Where is the Japanese Stablecoin Industry Headed?

The Current State and Future Prospects of Japan's Stablecoin Market

TL;DR

Japan has one of the most advanced regulatory frameworks for stablecoins among major countries, thanks to government-led growth and Web3-friendly policies.

However, there are only a limited number of use cases for stablecoins in Japan. There are no EPISP registrations for stablecoin businesses and no stablecoins listed on local exchanges. This has restricted the use of stablecoins in retail sectors.

Nevertheless, the existence of a regulatory framework carries significant meaning as it provides businesses with greater certainty. We can anticipate the participation of Japanese megabanks and large corporations, such as SONY, in the stablecoin market.

1. Introduction

Japan's stablecoin market has achieved stability, largely due to the establishment of a clear regulatory framework. This growth has also been supported by government initiatives and the ruling Liberal Democratic Party's policies aimed at accelerating the Web3 industry. Japan's proactive and open approach contrasts with the uncertain or restrictive stances taken by many other countries toward stablecoins. Hence, there is a growing optimism about the future of the Japanese Web3 market. This report examines Japan's stablecoin regulations and explores the potential impact of a yen-backed stablecoin.

2. Japan's Stablecoin Market Set to Take Off with Regulatory Advancements

In June 2022, Japan laid the groundwork for revising the Payment Services Act (PSA) to establish a regulatory framework for the issuance and brokerage of stablecoins. These amendments were enforced in June 2023. This marked the beginning of stablecoin issuance in earnest. The revised law provides detailed definitions of stablecoins, specifies issuing entities, and outlines the necessary licenses for handling them.

2.1. Definitions of Stablecoins

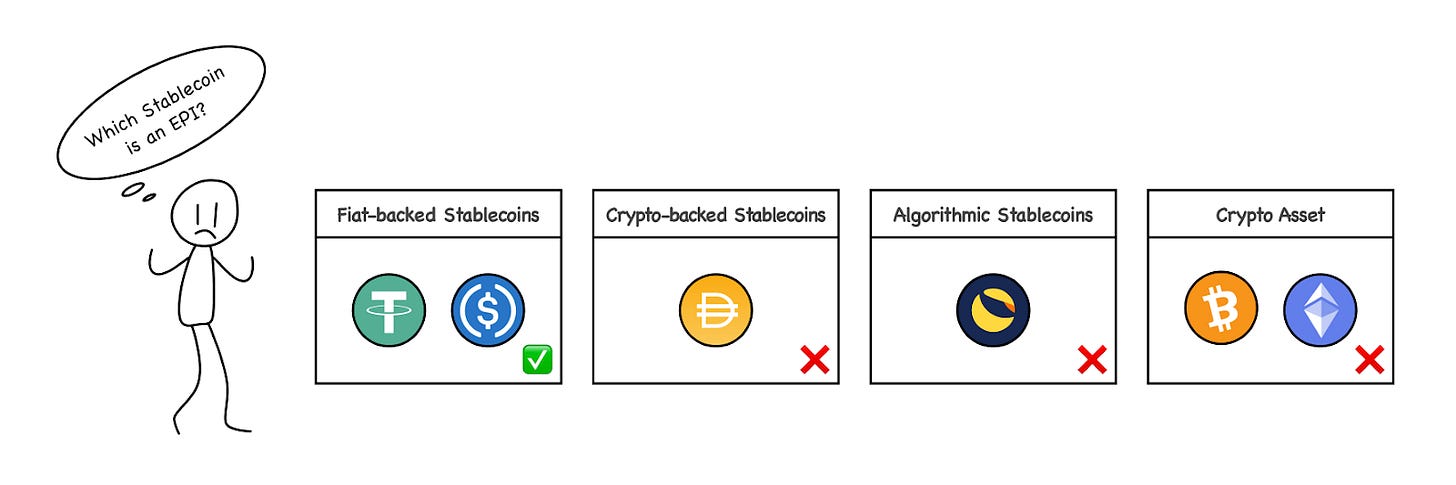

Under Japan's revised PSA, stablecoins are classified as “Electronic Payment Instruments(EPI),” meaning they can be used to pay for goods or services to an unspecified number of recipients.

However, not all stablecoins fall under this classification. According to Article 2 (5) (1) of the revised PSA, only stablecoins that maintain their value based on fiat currency are recognized as electronic payment instruments. This means that stablecoins backed by cryptocurrencies, such as Bitcoin or Ethereum—like MakerDAO’s DAI—are not classified as electronic payment instruments under this law. This distinction is a key feature of Japan's regulatory framework.

2.2. Stablecoin Issuing Entities

Japan's revised PSA clarifies who is authorized to issue stablecoins. Stablecoins can only be issued by three types of entities: 1) Banks, 2) Fund Transfer Service Providers, and 3) Trust Companies. Each entity can issue stablecoins with distinct features. For example, they may differ in terms of maximum transfer amounts and recipient restrictions.

Among these issuers, the most notable type is likely to be trust-type stablecoins issued by trust companies. This is because they are expected to be the most compatible with Japan's current regulatory environment and closely resemble common stablecoins like USDT and USDC in terms of their characteristics.

According to Japanese regulators, stablecoins issued by banks will be subject to certain restrictions. Banks must maintain financial system stability under strict regulations, but permissionless-based stablecoins are difficult to control and may conflict with this responsibility. As a result, regulators have emphasized that bank-issued stablecoins require careful consideration and may necessitate further legislation.

Fund transfer service providers also face restrictions. The amount transferred per transaction is capped at 1 million yen, and it remains unclear whether transfers can be made to recipients without KYC (Know Your Customer) verification. Therefore, stablecoins issued by fund transfer service providers may require additional regulatory updates beforehand. Given these conditions, the most likely form of stablecoin to emerge will be those issued by trust companies.

2.3. Stablecoin-related Licenses

To conduct stablecoin-related business in Japan, entities must obtain a stablecoin-related license by registering as an Electronic Payment Instrument Service Provider (EPISP). This requirement was introduced in the June 2023 revision of the PSA. Stablecoin-related business refers to activities such as buying, selling, exchanging, brokering, or representing stablecoins. For example, virtual asset exchanges that list and support stablecoin trading, or custodian wallet services that manage stablecoins on behalf of others, are also required to register. In addition to registration, these businesses must meet user protection and anti-money laundering (AML) compliance obligations.

3. Yen-Backed Stablecoins

With Japan's well-structured regulatory framework for stablecoins, various projects are actively researching and experimenting with yen-backed stablecoins. In the following section, we will explore key stablecoin projects in Japan to better understand the current state and characteristics of the yen-based stablecoin ecosystem.

3.1. JPYC: Prepaid Payment Instruments

JPYC is Japan's first yen-linked digital asset issuer, established in January 2021. However, the "JPYC" token is currently classified as a prepaid payment instrument, not as an electronic payment instrument under the revised PSA, meaning it is not legally considered a stablecoin. As a result, JPYC functions more like a prepaid coupon, with limited uses and applications. Specifically, while it is possible to convert fiat currency into JPYC (on-ramp), converting JPYC back to fiat currency (off-ramp) is not allowed, restricting its utility.

However, it is noteworthy that JPYC is making significant efforts to issue a stablecoin that complies with the revised PSA. First, it plans to issue a fund transfer stablecoin by obtaining a fund transfer license. The goal is to expand its use by enabling exchanges with Tochika, a deposit-backed digital money issued by Hokkoku Bank in Japan.

JPYC is also preparing to register as an EPISP to operate a stablecoin business. In the long term, the company aims to issue and operate a trust-type stablecoin based on Progmat's Progmat Coin, which enables it to support various business activities involving cash or bank deposits. Additionally, JPYC’s integration with the infrastructure of USDC issuer Circle is expected to provide a significant advantage in expanding its operations, particularly in cross-border payments.

3.2. Tochika: Deposit-backed digital money

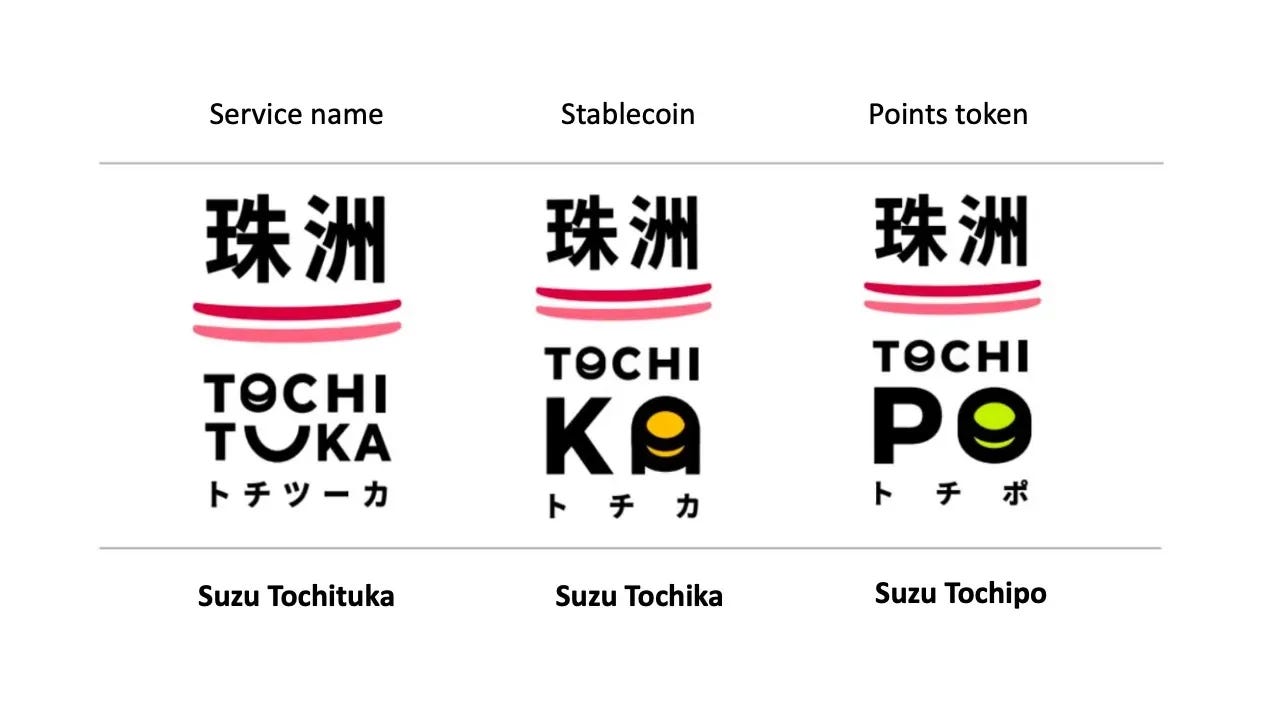

Tochika is Japan's first deposit-backed digital money. It was launched in 2024 by Hokkoku Bank, a regional bank in Ishikawa Prefecture. Tochika is backed by bank deposits and provides digital tokens that are available to the bank's account holders as a form of deposit service.

Users can easily access Tochika through the Tochituka app, which was jointly developed by Hokkoku Bank and the city of Suzu. The process is straightforward: users register their bank account on the app, top up their Tochituka balance, and can then use it as a payment method at participating merchants in Ishikawa Prefecture.

Tochika stands out for its simplicity and the attractive 0.5% commission rate it offers to merchants. However, there are a few limitations. Currently, it is only available within Ishikawa Prefecture, and re-cashing a reloaded Tochika is free only once per month—after which a fee of 110 Tochika (equivalent to 110 yen) applies. Additionally, Tochika operates on a permissioned private blockchain developed by Digital Platformer, restricting its use to a closed ecosystem.

Looking ahead, Tochika has plans to enhance and expand its services. These include linking to deposit accounts at other financial institutions, expanding its geographic coverage, and introducing person-to-person remittance capabilities. Despite its current limitations, Tochika sets a strong precedent for deposit-backed digital money. With its ongoing development efforts, Tochika’s future potential is certainly worth attention.

3.3. GYEN: Offshore stablecoin

GYEN is a Japanese yen-denominated stablecoin issued by GMO Trust, a New York-based subsidiary of Japan's GMO Internet Group. The stablecoin is regulated by the New York State Department of Financial Services and is listed on the Greenlist, which authorizes certain cryptocurrencies for issuance in New York. GYEN is the only Japanese yen-based stablecoin that is physically traded on a cryptocurrency exchange and is currently available for trading on Coinbase.

GYEN is issued at a 1:1 ratio to the Japanese yen, categorizing it as a trust-type stablecoin. However, since GYEN is not issued through a trust company within the Japanese regulatory system, it cannot be distributed in Japan or to Japanese residents, which limits its use domestically. Nonetheless, Japanese regulators are discussing specific requirements and compliance measures for GYEN, alongside stablecoins like USDC and USDT. It is worth noting that GYEN may be incorporated into Japan’s regulatory framework in the future.

4. Is the Stablecoin Business Really Possible?

Even though more than a year has passed since stablecoins were legally allowed, there has been limited progress from the various stablecoin projects emerging in Japan. Permissionless stablecoins, such as USDT or USDC, remain scarce in the Japanese market. No company has yet completed the EPISP registration required to operate stablecoin-related businesses.

In addition, the regulation requiring stablecoin issuers to manage all reserves as demand deposits poses a significant constraint on business operations. Demand deposits are generally unprofitable because they can be withdrawn at any time, offering little to no return. Although the Bank of Japan recently raised interest rates from 0%, the short-term rate remains low at 0.25%, which is still lower than in many other countries. This low rate will likely reduce the profitability of stablecoin businesses. As a result, there is a growing need for more competitive stablecoins backed by different assets, such as Japanese government bonds.

Nevertheless, industry expectations remain high as major Japanese financial institutions and conglomerates are actively engaging in the stablecoin business. This includes megabanks like Mitsubishi UFJ Bank (MUFG), Mizuho, and Sumitomo Mitsui Banking Corporation (SMBC), along with conglomerates such as SONY and the DMM Group.

Amid these expectations, there are increasing calls for regulators to reassess their policies. With the legal framework in place for some time but a lack of tangible results, questions and concerns about its effectiveness are likely to grow. In this context, it will be interesting to observe how the Japanese stablecoin market evolves in the future.

5. Closing Thought

Japan has been struggling with a weakened yen in recent years and has implemented various strategies to enhance its currency’s competitiveness. Stablecoins are part of this broader effort, serving as an experiment to make the yen both scalable and competitive. The adoption of advanced stablecoins is expected to pave the way for a range of global use cases beyond domestic applications, including cross-border payments. This could enable Japan to expand its influence in the global financial markets.

However, despite the regulatory framework for stablecoins being in place for over a year, the yen's presence in the stablecoin market remains minimal. Stablecoin examples are still scarce, and there have been no EPISP registrations for stablecoin-related businesses. The declining approval ratings of the Kishida cabinet and the Liberal Democratic Party have also made it difficult to advance strong Web3-related policies. Nevertheless, the establishment of a regulatory framework is a meaningful step forward. While progress may be slow, the changes it will enable are worth anticipating.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.