1. Introduction

What’s on your mind? Like right now, what are you thinking about? Perhaps I have you hanging onto every word. But I’m not vain enough to think that’s true. Your mind is probably a storm — family, friends, work, sex, drugs, rock and roll.

Whatever you’re thinking about, it’s not just this riveting research report. You’re scattered. That’s okay, so am I. We’re all drowning in digital stimulation. Price alerts. Emails. Telegrams. Tweets. Texts. Calendar invites. Browser tabs. DMs. FaceTimes. Such is life in 2024. We have more technology but less control.

Staying present is hard, especially in our land of magic internet money. Here, markets trade 24/7, blocks don’t take weekends, and Twitter never sleeps. Keeping up with crypto often feels like a Sisyphean task. It’s a war we all wage but rarely talk openly about.

Almost everyone sees the importance of attention on a personal level, but few see how it shapes everything around us. Attention is the most valuable yet misunderstood resource in the world. This report explores the role attention plays in our economy, markets, and minds. We will focus on three big dimensions — the past, present and future:

how Big Tech monetized attention

how crypto tokenizes attention

why AI will disintermediate attention

So, grab a coffee or stiff drink, whatever you need to lock in, and let’s talk attention.

2. Attention Must Flow

In Dune, the great Houses struggle over spice. To control spice is to control the universe. But here on Earth, our spice is attention. And the great Houses — the Big Tech companies — engage in a bloodless war over it.

The Big Tech Bene Gesserits have ruthlessly iterated, A/B tested and honed the Internet into an attention-warping machine. They employ legions of highly paid PhDs who devote their lives to ensuring that you never escape the digital matrix. If it were up to them, you would scroll, click, and add-to-cart forever.

Their ultimate creation is algorithms that monetize our attention. It’s probably the closest we’ve ever come to alchemy — attention in, profit out.

Netflix’s CEO, Reed Hastings, wasn’t kidding when he said the streaming giant “competes with sleep” for users’ attention. Every second counts when your business model is putting ads in front of eyeballs.

The game for Big Tech is threefold:

capture attention

retain attention

monetize attention

Remarkably, these three bullets built much of today’s Internet. Consider Google. These guys gave us an entire suite of free software — Gmail, Maps, Docs, etc. — all to serve more ads. More recently, these companies have invested billions to build some of the world’s most advanced AI — all to better analyze and predict our attention. We wanted flying cars, instead we got the ‘for you’ page.

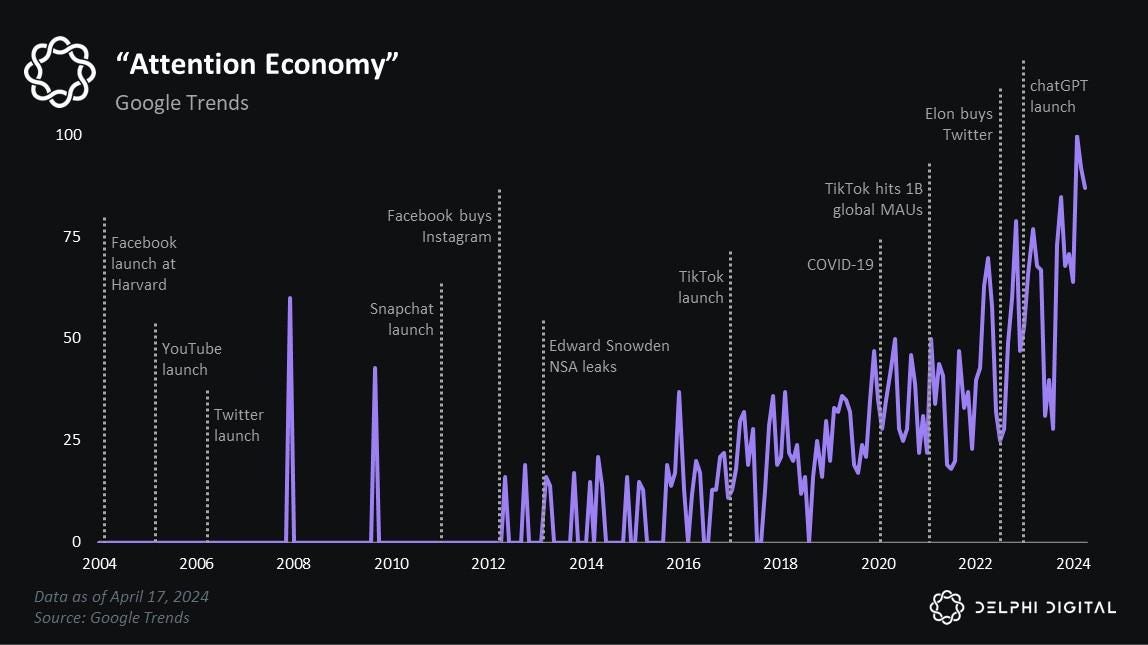

The term ‘attention economy’ gets thrown around so much that it’s become cliché. But that doesn’t mean it’s not real. It very much is — Big Tech proves that.

We’re talking about the most valuable corporations ever. And all they do is monetize our attention via industrial-grade spice harvesting machines. All the “connect the world” and “do no evil” doublespeak just obscures this reality.

If Big Tech is the aggregator and distributor of spice, then every other company under the sun is the buyer. Consider Alo — the athleisure brand that competes with Lululemon. Alo makes money by selling clothing. And it does so by producing cool and comfy clothes. So, a big part of their operating strategy is to “make doper stuff than Lulu.” But similar to a tree falling in the woods, if Alo makes a better product and no one knows, does it even matter?

As a result, Alo is forced to play the attention game. It’s why they pay big bucks to influencers like Jimmy Butler to wear their stuff and why they pay Zuck even more to serve ads. Anyways, the point is, they got me. After seeing a cool Jimmy Butler ad on Instagram for like the 20th time, I finally capitulated and bought some underwear. Alo won my attention — and my moolah.

The point of this riff is just to say — the real economy has totally reoriented itself around attention. Every time I talk to friends in marketing, I’m always amazed at how much of their job comes down to “muh Instagram clicks.” It’s all one big machine. And everyone is competing for the world’s scarcest resource — our attention — whether that’s Zuck, Alo, or anyone in between.

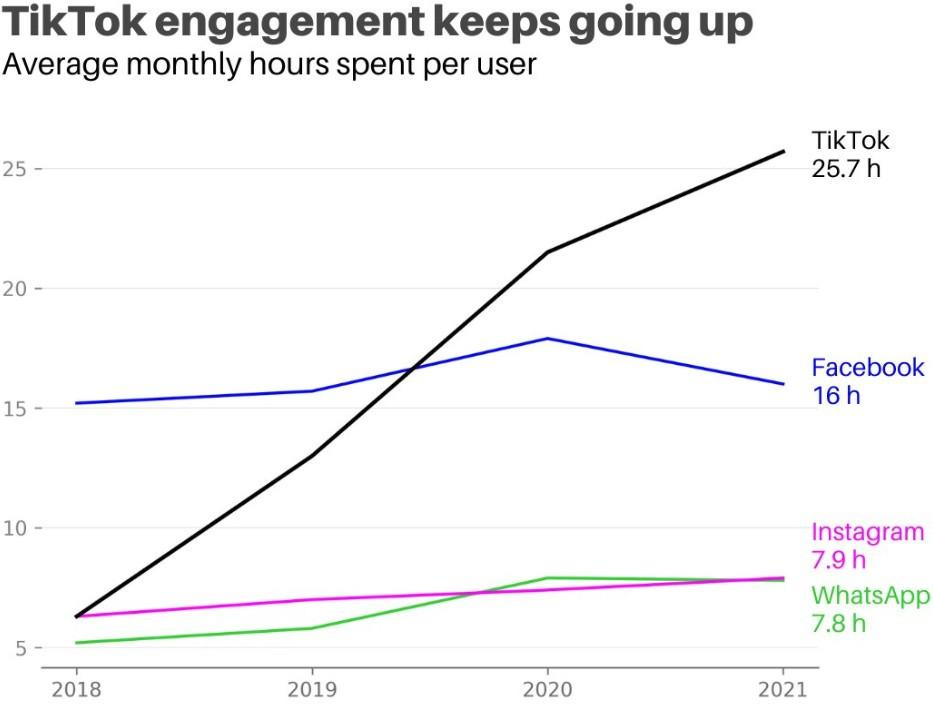

Naturally, the financial markets have woken up to the attention game. If you listen to a Meta earnings call, all the analysts talk about is time spent on platform. Zuck usually throws them a bone with some compliance-approved lingo on MAUs and retention. But these are mere abstractions. The real fundamental drivers of Meta’s business are shown in the chart below — Ad Impressions x Ad Price. If you were valuing META stonk from first principles, these would be the two model drivers.

In the non-tech world of spice buyers, things function in a similar way. The market is laser-focused on Alo, Lulu, or any ‘real world’ company’s ability to convert attention → sales. While this might sound overly reductive, it really isn’t. At the end of the day, all the marketing, ads, and influencers are designed to do one thing: capture our attention. Attention = sales. Don’t believe me? Well, this was the first analyst question from Lulu’s most recent earnings call:

“Great. Thanks so much for taking the question. I just wanted to hone in on the comments on the challenging consumer behavior. Just wondering, are you seeing that in some pockets of the business more than others, or is it broad-based? Is it a traffic or a conversion problem, or how do you see that?”

On the surface, it concerns the strength of the consumer. But if you read between the lines, the analyst is really trying to understand whether Lulu is being impacted by a minor macro slowdown or, more ominously, if they lost their customers’ attention. The “is it a traffic or conversion problem” is the tell — Wall Street is hyper-aware that attention is all you need.

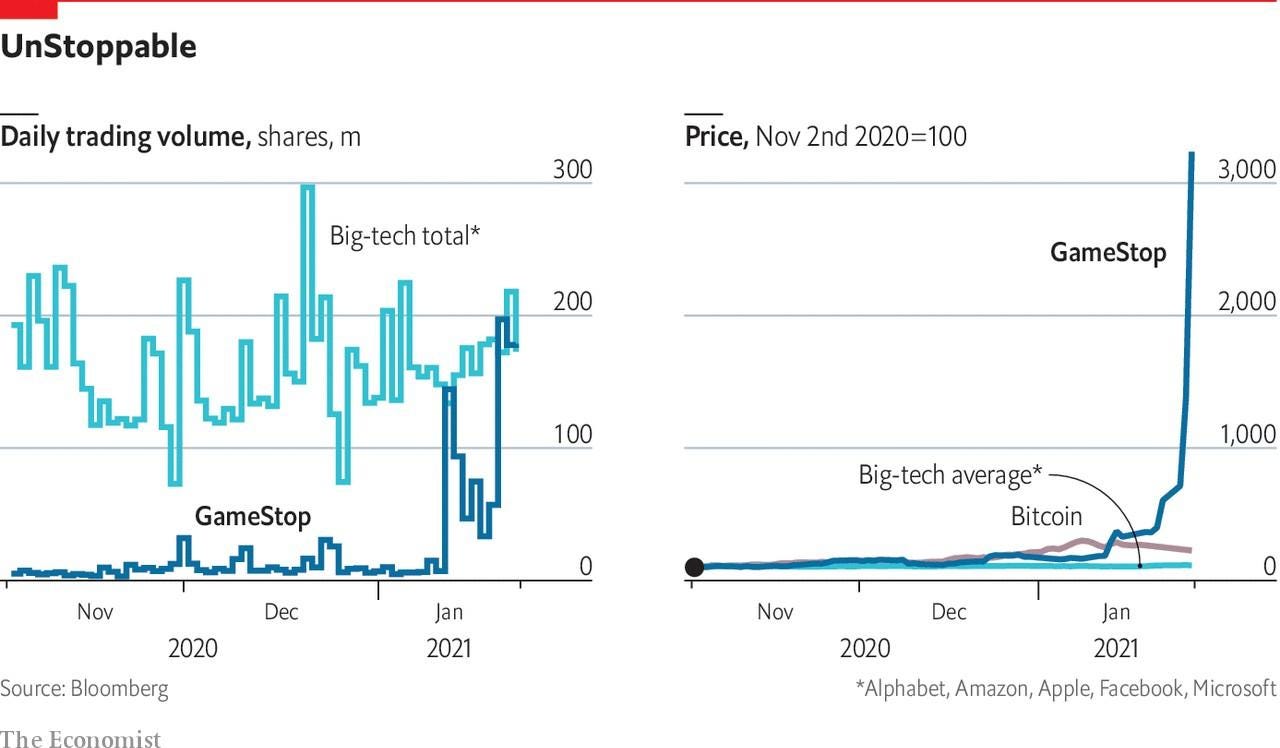

Aside from the Meta and Lulu anecdotes, the real elephant — or should I say ‘tendie’ — in the room is, of course, Gamestonk. The movie Dumb Money on Netflix offers a hilarious and nostalgic postmortem on the GME saga, but I shall try my best to TLDR.

It was late 2020, and the whole world was stuck inside quarantining. Everyone was a little confused, maybe scared, but most of all, bored. We all had a lot of time on our hands. And thanks to the stimmies and lack of stuff to spend money on, we had cash to burn. Around this time, a dude named Keith Gill / Roaring Kitty / DeepFvckingValue — depending on your social media platform — started bullposting about Gamestock.

Mr. Kitty said Wall Street was wrong and the shorts were gonna get burned. At the time, GME was one of the most heavily shorted stonks in the world. Investors were bearish because video game sales were in the midst of a secular shift from brick-and-mortar to digital. Not to mention the COVID lockdowns, which absolutely decimated in-store sales. From Wall Street’s perspective, GME was an obvious short.

But over the course of 2020, Roaring Kitty used Reddit’s r/wallstreetbets to build a cult-like community around GME stonk. People joined for all sorts of reasons, but the most popular were:

short squeeze: the crowd believed they could ‘burn the shorts’ if they pumped the stonk

populist movement: many saw Wall Street as evil and GME as a way to fight back

social phenomenon: people liked the community’s vibes and wanted to be part of a larger movement.

media coverage: as the story blew up, it drove attention, hype and FOMO

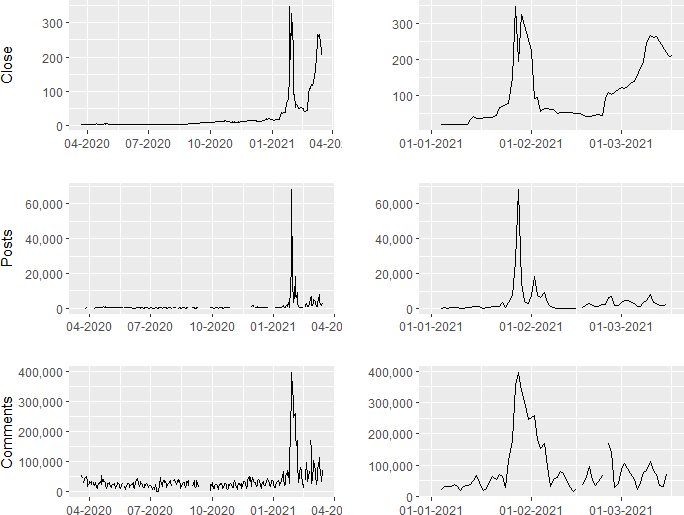

For whatever reason, thousands of individual investors put their hard-earned dollars at risk to bet on a company that was objectively struggling. Then, in early 2021, things got weird. The GME hype on Reddit reached a crescendo and the stonk actually started to rise. As more investors piled into GME, it created an insane reflexive loop that looked something like this:

retail buys → price up → shorts forced to cover → attention → retail buys → price up...

Another wrinkle here is the GME apes bought such an ungodly amount of OTM long GME calls that market makers were forced to hedge by buying spot GME. So, while the Gamestonk crowd often gets cast as a bunch of illiterate degens, they were actually doing some pretty sophisticated stuff.

This loop played out throughout January 2021. And by the end of the month, GME had mooned from $17 to $347—an increase of over 20x.

Gamestonk was a watershed moment for Internet culture, American politics, financial markets, and even crypto. At its core, it’s a David vs. Goliath story. A bunch of random strangers coordinated to pamp a downbad stonk and took down some high-powered hedge funds in the process. It served as a reminder of the latent populism that drove the Trump and Bernie campaigns and inspired the Occupy Wall Street movement.

GME also caused an earthquake in financial markets. The Street was officially put on notice over the rise of retail investors, so much so that several short sellers shut down in the aftermath. Others shifted to long-only strategies as retail investors began to hunt their short positions using the GME playbook.

On the crypto front, Gamestonk was a jarring lesson in centralization. Many have since forgotten, but what actually ended the GME saga was Robinhood quite literally removing the buy button. As the preferred venue for WallStreetBets traders, the ban kneecapped GME’s momentum and ultimately ended its short- lived pump. For once, the “crypto solves this” meme actually applies here.

For our purposes, though, the key takeaway from Gamestonk is all about attention. GME did not pump because of the stonk’s fundamentals; it pumped because of attention. What started as a small group of loyalists quickly snowballed into a viral movement that lit social media on fire and drove a tsunami of retail buying.

After the GME mania faded and the Congressional hearings ended, Mr. Kitty disappeared. He went off to touch grass and enjoy his profits — that is, until yesterday when he tweeted this:

The post immediately blew up and now has over 16 million views in 16 hours. Today, GME stonk was paused several times due to volatility as the stonk surged and short sellers were once again torched.

It appears the man, the myth, the legend — Mr. Kitty — is back and has graciously provided the perfect ending to this section on how attention has reshaped financial markets. A movement at this scale would have been impossible a decade or so ago. But now, armed with weapons-grade financial technology — Reddit and Robinhood — individual investors are able to compete with the big guns. Sometimes, all it takes is a simple meme to coordinate the Internet in the age of attention.

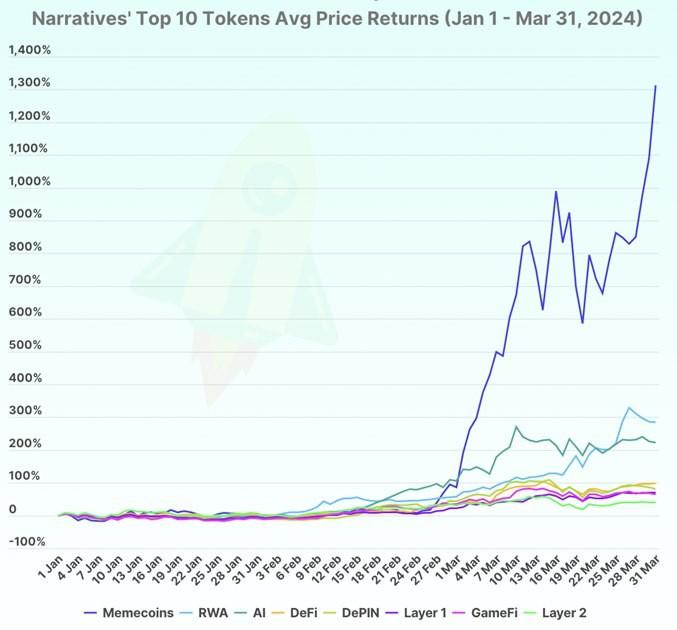

3. Pay Attention to Fundamentals

Last cycle, memecoins were mostly a joke. This cycle, they’re still funny but their price action is no laughing matter. DOGE and SHIB are outperforming BTC and ETH, again. And the newer crop of memes like WIF and PEPE boast returns that dwarf just about everything else.

The so-called ‘memecoin supercycle’ has triggered some existential angst and soul-searching within crypto.

Do fundamentals matter?

Is everything a meme?

Is crypto just a casino on mars?

I don’t promise to have all the answers to these somewhat philosophical questions, but I do hold three core beliefs:

crypto remains 99% speculation, 1% utility

most tokens are worthless

valuations are driven by attention

We’re 15 years into Satoshi’s grand experiment and still struggling to solve everyday problems for everyday people. Reasonable minds can debate over whether or not crypto has PMF. But at the end of the day, it’s all semantics. We’re still early. By my last count, only 5% of the world uses crypto, which is probably a generous figure.

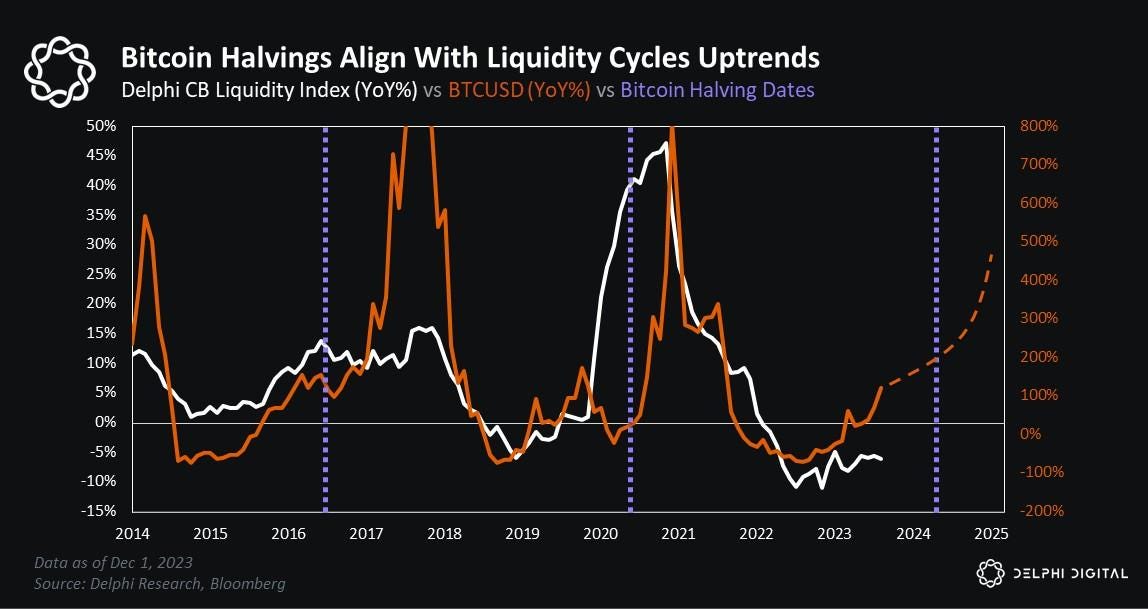

Today, crypto’s only real world use case is giving the entire world new ways to make money. As a result, the market rationally values tokens as purely speculative instruments. While some people try to use DCFs and P/E ratios to justify investments, we all know deep down that the market does not trade off these. The market trades off speculation. It’s why tokens remain so tightly correlated with global liquidity — crypto is the ultimate risk-on asset class.

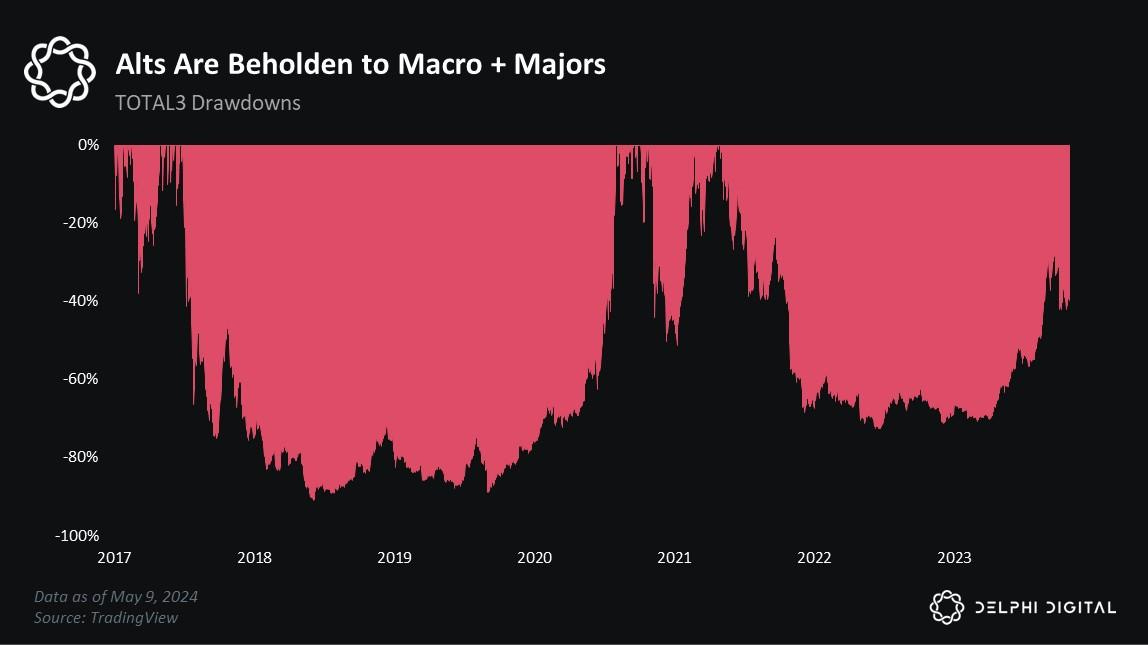

Many investors view crypto as a high-beta play on currency debasement. While many of us see it as more than just a monetary hedge, the market will continue to pigeonhole it until we build apps with millions of users who come to crypto for something other than making money. Until we actually solve real problems for real people, altcoins will pump, dump, and endure soul-crushing drawdowns like they have every cycle.

Another reason why token valuations are so subjective and volatile is structural. Legally, projects cannot deliver value to holders without running afoul of securities law. So, to avoid the long arm of Gary Gensler, most teams opt for governance tokens with precisely zero value capture. While there exist notable exceptions, the vast majority of tokens offer few guarantees to holders and fall junior to equity in projects. In a sense, many gov tokens are just memecoins with a fancy suit on.

The lack of regulation limits the types of investors that can play in crypto. In TradFi, the market is highly diverse — long-only, short, distressed, liquidation, M&A, etc. This doesn’t exist in crypto — everyone is essentially a highly liquid VC. The upshot is this means most of the market is long the same trade, which tends to increase volatility. In TradFi, buyers will set in when they believe securities have fallen below their intrinsic value. Warren Buffet did this following the 2008 Financial Crisis. But the only way this is possible is if there’s a robust regulatory framework that gives buyers the confidence to pursue liquidations, M&A, and other law-adjacent maneuvers. In crypto, there’s no such thing.

Given crypto’s nascency and structural challenges, it’s no surprise that tokens trade off the amorphous value of attention. It may be ephemeral, but valuing attention is easier than discounting highly volatile future cash flows or praying for some miracle regulatory overhaul.

All this “attention is value” stuff may seem kinda dystopic and self-defeating. And on some level, it is. Many came to crypto to make money but stayed to change the world. If you’re reading this, it’s probably because you genuinely believe that. I certainly do. The only problem is no one knows how to get there. How do we go from memecoins and speculation to world-altering technology? I don’t have a magic solution, but if I did, I would probably build a ZK L3.

On a more serious note, crypto’s big unlock is giving people the opportunity to make money on all sorts of new assets. For now, that happens to be memecoins and a million L2s. But one day, these investable assets will span just about everything. Every market shall be tokenized — by Larry Fink himself if need be.

What does tokenizing everything mean? It means crypto lets us share in the upside of the stuff we pay attention to. On Instagram, we pay attention to brands and influencers. For me, that’s Alo and Jimmy Butler. But the most I can do is repost and share this content with friends. The value of my attention is 100% captured by other people — Zuck, Alo and Jimmy Butler — likely in that order.

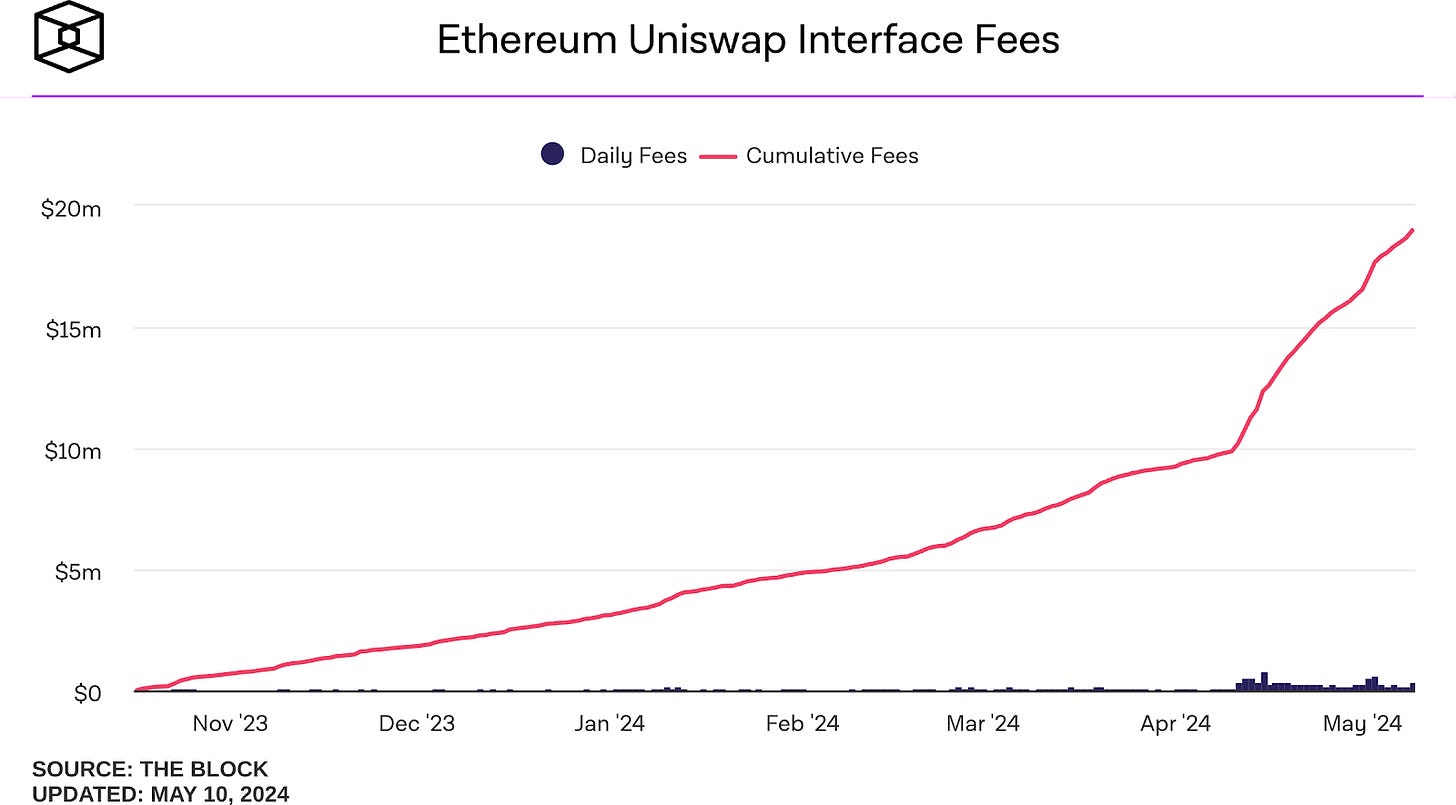

But crypto is different. Crypto ~democratizes~ attention by letting us own it. If you find yourself spending a lot of time on [insert ur favorite project: FriendTech, DRiP, pump.fun] you can actually own and profit from your attention. This may seem dumb and obvious, but it represents a seismic shift in the Internet’s economics.

Memecoins take the “attention is value” framework to its logical extreme. They offer the purest way to buy a token because of the future attention you think it will command. You don’t have to worry about product roadmaps or technical milestones, just attention. Memecoins are transparent about their utter lack of intrinsic value, which, funny enough, many people actually find refreshing.

Many view memes as a revolt against the perceived excess of the bourgeoisie, aka “the cabal” in CT speak. Whether we agree or not, there’s a perception that insiders fund projects that launch at inflated valuations and then dump their bags on retail. From the perspective of the proletariat, the game is rigged.

The logical retail reaction is to opt out. They know they can’t win a game with the rules skewed against them — no value capture, no access to private deal flow, and limited visibility into unlocks.

So, the disillusioned invented a new game, one with a more level playing field — no private deals, no high FDVs, and no unlocks. The rules of the game are simple — spin up a token and meme it all over Twitter and other socials. The winners are the most viral memes that are embraced by the culture.

The crazy thing about crypto is number go up (sometimes) makes the tech better. Just look at Bitcoin. In many ways, Bitcoin was the OG memecoin. At first, it was worthless, niche, and certainly didn’t offer any protection against WW3. But as its price rose, Bitcoin gained holders, advocates, developers and miners — all of which add real value to the network. Today, Bitcoin offers a singularly unique and highly valuable service — uncensorable non-sovereign money. But it wasn’t always this way — first, Bitcoin had to meme.

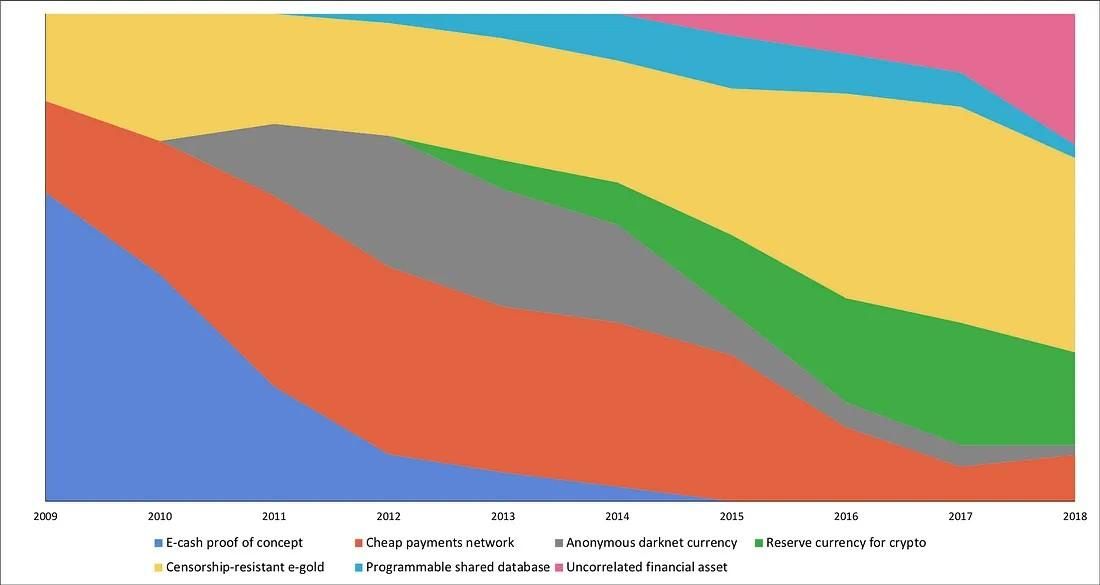

As Nic Carter’s “Visions of Bitcoin” so beautifully illustrates, Bitcoin’s narratives are in a constant state of flux. At first, it was e-cash designed to replace all fiat money. Then, a way for dark web hackers to transact. Today, Bitcoin is digital gold and a non-sovereign speculative asset.

This visual also underscores why Bitcoin remains so difficult to value. It has no cash flows, interest payments, or product roadmaps; it just has narratives. At its core, Bitcoin is an idea — an idea that’s proven to be bulletproof.

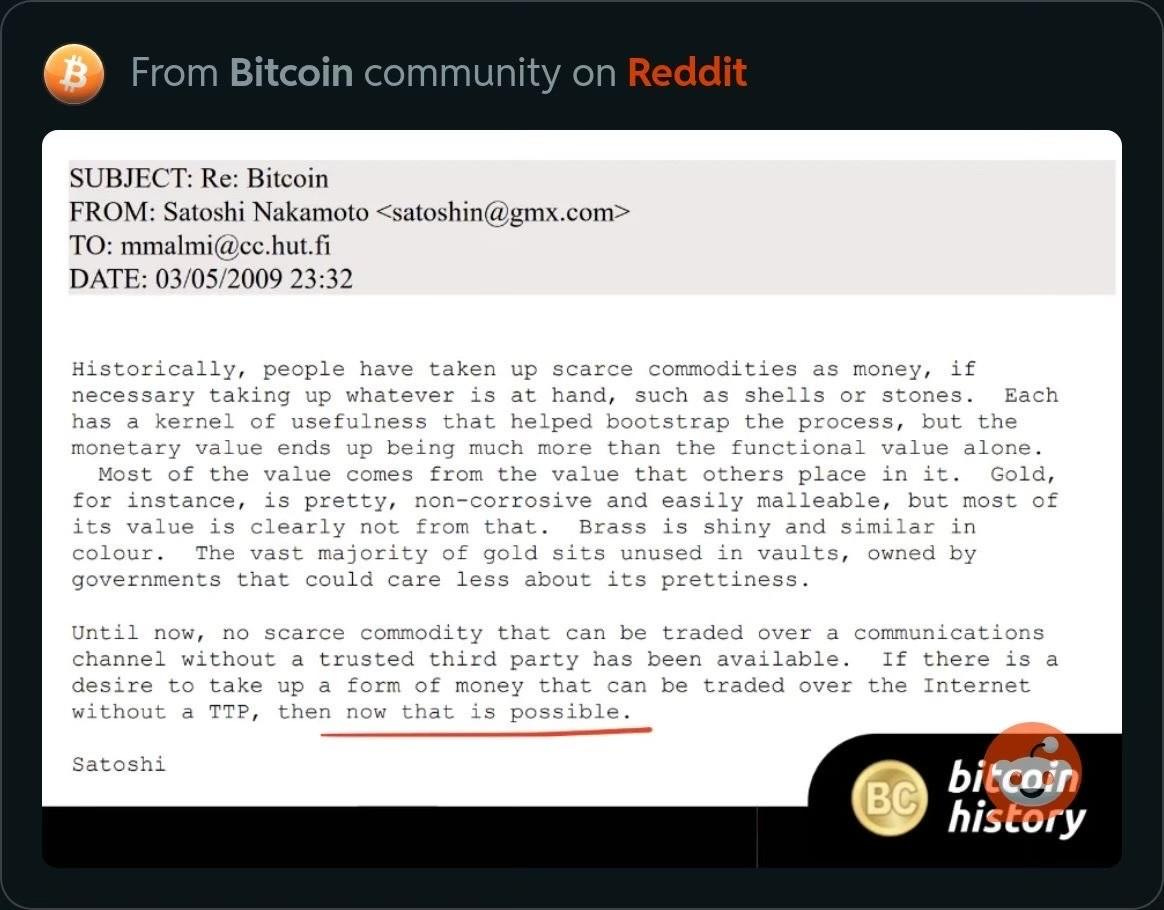

Satoshi was the first to recognize that the value of money has little do to with its “kernel of usefulness” and mostly “comes from the value that others place it in.”

One of the many things that makes the orange coin unique is that there’s no blessed canon — Bitcoin contains multitudes.법정화폐는 가치를 잃을 것이다..

Fiat to zero

Money printa go brrr

Government is corrupt

WW3 is coming

Crypto to the moon

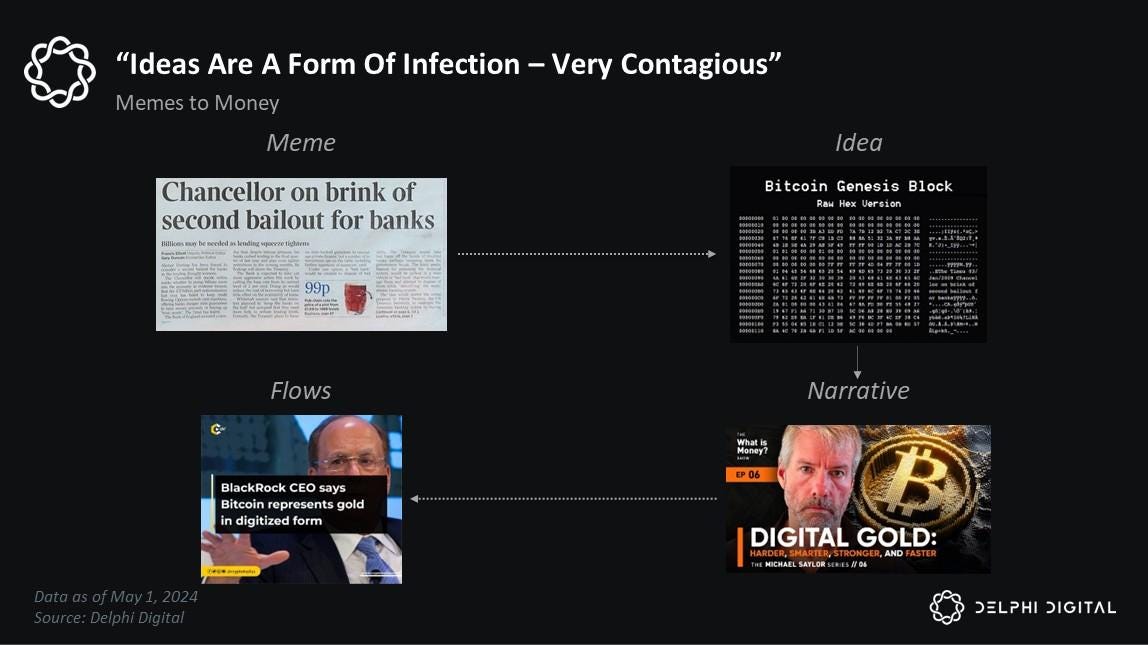

Whatever you believe, Bitcoin is a way to express it. This dynamism is what makes it such a powerful and enduring meme. Bitcoin doesn’t have ‘fundamentals’ like traditional assets. It has memes, which lie upstream of ideas and, ultimately, narratives that offer themselves up for belief. The flow of attention looks something like this:

To be clear, this is not to say that some random memecoin will be the next Bitcoin. Far from it. 99% of memes will die violent and unmemorable deaths. Bitcoin is singular. And nothing in crypto will ever compete with its virgin birth or digital gold narrative. But that doesn’t mean other memes can’t or won’t capture enduring attention and value.

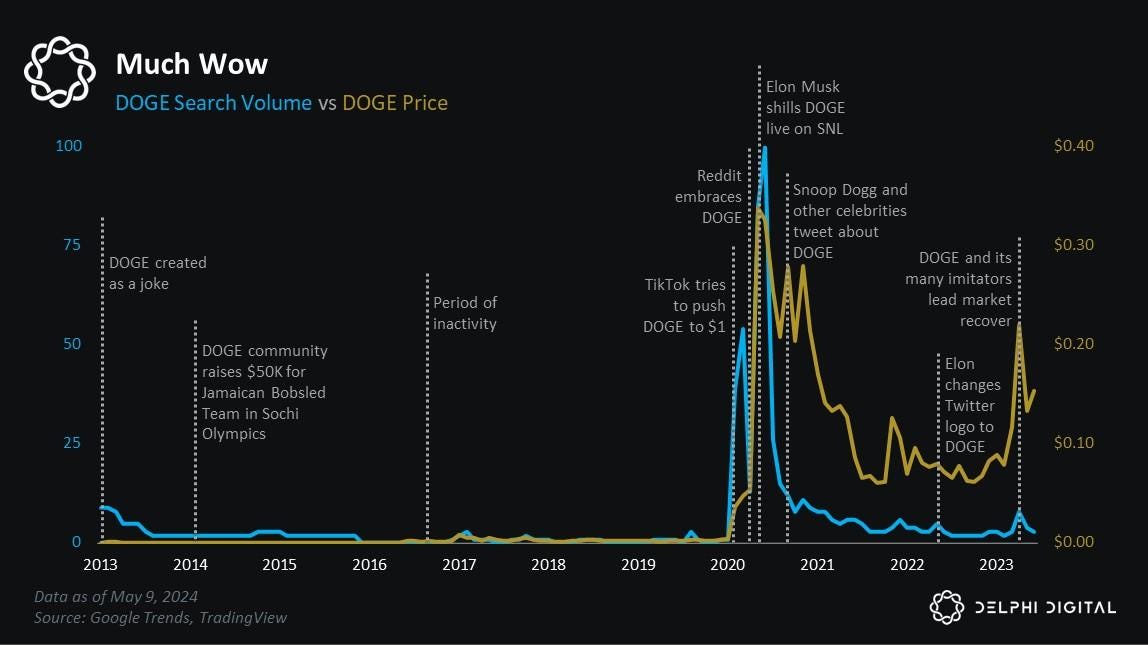

DOGE is a great example. It’s the OG dog coin and perhaps crypto’s very first meme, although I’d want to double-check with memecoin historians on that. Anyways, DOGE was created way back in 2013 by a couple of engineers as a joke. It wasn’t until 2020 that things really started to take off. Similar to GME, it started small with a group of diehard bulls who actually believed DOGE was the people’s currency. But it soon spread — this time to TikTok and then Reddit. It captured so much attention that even Elon Musk was tweeting about it and engaging with DOGE devs over the design.

As the attention was reaching a boiling point, it was announced that Elon was slated to host Saturday Night Live. This was like the ultimate catalyst for a token whose whole value prop is attention and making people laugh. In the week leading up to that Saturday night — May 8, 2021 — DOGE pumped over 100%. The whole market was watching with bated breath to see whether Elon would mention DOGE, and if so, how often and how early into the show. Ultimately, Elon called himself the Dogefather midway through the show during the Weekend Update, and almost immediately, DOGE put in its all-time high and began to fall back to earth.

Fast forward to today, and Dogecoin has become synonymous with crypto culture. When normies think of “cryptocurrency,” they usually mean BTC and DOGE. Its parabolic run in 2021, Elon’s SNL shill at the pico top, and its rise from the ashes this cycle has all but cemented DOGE in the lore. What exactly that’s worth is anyone’s guess, but the attention DOGE commands suggests the market will continue to ascribe significant value to crypto’s first dog(e).

Since most of crypto is open source, almost everything can be forked. We’ve seen this dynamic play out many times — Bitcoin forks, EVM forks, Uniswap forks, and most recently, memecoin forks. In most cases, the forks fail not because of the tech but because of the community and attention the original project commands. As the modern-day philosopher Kim Kardashian once said: “They can steal your recipe, but the sauce won’t taste the same.”

Back in 2017, many people genuinely believed Bitcoin Cash was better tech than Bitcoin. And in some ways, they were right. But it didn’t matter because Bitcoin’s community held strong. Attention stayed with BTC. The same thing happened with Ethereum Classic and Sushiswap. Tech can certainly be a moat in crypto, but you can make a strong argument that community is just as important.

Another way to mooch off an incumbent’s clout is to create a derivative work that, in some way, pays homage to the OG. Last cycle, Shiba Inu coin (SHIB) executed this playbook well. But this cycle, memecoin derivatives have hit another level. Nowadays, every chain has its own dog and cat coin. Dogwifhat on Solana is probably the most prominent example, but there are literally thousands more. All of these coins trade off the hope of being the “next Dogecoin.” In a relative value world, the top doge is king.

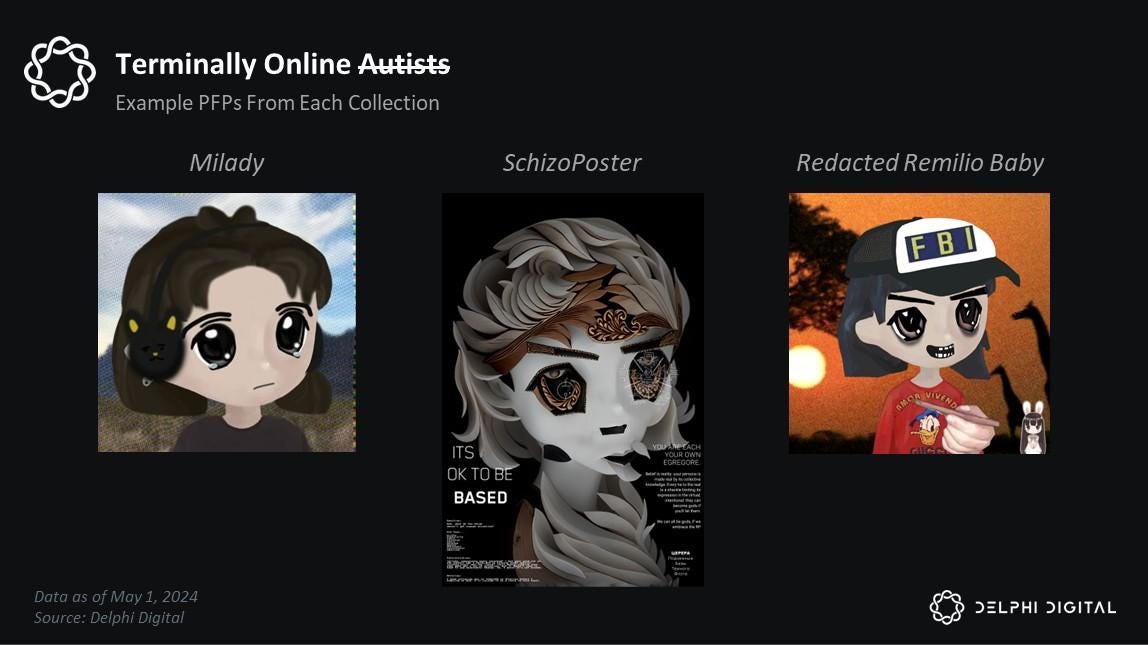

Outside of forking or spinning up a derivative work, one final way to attract attention from specific communities is to simply give them free money. Airdrops have become the primary method of user acquisition in crypto because who doesn’t love free money? Airdropping to specific NFT communities has become a way for protocols to connect with power users and gain influential supporters. Projects like Pudgy Penguins and Mad Lads have been frequent recipients, mostly due to their status as blue-chip collections. This is in part why people were so shocked by the recent Ethena airdrop to Miladys, SchizoPosters, and Redacted Remilio Babies. Unlike Madlads and Pudgies, these communities are, uh, not always the most PC Internet users.

But when asked why Ethena chose these NFT communities, Guy Young, the founder of Ethena Labs, gave a fascinating answer:

“There’s two reasons. The first is I just sorta vibed with the communities. And I’ve been hanging out in their Discords for a while and just liked the vibes of the people associated with it. There’s actually a bit of a backstory for my profile picture on Twitter. I approached @notsofast who used to own my profile picture, and none of the rare versions of the SchizoPosters had actually been sold at all. So, I was just trying to see if he would do a deal direct. And he basically said, “hey, you can just have it, like zero strings attached or anything.” So, I remembered that in mind and I was going to pay it back for the generosity.

But thinking about this as a strategy, I’m quite a firm believer that valuations and the ways things trade in crypto are like 10% fundamentals and 90% narratives and attention. I do actually think that attention is the only scarce resource within crypto. And these [three NFT] communities on Twitter are pretty loud and grab people’s attention. So, associating what is supposed to be a reasonably serious project with what looks like quite a ridiculous NFT community is just something that people are gonna talk about. And we just wanted to grab that virality.”

Attention drives valuations in crypto. “The fundamentals are strong” can certainly become a powerful narrative that captures attention, as we’ve seen with Ethereum, Banana Gun, and Rollbit to varying degrees in the past. But fundamentals only matter if people believe they matter. And right now, no one in crypto believes that. So, we must come to peace with this reality and invest accordingly.

For now, memes have the market’s attention. This may prove to be fleeting, as attention often is. But this report’s core thesis is that attention lies upstream of capital flows — aka the hot ball of money in crypto. We should be careful to avoid drawing arbitrary red lines over what’s “deserving” and “not deserving” of the market’s attention. When we do that, we are imposing our personal beliefs on the market. We’re saying, “I know better than the market.”

Instead of getting frustrated with the memecoin meta, we should seek to understand it and ultimately front run it.

So, in the spirit of understanding, let’s channel our inner empaths and steelman the arguments for why memes are capturing so much attention this cycle. Whether we agree with all, some, or none of the points below does not matter. What matters is that other people believe them. And understanding the market’s psychology is key to front-running the flows that inevitably follow the attention.

Fastest Horse: Memecoins are the highest beta assets in crypto. In bear markets, they drawdown more than anything, but in bulls, they go up more than everything. If you have a bullish view on crypto, memecoins are an easy way to get high beta exposure with no leverage.

Favorable comps: The crypto market loves relative value. “X is worth $100 million, and Y is similar, so Y should trade near $100 million.” The popularity of the ETH/BTC ratio is a testament to this. Obviously, all memecoins go ahead and comp themselves to DOGE and SHIB, which last cycle hit a combined market cap of nearly $100 billion. This lets meme holders dream bigger than any other comp in crypto.

Financial nihilism: Millennials and GenZ are staring down crushing debt, unattainable housing, and wages that are insta-eroded by inflation. Many feel the system is rigged against them, and the only way to win the new rat race is to hit 100x and turn $10k into $1 million.

Protest vote: Retail is tired of buying high FDV/low float tokens and getting dumped on by insiders. They know these coins offer little upside by the time they hit public markets, so they have learned to look elsewhere for coins VCs can’t or won’t touch.

Regulation: Regulation limits how much value tokens can share with holders without being deemed a security. Retail is not dumb; they realize most governance tokens are worthless. So, what’s the difference between holding a gov token and memecoin if neither has any intrinsic value? At least the memes are honest about it...

TINA: There Is No Alternative. Last cycle birthed DeFi and alt L1s. Those early to either trade printed biblical returns. This cycle, the new infra has been less inspiring, and the market has been choppier, with greater dispersion and no obvious trend. Memecoins have become perhaps the most compelling Schelling point for the trade of the cycle.

Again, whether we agree with these memecoin talking points is irrelevant. All that matters is the degree to which the market believes them. As of today, memecoins remain a highly contentious topic, as evidenced by the nonstop CT debates and TL cope whenever they pump. From a cycle timing perspective, this is actually bullish if you are a memecoin bull. It means a good chunk of the market is underexposed and implicitly short the meme meta. The day memecoins become consensus is the day they top. Until then, there’s probably still juice in the fabled memecoin supercycle.

In summary and summation, attention is crypto’s most important fundamental. It lies upstream of all good things — developers, users, and capital flows. Until crypto solves everyday problems for everyday people, its best product will be helping people make money. The projects that lean into this dynamic — whether they be serious, memes, or something in the middle — will likely outperform. Big Tech got rich off our attention; now it’s our turn to do the same.

4. Attention Amid Abundance

What do the economy, markets, and chatGPT have in common? They are all driven by attention. The title of this report comes from the landmark AI research paper that made chatGPT —and every other LLM — possible. Written by a team at Google, the paper introduced the transformer architecture, which helped unlock the scaling laws that have powered most of the recent progress in AI.

The paper’s core insight was finding that neural nets perform better when they ‘focus their attention’ on the most relevant parts of the input data. This is analogous to the way humans focus more on certain aspects of their environment while ignoring others, depending on whatever is relevant at the moment. While the paper’s technical nuances fall outside our scope, AI’s impact on crypto and attention does not.

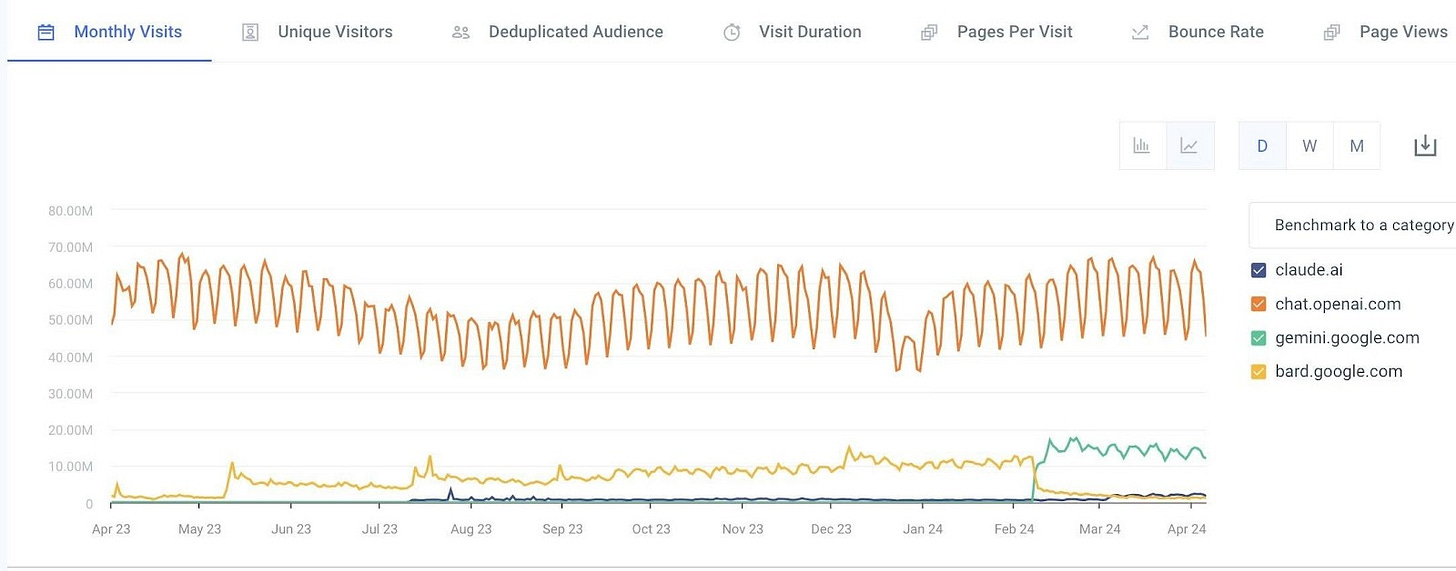

chatGPT is an answer machine. You ask it a question — any question — and it responds with an answer. It’s a wildly different experience than ‘Googling’ something and being forced to click through a dozen or so links, all while navigating annoying pop-up ads. chatGPT does all of this for you. No links, no ads, just answers. This is obviously a huge UX improvement for consumers, but it represents an existential threat to the attention economy as we know it. As we riffed on in the opening section, everyone from Zuck to Alo to Jimmy Butler relies on putting ads in front of eyeballs.

For now, the threat is limited. chatGPT’s usage remains relatively niche compared to Google Search’s dominance. But this is mostly a function of AI’s immaturity. As these models become more useful, more people will use them. And the threat to Google — along with every other player in the attention economy — will grow.

Illia — co-author of the Attention paper and founder of NEAR — believes we’re now “in the middle of a massive business model transition from an attention to data economy.” If he’s right, the Internet’s current construction is untenable. Its advertising-centric business model will burn as eyeballs are replaced by AI agents.

Everyone and their mother is trying to figure out what the next version of the Internet will look like. At the end of the day, no one knows. But it does look increasingly likely that we will engage with the Internet — and probably the world — through an AI filter. Google and OpenAI are already taking steps to make this a reality, with both rumored to be releasing AI assistants — think Siri, but actually smart — this week.

The future is path-dependent and often impossible to predict, but one thing that’s clear is the attention economy will need a new way to engage users. Brands like Alo will no longer be able to rely on Google to connect them with human eyeballs as Google ads will soon be disintermediated by answer machines.

Despite AI’s immense power, it is not a new form of distribution. Mobile was a new form of distribution that enabled novel businesses like Uber, which previously were impossible. But to date, AI has only reinforced existing forms of distribution like Google, Facebook, and Twitter. In part because of its high entry costs, AI will likely continue to overwhelmingly benefit the incumbents who have the capital necessary to compete.

This leaves startups or smaller brands like Alo stuck between a rock and a hard place. How can Alo connect with its customers if it can no longer rely on existing distribution channels like Google? Should it build its own AI? Create its own social media? These sound hard, especially for a non-tech company. Something that’s much easier is connecting with your community via crypto. Crypto is a new distribution channel. Similar to mobile, it’s a new way for businesses to connect with their users. And we’re still scratching the surface of what those relationships and the value flows between them will look like.

As we’ve discussed throughout this piece, crypto already solves the “attention” part of the equation by giving people ownership (read: upside) in digital goods. Now, it needs brands like Alo to come in and build enduring relationships with their users. Even if crypto were to capture a fraction of the value in the pre-AI attention economy, this would have massive ramifications across the space. Google printed $305 billion in revenue last year — mostly by placing ads next to links. This revenue model will simply not survive the shift to an AI-centric Internet. New ways of engaging with users will be needed, and if crypto has proven one thing — it’s that it knows how to get people’s attention.

5. Attention Is Dead, Long Live Attention

Attention has built trillion-dollar companies, coins, and soon AI models. It is by far the most important resource in our world. Our entire economy revolves around it. And to date, it’s been the most profitable hustle known to man. But all good things must end, and the attention economy is no different. For the first time ever, Big (ad) Tech looks vulnerable. They are struggling to attract top talent and fend off regulators. Some have even taken to paying out dividends to placate their worried investor bases.

Meanwhile, crypto is on the rise. Speculation still dominates, but it’s planting the seeds of a hyper-financialized future. This cycle in particular, we’ve seen more and more people embrace crypto’s free markets ethos. This is a good thing. Crypto’s strongest area of PMF is giving people new ways to make money. Memecoins are the ultimate example of this. They let us own the culture we all contribute to. And as history shows, Internet culture always wins.

AI will accelerate these trends and break the Internet as we know it. CAPTCHAs and other sybil safeguards will not survive first contact with sufficiently advanced AI, nor will the web’s advertising-centric business model. Agents will replace eyeballs and put trillions of dollars in value up for grabs. How this all shakes out is anyone’s guess, but every company in the world will be searching for ways to break through the chatbot forcefield and connect with real, human users. The old world is dying, and the new world struggles to be born: now is the time of attention.

Disclaimer

This report is the original document written by Delphi Digital. It is provided for informational purposes only and should not be considered investment advice. Before making any investment decisions, refer to the original document and seek professional advice. Tiger Research does not guarantee the accuracy, completeness, or timeliness of this report and is not responsible for any losses or damages resulting from its use. All disclaimers, risk warnings, and conflict of interest disclosures in the original Delphi Digital document also apply to this report.