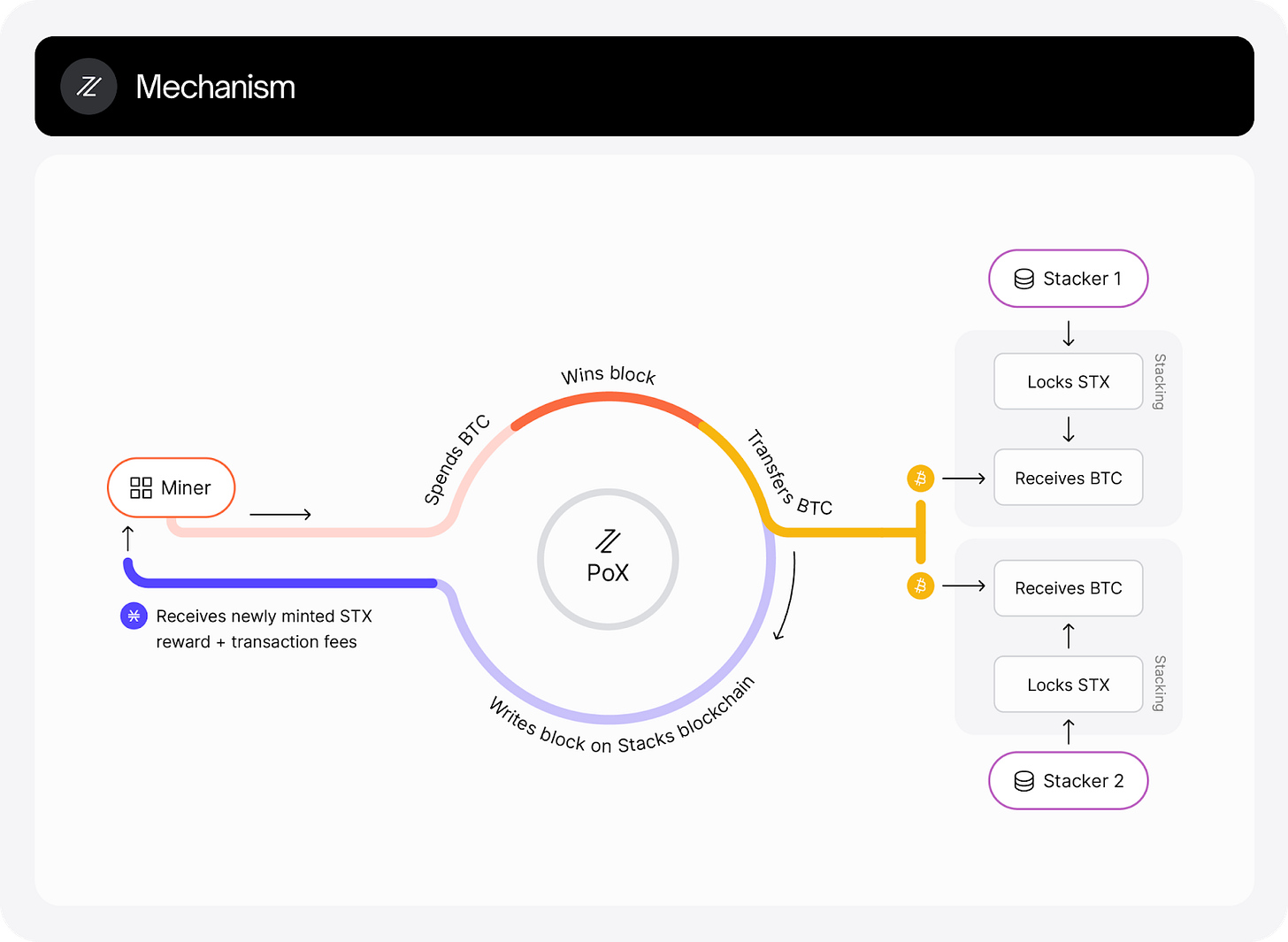

Stacks is the most prominent example of a Bitcoin-anchored blockchain that uses its own consensus mechanism, Proof of Transfer (PoX), to connect to Bitcoin. In PoX, Stacks miners post Bitcoin transactions and essentially “bid” BTC to win the right to produce blocks on the Stacks chain.

This links Stacks to Bitcoin’s economic layer — not by reusing hash power, but by recycling Bitcoin’s proof-of-work as a resource. Like hybrid PoS chains, Stacks also anchors its state to Bitcoin by including hashes of Stacks blocks in PoX block-commit transactions on Bitcoin, ensuring that its chain history is timestamped and tamper-evident at the Bitcoin layer.

Stacks features a Turing-incomplete Clarity smart contract language, designed with predictability and security in mind. Developers can read Bitcoin state and trigger contract logic based on Bitcoin transactions — making it one of the earliest and most mature Bitcoin-adjacent DeFi platforms.

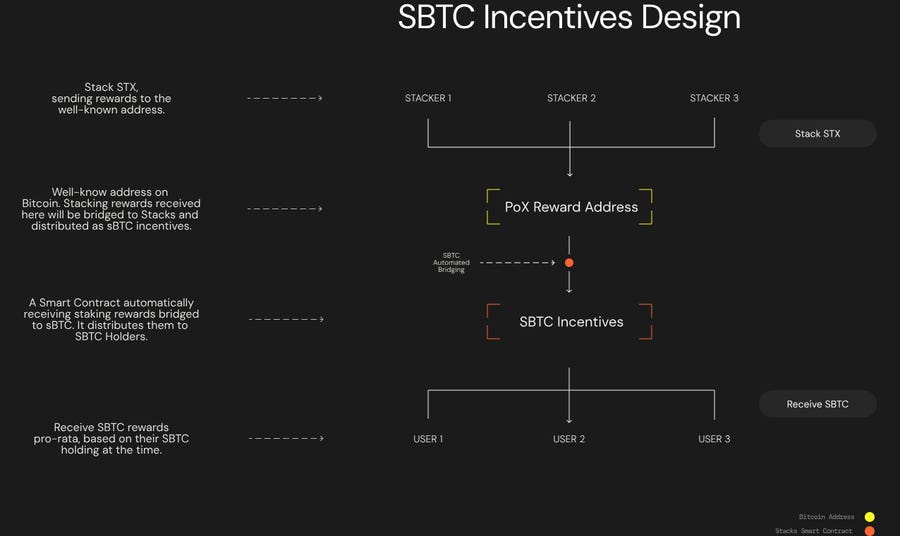

The BTC asset bridge on Stacks is handled via sBTC, a 1:1 BTC-pegged asset maintained by threshold signers. These signers are also validators who secure the Stacks network by staking STX, which reduces the likelihood of malicious behavior since any attack could negatively impact their staked assets. While the bridge design still involves some trust assumptions, it is permissionless to exit as long as a majority of signers behave honestly.

Stacks inherits Bitcoin’s security for settlement finality, anchoring its state to Bitcoin and using Bitcoin transactions as a source of truth. However, execution and bridge custody are secured by the Stacks network itself, allowing greater flexibility than a fully trustless Bitcoin L2. The network has its own native token (STX) and consensus rules, meaning it is not a Layer-2 in the strictest sense, but its entire ecosystem revolves around Bitcoin’s value.

3. BTC-Staked or Hybrid PoS Chains

BTC-staked or hybrid PoS (Proof-of-Stake) chains are execution environments that incorporate Bitcoin directly into their security model — either by requiring users to stake actual BTC or by anchoring their state back to Bitcoin. These chains typically offer high throughput, fast finality, or EVM compatibility while still relying on Bitcoin to backstop trust in some form.

Unlike traditional sidechains, which rely on fixed federations, BTC-staked chains seek greater decentralization and transparency by:

Requiring validators to stake BTC as collateral, usually on L1

Using Bitcoin block entropy (randomness from block hashes) to fairly select node operators

Anchoring checkpoints back to Bitcoin to create tamper-proof audit trails

Think of it like renting a vault in a secure national bank, but running your own business operations elsewhere. The bank (Bitcoin) doesn’t oversee your business, but it holds your collateral in full view, and you must play by the rules or risk losing your deposit. Customers (users) trust you not just because of your services, but because their money is ultimately backed by Bitcoin’s security guard.

This design balances performance and decentralization. It avoids the pitfalls of static multisigs while stopping short of full rollup-style trustlessness. These chains are particularly attractive to institutional users, as they combine:

Familiar smart contract interfaces

Direct BTC staking mechanisms

Exit paths to Bitcoin L1 that don’t require permission from a federation

Each implementation varies in terms of staking mechanics, governance, and token design — but the common thread is turning BTC into a productive, security-bearing asset, not just an idle reserve.

3.1. Botanix: Spiderchain and PoS Anchoring

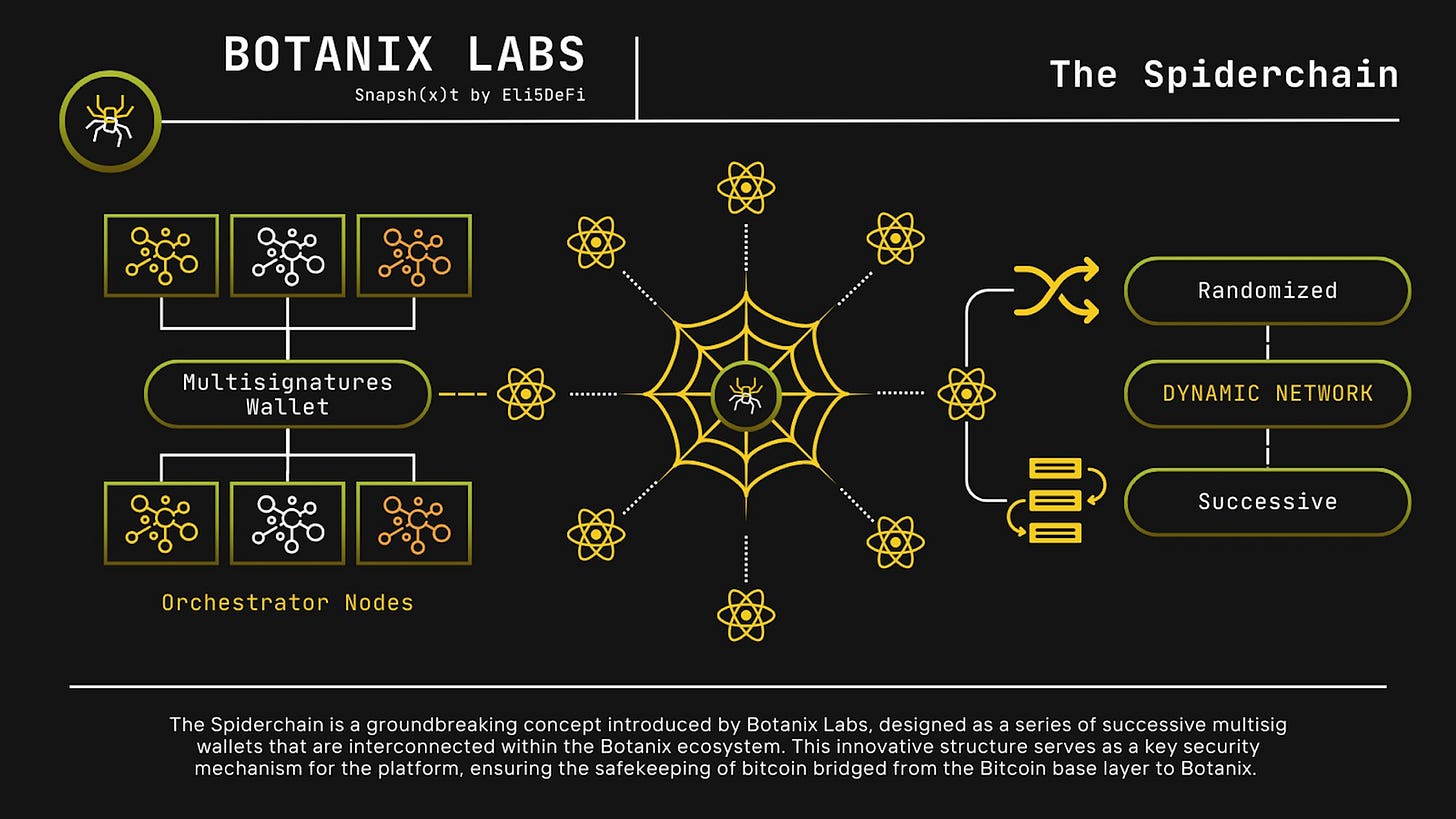

Botanix is a newly launched Bitcoin L2 that combines proof-of-stake validation with Bitcoin anchoring via a novel architecture called the Spiderchain.

At its core, Botanix uses a rotating set of orchestrator nodes that manage a multisig BTC bridge. These nodes are selected randomly using Bitcoin block hashes as entropy and are required to stake actual BTC on Bitcoin L1. The network commits state hashes to Bitcoin periodically, making Bitcoin a final checkpoint for the Botanix chain.

This architecture eliminates the need for a fixed federation and enables users to withdraw their BTC at any time with finality, creating a permissionless exit path. On-chain activity is EVM-compatible, with all gas fees paid in BTC — not a wrapped token or separate gas asset.

Botanix also powers native DeFi applications like Rover, a liquid staking protocol that distributes yield from network fees. The security assumption hinges on a PoS majority of honest orchestrators and visibility of fraud on Bitcoin L1 — striking a balance between performance and decentralization.

With all the updates and future developments, Botanix positions itself as a credible infrastructure layer for Bitcoin-native finance.

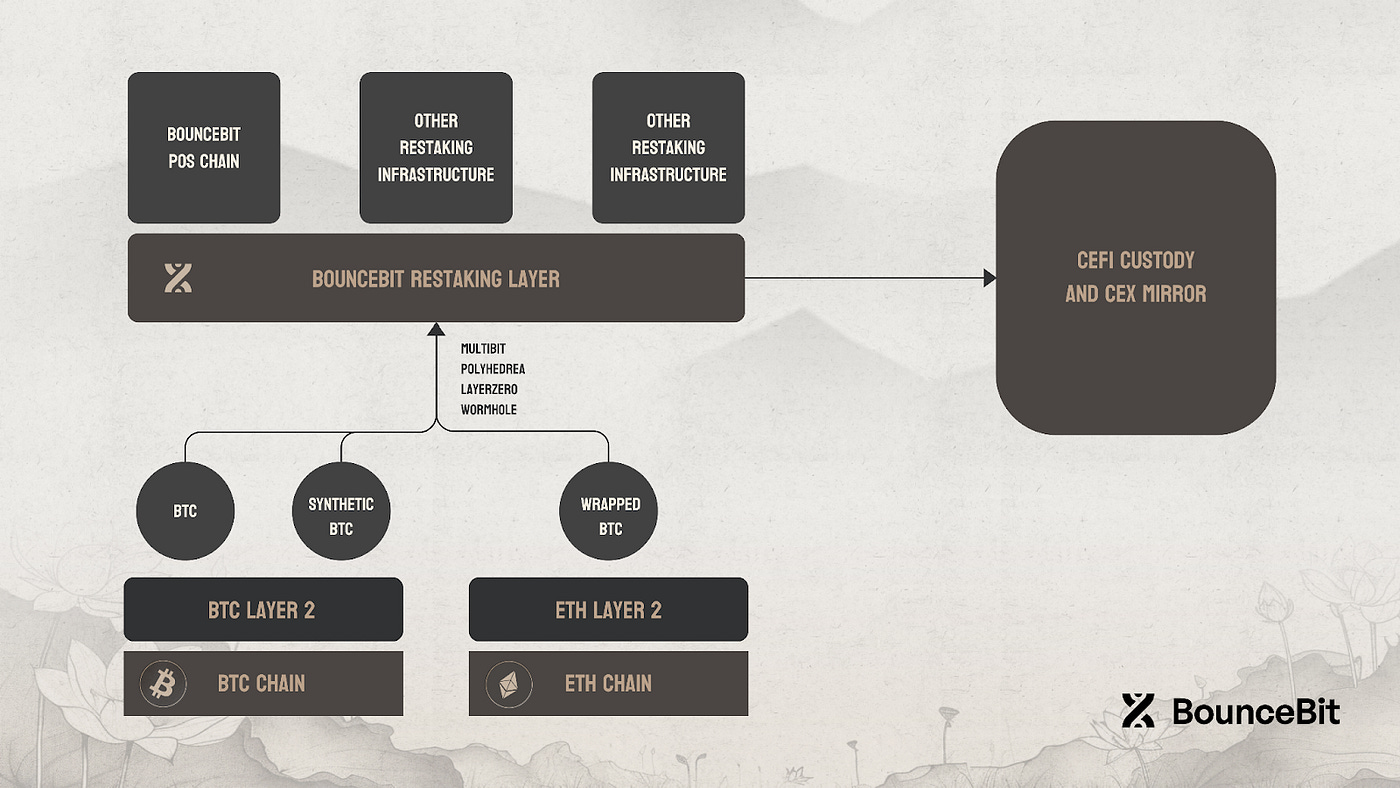

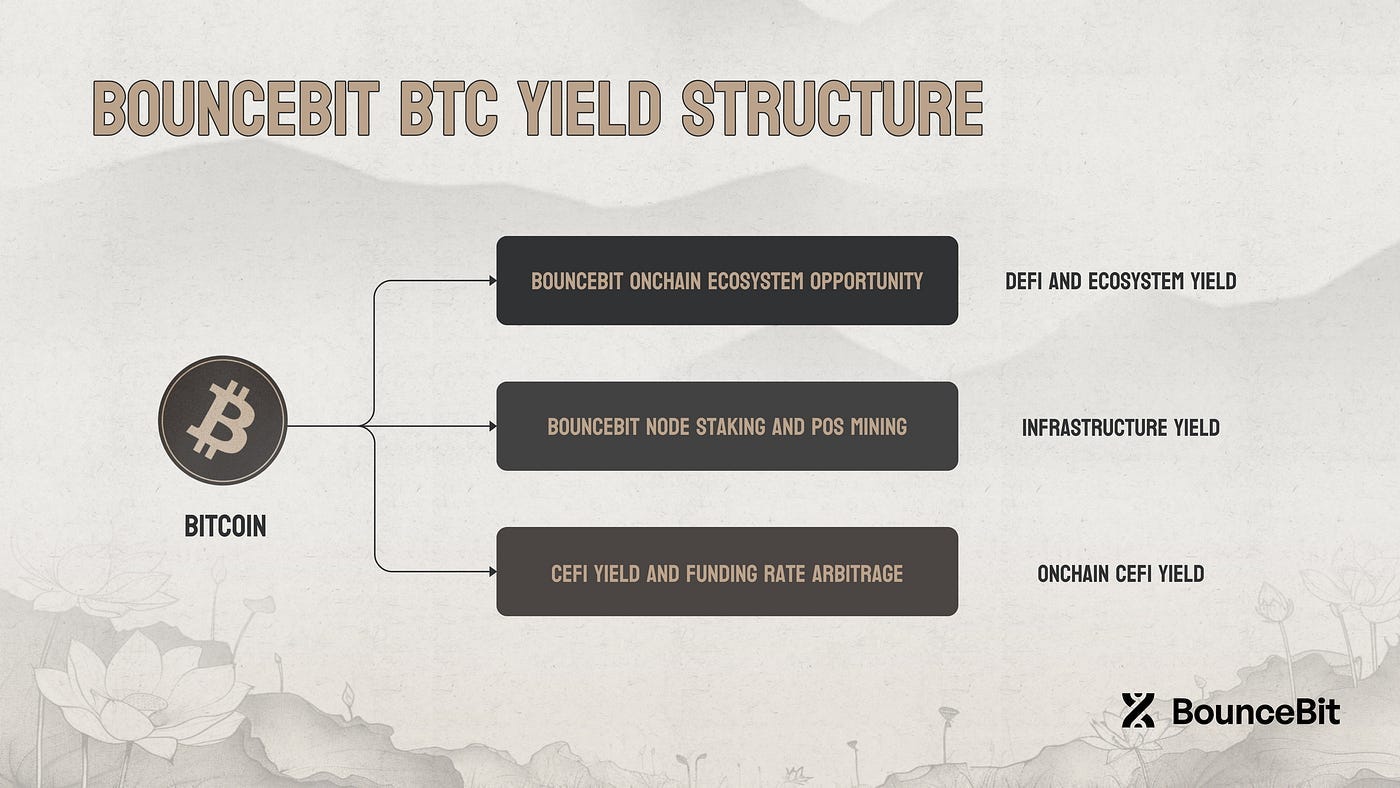

3.2. BounceBit: CeDeFi and Institutional Yield Layer

BounceBit takes a different approach, targeting institutional users by fusing CeFi infrastructure with DeFi access, using Bitcoin as the primary source of liquidity and trust.

Its consensus model is a dual-token PoS, combining the native BB token with BBTC, a tokenized 1:1 representation of BTC. Validators are chosen based on their combined stake in both assets. To enter the system, users deposit real BTC with a regulated custodian and receive BBTC on-chain — a centralized bridge, but one designed with auditability and legal compliance in mind.

Once on-chain, BounceBit users can access a range of “one-click yield” strategies powered by automated CeDeFi infrastructure. These include arbitrage, basis trading, and — in future iterations — tokenized RWA yield such as Treasury bills. The ecosystem is modular, with oracles, liquidity strategies, and validator sets all revolving around Bitcoin as productive capital.

While the trade-off is clear (custodial risk and permissioned components), BounceBit’s focus is on usability, compliance, and stable returns — making it attractive for institutions looking to deploy BTC in yield-bearing strategies without needing to manage complex DeFi tools directly.

BounceBit exemplifies a BTCFi path that prioritizes real-world integration over strict decentralization, offering infrastructure for bridging traditional finance and Bitcoin-native capital markets.

4. Rollup-Inspired Protocols

Rollup-inspired protocols aim to bring Ethereum-style scalability and programmability to Bitcoin, without changing Bitcoin itself. These systems execute transactions off-chain and post proofs back to Bitcoin — enabling high throughput and smart contract support while still relying on Bitcoin as the final arbiter of trust.

There are two core designs:

Optimistic rollups, which assume transactions are valid unless someone disputes them, in which case fraud proofs are submitted

ZK-rollups, which generate zero-knowledge proofs that mathematically confirm every transaction batch is valid

Bitcoin presents real technical challenges for these designs:

It lacks native support for complex verification logic or recursive proofs

Its scripting language is limited, making real-time fraud detection difficult

There's no enshrined rollup framework like in Ethereum’s roadmap

To overcome this, developers build off-chain execution environments and post condensed data (proofs, state roots, or transaction hashes) back to Bitcoin L1. You can think of these rollups like shipping containers through a customs checkpoint. The off-chain system does all the packaging, sorting, and logistics.

Bitcoin is the customs officer — it doesn’t open every box, but it requires a manifest (the proof) that checks out. If something’s wrong, there’s a way to escalate (fraud proofs or challenge periods). The process is fast, efficient, and scalable — but only if the manifests are trustworthy and the inspection system works.

These designs offer strong theoretical guarantees and a path toward Bitcoin-native smart contracts with high performance. However, they’re also the most complex and still relatively new in the Bitcoin ecosystem. Trust assumptions vary depending on the bridge, the proof model, and whether participants actually challenge invalid behavior.

Despite the risks, rollup-style systems represent the closest thing to trust-minimized scalability for Bitcoin, and they are quickly gaining traction with developers and capital allocators alike.

4.1. Merlin: zkEVM Rollup with BTC Staking

Merlin Chain is one of the most advanced attempts to build a zkEVM rollup on Bitcoin, combining zero-knowledge proofs with Bitvm-based Bitcoin security and a decentralized oracle network.

It batches off-chain transactions, generates ZK proofs of state transitions, and posts those proofs to Bitcoin L1 for finality. To handle data availability (which Bitcoin cannot provide natively), Merlin uses a Data Availability Committee (DAC) composed of oracle nodes that store and attest to the off-chain data. In its proposed architecture, these DAC nodes must stake BTC and are slashed if they sign off on invalid state updates that are later disputed.

Merlin offers a smooth EVM experience, supports assets like Ordinals and BRC-20, and uses MBTC (wrapped Bitcoin on Merlin) as its base currency. It bridges BTC from L1 through a multi-party computation (MPC) custody setup with Cobo and mints MBTC on the network.

The rollup model here is not entirely trustless — users must assume at least one honest party would challenge a fraudulent state, and the bridge introduces custodial risk. But it offers high performance, Ethereum-grade composability, and cryptographic assurance of correctness.

Merlin has already attracted significant traction, such as its TVL ATH reaching over $3B, demonstrating that practical DeFi yield can outweigh theoretical purity for many users.

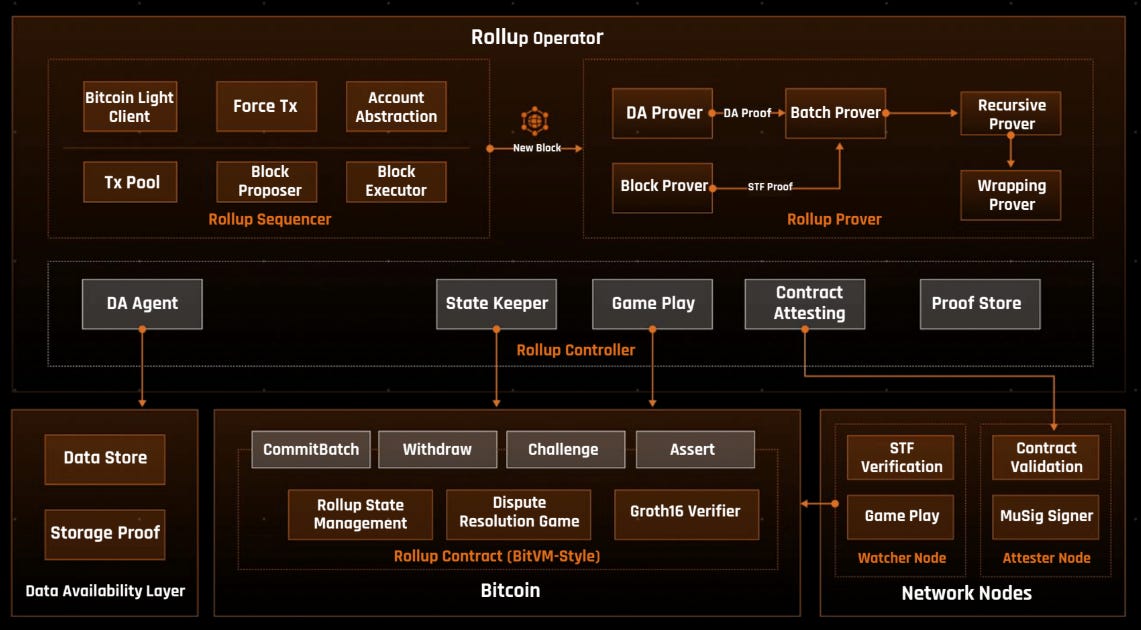

4.2. Bitlayer: BitVM + ZK Rollup Hybrid

Bitlayer addresses the critical gap between Bitcoin's unparalleled security and modern blockchain demands for scalability and programmability. By harnessing Bitcoin's base layer strength, Bitlayer inherits the same level of trust, decentralization, and resilience that established Bitcoin as the world's most secure blockchain.

Simultaneously, Bitlayer extends Bitcoin’s functionality by introducing Turing-complete programmability, enabling developers to create complex decentralized applications and smart contracts previously impossible within Bitcoin’s native framework.

Bitlayer introduces smart contract capabilities while respecting Bitcoin’s foundational principles, and its full compatibility with the Ethereum Virtual Machine (EVM) allows seamless migration of Ethereum applications and tools without significant modifications. Its evolution has been rapid, marked by clear development milestones:

Bitlayer PoS (Mainnet-V1): Live since April 2024, establishing the network’s initial validator and execution environment

Bitlayer Rollup (Mainnet-V2): Currently in development, featuring the live BitVM Bridge mainnet beta for secure BTC asset bridging

Bitlayer Rollup (Mainnet-V3): Planned upgrade for lightning-fast confirmations and unmatched execution performance

At the core of this architecture is the BitVM Bridge — sometimes called the “3rd generation Bitcoin bridge” — which replaces traditional multisignature custodians with a cryptographic challenge–response model. This ensures that even if most participants fail, a single honest verifier can safeguard user funds and enforce correct execution.

Ecosystem expansion has accelerated in 2025, driven by partnerships and infrastructure integrations:

Strategic alliances with Sui, Base, Starknet, Arbitrum, Sonic SVM, Cardano, and Plume Network

API support from major Bitcoin mining pools such as Antpool, F2Pool, SpiderPool — enabling real-time Non-Standard Transaction (NST) processing from the BitVM Bridge

Deployment of YBTC.B, Bitlayer’s wrapped BTC, across BSC, Sui, Avalanche, Ethereum, and Plume

This growth has translated into measurable impacts:

65M+ transactions processed since March 2024

$850M peak TVL on Bitlayer

$350M+ TVL for YBTC.B assets (per DeFiLlama)

By converging Bitcoin’s security with next-generation scalability and programmability, Bitlayer is positioned to fundamentally redefine Bitcoin Layer-2 capabilities and shape the future of Bitcoin DeFi.

5. Hybrid Consensus Chains Aligned with Bitcoin

Hybrid consensus chains aligned with Bitcoin are independent Layer-1 blockchains that combine multiple security models — typically proof-of-stake (PoS) and elements of Bitcoin’s proof-of-work (PoW) — to create execution environments that benefit from Bitcoin’s credibility and economic weight, without relying on it for direct state settlement or consensus.

These chains do not post data to Bitcoin or settle transactions on it. Instead, they:

Incentivize Bitcoin miners and holders to participate in network security — not by directly using Bitcoin hash power, but by economically aligning their incentives through staking mechanisms or validator influence

Allow BTC holders to stake their assets non-custodially, often through time-locked or smart contract-based methods

Design validator economics and governance systems to attract Bitcoin ecosystem participants — from miners to long-term holders

Think of them like special economic zones built to attract Bitcoin capital. They have their own laws (governance), infrastructure (consensus), and services (dApps), but offer rewards and influence to Bitcoin-aligned participants. You don’t need to leave Bitcoin behind — these zones are purpose-built to let your BTC work for you.

What sets them apart is that Bitcoin becomes part of their validator economics, shaping who secures the chain and how rewards are distributed. While Bitcoin is not part of the cryptographic consensus engine, its holders and miners are invited to secure the system via economic mechanisms — creating a powerful blend of autonomy and alignment.

This structure appeals to BTC holders who want to earn yield without giving up custody, and to miners seeking to maximize capital efficiency without leaving the Bitcoin ecosystem. Hybrid chains don’t compete with Bitcoin — they extend its influence by turning its stakeholders into active participants in adjacent ecosystems.

It’s a looser coupling than a true L2, but far more integrated than a generic alt-L1. These chains reflect a broader trend in BTCFi: you don’t need to build on Bitcoin to build for Bitcoin — as long as the incentives, architecture, and user base stay aligned.

5.1. Core: Satoshi Plus and BTC Hashpower Delegation

Core (CoreDAO) is a fully EVM-compatible Layer-1 blockchain that launched in 2023 with a unique hybrid consensus mechanism called Satoshi Plus. This model combines:

Delegated Proof of Work (DPoW) — Bitcoin miners delegate their hash power to secure Core blocks

Delegated Proof of Stake (DPoS) — CORE token holders stake to validators

Self-custodial BTC staking — BTC holders can lock BTC on L1 to support validators without giving up custody

In this model, Bitcoin miners are incentivized to contribute hash power to Core’s validator selection process, earning extra rewards without disrupting their normal Bitcoin mining activities. Meanwhile, BTC holders can participate in network consensus via time-locked transactions on Bitcoin L1, enabling what Core calls “trustless Bitcoin staking.”

Core delivers fast block times, low fees, and full Ethereum compatibility. It offers DeFi, NFT, and dApp infrastructure that feels similar to Ethereum — but ties its validator set to Bitcoin’s economic and mining power, creating an alignment that few chains attempt.

While Core has its own token (CORE) and governance processes — and does not anchor state directly to Bitcoin — it positions itself as complementary rather than competitive with Bitcoin. Its vision is not to be a Bitcoin L2 in the narrow technical sense, but to act as a Bitcoin-aligned smart contract chain where BTC users and miners benefit from on-chain activity.

With over 125+ dApps already deployed and a growing user base, Core illustrates a BTCFi strategy that blurs the line between alt-L1 and Bitcoin infrastructure, offering an Ethereum-grade ecosystem grounded in Bitcoin’s credibility and capital base.

6. The Lightning Network: A Parallel Track

No discussion of Bitcoin’s scaling architecture is complete without acknowledging the Lightning Network - a Layer-2 solution purpose-built for fast and low-cost payments. Unlike BTCFi protocols that focus on lending, yield generation, or tokenization, Lightning operates on a separate track, excelling in its original mission: enabling Bitcoin to function as peer-to-peer cash.

Lightning works by establishing state channels between users. By locking BTC in a channel, two parties can transact off-chain with near-zero latency and negligible fees, only settling the net result back on Bitcoin’s base layer. This model drastically increases transaction throughput—Lightning can theoretically process millions of transactions per second—and reduces transaction costs to fractions of a cent.

As of 2025, the Lightning Network secures between $400–500 million in BTC liquidity and powers real-world payment applications such as Strike, particularly in emerging markets where fast remittances and low fees are critical.

However, while Lightning excels at payments, its architecture is not designed for DeFi. Its smart contract capabilities are minimal—optimized for simple channel scripts rather than complex financial logic. You can buy a coffee or stream micro-payments, but not launch a lending protocol or deploy a decentralized exchange on Lightning. Liquidity is also fragmented across thousands of channels, making it difficult to aggregate capital for pooled DeFi strategies.

While Lightning remains specialized and DeFi integration is still minimal, its strategic importance is clear. It complements BTCFi protocols by enabling BTC to move cheaply and instantly, while BTCFi platforms unlock value by locking BTC into yield strategies. As bridging technologies improve, Lightning’s liquidity could increasingly feed into BTCFi flows, connecting the spending side of Bitcoin with its productive capital layer.

7. New Ideas and Infrastructure Development

As explored in Part 2, infrastructure layers are unlocking Bitcoin’s dormant capital by moving complexity off-chain while anchoring trust back to L1.

New entrants are already pushing these ideas further. Plasma is an emerging Bitcoin-anchored sidechain built for fee-free, stablecoin-friendly settlements, combining EVM compatibility with privacy features. Arch Network, meanwhile, is pioneering a bridgeless execution layer directly on Bitcoin, enabling high-throughput dApps without relying on wrapped assets. Though different in design, both reflect the same ethos: innovate around Bitcoin’s strengths, not at their expense.

The path forward for BTCFi will be modular and diverse. But infrastructure is only one side of the equation — in Part 3, we turn to the asset and custody layer, where the focus shifts to how Bitcoin moves, is held, and is represented across these networks.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.