Derivatives: The Rising Narrative in Crypto

Harnessing the Unique Potential of Crypto Assets: PerpDex and SynFutures

TL;DR

Crypto assets face fewer restrictions on product development, enabling the creation of diverse derivatives like 'perpetual futures.' These assets leverage their transformative nature to design unique financial products.

SynFutures, an on-chain decentralized exchange, has gained significant attention in the perpetual futures trading sector due to its high trading volume. This Perp DEX has evolved from V1 to V3, introducing the Oyster AMM, which combines concentrated liquidity and a limit order model to maximize capital efficiency.

Although there are some concerns about perpetual futures trading, it is valuable for experimenting with new derivatives and providing investors with diverse strategies. Growth is particularly expected in the active derivatives trading markets in Asia, highlighting the need to monitor its impact on the financial market.

1. Introduction

The cryptocurrency market has recently witnessed the emergence of various derivative products, attracting significant attention. Unlike traditional finance, the cryptocurrency sector has fewer restrictions on product development, allowing for more flexible design and introduction of new derivative products. As a result, the cryptocurrency market frequently exhibits more dynamic and transformative initiatives compared to traditional finance.

These characteristics present new opportunities for investors. The diverse range of derivative products enables investors to diversify their investment strategies and construct more flexible portfolios. In particular, the introduction of novel investment products such as Perpetual Futures has equipped investors with tools to respond to a wider array of market conditions. Perpetual futures trading has become a crucial component of cryptocurrency transactions, with many exchanges now offering it as a standard trading option.

This report aims to analyze 'Perpetual Futures' trading, which has established itself as a key element in the cryptocurrency market. Additionally, through an examination of 'SynFutures', an on-chain based perpetual futures exchange, we will conduct an in-depth exploration of how these derivative products are driving innovation in both the cryptocurrency market and the broader financial landscape.

2. Derivatives: A New Investment Opportunity in the Crypto Market

Before delving into perpetual futures trading, it is essential to understand the concept of derivatives and their application in the cryptocurrency market. Derivatives are financial instruments whose value is derived from the fluctuations of an underlying asset. Their primary function is to mitigate loss risks associated with price volatility, thereby reducing future uncertainties and enabling effective risk management. Additionally, derivatives provide market liquidity through leverage and offer investors diverse investment opportunities.

Derivatives serve as important risk management tools not only for investors but also for network miners of cryptocurrencies like Bitcoin. Miners utilize derivatives to minimize future income risks stemming from uncertain profitability and sharp price fluctuations. Consequently, derivatives have become an essential instrument in the cryptocurrency market, allowing both investors and miners to implement diverse and flexible strategies.

The cryptocurrency market is characterized by high price volatility. In this environment, derivatives have become indispensable tools for investors, facilitating risk management and the execution of various investment strategies. The significance of derivatives in the cryptocurrency market is evident in trading volumes. According to market analysis firm CCData, as of April 2024, derivatives account for 70% of the total cryptocurrency trading volume. Even considering the higher absolute trading volumes due to leveraged trades, this figure is remarkably high. This trend indicates that derivatives play an even more crucial role in the cryptocurrency market than in traditional financial markets, and their importance is expected to grow further in the future.

3. The Emergence of Unique Crypto Derivatives: Perpetual Futures

Cryptocurrencies possess unique and transformative qualities, bringing new innovations when combined with various industries. This innovation is also evident in derivatives, with the prime example being "Perpetual Futures."

Perpetual Futures were first proposed by economist Robert Shiller in 1992. At that time, Shiller devised this concept to enhance the liquidity of illiquid assets. Traditional futures trading is fragmented by expiration dates (e.g., June contracts, July contracts). As the expiration date approaches, trading volume decreases sharply, making it difficult for illiquid assets to maintain liquidity during that period. Perpetual Futures were introduced to overcome these limitations by creating a more active trading environment for assets facing liquidity problems.

A key feature of perpetual futures is the ability to maintain contracts without an expiration date. This feature reduces the additional effort associated with 'roll over' contracts, a common occurrence in traditional financial markets due to expiration dates. The continuity of trading provides higher liquidity compared to conventional futures trading. However, the absence of an expiration date also presents drawbacks. Without the reset of price differences between spot and futures markets that typically occurs at contract expiration, there is potential for market distortions. This could become a potential risk for investors, as the lack of a natural price convergence mechanism could lead to sustained price discrepancies.

To address the issue of price discrepancies, perpetual futures products introduce a unique mechanism called the 'Funding Rate'. This system is designed to keep the price of perpetual futures contracts closely aligned with the spot price. As illustrated in the figure, it operates by requiring long and short position holders to periodically exchange payments.

Although considerable time had passed since the concept of perpetual futures was first proposed, its initial implementation only occurred recently in the cryptocurrency market, with trading beginning in 2016 through the cryptocurrency exchange BitMEX. In traditional financial markets, the introduction of perpetual futures was limited due to technological infrastructure constraints and operational challenges associated with 24/7 trading.

However, the emergence of cryptocurrencies as a new asset class, coupled with the round-the-clock nature of crypto exchanges, enabled the full-scale utilization of perpetual futures. Notably, the cryptocurrency market's lack of restrictions on product development and its distinct structure that differentiates it from traditional finance made it possible to realize the trading of this unique financial instrument.

4. The Rise of Decentralized Perpetual Futures Exchanges

Perpetual futures have become a leading product in the cryptocurrency market. The trend continues as these instruments expand to decentralized exchanges, marking a significant shift towards more transparent and efficient trading. This development represents a new phase in the evolution of cryptocurrency derivatives.

This development has become particularly important in light of a series of events on centralized exchanges. For example, the massive outage on Binance on May 19, 2021, coupled with sharp price fluctuations, prevented investors from exiting their positions, resulting in significant losses. The bankruptcy of FTX also undermined trust in centralized exchanges, further emphasizing the need for decentralized exchanges.

Unlike centralized exchanges, decentralized perpetual futures exchanges (or Perp DEXs) enhance efficiency through automated settlement processes based on blockchain technology and ensure transparency through on-chain operations. These features have made Perp DEXs highly appealing among traders. At the center of this change are platforms like SynFutures, a perpetual futures exchange for trading various cryptocurrencies, which has gained attention for its transparent operations and innovative systems.

5. Perp DEX, SynFutures

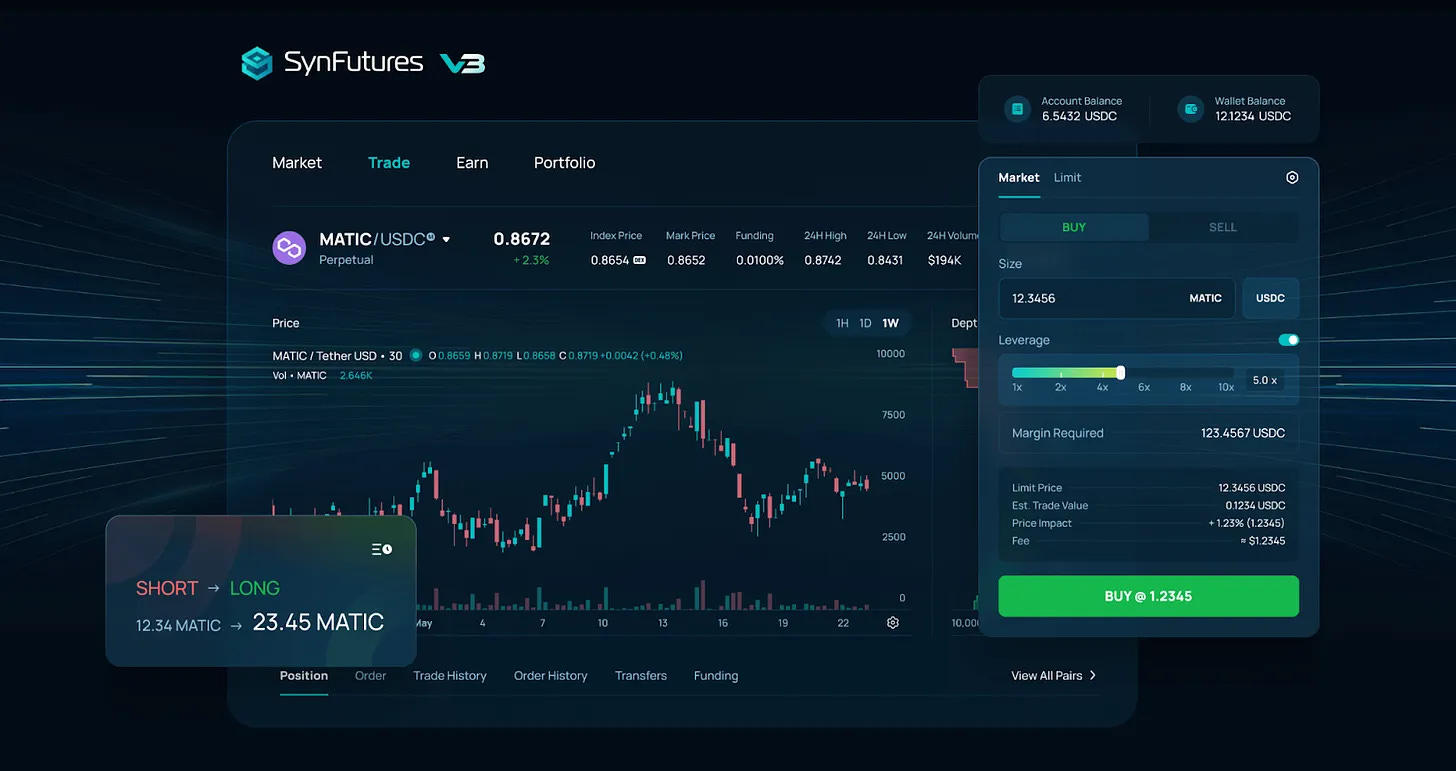

SynFutures, an on-chain Perp DEX supporting perpetual futures trading, has shown rapid growth since its 2021 launch. In March 2024, it migrated to the Blast mainnet, creating a faster and more cost-effective trading environment. Additionally, the release of its new operational mechanism, 'Oyster AMM V3', has attracted significant attention in the market.

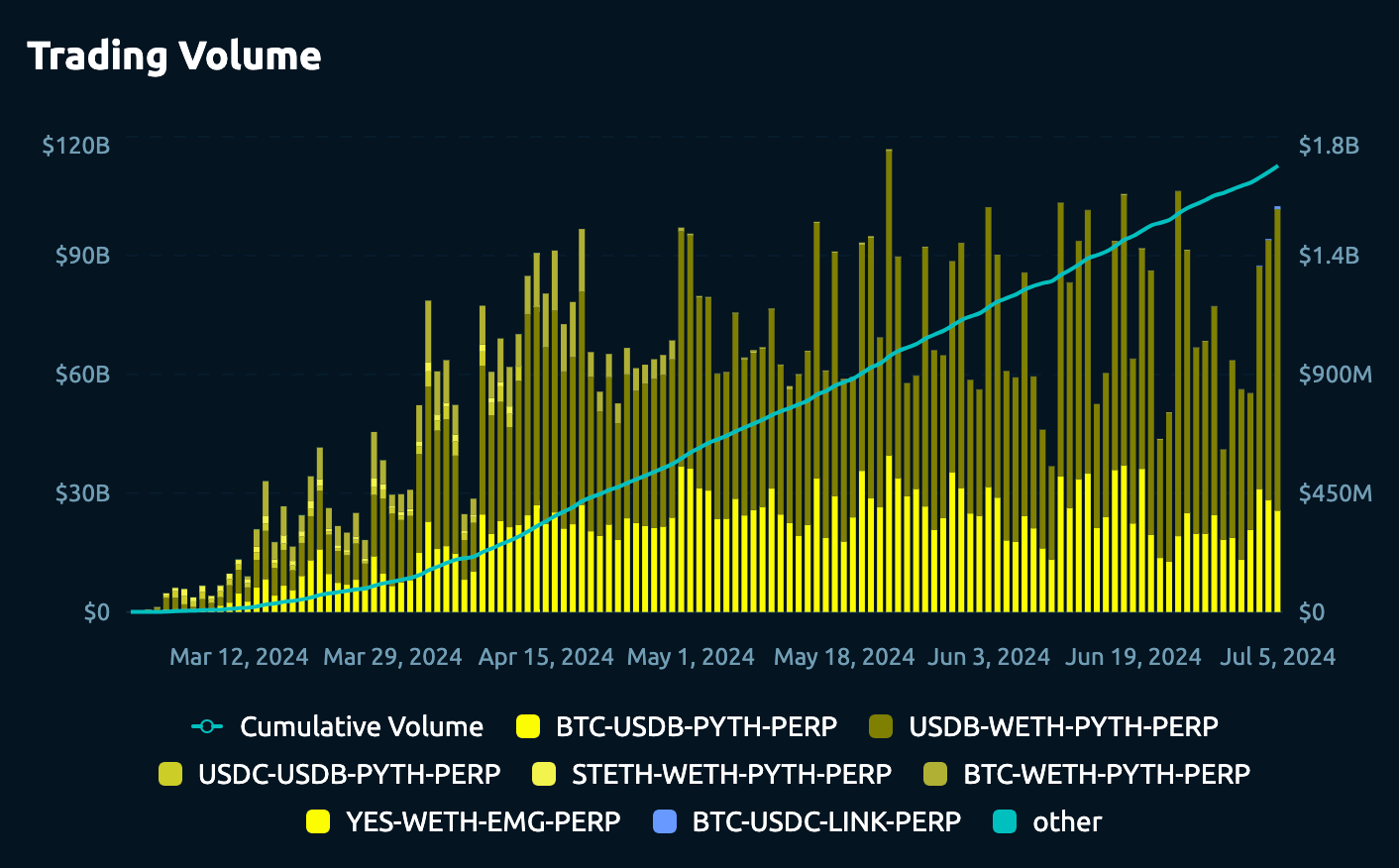

SynFutures also boasts a high trading volume. As of July 10, 2024, it has a cumulative trading volume of $118 billion and once held the highest trading volume in the Blast ecosystem. Recently, SynFutures has garnered renewed attention by expanding support to the BASE chain. These developments demonstrate SynFutures' agility in adapting to rapidly changing market trends and its commitment to continuous improvement.

SynFutures' efforts extend beyond trend-following. Its success is built on consistent improvements since 2021, with V1 and V2 iterations. The recent launch of its Oyster AMM mechanism demonstrates SynFutures' role as a market leader. We will now explore four key reasons behind its appeal.

5.1. Maximizing Capital Efficiency

SynFutures' most distinctive feature is its capital-efficient mechanism. It combines a Concentrated Liquidity model with an Order Book model to maximize efficiency.

The concentrated liquidity model, actively used by several DEXes including Uniswap V3, employs automated market makers (AMMs) to concentrate liquidity within a specific price range. This can maximize capital efficiency within that range. However, the downside is that slippage costs increase dramatically when the price moves outside of that range, potentially leading to low liquidity at certain price points.

To overcome these shortcomings, SynFutures combined the AMM model with a limit order model and developed a new ‘Oyster AMM’ model specialized for the derivatives market. This model first checks if a limit order can be processed when a trade is made, then uses concentrated liquidity in a unique execution method. This approach aims to reduce slippage costs, improve price discovery efficiency, and ultimately enhance capital efficiency.

The table results demonstrate that Oyster AMM supports a wider price range than Uniswap V3 while maintaining higher capital efficiency. This means it can provide more trading volume and liquidity with the same capital. These features are expected to enhance overall exchange efficiency and offer users an improved trading experience.

5.2. Operating a Fully On-Chain-Based Trading Environment

SynFutures is notable for operating a fully on-chain-based exchange utilizing an on-chain limit order model. The transparent operation of the exchange is an attractive factor for investors. SynFutures allows traders to see trade execution information, such as the wallet address of the limit order holder and the price. This information is permanently recorded on the blockchain in real-time. This transparency eliminates the risk of intentional price manipulation or unfair trading. Additionally, the automated operation method through smart contracts provides the advantage of a fast and stable trading environment.

5.3. A Wide Range of Assets

As a decentralized exchange, SynFutures supports the trading of a wide range of assets. This approach is similar to open commerce platforms like Amazon. Assets face lower barriers to market entry compared to traditional centralized exchanges. This provides any asset the opportunity to be traded. Just as open commerce has seen rapid development, SynFutures has the potential to achieve even further growth through the activities of various market participants.

While most decentralized exchanges struggle with long-tail assets that are less liquid due to low trading demand, SynFutures can effectively increase the liquidity of these assets through its capital-efficient Oyster AMM model. This enhancement will further improve the operational viability of the non-licensed exchange model, creating positive synergies with perpetual futures, which are designed to increase liquidity in illiquid assets.

In other words, SynFutures can offer investors more choices through long-tail assets while still maintaining operational efficiency through its unique trading mechanism. This can enable early-stage projects to gain more liquidity and transaction volume.

5.4. High Usability with a Single Token Liquidity

Finally, SynFutures' highly simplified method of supplying liquidity pools is another attractive factor. The Oyster AMM inherits the single-token liquidity provision mechanism from the original SynFutures V1's Synthetic AMM (sAMM) model. This maximizes usability by allowing liquidity providers to supply liquidity with a single token, rather than requiring the simultaneous provision of two tokens.

For example, if a liquidity provider wants to provide liquidity to an ETH/USDT (Base/Quote) pool, they can simply supply USDT. The sAMM will then synthesize the remaining asset, ETH, to create the position. In other words, the liquidity provider makes a single provision of Quote assets, which are automatically synthesized and fed into the liquidity pool. This simplicity appeals to many liquidity providers, as it contrasts with the complex processes of other exchanges, fostering an active trading environment on SynFutures.

6. Conclusion

SynFutures has established itself as a key player in the Perp DEX sector, driven by steady growth in trading volume and user base. This success stems from continuous development and innovation, progressing from V1 and V2 to the recently announced V3.

SynFutures is well-positioned for growth in the Asian market, a region known for its active derivatives trading. Notably, South Korea led global derivative trading volumes until the early 2010s. This background suggests that SynFutures could offer attractive products to Asian investors. Concurrently, participation from these experienced investors is likely to drive SynFutures' expansion and development.

While concerns exist about Perp DEXs potentially encouraging excessive speculation, SynFutures still is a crucial tool for expanding asset liquidity and providing diverse strategies to investors. Its on-chain transparency offers an attractive alternative to centralized exchanges. Rather than viewing Perp DEXs with prejudice as a simple gambling tool, an open-minded approach is warranted. Protocols like SynFutures, with their innovative efforts in the crypto derivatives market, merit close observation for their potential impact on the broader cryptocurrency landscape.

🐯 More from Tiger Research

Read more reports related to this research.[Special Report] APAC Web 3 Powerhouse : Inside Vietnam's Blockchain Market

[Special Report] The Giant of Southeast Asia, Indonesia Web3 Market Report

Disclaimer

This report was partially funded by SynFutures. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others' views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo, and 3) incorporate the original link to the report. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.