Dunamu : The Leader in the Korean Virtual Asset Market

History of Upbit from Underdog to Frontrunner

TL;DR

Dunamu is the operator of Korea's leading cryptocurrency exchange, Upbit, and has been able to achieve remarkable growth based on its cryptocurrency exchange business.

Due to the recent crypto winter, Dunamu's market value has decreased, and the reasons include 1) a worsening of crypto investment sentiment , 2) failure to improve the profit structure through business diversification, and 3) difficulty in international expansion.

Despite these difficulties, Dunamu has been steadily exploring opportunities to enter overseas markets. In addition, they are making continuous efforts to diversify their business structure and are looking forward to creating synergy with their exchange business in the future.

Dunamu, the operator of Korea's No. 1 cryptocurrency exchange Upbit

Dunamu is the operator of South Korea's leading cryptocurrency exchange, Upbit. Although Dunamu was a latecomer to the Korean crypto exchange scene, it has grown to establish itself as the leading crypto exchange in Korea, with a domestic market share of roughly 90%.

The company was first established in 2012 and launched its stock trading service, ‘Securities Plus’, in 2014. From then on, Dunamu began to gain experience in the digital financial services market. In October 2017, it went on to launch the cryptocurrency exchange service 'Upbit'. In September 2021, the company acquired the first virtual asset service provider (VASP) license in Korea, establishing itself as the country's leading virtual asset exchange.

From latecomer to market leader

As mentioned earlier, Dunamu is a "latecomer" to the crypto exchange scene. It was the fourth company to launch a crypto exchange after Korbit, Bithumb, and Coinone. Before the launch of Upbit, Bithumb was the dominant exchange, with its Bitcoin trading volume being the highest in the world in 2017, accounting for 12%.

With the onset of the crypto winter in late 2017, Bithumb's seemingly unbreakable dominance began to show cracks. It was at this point that Dunamu capitalized on the crisis and surged to the top. Here's how Dunamu was able to rise to the top in a turbulent crypto market.

Better quality of service than other exchanges based on its previous experience in operating securities trading services.

Swift response to the implementation of 'real name account verification system' by partnering with K-Bank, a domestic internet bank.

Its cryptocurrency trading fees were the lowest in the industry, with a fee rate of 0.05%. In comparison, Bithumb’s fee rate was five times higher.

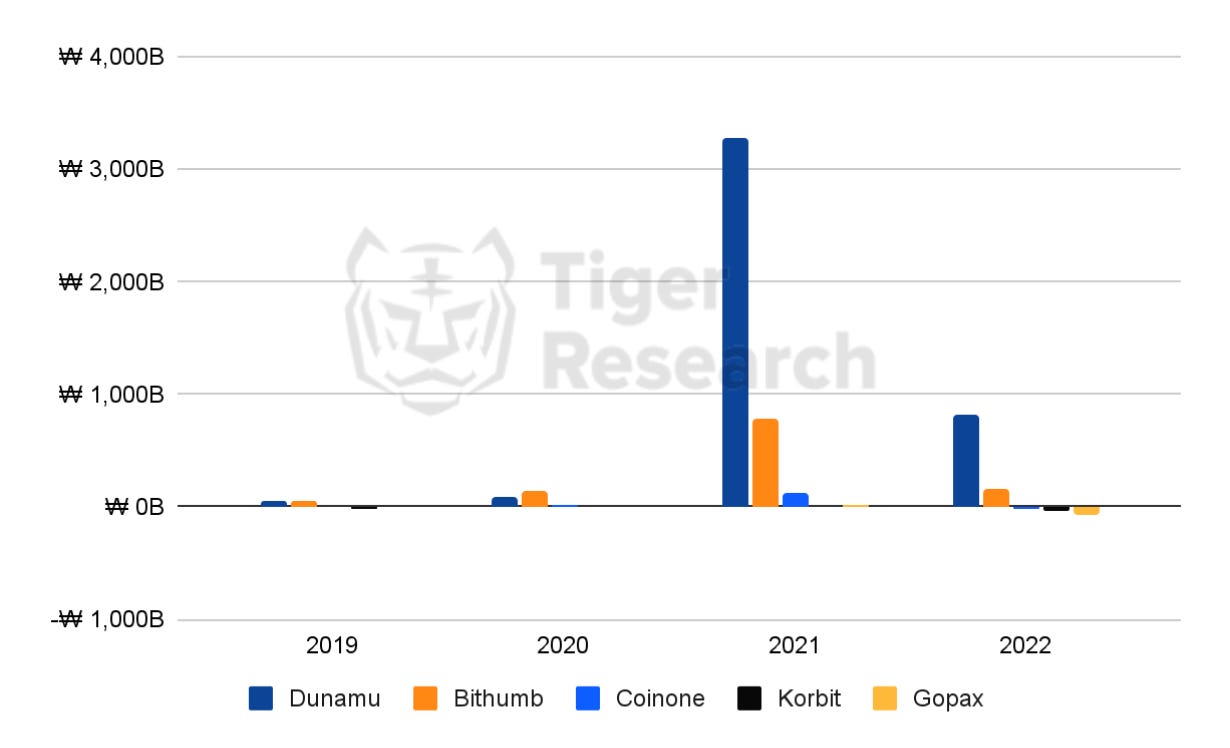

Dunamu suffers earnings plunge following crypto winter

Until recently, Dunamu was growing rapidly, reaching $923 million in revenue. However, the company has been facing headwinds due to the ongoing volatile market conditions such as global liquidity contraction and the crypto winter. In fact, the valuation of Dunamu itself has been declining, with its unlisted stock price down about 85% from its peak.

There are three reasons behind Dunamu's recent performance.

1) Crypto winter dampens investor sentiment in virtual assets.

Crypto trading volume has dropped significantly compared to the previous boom period. With a revenue structure centered on transaction fees, it was inevitable that Dunamu's performance would decline. In fact, fee revenues account for over 98% of Dunamu's total revenue in absolute terms.

2) Failure to diversify business to improve revenue structure.

Dunamu recognized this situation early on and began to work hard to improve its revenue structure. Despite its efforts, it has been struggling to profit from diversifying its business. For example, the NFT business 'Levvels', which Dunamu launched with the entertainment company Hive last year, recorded a deficit of about $7.69 million last year alone.

3) Challenges of expanding internationally whilst following national laws.

Lastly, Dunamu is located in South Korea, which means that it is subject to domestic laws and is not free from Korean government regulations. For example, according to Dunamu CEO Lee Seok-woo, when Dunamu wanted to transfer its incorporation funds overseas in order to enter overseas exchanges, the government and banks inexplicably refused to allow the transfer.

In addition, Dunamu is subject to the 'Real Name Account Authentication System' and cannot provide services to non-resident customers, i.e., foreigners, which is disadvantageous for market expansion. It is also subject to regulations as a large domestic company, such as being classified as a ‘major conglomerate’ and having disclosure obligations under the Fair Trade Act.

Dunamu, No. 1 in VASP Business

While it is true that Dunamu has been facing difficulties in terms of diversifying its revenue structure and plummeting performance compared to the the past, it still boasts an unrivaled influence in the cryptocurrency business. In recent years, Upbit has taken over 90% of the domestic cryptocurrency market, further solidifying its position as the undisputed leader in the space.

Upbit’s international expansion is also promising, as the company has been aggressively expanding in Southeast Asia since opening its APAC office in Singapore in 2018. In fact, the company is licensed to operate crypto exchanges in Singapore, Indonesia, and Thailand. Upbit's efforts to expand overseas have paid off, as it is currently the second largest exchange in the world in terms of global cryptocurrency trading volume, behind only Binance.

Conclusion

While Dunamu has a strong global presence centered on its cryptocurrency exchange, ‘Upbit’, the company's performance outside of the cryptocurrency business has been disappointing. Nevertheless, Dunamu continues to make efforts to diversify its business structure.

On a positive note, it is clear that the ongoing projects are only in the early stages and show strong growth potential. In the future, it is expected that Dunamu’s main service 'Upbit' can create synergy with its various subsidiaries. One such case is 'Lambda256', which is in charge of Dunamu’s blockchain and STO business. Another is 'Levvels', which operates an NFT business. Finally, there is 'Viver', which runs a reselling platform.