TL;DR

Cryptocurrencies are often used in low-income countries that are 1) politically unstable, 2) lacking in trust in centralized financial institutions, and 3) experiencing high rates of inflation.

Cryptocurrency use is largely driven by the private sector and is used to: 1) reduce economic instability, 2) rebuild collapsed economies, and 3) fight crime.

While efforts for mass adoption on a global scale are underway, it is worth noting that real-life use cases are already emerging naturally in low-income countries.

Cryptocurrencies in low-income countries

Cryptocurrencies can be traded anywhere in the world without the need for a centralized mediator such as financial bodies or governments. This has made them of great interest in low-income countries (LICs), where access to traditional financial systems is difficult. In particular, cryptocurrencies are becoming increasingly important in countries that are 1) politically unstable, 2) lacking trust in centralized financial institutions, and 3) experiencing high inflation rates that have destabilized the value of their domestic currency.

According to the World Bank, countries with a gross national income (GNI) of $1,135 or less are classified as low-income countries. Most of these countries are located in Africa and Asia, with countries like Afghanistan, North Korea, Yemen, and Syria facing restrictions on traditional remittance methods due to national issues or civil wars. This has led to the rise of cryptocurrency use.

Crypto in low-income countries in Asia

Some low-income countries in Asia, such as Afghanistan, have unstable state systems. Such a system makes it difficult for them to introduce cryptocurrency or develop blockchain technology at the national level. The absence of state initiatives has led to a natural growth of cryptocurrency use in the private sector.

Criminal groups have taken advantage of it as well. In particular, some have exploited cryptocurrency to the point where it has become a problem at the international level, highlighting the ambivalence of crypto.

Afghanistan: Solving economic disparity

With the Taliban seizing power in Afghanistan in 2021, the country has gone through many changes in a short period of time. This political instability led to increased international sanctions, and the economic turmoil that ensued was a major barrier to stable financial transactions among ordinary citizens. As a solution, there was a great deal of interest in cryptocurrencies that could overcome the barriers to international financial transactions.

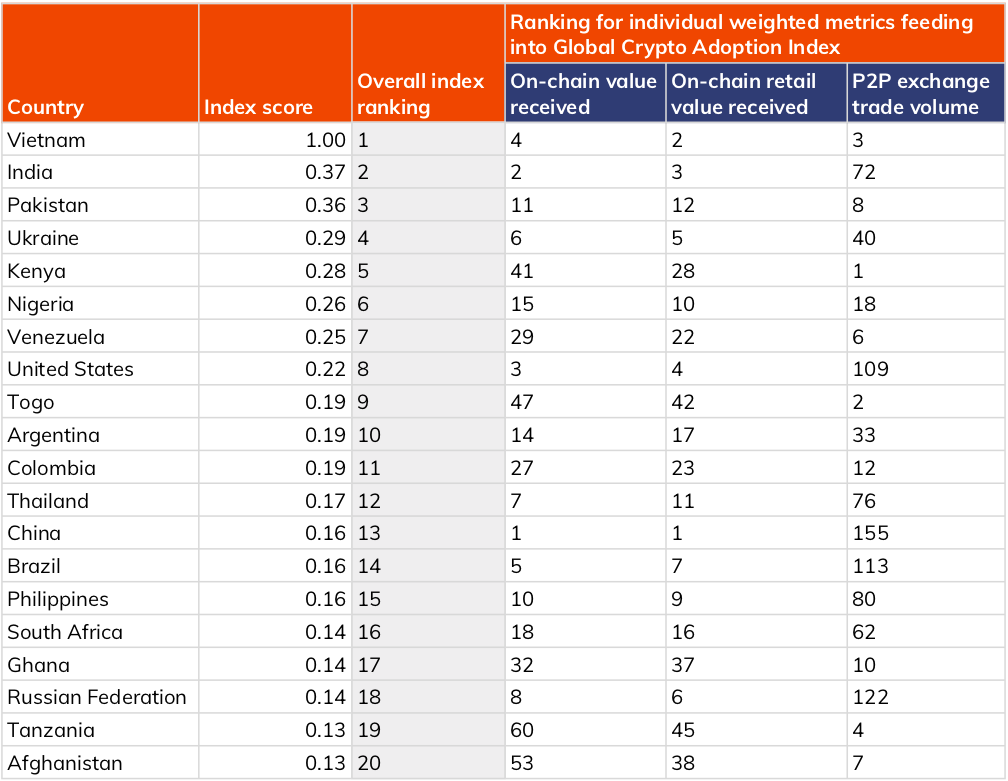

Afghanistan ranked 20th in the 2021 Chainalysis global cryptocurrency adoption index, making it clear how interested Afghans were in cryptocurrencies during increased international sanctions. In particular, stablecoins with high price stability were used as a countermeasure against the depreciation of value in the national currency, and most importantly as a means to participate in international transactions. However, this trend was sharply reversed after the Taliban's rise to power. Due to strict policies and crackdowns, the country's global adoption ranking dropped to 146th in 2022 and further dropped to 148th in 2023.

Yemen and Syria: Rebuilding collapsed financial systems

Yemen has been long plagued by civil war, and the renewed conflict since 2014 has created a major crisis in the country. Millions of Yemenis have lost access to basic necessities, and the financial infrastructure has collapsed, making it difficult to access banking and financial services.

In 2021, Babb, a UK-based company that supports cross-border peer-to-peer transactions, provided digital financial services in Yemen. Through a partnership with the privately funded Al-Amal Microfinance Bank (AMB), they supported RIALxA and RIALxS stablecoins. The company was also licensed by the UK Financial Conduct Authority (FCA) and intended to operate in the country. Unfortunately, due to the unstable internal situation in Yemen this year arising from regulatory issues and the impact of war, Babb suspended its activities in the country.

For the same reasons as Yemen, Syria also made extensive use of cryptocurrency for international relief purposes. Especially after the recent earthquake in the country, many relief efforts relied on cryptocurrencies for funding.

North Korea: Crypto in crime

While there is limited information about North Korea's use of cryptocurrency, it is clear that the country has been known to steal cryptocurrency through various hacking activities. In particular, the Lazarus Group, a major North Korean hacking organization, was behind a large number of major cryptocurrency-related attacks. It is reported that some of the cryptocurrencies stolen through their activities include stablecoins.

What are the practical uses of cryptocurrency?

In low-income countries, political stability is a bigger issue than economic stability. This makes it difficult to officially introduce cryptocurrency at the national level. As a result, it is the private sector that is using cryptocurrencies as a means to cope with headwinds. This has led to the adoption of cryptocurrencies in a variety of areas not often found in higher-income countries. These uses can be categorized into three main types.

Reducing economic instability: Many low-income countries face financial and economic instability. Rapid fluctuations in the value of currencies and high inflation rates cause great inconvenience to people's daily lives. Cryptocurrencies, including stablecoins, are becoming an increasingly popular solution to these problems.

Rebuilding collapsed economies: The collapse of financial systems due to economic and political crises or wars leaves people without access to traditional financial services. In these situations, digital financial alternatives like cryptocurrencies can help rebuild parts of the economy.

Criminal usage: However, the anonymity and speed of cryptocurrency transactions are also attractive to criminal groups. As organizations such as North Korea's Lazarus Group expand their hacking activities through cryptocurrencies, the number of abuses through cryptocurrencies is also on the rise.

These practical examples that have yet to take root on a global scale are already happening in low-income countries, driven primarily by the private sector. This shows the overall blueprint of what blockchain technology is aiming to achieve, which is bigger than simply economic benefits. Continued use cases from low-income countries will provide a clearer picture of the future of Web3 mass adoption.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.