How Cryptocurrency Regulation evolved in South Korea

South Korea's Regulatory Landscape and Key Law Firms

TL;DR

The South Korean government's regulation of cryptocurrencies has evolved from an initial outright ban to a system that focuses on minimal investor protection, but it is still limited in its ability to open up the Web3 industry as it focuses primarily on 'virtual assets'.

Major cryptocurrency incidents and accidents in South Korea have been characterized by 1) arbitrage trading using “kimchi premium”, 2) the collapse of fraudulent projects, and 3) illegal listing lobbying and solicitation. These incidents have been highly publicized, especially due to South Korea's high perception of "fairness" and the lack of a healthy public relations culture.

Major law firms in Korea have established dedicated teams for blockchain and cryptocurrency as a specialized industry sector, and are expanding their activities in various sectors by conducting various advisory and litigation services to respond to legal and technological changes in this field.

As the Web3 market gradually enters regulatory purview, the number of related incidents is also on the rise. In the nascent Web3 market, lacking clear guidelines, these cases serve as vital references for future legal decisions. In addition, law firms that can interpret these cases and provide guidance are essential for companies that want to enter the Web3 market.

South Korea is a country with rapid economic development and technological innovation, playing a leading role in the Web3 market. Due to investor enthusiasm for virtual assets, many projects are eager to penetrate the Korean market compared to other countries.

Legal advice will be essential for clients wishing to enter the Korean market. Being unaware of the regulatory situation, cases, and law firms in Korea can be a major obstacle to business development. For Web3 projects considering entering the Korean market, this report provides 1) regulatory frameworks, 2) major cases, and 3) a list of law firms that cover the Web3 industry. However, this information is not based on legal expertise and should not be used as a basis for legal interpretation, and is of limited use as a legal basis.

Tighter Korean government regulations

South Korean government regulation has moved slowly from an outright ban on cryptocurrencies to a regulatory landscape focused on investor protection. In 2018, the so-called "Park Sang-gi's ordeal" was the beginning of the attempt at an outright ban on cryptocurrencies, when Justice Minister Park Sang-gi announced the preparation of a bill aimed at banning and shutting down cryptocurrency exchanges.

At the time, the government viewed crypto investments as speculation and as something to be eradicated, to the point where gambling laws were mentioned. While cryptocurrencies have already established themselves as an investment product in the global market, the Korean government has been slow to recognize this and establish a market order to protect investors.

Fast forward to 2020, and the 'Amendment to the Act on Reporting and Utilization of Financial Transaction Information' was passed. The amendments included the activities of virtual asset service providers (VASPs), and all VASPs were required to revise their AML/KYC systems to comply with the law and register with the South Korean Financial Supervisory Service before starting business. From this point on, the government's attitude gradually shifted from an outright ban to a focus on minimum investor protection.

However, since the focus has been on preventing money laundering, there have been limitations in preventing user harm, supervising and punishing virtual asset operators, and responding to unfair trade. In response, the government has been working to establish a broader protection system through various efforts, including the formation of a task force, and the Act on the Protection of Users of Virtual Assets (hereinafter referred to as the Virtual Asset Act).

The Act passed a subcommittee of the Political Affairs Committee of the National Assembly of Korea in April 2023 and was approved by the plenary session of the National Assembly in June. The Act includes protecting the assets of virtual asset users, regulating unfair trade practices in the virtual asset market, and authorizing financial authorities to supervise and sanction virtual asset markets and operators.

This means strengthening the supervision and inspection of virtual asset operators, and the passage of the Virtual Asset Law by the plenary session of the National Assembly marks the beginning of efforts to integrate virtual assets into the institutional system and protect investors on a broader scale.

However, South Korea's laws are primarily focused on "crypto investment," which leaves something to be desired. In particular, despite the potential for blockchain technology to be popularized in the gaming industry, cash transactions for game items are prohibited due to past regulations against gambling. As a result, blockchain games or P2E (Play to Earn) games are currently banned in South Korea.

Major cryptocurrency legal cases in South Korea

Along with legal developments, major cryptocurrency incidents and accidents in South Korea can be categorized into three types: 1) arbitrage, 2) the collapse of fraudulent projects, and 3) illegal solicitation. Especially in Korea, the ethical standard of "fairness" is very important, and this series of incidents has greatly undermined the "fairness" of the industry, causing social outrage. In addition, Korea lacks a legitimate lobbyist culture, which has led to many cases of illegal solicitation in an unregulated market.

Arbitrage with ‘Kimchi Premium’

The Seoul Central District Prosecutors' Office's International Criminal Investigation Division and Seoul Customs Investigation Bureau indicted 20 people for illegally transferring foreign currency by taking advantage of the "kimchi premium," which is a phenomenon where the price of virtual assets in Korea is higher than overseas. They sent 4.3 trillion KRW (approx 3.2 billion USD) overseas and profited by selling the cryptocurrencies they bought overseas at high prices in Korea. Their market price gains amounted to about 91.9 ~ 160 million USD, and the prosecution plans to confiscate 10 million USD in criminal proceeds.

Terra Luna collapse event

The collapse of Terraform Labs, which was based in Singapore but had a significant impact in South Korea, led to a sharp downturn in the local cryptocurrency market. This led to a 58% drop in market capitalization in the first half of 2022 compared to the second half of 2021. The main figures in the case are under investigation. Former CEO Shin Hyun-sung is under investigation in South Korea and former CEO Kwon Do-hyung is under investigation in the United States.

In response to prosecutors' allegations that Shin defrauded investors through false publicity and trade manipulation in connection with the Terra project, Shin claims that he and Kwon split in 2020 and had nothing to do with Terra-Luna's collapse. Do Kwon is under investigation for similar charges in the U.S., and the SEC has moved for summary judgment on the basis that his allegations are plausible.

Illegal solicitation

The Seoul Southern District Prosecutors' Office's Financial Investigation Division has arrested two executives of the domestic cryptocurrency exchange Coinone and two cryptocurrency listing brokers for accepting money in exchange for listing coins. They exchanged rebates worth millions of dollars since 2020, and the head of the listing team cashed in the coins he received and used them to purchase real estate. The prosecution plans to uncover the brokers’ connections and strengthen its investigation into the illegal forces manipulating the coin market.

Meanwhile, in the case of the crypto allegations involving Independent Representative Kim Nam-guk, there are mixed opinions on whether crypto issuers or exchanges may have provided crypto assets for lobbying purposes. Some argue that cryptocurrencies are inappropriate for lobbying because they leave a record of transactions.

Major law firms working on blockchain and cryptocurrency

As South Korea's laws become increasingly clear, major law firms are establishing blockchain and cryptocurrency as specialized industry sectors and building dedicated teams. The move is particularly relevant concerning the surge in cryptocurrency crime. In 2017, the value of cryptocurrency crimes increased from about 358 million USD to 913 million dollars in 2022, an increase of about 118% in five years.

In response, prosecutors have launched a dedicated investigative agency specializing in cryptocurrency crimes, and law firms have been actively building dedicated teams in response to the increasing number of cases. This is because law firms believe that they will be able to expand their activities in various sectors beyond providing corporate legal advice in the Web3 market.

Major law firms

South Korea's major law firms are offering a specialized approach to the blockchain market based on their strong expertise in traditional financial regulation and proficiency in government affairs. These firms have taken on advisory roles in major cases in Korea, and have joint blockchain-related teams to provide clear and specialized advice in new regulatory contexts and unexplored areas.

List of law firms specializing in blockchain

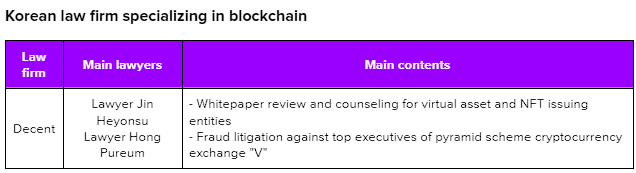

In addition, specialized law firms targeting blockchain are also gradually emerging, such as Law Firm Decent. Although the firm also covers other areas, it started as a law firm specializing in virtual assets and startups. It is expected that it will be able to provide professional advice on the rapidly changing Web3 market due to its deep technical understanding as well as legal understanding in the blockchain field.

The only answer? Continuous monitoring

South Korea's Web3 market initially began with a blanket ban on cryptocurrencies, but is now gradually building a more specific regulatory framework through the development of legislation centered on investor protection. However, the blockchain market is still developing at a rapid pace and new cases are constantly emerging. This raises the possibility that existing legal frameworks and regulations may not be sufficiently responsive to future developments, making it difficult to predict how the current regulatory framework will evolve in the future.

However, the regulatory landscape is an important consideration for projects. If a project is looking to enter the Korean market, it is important to focus on constantly monitoring regulatory trends and legal developments in the country and developing a strategy to adapt to the changing landscape in line with key developments. It will also be important to have a relationship with a law firm that can advise you. With this approach, you will be able to have a stable business and minimize any potential risks that you may not have identified.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.