How MANTRA is Leading the RWA Market Revolution

Pioneering Compliance and Innovation in Real World Asset Tokenization

TL;DR

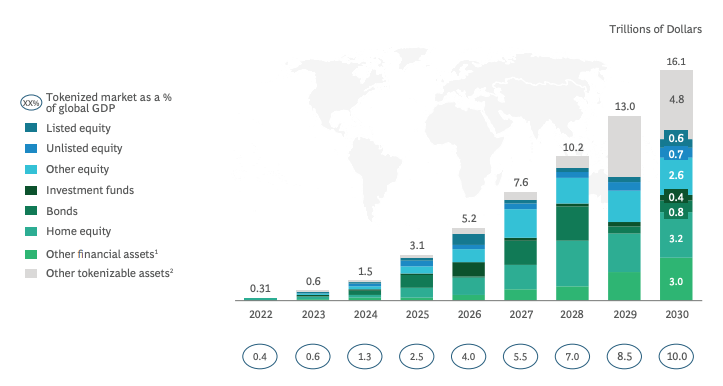

The Real World Asset (RWA) market is growing rapidly, with predictions of reaching US$16 trillion by 2030, but faces regulatory challenges that need to be addressed to achieve full market potential.

MANTRA is pioneering compliance and innovation in RWA tokenization by implementing regulatory mechanisms at the protocol level through MANTRA Chain with its 'MANTRA compliance' feature.

MANTRA is actively building its ecosystem through self-developed platforms, strategic partnerships, and a US$500 million asset tokenization deal with MAG Group, positioning itself to potentially set the standard in the RWA market.

1. The RWA Market is Growing, but How Does it Actually Perform?

Recently, real-world assets (RWAs) have become a promising trend in the blockchain industry. RWA refers to the transformation of real-world assets such as stocks, real estate, and commercial paper into tokens that can be traded on the blockchain.

Many regard RWAs as a promising sector in the blockchain market. BlackRock CEO Larry Fink stated that "The next generation for markets, the next generation for securities, will be tokenization of securities." The Boston Consulting Group has predicted that the RWA market will grow up to US$16 trillion by 2030.

The RWA landscape is currently dominated by stablecoins, with US Treasuries being the most commonly tokenized asset. This indicates that the RWA market is still in its nascent stages and there is much to be improved in terms of liquidity provision and investment opportunities. Future advancements will likely see a greater diversity of real assets being tokenized, accompanied by the development of novel financial services to meet evolving market expectations.

Basic asset tokenization is only the first step for RWA market growth. It is essential to develop sophisticated financial products and services that leverage blockchain's full potential. This potential can even extend to revitalizing the existing financial market. However, regulatory challenges need to be addressed first in order to properly develop the next stages of the RWA market.

2. The RWA Market in the Face of Regulation

The RWA market is governed by stringent financial regulations due to its involvement with tangible assets. Jurisdictions that allow RWA tokenization such as the United Arab Emirates, Singapore, and the United States, enforce comprehensive financial regulations on RWA products. These regulations encompass essential know-your-customer (KYC) procedures and anti-money laundering (AML) measures, comparable to the regulatory standards imposed on conventional financial products.

Authorities worldwide are introducing regulatory sandboxes to facilitate the healthy development of the RWA market. For instance, RWA-related businesses are currently being tested in regulatory sandboxes in Indonesia and other countries, as noted in a previous report.

South Korea’s approach is using a financial sandbox to test and implement regulations concurrently. The February 2023 guidelines released by Korea’s Financial Services Commission (FSC) underscore this strategy. These guidelines reaffirm that the fundamental nature of securities remains unchanged, regardless of the form it is issued. Despite the advent of new types of RWAs, the inherent characteristics and scrutiny placed on securities persist. While acknowledging the necessity for new issuance forms, the regulatory standards remain constant.

This indicates that the RWA market will not be exempt from regulatory oversight. Consequently, RWAs, despite their innovative nature, are classified as financial instruments and are expected to adhere to the existing securities regulatory framework.

3. The Need for Regulatory Mechanisms at the Protocol Level

The primary challenge for the RWA market is achieving regulatory compliance effectively. Currently, most RWA Dapps focus on compliance at the application level, limiting the full utilization of blockchain's interoperability and compatibility. For instance, investors must undergo separate KYC processes on each platform to buy and trade real estate tokens, mirroring the procedures of traditional stock exchanges.

For the RWA market to fully leverage the advantage of blockchain technology, compliance mechanisms need to be embedded at the blockchain protocol layer. This approach involves creating a standardized method for value exchange by supporting compliance at the protocol level, rather than at the application level. By internalizing compliance mechanisms in the underlying blockchain infrastructure, rather than in isolated silos per exchange built on top of it, the market can facilitate a more organic and efficient trading environment. This shift would enhance transparency, streamline operations, and promote broader adoption of RWA platforms.

Currently, each application independently identifies and verifies users. However, with the ability to authenticate users at the protocol layer, individuals can be transparently verified by all participants. This development lays the groundwork for future on-chain trading of asset ownership and real-world value.

This change could take the RWA market to the next level. For example, investors could buy real estate tokens by paying with their preferred cryptocurrencies, including stablecoins, and take ownership of the actual property. The real estate token represents an interest in the property, and the rental income can be automatically distributed to the real estate token holders without intermediaries, all on-chain.

In order to bring more assets on-chain, regulatory mechanisms need to be implemented at the protocol level. This will allow for the eventual development of an RWA market where more assets are freely transferred and traded on the blockchain. Of course, this will require close consultation between regulators and the blockchain industry to establish a regulatory framework optimized for RWA.

4. MANTRA's Next Steps for the RWA Market

MANTRA represents the advanced approach to regulatory compliance needed for the evolving RWA market. John Patrick Mullin, CEO of MANTRA, has been actively involved in security token offerings (STOs) and RWA tokenization projects since 2018. His extensive experience provides him with a profound understanding of how regulatory compliance can drive the RWA market forward.

Leveraging this expertise, MANTRA has developed an innovative system for RWA tokenization that addresses the critical need for regulatory mechanisms at the protocol level. Central to this system is the 'MANTRA compliance' feature, an advanced solution designed to manage regulatory tasks at the foundational level of the blockchain. This approach ensures that regulatory compliance is seamlessly integrated into the blockchain protocol, rather than being handled individually by applications. This enhances the interoperability and efficiency of RWA platforms, paving the way for a more robust and compliant RWA market.

MANTRA compliance employs a decentralized identity (DID) system to securely and efficiently verify individuals' identities. Once verified, users receive a unique decentralized ID (Soulbound NFT/ID) that can be used for KYC verification across multiple platforms.

Previously, an investor looking to buy tokens that represent real world assets traditionally had to undergo identity verification on each platform separately. With a decentralized ID issued through MANTRA compliance, the investor can authenticate seamlessly across multiple platforms using just that ID. This process saves significant time and money while enhancing the user experience.

Additionally, MANTRA facilitates cooperation with regulators. If a regulator in a particular country introduces new regulations for RWA trading, MANTRA compliance can quickly reflect this change unilaterally, which extends to developers building applications on top of the platform. This ensures effective compliance across the entire RWA ecosystem.

As more RWA projects adopt this system, the overall safety and integrity of the RWA market is expected to improve. By introducing more types of RWA tokens - such as real estate tokens, art tokens, and bond tokens - in a compliant manner, investors and asset owners can accumulate on-chain transaction records under the regulation which in turn can attract more participants to engage in this market with confidence.

In this way, MANTRA effectively balances regulation and technology, setting a new direction for the RWA market. MANTRA's approach is anticipated to play a crucial role in evolving the RWA market into a more mature and trusted financial ecosystem.

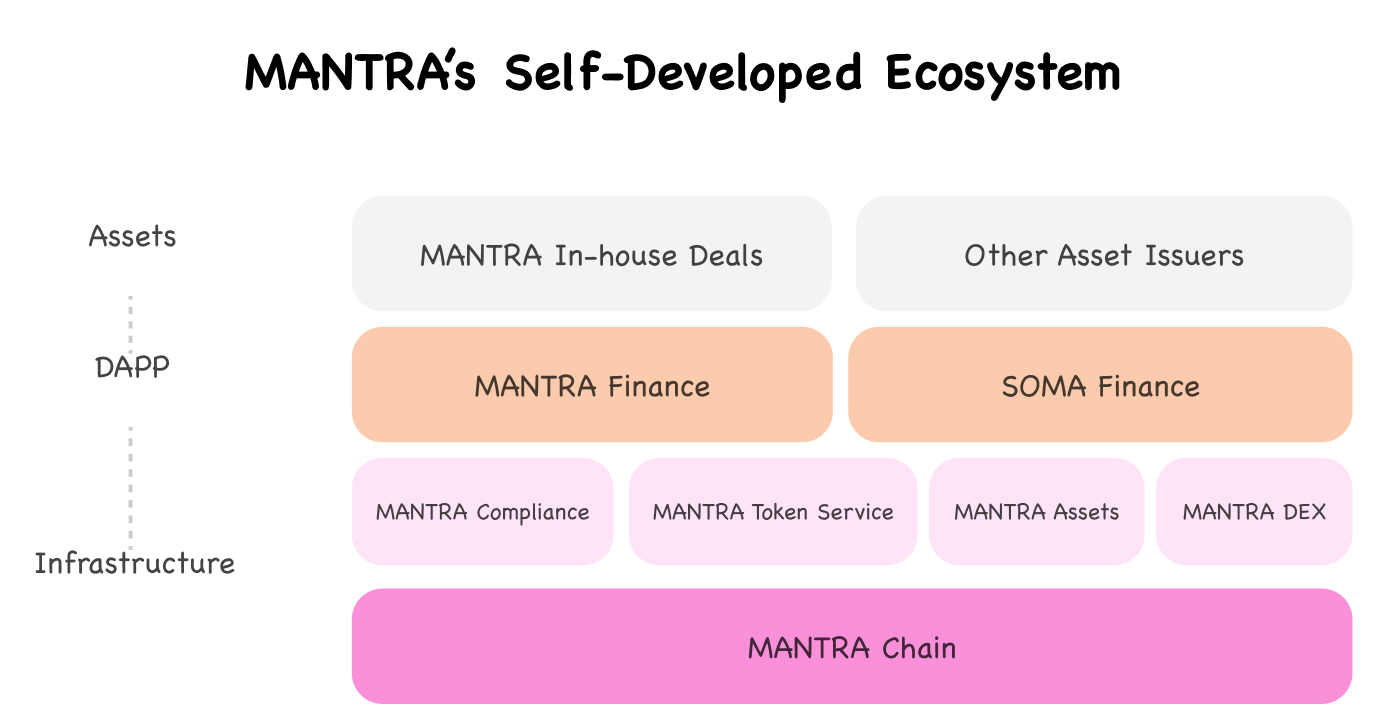

5. Self-Developed Ecosystem

Similar to other Layer 1 platforms, MANTRA works with numerous partners. However, unlike platforms that rely on external technologies, MANTRA leverages its own expertise to actively develop the RWA market. This self-sufficient approach has enabled MANTRA to establish leadership and drive innovation in the RWA market.

5.1. Build the RWA DAPP

MANTRA is prioritizing regulatory compliance and global expansion while strengthening its position in the RWA market through its proprietary platforms, MANTRA Finance and SOMA Finance.

A notable aspect of MANTRA's strategy is its expansion into the UAE. They are in the process of obtaining licensing from the Virtual Assets Regulatory Authority (VARA) in the UAE, demonstrating its commitment to regulatory compliance and potential for global growth. With this license, MANTRA intends to leverage MANTRA Chain to develop a variety of financial products and expand its global footprint.

MANTRA also has a strong interest in the Asian market, particularly South Korea. The country’s high quality assets, intellectual property and strong interest in blockchain technology places it as a key focus of MANTRA's strategy in Asia.

MANTRA's strategy is characterized by a customized approach that takes into account the unique characteristics and requirements of each region. By leveraging its proprietary platform, MANTRA aims to secure a leading position in the global RWA market by offering RWA solutions that are tailored to the regulatory environment and market characteristics of different regions.

5.2. Identify Investment Products

At the end of the day, what investors ultimately care about is the actual investment value of a financial instrument. This holds true in the RWA market as well. MANTRA recognizes this and is focused on identifying investable assets and tokenizing them. It is important for the growth of the RWA market to be able to offer investors with attractive assets that can provide a real return on their investment, rather than just a technology that tokenizes assets.

MANTRA operates its own incubator program to identify and nurture various RWA projects, fostering their growth on the MANTRA Chain. Key features of the incubator program include:

Investment and Funding: MANTRA offers seed investments of up to US$1 million to selected RWA projects

Global Mentorship: The MANTRA team provides multidisciplinary mentorship in areas such as compliance, marketing, business strategy, and more

Global Access: With a local presence in Dubai, Hong Kong, Singapore, and other regions, MANTRA helps projects reach global markets

Access to Investor Network: Projects can connect with MANTRA's extensive investor network to secure additional funding

MANTRA is proactively creating its own deals, rather than solely acting as a platform for externally sourced assets. A notable achievement is a US$500 million asset tokenization deal with the Middle Eastern real estate developer MAG Group. This initiative involves tokenizing real estate assets in multiple tranches, with the first tranche including the Keturah Reserve residential project in Meydan, Dubai, and the US$75 million mega-mansion at The Ritz-Carlton Residences, Dubai Creekside.

This deal exemplifies MANTRA's capability to execute the tokenization of high-value real-world assets, underscoring its commitment to adding real value to the RWA market. By focusing on enhancing the value of real-world assets through tokenization, MANTRA aims to drive significant growth and innovation within the RWA sector, beyond simply providing technological solutions.

6. Whoever Creates the Standard First Will Lead the Market

The current RWA market has numerous chains vying to become the "standard." However, many of these chains are general-purpose and not yet equipped to address the regulatory and technical demands of the RWA sector. In contrast, MANTRA possesses a profound understanding and expertise in the RWA market and is poised for growth by simultaneously promoting compliance and technological innovation.

MANTRA Chain provides the essential technology infrastructure, while MANTRA's strategic deals attract investors. Establishing a standard requires appealing to both providers (asset managers) and consumers (investors). MANTRA is on track to set this standard by providing asset managers with robust technology, drawing investors with lucrative deals, and consolidating both groups within a cohesive platform.

In this context, MANTRA emerges as a strong contender to establish the standard for the RWA market. Although the blockchain-based RWA market is still in its early stages, it is anticipated to grow rapidly. MANTRA is well-positioned to offer a unified platform that harmonizes technology and regulation, paving the way for future growth and innovation.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by MANTRA. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others' views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo, and 3) incorporate the original link to the report. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.