The Inevitability of Decentralized Dark Pools

Can on-chain dark pools revolutionize financial markets?

TL;DR

In traditional financial markets, large-scale transactions by institutional investors can significantly impact market prices. This can potentially cause losses for other market participants. To mitigate these effects, dark pools were introduced as an alternative trading system where transaction details remain undisclosed until the trade is executed.

While dark pools have seen steady growth since their inception, they have faced increasing scrutiny due to instances of information leakage and misuse by operators, which has eroded trust. In response, regulatory authorities in several countries have moved to strengthen oversight of these platforms. In light of this, blockchain-based dark pools have emerged as a potential solution.

On-chain dark pools offer anonymity for traders while eliminating the need for centralized intermediaries. This addresses several issues present in traditional financial systems. Furthermore, the growing demand for private transactions is expected to fuel the expansion of the on-chain dark pool market in the near future.

1. Introduction

The volatility in traditional financial markets has been steadily rising, driven by technological advancements and various market dynamics. Institutional investors’ large-scale transactions, particularly block deals and the development of high-frequency trading (HFT) technologies, are key contributors to this volatility.

Such heightened market fluctuations present significant risks for retail investors. As a result, institutional investors have sought alternatives that allow them to execute large transactions while minimizing market disruption. One solution that has gained prominence is dark pools, which are alternative trading systems designed for private transactions.

Dark pools differ from conventional exchanges in several key ways. First, transaction details such as order price and volume remain undisclosed until the trade is executed. Second, dark pools primarily facilitate large orders, and some platforms impose minimum order sizes to filter out smaller trades. Lastly, they employ unique execution methods, including matching large orders collectively and executing trades at the mid-point of the market spread. These features enable institutional investors to execute large-scale trades at favorable prices without revealing strategic information to competitors, while simultaneously reducing the impact on market prices.

Dark pools have primarily developed in financial hubs such as the United States and Europe. In the U.S., dark pools once accounted for around 15% of total trading volume, with peak levels reaching 40% of daily average volume. Currently, over 50 dark pools are registered with the Securities and Exchange Commission (SEC) and growing. In Europe, the introduction of MiFID (Markets in Financial Instruments Directive) in 2007 spurred the formalization and growth of dark pools.

The trend is also spreading across Asia. Since 2010, Hong Kong and Singapore have adopted dark pool systems, while Japan and South Korea are integrating these platforms within their respective regulatory frameworks.

Although dark pools were traditionally designed for institutional investors handling large trades, recent data reveals a shift towards smaller transactions. According to FINRA (Financial Industry Regulatory Authority), the average trade size within the top five U.S. dark pools is just 187 shares. This shift can be attributed to two factors: First, the emergence of platforms catering to retail investors has diversified trade types within dark pools. Second, institutions are increasingly splitting large orders into smaller transactions to mitigate market impact, leading to a change in the transaction patterns within these platforms.

2. Challenges Facing Dark Pools in Traditional Financial Markets

Dark pools offer clear advantages by reducing market impact and lowering transaction costs for large institutional trades, thanks to their ability to keep transaction details undisclosed until after execution. However, criticism surrounding dark pools has persisted, leading some countries to either avoid their adoption or limit their use. This is largely due to the following concerns.

First, while dark pools enable cost-efficient large-scale transactions, they do so at the expense of transparency. In public markets, information about trades occurring within dark pools remains hidden until the transactions are completed. This lack of transparency complicates monitoring and oversight. which raises concerns about the potential negative impact on financial markets. Second, concentrated liquidity in dark pools reduces liquidity in public exchanges. This increases transaction costs for retail investors and potentially lowers market efficiency.

Third, despite the confidentiality in dark pool transactions, platform operators have been known to leak information deliberately. Documented cases show the harmful impact of these breaches, fueling growing skepticism about the dark pools.

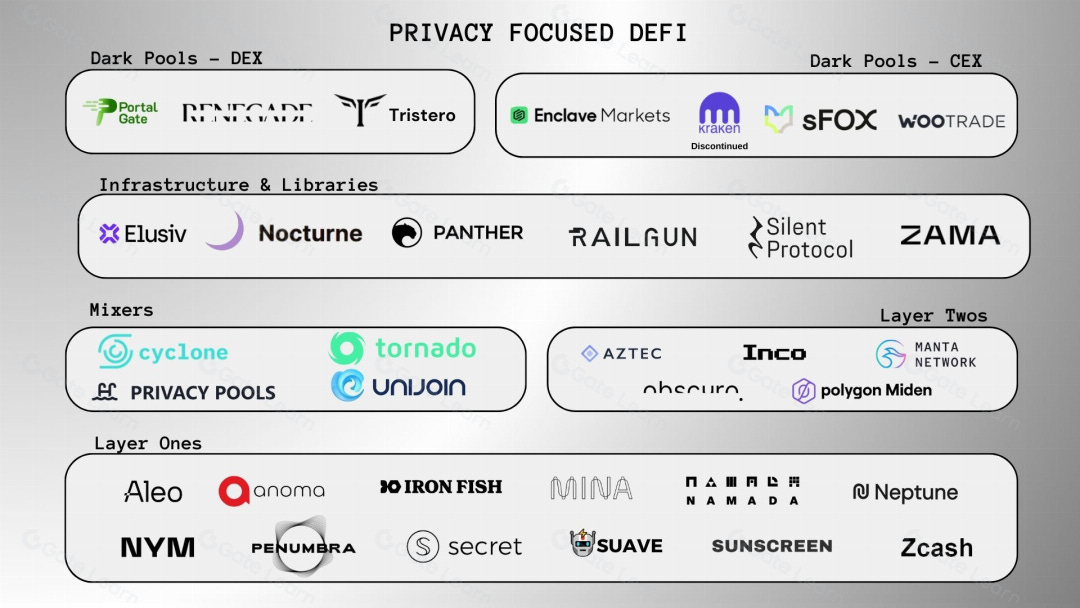

3. The Inevitable Rise of On-Chain Dark Pools

Some argue that decentralized finance (DeFi) systems offer a solution to the issues plaguing traditional dark pools. As previously mentioned, the functioning of dark pools relies heavily on the assumption that operators do not exploit client information. This is a critical element in ensuring the confidentiality of trades. However, cases of operators leaking information in exchange for compensation are not uncommon in the traditional dark pool space.

Consider a hypothetical scenario involving a dark pool named "BlackTiger" and a stock called "Tiger." Suppose Institution A intends to purchase 5 million shares of Tiger from Institution B. The operators of BlackTiger leak this information to Investor C in exchange for compensation. Given that dark pool transactions can take time to execute, Investor C waits for Tiger's price to drop before purchasing a large number of shares. After the dark pool transaction is publicly disclosed, the stock price rises, allowing Investor C to sell the shares at a profit, exploiting the information imbalance.

Such practices have eroded trust in centralized dark pools within traditional finance. One reason for the persistence of this issue is the substantial profits operators can gain from leveraging this information imbalance, which often outweigh the risks of penalties. While some countries have sought to mitigate these issues through stricter regulations, skepticism toward dark pool operators remains high.

4. How On-Chain Dark Pools Are Implemented

In the DeFi space, some platforms have already partially adopted dark pool functions. Decentralized exchanges (DEXs), such as Uniswap, offer partial anonymity for traders by leveraging automated market makers (AMMs) to match token trades without revealing the identities of participants. DEXs operate using blockchain networks and smart contracts, eliminating the need for intermediaries or centralized control. This effectively removes the trust issues often associated with traditional dark pools, where operators might misuse client information.

However, due to the inherent transparency of blockchain technology, it is challenging for DEXs to fully replicate the confidentiality of traditional dark pools. Wallet addresses associated with certain institutions or large traders are often labeled and can be tracked, and transaction details are visible to anyone on the blockchain. Services like explorers and trackers make both completed and pending transactions easily accessible. Traders and platforms often exploit this transparency. This can lead to increased market instability and issues such as transaction copying and Maximal Extractable Value (MEV) attacks, creating a less favorable environment for investors.

To address these challenges, on-chain dark pools incorporate technologies such as Zero-Knowledge Proofs (ZKP), Multi-Party Computation (MPC), and Fully Homomorphic Encryption (FHE) to implement private trading mechanisms. ZKP ensures that participants can prove the validity of a transaction without revealing the actual inputs, maintaining confidentiality. For example, traders can prove they have sufficient token balances to complete a transaction without exposing their full balance.

One notable on-chain dark pool is Renegade, which uses MPC for order matching and ZKP to execute matched trades. This ensures that until a trade is completed, no information about the order or balance is disclosed. Even after the trade, only the exchanged tokens are visible. The smart contracts verify the ZKP, which minimizes the risk of malicious behavior by block producers or sequencers. Other protocols, such as Panther, also utilize ZKP and encryption technologies to facilitate private on-chain transactions.

Meanwhile, AMM-based DEXs like Uniswap and Curve are vulnerable to front-running and back-running attacks. This is when transactions are copied or manipulated by third parties monitoring the mempool, resulting in adverse price outcomes for the original traders.

In response, projects like Fugazi that earned recognition at ETH Online have introduced mechanisms such as batch transaction processing and noise orders to prevent MEV attacks. Fugazi bundles user transactions with randomized noise orders, then encrypts them using FHE. This prevents third parties from identifying specific transaction details and executing front-running attacks. While many on-chain dark pools adopt peer-to-peer (P2P) systems to reduce slippage, Fugazi’s approach of combining AMM with measures to mitigate MEV attacks is a promising development in safeguarding participants.

5. The Dilemma of On-Chain Dark Pools: Transparency

One of the primary concerns surrounding on-chain dark pools is whether they compromise the transparency of blockchain networks. From its inception, blockchain technology has faced challenges such as the "blockchain trilemma" (balancing scalability, decentralization, and security). Similarly, the transparency issue posed by on-chain dark pools is another challenge that will require extensive research and experimentation to address.

In essence, transparency and security in blockchain systems may represent a partial trade-off. On-chain dark pools, developed to minimize security risks and market impact, are a response to the transparency inherent in blockchain. Even Vitalik Buterin, the creator of Ethereum, has proposed the concept of stealth addresses to mitigate privacy concerns arising from publicly available information, such as wallet addresses and Ethereum Name Service (ENS) records. This suggests that while transparency is a key strength of blockchain, achieving mass adoption may require balancing transparency and user privacy without compromising the user experience.

6. The Outlook for On-Chain Dark Pool

The growth potential of on-chain dark pools is expected to increase significantly. This is evidenced by the rapid rise in private transactions within the Ethereum network. While private transactions accounted for just 4.5% of total Ethereum transactions in 2022, they have recently surged to represent over 50% of total gas fees. This shows the growing effort to avoid bots that influence trading outcomes.

Users can leverage private mempools for private transactions, but this still relies on trusting a small group of operators controlling these mempools. Despite offering greater resistance to censorship compared to public mempools, the fundamental issue persists: block producers can still monitor and potentially exploit transaction details. Given these challenges, the market for on-chain dark pools—where transactions can be securely concealed while maintaining transparent accessibility—is poised for continued expansion.

7. Can an on-chain dark pool revolutionize financial markets?

Dark pools in traditional financial markets have faced significant trust issues due to cases of money laundering, hacking, and information leaks. As a result, regions such as the United States and Europe, once leaders in dark pool adoption, have introduced regulations to increase transparency. They have also set clear conditions under which non-public trading can occur. In contrast, markets like Hong Kong, where dark pool usage has been limited, have restricted participation and prohibited retail investors from engaging in dark pool transactions.

Despite these challenges, on-chain dark pools with strong censorship resistance and security could bring a transformative shift to the financial sector. However, two key factors must be addressed for the widespread adoption of on-chain dark pools. First, the platforms and entities operating these pools must be thoroughly vetted for stability and reliability, given their dependence on blockchain networks and smart contracts. Second, on-chain dark pools currently lack a well-defined regulatory framework. Institutional investors must engage cautiously and ensure that all relevant regulatory considerations are reviewed before participating in such markets.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.