The State of the Blockchain Market in 2024 as Seen by Web Traffic (Part 2)

From Media to Re-staking Protocols

TL;DR

Blockchain media: This sector splits into journalistic outlets and influencer-driven channels. While influencers wield significant sway in emerging markets, journalistic media play a crucial role in driving broader adoption. The current boom period has seen lower web traffic to blockchain media than previous surges.

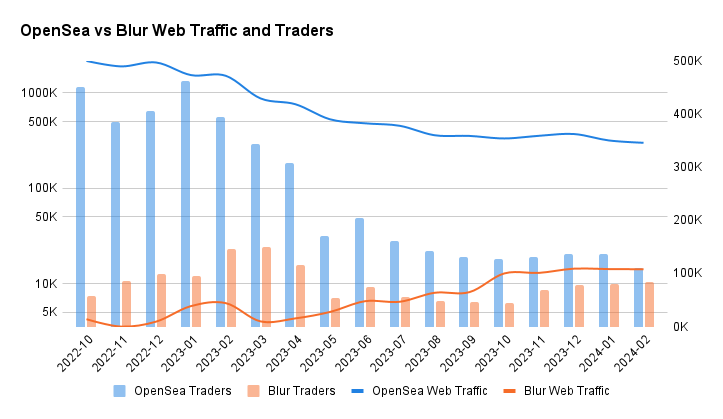

NFT Marketplaces: Marketplaces have struggled after the crypto winter. Despite having lower web traffic compared to OpenSea, Blur boasts twice the trading volume, highlighting its growing market presence.

Real World Asset (RWA): The RWA market is divided into direct and indirect investment avenues. Currently, the indirect investment sphere is witnessing more growth. The anticipated launch of the BUIDL fund by BlackRock is expected to spark increased interest in direct investments within the RWA market.

Re-Staking Protocol: This sector is rapidly gaining momentum due to its offer of additional rewards and enhanced network security. Its swift growth shows its potential to significantly contribute to the market expansion in this current boom period

In part one, we analyzed exchanges via web traffic data. In this report, we shift focus towards the traditional media industry and the re-staking protocols that are gaining traction during the current boom. For a comprehensive understanding of the role web traffic plays in blockchain market analysis, we encourage readers to refer to our prior research.

1. Media Industry

The blockchain media industry can be sorted into two main categories. The first consists of news organizations that fall under the portal news category, delivering structured, journalistic content. The second category includes the platforms of influencers on X (formerly Twitter) and Telegram, where individual thought leaders share insights, updates, and commentary on blockchain and related technologies

While news organizations traditionally wield more influence across most industries, the dynamics within the blockchain market uniquely favor influencer channels. This shift in influence is attributed to the asymmetry and the importance of timeliness in disseminating information within this emergent market, where influencers can provide rapid updates and insights.

However, media in the form of news organizations also play an important role in the blockchain market. While influencers' channels are mainly aimed at high-level market players, journalists' articles are aimed at a wider audience, including low-level players. This means that journalists specializing in the blockchain market can easily communicate relevant news to a wider audience, thus influencing a wider market.

Nonetheless, news organizations continue to play a crucial role within the blockchain market. Unlike the influencer channels, which primarily target high-level market participants, journalistic content is designed to reach a broader audience, encompassing both seasoned players and newcomers. This approach allows journalists specializing in the blockchain sector to disseminate relevant news and insights to a broader audience, thereby exerting influence over a wider segment of the market.

The correlation between web traffic to global blockchain media outlets, such as CoinDesk, and the price of Bitcoin reveals a divergence in trends between the previous and current booms. Web traffic and Bitcoin's price exhibited similar growth during the last surge, whereas the current boom has witnessed relatively subdued web traffic. This discrepancy can be attributed to two primary factors:

● Lower price appreciation: The previous boom saw Bitcoin's price escalate approximately sixfold from its all-time high, generating substantial interest. In contrast, the current boom has only just surpassed the previous all-time high, potentially sparking less intrigue.

● Decreased visibility of specialized media: The visibility of specialized blockchain media has possibly diminished as general media outlets increasingly report on the blockchain market, contrasting with earlier periods when specialized outlets predominantly covered such news.

Consequently, the diminished web traffic observed in specialized blockchain media outlets during the current boom reflects a blend of more moderate Bitcoin price appreciation and the broadening of blockchain coverage to include general media outlets, which has collectively diluted the exclusive spotlight on specialized media.

The web traffic to media organizations is significantly impacted by the occurrence of major events. Notably, the pattern of web traffic spikes observed in blockchain-related news organizations, such as those following the collapse of the Terra ecosystem and the bankruptcy of the FTX exchange, has not been replicated to the same extent in response to recent developments, like the approval of the Bitcoin ETF.

2. NFT Marketplace

The NFT marketplaces that were at the forefront of the last boom encountered significant operational challenges during the subsequent "crypto winter," a period marked by widespread downturn and scrutiny over the intrinsic value of NFTs.

During the boom, a variety of NFT marketplaces were established,including local platforms tailored to specific regional characteristics. However, the enduring impact of market contraction has led to many of these marketplaces either winding down or undergoing significant restructuring.

OpenSea, a trailblazer among NFT marketplaces, experienced a significant decline in web traffic following the boom period, a trend mirrored by other platforms like Magic Eden and X2Y2. However, Blur stands out as an exception, demonstrating sustained growth amidst the market's overall contraction. This can be largely attributed to its strategic use of incentive systems and airdrops, mechanisms that have proven effective in continually attracting and retaining users.

Despite Blur's noteworthy growth and strategic user engagement, web traffic volume remains comparatively low. As can be seen from the graph, Blur is far ahead of OpenSea in trading volume. In contrast, the cumulative web traffic disparity between Blur and OpenSea is more than a hundred-fold. This discrepancy highlights intriguing dynamics within the NFT marketplace sector, suggesting that high trading volume does not necessarily correlate with equally high web traffic.

OpenSea has historically dominated in both web traffic and investor count compared to Blur, although the gap between the two platforms is gradually closing. The trading behavior on Blur is characterized by larger transactions, driven by its targeted incentive system and airdrops, appealing to a specific segment of high-volume traders within the market. Conversely, OpenSea functions more broadly as a marketplace and has established itself as a primary information hub for the wider public interested in NFTs.

3. RWA(Real World Assets)

"RWA" is arguably one of the most important keywords in this boom period. The RWA market can be categorized into two main types. The first is the direct market, where investors invest directly in RWA products, and the second is the indirect market, where investments are made indirectly. This dichotomy is similar to the distinction observed in traditional financial markets between direct investments in equities, as seen on exchanges like Nasdaq, and indirect investments through vehicles such as funds.

For example, INX and Securitize are platforms where investors directly invest in RWA tokens. Conversely, setups like MakerDAO represent the indirect market approach, where investors deposit stablecoins into the platform, which then allocates these funds into RWA products under its management.

Despite the significant attention garnered by RWAs (Real World Assets), the direct investment market within this space has seen relatively limited interest. This trend is likely due to the stringent qualifications required for investors to participate directly, coupled with the market's current inclination towards indirect investment methods. The indirect investment market presents fewer qualification constraints, thereby enabling a broader investor base to engage. This accessibility is a key factor driving growth in the indirect investment sector.

The recent announcement that BlackRock, a leading global asset manager, has submitted plans to the SEC for launching a BUIDL fund in collaboration with Securitize marks a significant turning point for the direct investment market. The involvement of a heavyweight institutional investor like BlackRock is poised to enhance the credibility of the direct investment sector, drawing increased attention from both individual investors and affluent entities.

4. Re-staking Protocol

Re-staking protocols offer users the innovative capability to re-stake tokens that are already staked within one protocol onto additional protocols. This method not only provides an avenue for users to accrue additional rewards but also simultaneously enhances the security of multiple networks.

These protocols provide smaller blockchain projects the ability to bolster their security by leveraging tokens from established and validated chains, such as Ethereum. This symbiotic approach benefits both investors seeking higher returns and emerging protocols in need of enhanced security measures. The ecosystem for re-staking protocols is expanding swiftly, with EigenLayer at the forefront of this innovative trend.

This growth is also evident in web traffic data. Since the launch of EigenLayer, there has been a consistent uptick in web traffic to related protocols. Platforms like Puffer, alongside other entities within the re-staking ecosystem, have observed a continuous upward trend in their web traffic.

The increasing web traffic with re-staking protocols affirms their role as innovative catalysts within the staking ecosystem. During this current period of growth, re-staking protocols are anticipated to be central drivers of expansion in the staking market, heralding a new era of opportunities and developments in blockchain technology and investment strategies.

5. Closing thoughts

In this two-part series, we've explored the blockchain market from the perspective of web traffic, a metric that has not traditionally received as much attention as other analytical factors.

By examining web traffic data from exchanges, our analysis reveals the substantial influence of prices determined by external markets. Furthermore, the relatively subdued activity of retail investors suggests that it's premature to declare the market is in a full-blown boom phase.

In the second installment of our analysis, we expanded our focus beyond exchanges to encompass the broader blockchain marketplace. Media and NFT marketplaces have not yet experienced the level of significant growth observed in previous periods. While RWA has emerged as a key buzzword, its actual growth has not met market expectations. On the other hand, re-staking protocols, which have emerged during this boom, have been growing rapidly with high interest from participants across the market.

We hope that this series will remind market participants of the importance of this often-overlooked analytical element of web traffic and provide a more nuanced view of the blockchain market.

Get 20% off your SEABW ticket today!

Join us at the biggest blockchain event of the year in Southeast Asia! This is your chance to connect with industry leaders, explore innovative blockchain solutions, and engage in valuable networking opportunities. The event runs from April 22nd to 28th in Bangkok.

Exclusive Offer for Our Readers: Use code TIGERR20 to receive 20% off your general admission tickets. Tickets are limited — secure yours now to ensure your spot at this event. (Discount automatically applied through the link below).

Get 30% off the biggest SEABW side event: ONCHAIN 2024

Tiger Research is a proud media partner of ONCHAIN 2024.

As Asia’s first Real-World Asset conference, the event will feature speakers including leaders from global financial institutions, leading RWA protocols and regulators.

Get a glimpse into the future of RWA tokenisation at ONCHAIN 2024: April 26th, Bangkok!

Enter code “tiger30off” to receive 30% off your tickets to the event.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.