[Special Report] Hong Kong Web3 Market Analysis: From Asian Financial Hub to Web3 Hub

Leveraging Regulatory Innovation and Financial Infrastructure to Become a Global Digital Asset Center

Key Leaders Comments

Hong Kong is strategically positioning itself as a premier global Web3 hub. The city has successfully implemented a comprehensive Virtual Asset Service Provider (VASP) licensing regime and is on the verge of enacting a regulatory framework for fiat-referenced stablecoin issuance. Further demonstrating its commitment to the sector, during Consensus week, Hong Kong released a detailed roadmap outlining future regulatory initiatives encompassing virtual asset custody, OTC trading, derivative trading, margin trading, and staking. I am optimistic that this proactive and forward-thinking regulatory approach, combined with Hong Kong's established traditional financial infrastructure, a deep pool of skilled talent, and its advantageous geographical location, positions the city to potentially establish the most comprehensive Web3 regulatory framework globally within the next 12 to 18 months.Hong Kong is strategically positioning itself as a premier global Web3 hub, bridging traditional finance with blockchain innovation. The government has adopted a notably supportive stance toward cryptocurrency development, creating a clear regulatory framework that provides certainty for businesses. This regulatory clarity has reinforced Hong Kong's role as an essential "information hub" and "talent hub" where companies can establish their management teams while leveraging regional connections. The city offers a unique combination of advantages: strong financial infrastructure, access to technical talent from Shenzhen via high-speed train, and its position as a gateway to both mainland China and Southeast Asia. While Hong Kong's local market is relatively small, its significance lies in connecting to much larger regional markets, making it an increasingly important player in the global Web3 landscape. This powerful combination of progressive regulation, financial expertise, and talent accessibility establishes Hong Kong as one of Asia's most promising centers for Web3 development.Hong Kong has become more attractive for global players following Consensus 2025. Progressive regulations, institutional movements, and strong local builder ecosystems have created a well-balanced market that compares favorably to other global regions. Building on these current strengths, Hong Kong demonstrates significant potential for continued growth. The region serves as a key connector between global finance and Asian markets. While not an immediate prospect, the possibility of mainland China opening creates opportunities for builders and projects looking to enter the Hong Kong market. With continuous regulatory progress, Hong Kong has the potential to become a leading region in the Web3 industry, establishing itself as a Web3 hub alongside its role as a financial hub.1. Hong Kong’s Financial Development and Its Evolution into a Web3 Hub

Hong Kong has long served as a critical hub for East-West trade, a role rooted in its colonial past and strengthened by its strategic location. Since the 1970s, its financial sector has grown alongside Mainland China's economic opening, serving as a key conduit for Chinese companies to secure foreign investment and list shares. This has reinforced Hong Kong's status as a global financial center.

Over the past few decades, more than 1,000 mainland Chinese companies have raised capital through Hong Kong listings, driving market expansion as mainland and global capital converge. Its role as a "super connector" and high degree of autonomy under "one country, two systems" have provided competitive advantages that are difficult to replicate. As a result, Hong Kong ranks among the world's top three financial hubs, alongside New York and London, cementing its position as Asia's financial gateway.

This financial-centric structure is reflected in Hong Kong's domestic economy, where the service sector accounts for approximately 93.5% of GDP. Finance and insurance play a key role, contributing around 25% of GDP. The financial sector employs about 270,000 people, representing over 7% of total employment, underscoring its significance in economic performance and job creation.

Hong Kong's deep financial roots have recently extended to the Web3 market. Its long-standing financial expertise has facilitated entry into this space, attracting strong institutional interest compared to other markets. What sets Hong Kong apart isn't just its expertise but also its unparalleled ability to attract global talent. Many foreign investors are returning to Hong Kong because of its crypto-friendly regime and superior lifestyle compared to alternatives.

Hong Kong's relationship with mainland China is also an important variable in the development of Web3 in Hong Kong. While the mainland has taken a restrictive stance on cryptocurrencies, Hong Kong has been more receptive, playing a prominent role as a "strategic testbed".

This dynamic has led to industry speculation that Hong Kong's Web3 advancements could pave the way for regulatory easing in Mainland China. Hong Kong's approach allows global firms to engage with the Chinese market, reinforcing its role as a bridge between China and the international Web3 ecosystem.

2. Regulatory Landscape

Hong Kong has historically taken a strict approach to regulation compared to other jurisdictions. This has been particularly evident in restrictions on retail investors, such as limiting the number of tokens available for trading.

However, the regulatory landscape has been gradually expanding through initiatives such as ETF approvals and the establishment of regulatory sandboxes. Coupled with a tax and fiscal environment deliberately structured to nurture financial innovation, Hong Kong stands uniquely positioned to institutionalize Web3 at scale.

On February 19, 2025, during Consensus 2025, the Securities and Futures Commission (SFC) introduced the "ASPIRe" roadmap, outlining an open regulatory framework for the virtual asset market. This approach follows the principle of "same business, same risk, same rules," integrating traditional financial safeguards into the virtual asset sector while adapting to its unique characteristics.

The SFC emphasized that the roadmap serves as a "living blueprint" rather than a final destination, underscoring the need for continuous regulatory evolution in response to technological and market developments.

Through this framework, Hong Kong aims to maintain robust investor protection while enhancing market accessibility, product diversity, and liquidity. Additionally, the city’s regulatory stance reflects a commitment to balancing oversight with innovation by fostering global collaboration and a flexible regulatory structure.

Hong Kong now provides a clear regulatory pathway for cryptocurrency businesses to establish and operate legally. Previously unregulated over-the-counter (OTC) trading platforms and custodial services can now obtain official licenses. By encouraging global cryptocurrency exchanges to enter the market, Hong Kong enables local investors to access international markets while benefiting from regulatory safeguards. These changes have increased the number of compliant service providers, offering investors broader choices and access to a wider range of assets and financial products while ensuring oversight for enhanced investor protection.

The regulatory framework balances investor protection with reducing unnecessary compliance burdens for businesses. Previously, companies were required to store the majority of customer assets in cold wallets. Now, storage ratios can be adjusted based on each firm’s security standards. This shift allows for a more tailored security approach, similar to banks selecting their vault systems based on individual security needs.

The SFC prioritizes a comprehensive security system, emphasizing real-time monitoring, independent external audits, and robust cybersecurity measures over reliance on hardware solutions alone. Additionally, businesses now have flexibility in designing compensation mechanisms for potential losses due to hacking or system failures. Clear classification standards for tokenized securities, utility tokens, and cryptocurrencies have also been introduced, improving regulatory clarity and compliance understanding.

The availability of financial products and services has been diversified based on investors' knowledge and experience levels. Professional investors now have access to a broader range of assets, including various tokens, Bitcoin futures, and margin trading. Staking services are also considering allowing investors to deposit assets and earn rewards. While functionally similar to fixed deposits, this process compensates participants for contributing to blockchain security. Professional investors can also leverage their crypto holdings as collateral for loans or lend assets to earn interest, further expanding financial opportunities within the regulated framework.

Advancements in regulatory technology have strengthened market oversight and interagency cooperation. A streamlined reporting system allows cryptocurrency firms to efficiently submit required information to regulators. Sophisticated tools such as on-chain analytics, wallet monitoring, and transaction surveillance have been implemented to detect illicit activities at an early stage.

Cooperation has also been reinforced both domestically—between financial regulators and law enforcement—and internationally, enabling a coordinated response to cross-border financial crimes.

A key focus has been on improving regulatory quality through increased engagement between industry players and regulators, and investor education. A structured framework now governs financial influencers providing cryptocurrency investment advice via social media and online platforms. Additionally, the Virtual Asset Consultative Panel (VACP) facilitates ongoing dialogue with industry experts, integrating their insights into policy development. To support long-term market growth, initiatives have been launched to cultivate talent across essential areas such as exchange operations, asset management, product development, technology, legal, and accounting.

3. Cryptocurrency ETFs

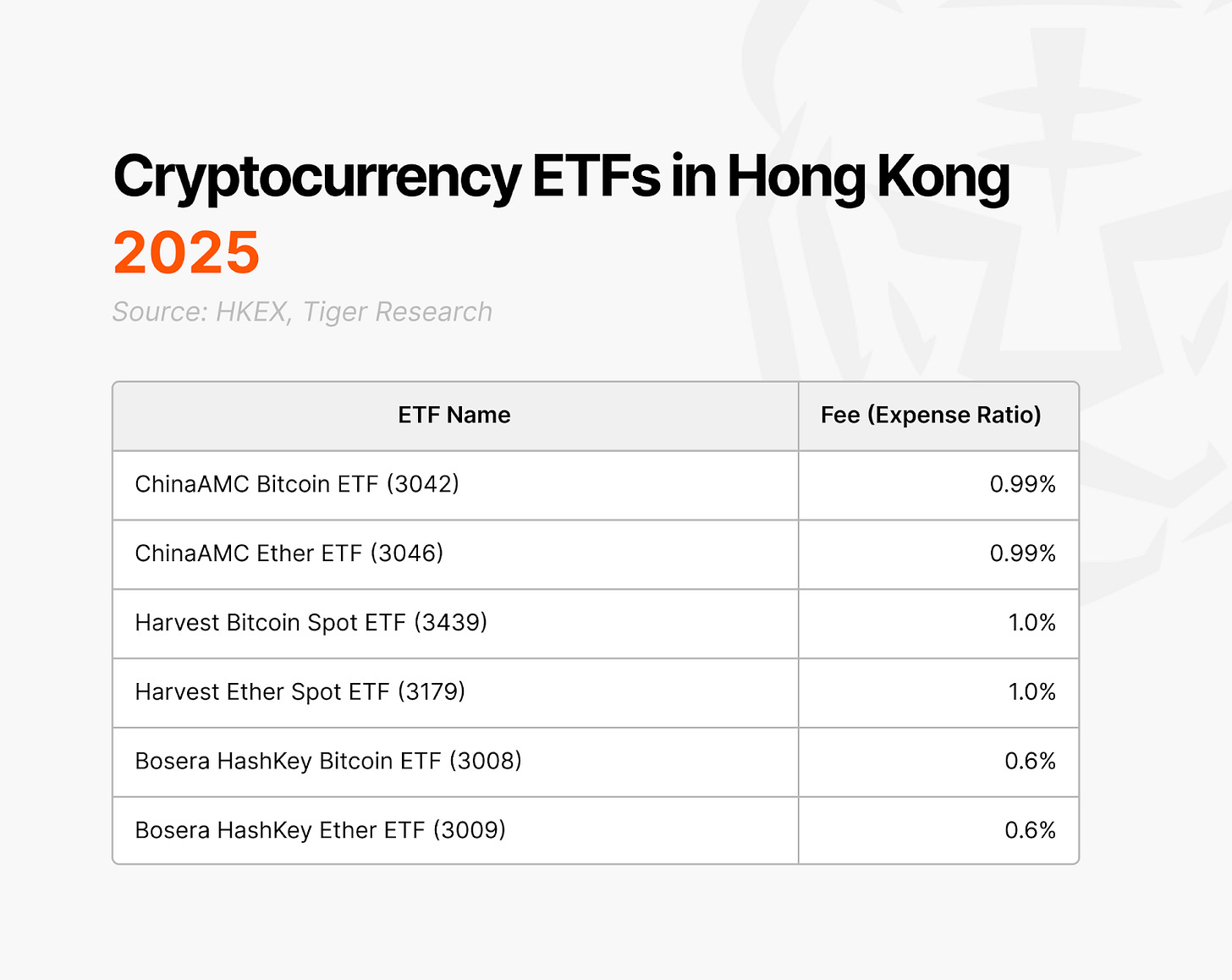

Hong Kong’s cryptocurrency ETF market reached a significant milestone in April 2024 with the approval of the first spot Bitcoin and Ethereum ETFs in Asia. Three China-based asset management firms—China Asset Management (CAM), Harvest Global Investment (HGI), and Bosera—each launched two spot ETF products, introducing a total of six new offerings to the market.

Currently, the total assets under management (AUM) for U.S. spot Bitcoin ETFs stand at $94.37 billion, whereas Hong Kong’s ETF market remains significantly smaller at approximately $400 million. The primary constraint on Hong Kong’s ETF market growth is its limited domestic market size. With a population of only 7.5 million, Hong Kong has a relatively small retail investor base.

Institutional investors have already gained exposure to Bitcoin ETFs through U.S. markets, reducing the incentive to shift to Hong Kong-listed products, especially due to their higher management fees. Hong Kong’s spot Bitcoin ETF fees range from 0.6% to 1.0%, while U.S. spot Bitcoin ETFs charge between 0.15% and 1.5%, underscoring the need for better price competitiveness.

Despite these challenges, Hong Kong holds a strategic advantage as a testbed for the Mainland Chinese market and a gateway for Chinese capital inflows. If Mainland Chinese funds were permitted to invest in Hong Kong-listed cryptocurrency ETFs, it could reshape the market landscape. Currently, regulatory restrictions prevent Mainland Chinese funds and asset management firms from directly purchasing Hong Kong ETFs or other cryptocurrency-based ETFs. CAM has issued ETFs that support transactions in offshore yuan (CNH), indicating ongoing preparations for potential regulatory changes.

Recent regulatory developments may pave the way for structured products such as equity-linked securities (ELS) and derivative-linked securities (DLS), enhancing hedging and risk management tools. As a result, market participants anticipate greater product diversification, supporting the long-term growth and stability of Hong Kong’s cryptocurrency ETF sector.

4. Cryptocurrency Trading Landscape

Hong Kong’s cryptocurrency trading environment continues to evolve within a defined regulatory framework. Currently, cryptocurrency trading is permitted only on virtual asset trading platforms (VATPs) licensed by the SFC. Retail investors can trade only SFC-approved cryptocurrencies, which must be included in at least two independent index providers' approved indices. As a result, the number of tradable assets for retail investors remains limited to Bitcoin (BTC), Ethereum (ETH), Avalanche (AVAX), Chainlink (LINK).

In contrast, professional investors have access to a broader range of assets, including stablecoins and all cryptocurrency trading pairs. However, the qualification criteria for professional investor status remain stringent, requiring a minimum investment portfolio of HKD 8 million (~USD 1 million) over the past three months. This threshold limits the number of eligible individuals to an estimated 140,000 to 150,000, representing only 1.5–2% of Hong Kong’s total population.

While regulatory constraints persist, potential reforms could drive significant growth. A more accommodating framework allowing broader investment options beyond spot trading could attract greater institutional capital inflows. Hong Kong, a key financial hub managing significant regional assets, extends beyond local investors. If regulations become clearer and more flexible, capital inflows from Mainland China could further expand the market.

As of now, ten exchanges, including OSL and HashKey, have obtained VATP licenses and operate in Hong Kong, with an additional eight exchanges under review. However, stringent licensing requirements have led many global exchanges to either fail to secure approval or voluntarily withdraw their applications.

Despite these challenges, some global exchanges still see Hong Kong as a promising market. For example, Gate.io has sponsored the Consensus 2025 event with a prominent presence, where it hosted a major booth to connect with the audience. Its operationally independent associate, Gate.HK, has set up an office in Hong Kong, ready to engage with regulators to navigate licensing requirements and establish a foothold in the market.

Recent regulatory updates suggest potential opportunities for global exchanges. If international platforms set up operations in Hong Kong and comply with local requirements, they may gain access to a global order book, boosting market liquidity. With its prior preparations, Gate.io is well-positioned to take a leading role in leveraging these regulatory shifts.

However, local exchanges continue to face operational challenges. HashKey Exchange, Hong Kong’s first retail-focused cryptocurrency exchange, has onboarded 170,000 users since its launch. Yet, its daily trading volume remains around USD 35 million—far below major global exchanges, reflecting the growth limitations of the Hong Kong market.

To address these challenges, alternative trading models are emerging. A notable example is ZA Bank’s crypto trading service, which uses a broker model in partnership with licensed exchanges such as HashKey. This allows users to buy cryptocurrencies directly through the ZA Bank app, making crypto more accessible within Hong Kong’s regulated framework.

Beyond regulated channels, retail investors actively seek alternative trading methods. OTC storefronts have become a prominent part of Hong Kong’s crypto landscape, with street advertisements promoting stablecoin exchanges. These stores facilitate cryptocurrency transactions in person, keeping the crypto trading ecosystem active despite regulatory constraints. However, new regulatory guidelines are expected to bring OTC shops under greater oversight, signaling further market changes.

Additionally, many retail investors still use global cryptocurrency exchanges, as Hong Kong regulators have not imposed IP restrictions on offshore platforms. This trend mirrors global market behavior, where investors frequently trade on international platforms despite domestic regulations.

Beyond these regulatory constraints and alternative trading channels, a parallel development is emerging in the consumer finance sector. While retail cryptocurrency trading faces limitations, DeFi applications are gradually integrating with traditional financial services, creating new opportunities for everyday users. These developments include tokenized assets, stablecoins, and permissionless financial services that extend beyond trading into practical financial activities.

Given Hong Kong's established financial infrastructure and regulatory framework, the city is strategically positioned to facilitate these consumer-oriented DeFi applications—particularly in areas such as tokenized consumer credit, on-chain trade finance, and programmable money solutions that complement existing payment systems without bypassing regulatory oversight.

5. Real World Assets (RWA)

Hong Kong is expanding its real-world asset (RWA) tokenization market, leveraging its established financial expertise. Under the oversight of the Hong Kong Monetary Authority (HKMA) and the SFC, major financial institutions, including HSBC and BlackRock, are leading adoption efforts. Technology firms such as Microsoft and Ant Group, along with blockchain-focused companies like HashKey, provide technical expertise, forming the foundation of Hong Kong’s RWA tokenization ecosystem.

October 2022: The Hong Kong government announces its virtual asset policy direction, introducing pilot projects and signaling intent to assess the legal enforceability of tokenized asset ownership and smart contracts.

February 2023: The government issues the world’s first tokenized green bond (HK$800 million), utilizing Goldman Sachs’ blockchain platform for distributed ledger-based settlement.

June 2023: Bank of China International (BOCI) issues a CNY 200 million structured note on Ethereum, marking the first public blockchain-based securities issuance by a Chinese financial institution in Hong Kong.

November 2023: The SFC releases tokenized securities guidelines, regulating tokenized securities under the same framework as traditional securities and opening access to retail investors. HSBC launches a gold tokenization pilot through its Orion platform.

February 2024: The Hong Kong government issues its second tokenized green bond, supporting transactions in multiple currencies (HKD, CNH, USD, and EUR), making it the world’s first multi-currency digital bond.

March 2024: The HKMA introduces the "Stablecoin Sandbox", a regulatory testbed for stablecoin issuers. HSBC begins offering tokenized gold investment services to retail customers.

July 2024: The HKMA announces the results of its stablecoin regulatory consultation and discloses five firms selected for the first phase of the Stablecoin Sandbox, including trials for HKD-pegged stablecoin issuance.

August 2024: The HKMA formally launches "Project Ensemble", connecting four banks to a tokenized deposit platform and testing various tokenized asset transactions.

October 2024: The Hong Kong Chief Executive announces a subsidy program covering 50% of digital bond issuance costs (up to HK$2.5 million) to promote tokenized bond adoption.

December 2024: The Hong Kong government submits the 2024 Stablecoin Bill to the Legislative Council, mandating licensing requirements for stablecoin issuance and operations.

February 2025: Standard Chartered, Animoca Brands, and HKT formally announce plans to launch Hong Kong’s first HKD-pegged stablecoin.

Since 2022, Hong Kong has led RWA tokenization, spearheading initiatives such as government-issued tokenized green bonds, BOCI’s USD 50 million structured note, and HSBC’s gold-backed tokenization project. These efforts have positioned Hong Kong at the forefront of digital asset innovation, fostering a scalable, regulated tokenization ecosystem.

The city’s digital asset infrastructure is structured around two major initiatives. Project Ensemble focuses on advancing tokenized assets and integrating financial infrastructure, creating a framework for broader adoption. At the same time, the Stablecoin Sandbox serves as a regulatory testbed to support stablecoin issuance and compliance, ensuring alignment with financial market stability. Through these initiatives, Hong Kong continues to develop its digital asset market, reinforcing its role as a global leader in RWA tokenization and financial innovation.

The city’s digital asset infrastructure centers on two major initiatives. Project Ensemble advances tokenized assets and integrates financial infrastructure. Meanwhile, the Stablecoin Sandbox functions as a regulatory testbed to support stablecoin issuance and compliance. Through these initiatives, Hong Kong continues to develop its digital asset market, strengthening its role as a global leader in RWA tokenization and financial innovation.

5.1. Project Ensemble

Project Ensemble, launched by the HKMA in 2024, is an infrastructure initiative aimed at advancing tokenized financial markets. It provides a sandbox platform where banks experiment with tokenized deposits and wholesale central bank digital currency (wCBDC) to enable transactions involving real-world and traditional financial assets.

Officially launched in August 2024, the Ensemble Sandbox brings together major financial institutions, including HSBC, Standard Chartered Hong Kong, Bank of China Hong Kong, and Hang Seng Bank. These participating banks are integrating their independently issued tokenized deposits into the sandbox network, conducting real-world tests of financial innovation.

Collaboration between technology firms and financial regulators plays a central role in Project Ensemble. Ant Digital (a subsidiary of Ant Group), Microsoft Hong Kong, and HashKey have joined as technology partners. The SFC is directly involved in the project, developing regulatory frameworks for tokenized assets within a public-private partnership model.

The first phase of experimentation centers on four core use cases spanning both traditional financial assets and real-world assets. Since the sandbox’s launch in 2024, HSBC has successfully executed a transaction where tokenized bonds issued via its Orion digital platform were purchased using another bank’s tokenized deposits. Additionally, HSBC and Hang Seng Bank completed a cross-bank tokenized deposit transfer, demonstrating the viability of interbank transactions within a tokenized financial ecosystem.

5.2. Stablecoin Sandbox

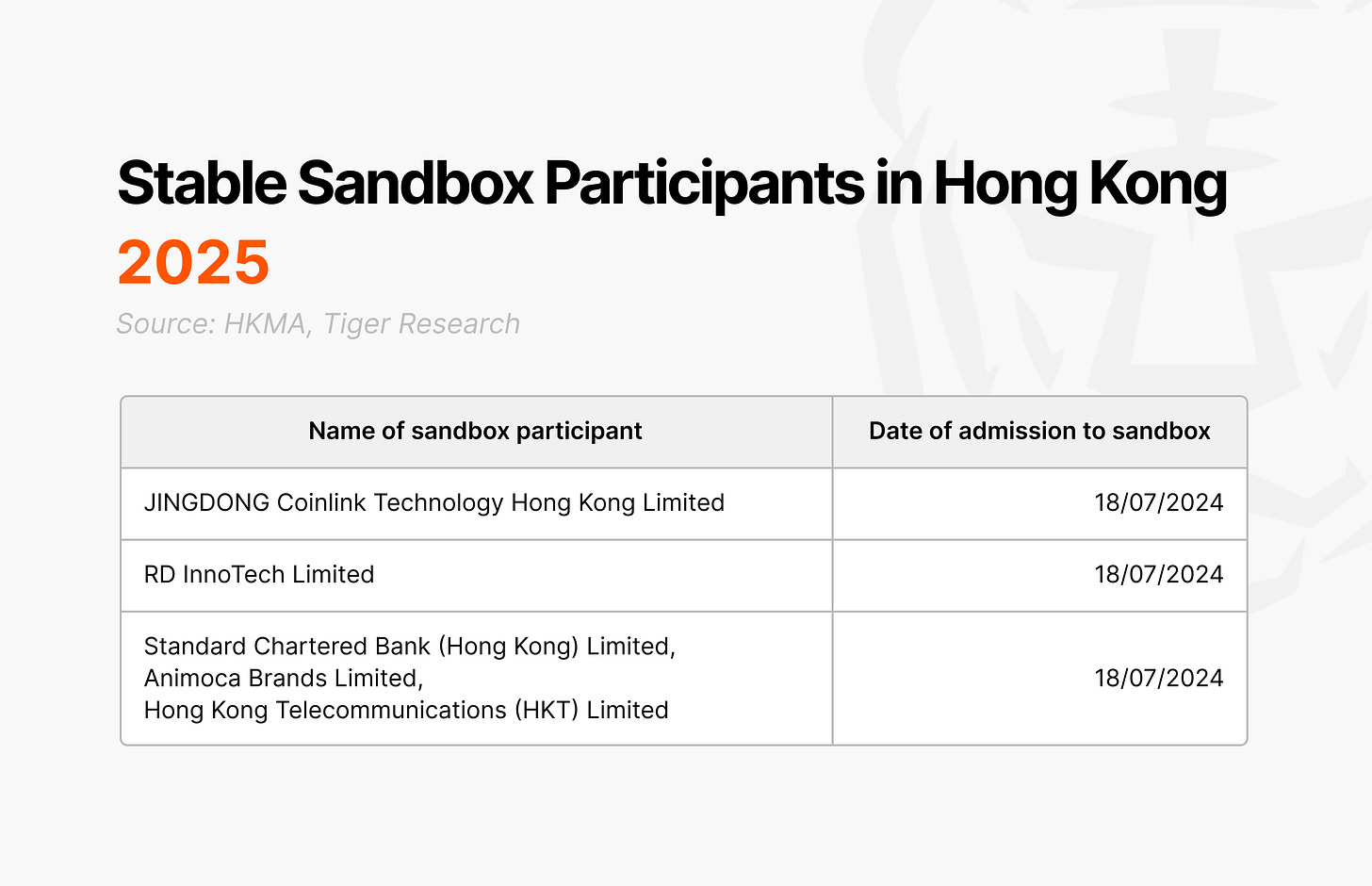

Hong Kong’s Stablecoin Sandbox, introduced by the HKMA in March 2024, acts as a regulatory testing environment for stablecoin issuers. Building on the 2023 legislative proposal, the sandbox allows selected issuers to test stablecoins under regulatory supervision before formal rules are implemented.

The sandbox has two primary objectives. The first is supporting the development of Hong Kong’s virtual asset ecosystem. Second is providing stablecoin issuers with compliance guidelines and supervisory expectations, ensuring that the eventual regulatory framework is both practical and effective. Participating firms focus on best practices in reserve asset management, value stabilization, governance, and consumer protection, establishing regulatory standards for fiat-backed stablecoin issuance.

In July 2024, the HKMA announced the first group of sandbox participants, including Jingdong Coinlink (a JD.com subsidiary), fintech firm RD InnoTech, and a joint initiative by Standard Chartered Hong Kong, Animoca Brands, and Hong Kong Telecom (HKT). These firms are primarily testing HKD-pegged stablecoin issuance and applications in cross-border payments, DeFi, and other financial services. While sandbox participation does not ensure regulatory approval, the HKMA is collaborating with issuers to refine the regulatory framework before full implementation.

Formal legislation is advancing quickly. In December 2024, the Stablecoin Licensing Bill was submitted to the Legislative Council, establishing a licensing regime for stablecoin issuance and operations. Sandbox participants are preparing for regulatory approval and the commercial launch of licensed stablecoins once the framework is implemented.

6. Mainnet Landscape

Hong Kong’s blockchain market remains decentralized, with no single mainnet dominating the ecosystem. Instead, a diverse mix of global and local platforms compete to establish their presence. Solana has expanded its reach through Solana Superteam and is also exploring opportunities in the Chinese market. Similarly, Avalanche has strengthened its foothold through local events and partnerships with Hong Kong-based enterprises. Polkadot has also made significant inroads by educating local builders through its Polkadot Blockchain Academy (PBA) in Hong Kong. Meanwhile, Ethereum, particularly through its Base network, continues to gain traction.

Bitcoin Layer 2 solutions such as Bitlayer, are gaining traction across Greater China, a trend also evident in Hong Kong. Locally, HashKey Chain is positioning itself as a Hong Kong-based mainnet, though it has yet to reach the scale of leading global blockchain ecosystems.

Conflux, originally based in Shanghai, has strategically relocated its management team to Hong Kong. This move aims to combine China’s technological expertise with Hong Kong’s regulatory environment, positioning Conflux as a key player in the region’s evolving blockchain landscape.

7. Builder Ecosystem

While Hong Kong has long been known as a finance and exchange-driven market, its builder ecosystem is expanding across a broader range of Web3 sectors. Cyberport, a key incubation hub, actively supports blockchain projects and has provided HKD 50 million in funding to accelerate Web3 ecosystem development.

Currently, Cyberport supports more than 270 Web3-related projects in Hong Kong, though the actual number is likely higher when accounting for initiatives operating outside its incubation framework. These projects extend beyond financial services into Web3 gaming, DeFi, infrastructure development, and decentralized science (DeSci). This diversification reflects Hong Kong’s evolution beyond its traditional finance-focused identity, signaling the growth of a more dynamic and multi-faceted Web3 industry.

Leveraging its strategic geographical and cultural position, many of these projects are expanding into both Greater China and global markets. While some builders have raised concerns about aspects of the local environment, Hong Kong remains one of the most supportive jurisdictions for blockchain development, backed by robust government initiatives and regulatory engagement.

The government's financial support and regulatory framework are positioning Hong Kong as a leading Web3 hub in Asia. This environment provides startups and developers with a strong foundation for growth while attracting interest from global investors.

8. Developer and Community Environment

Hong Kong benefits from its proximity to Shenzhen, accessible via a 20-minute high-speed rail. This direct link provides access to millions of developers and technical professionals, with many engineers commuting daily from Shenzhen to Hong Kong. The ability to tap into this talent pool is widely seen as a key competitive advantage for Hong Kong’s tech ecosystem.

In terms of developer expertise, Hong Kong excels in business ideation and use case development, while technical development is often outsourced to Mainland China or Vietnam. However, local institutions such as Hong Kong Polytechnic University continue to train skilled developers, fostering an ecosystem that blends business acumen with technical solutions. This hybrid talent pool has become a vital asset for the growth of Hong Kong’s Web3 industry.

Cyberport plays a key role in talent development, collaborating with 11 local universities to run Web3-focused training programs. Expanding beyond Hong Kong, it has also partnered with Stanford, Cambridge, and Draper University, offering boot camps to strengthen blockchain expertise. Additionally, collaborations with Solana, Chainlink, and other major mainnets have led to certification programs and hackathons, equipping developers with practical Web3 skills.

Hong Kong's blockchain community is highly active, with Telegram serving as the primary communication channel. Participants engage across various platforms, including WhatsApp and, to a lesser extent, WeChat, fostering a globally connected and accessible environment for Web3 discussions and collaboration.

Hong Kong's blockchain community is highly active, with Telegram as the primary communication channel. Participants also engage on WhatsApp and, to a lesser extent, WeChat, creating a globally connected environment for Web3 discussions and collaboration.

9. Market Opportunities

Hong Kong is actively developing the Web3 industry, leveraging its strengths in traditional finance to cultivate a favorable environment for institutional-grade Web3 projects and RWA tokenization initiatives. The city's strategic location provides access to Mainland China while benefiting from Shenzhen’s technical talent pool.

Government-backed initiatives play a pivotal role in industry support. Cyberport, a state-sponsored innovation hub, supports over 270 Web3 projects with office space, grants, and investor networking programs. In February 2025, the SFC introduced the “ASPIRe” roadmap, emphasizing market accessibility. Key measures include licensing frameworks for OTC trading and custody services, attracting global liquidity providers, and reviewing token listing and derivatives trading structures for professional investors.

With its strong financial infrastructure, Hong Kong provides institutional-grade Web3 projects a solid foundation to collaborate with established financial institutions. Given its leadership in RWA tokenization and stablecoin adoption, the city presents major opportunities for firms entering this space.

Regulatory advancements have also prompted global exchanges to expand into Hong Kong. As regulators signal openness to integrating with global liquidity networks, engaging directly with regulatory bodies and institutional stakeholders remains a key strategy for market entry.

9.1. Challenges

Despite these opportunities, several challenges remain. Hong Kong’s limited domestic market size, with a population of 7.5 million, constrains local demand, making long-term growth reliant on expansion into Mainland China and broader Asian markets. For Web3 projects targeting Chinese-speaking markets, Hong Kong serves as an entry point, offering networking advantages and investor access within the Greater China region.

Talent acquisition is another hurdle. Foreign companies often struggle to find reliable local representatives, and high employee turnover rates pose challenges for long-term operations. Cultural differences in communication styles and decision-making processes between headquarters and local teams can also create friction.

9.2. Entry Strategies

A successful entry into Hong Kong’s Web3 industry requires a strategic, adaptive approach. First, building strong relationships with local regulators is essential. Hong Kong’s regulatory landscape is constantly evolving, making proactive engagement with authorities crucial for compliance and long-term stability.

Second, balancing local and international talent is key. Combining professionals familiar with Greater China’s regulatory and business culture, including Mandarin-speaking team members, with global Web3 specialists creates synergies in market execution.

Third, securing institutional partnerships enhances credibility and market positioning. Hong Kong's status as a financial hub makes institutional engagement a critical success factor. Leveraging government-backed programs such as Cyberport can help reduce initial costs and build local networks. Additionally, engaging with local Web3 investors like Animoca Brands, Spartan, Hashkey Capital, and Kinetic provides significant advantages, as these firms offer broader networks and more specialized perspectives than traditional institutional investors, enabling them to provide more targeted support for Web3 projects.

Finally, a long-term perspective is essential. While Hong Kong serves as a potential gateway to the Mainland Chinese market, regulatory shifts take time. Firms must stay patient, cultivate the market, and adapt to evolving regulations for sustained success.

Despite optimism around Hong Kong’s proactive stance, a full-scale opening of the Mainland Chinese crypto market will require significant policy shifts. Rather than expecting immediate changes, it is more realistic to view Hong Kong’s Web3 initiatives as a gradual signal of potential long-term transformation in China’s broader digital asset policies.

Core Contributors

Yoon Lee, Head of BD of Tiger Research | X

Margot Lee, Head of Marketing of Tiger Research | X

Ian Yeung, Associate Director of Animoca Brands | X, LinkedIn

This report would not have been possible without the invaluable support of our partners.

Research Methodology

The Tiger Research team wrote this report based on interviews with various industry experts and leaders during their stay in Hong Kong from February 17 to 21, 2025, coinciding with 'Consensus 2025’. The primary goal was to gain a comprehensive understanding of the unique and complex structure of the Hong Kong Web3 market from a broad perspective. Although the opinions gathered through the interviews occasionally varied among local experts, this diversity of views reflects the market's richness and has enhanced the overall understanding of Hong Kong’s Web3 landscape.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo, and 3) incorporate the original link to the report. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.