TL;DR

Coinone and Bithumb, two of South Korea's major cryptocurrency exchanges, recently listed stablecoin USDT on the Korean won market, marking a significant change in the South Korean cryptocurrency market.

Bithumb has been able to attract customers from global exchanges such as Binance by listing USDT along with its promotional activities such as zero trading fee policy, which has led to a rise in trading volume.

The Bank of Korea has consistently expressed concerns about stablecoins and is currently focusing on developing CBDCs as an alternative to stablecoins.

Continued USDT listings on Korean exchanges

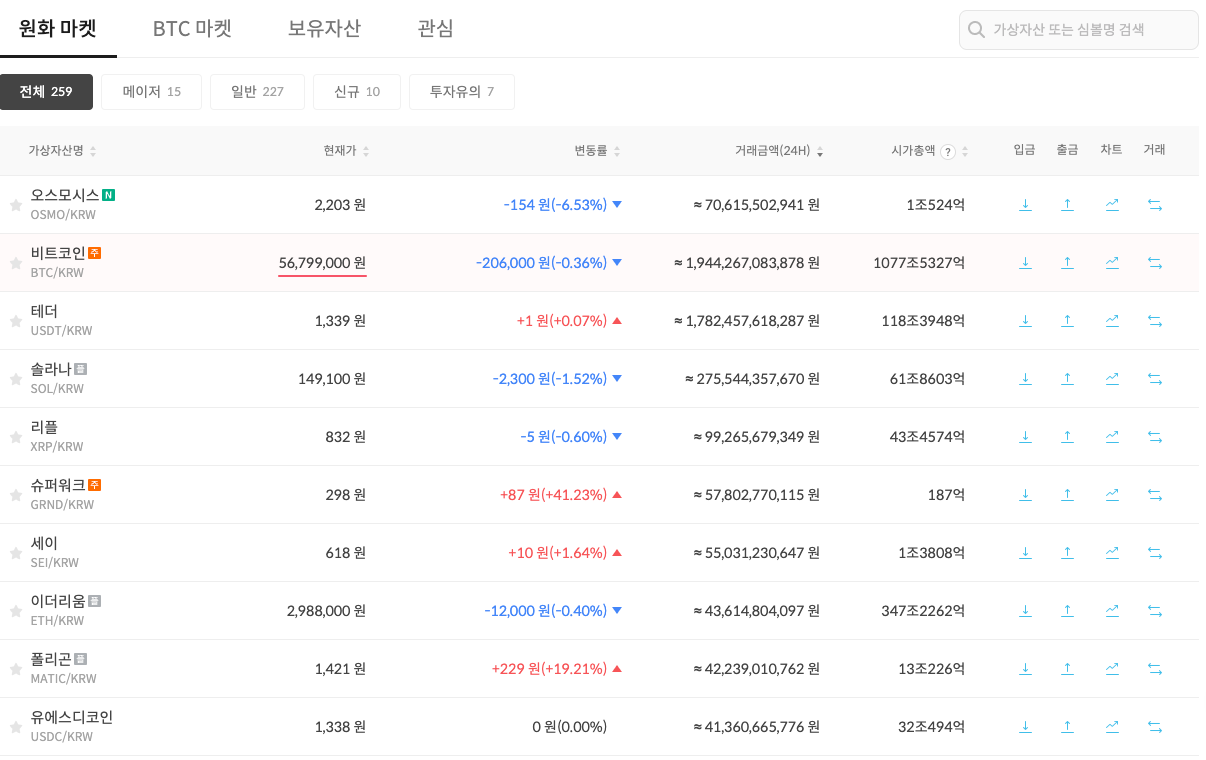

Recently, Coinone and Bithumb, two of South Korea's leading cryptocurrency exchanges, each listed USDT (Tether) on the KRW (Korean Won) market, marking a significant shift in the Korean cryptocurrency trading scene. Coinone made its first foray into the market by listing USDT on December 1st, and Bithumb followed suit a few days later on December 7th. As a globally popular stablecoin, USDT aims to maintain a 1:1 peg to the U.S. dollar, making it an important asset that provides stability and convenience in trading. The listing of USDT by major Korean exchanges shows their intention to 1) strengthen the connectivity of the local cryptocurrency market to the global market and 2) increase the competitiveness of their exchanges.

This is not the first listing in South Korea. Huobi Korea had already listed USDT on its KRW market on January 4th, 2019. However, after the mandatory VASP notification in 2021, only exchanges that have received a real-name account from Korean banks were allowed to operate KRW markets. Huobi Korea could not receive a real-name account and thus was unable to continue supporting USDT trading in the KRW market. However, Upbit, Bithumb, Coinone, Korbit, and Gopax, the five exchanges that can operate the KRW market, have not supported USDT trading until now.

Why hasn't USDT been supported until now?

One of the main reasons why South Korean crypto exchanges have been hesitant to list global stablecoins such as USDT in the KRW market is due to the uncertainty over regulations related to foreign exchange trading by financial authorities. Since stablecoins pegged to the dollar can perform currency exchange functions, trading stablecoins in fiat currency is closely linked to foreign exchange regulations.

However, there is no clear definition of whether stablecoins fall under the definition of "payment instrument" in the Foreign Exchange Act or are part of capital transactions, and the Ministry of Economy and Finance has not announced a clear position yet regarding the matter. As a result, it is unclear whether stablecoins are subject to foreign exchange regulations.

In December 2022, the Bank of Korea announced its advocacy for special measures to exempt transactions via cryptocurrency exchanges from foreign exchange reporting requirements, citing similar legislation in Japan. This is because stablecoins traded by exchange users who have undergone KYC (identity verification) procedures are traceable, which may resolve the uncertainty to some extent. In addition, local exchanges have "travel rules," which are rules concerning the movement of cryptocurrencies, that can control the extent of immediate withdrawals. Finally, cryptocurrencies such as USDT are not considered foreign exchange until they are converted into actual dollars, so it seems that the Bank of Korea found no problem with listing stablecoins for trading in KRW markets.

What has been the impact of stablecoin listing?

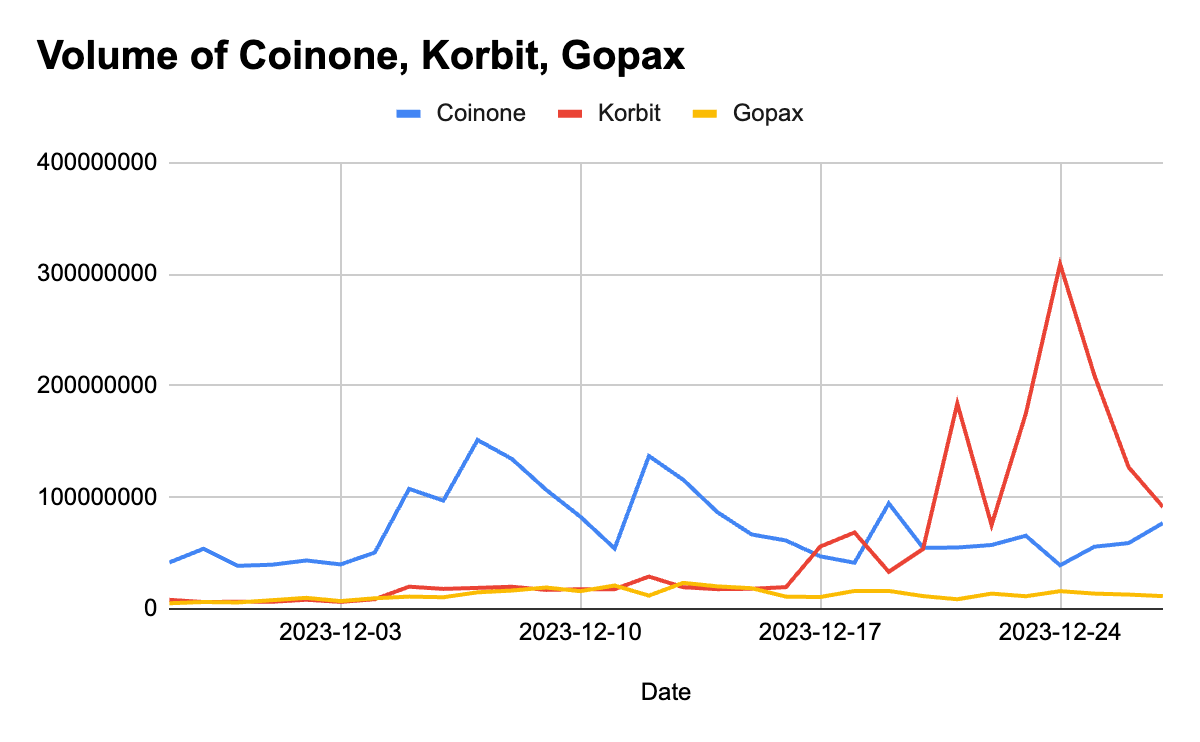

Unlike Upbit's 90%+ market share in the past, Bithumb's share has increased significantly. On the 27th, Bithumb even surpassed Upbit in trading volume. Market sentiment indicates that Bithumb's zero trading fee policy is probably the biggest factor in its market share gains. However, it seems that stablecoins have contributed more to Bithumb's market share than many realize. Bithumb started gaining more market share from the 7th, the day USDT was listed on Bithumb.

In particular, stablecoins seem to have played an important role in attracting Korean customers who use global exchanges such as Binance to Bithumb. This is because using global exchanges usually requires trading in crypto assets that act as an intermediate bridge, but Bithumb's support for USDT to KRW trading has made it easier to use global exchanges without this extra step. With Bithumb's zero trading fee policy, there is no barrier for users to use the exchange. With USDT currently trading at a 3% higher price in Bithumb due to the kimchi premium, it also provides arbitrage traders with a stable source of revenue.

Without USDT listed, the average trader using global exchanges would usually follow the steps listed below to convert crypto assets into KRW:

Buy crypto assets such as TRON with low volatility and low transaction fees on local exchanges such as Bithumb.

Deposit the purchased crypto to their global exchange wallet.

Trade in the global exchange by selling the deposited cryptocurrency for USDT, etc.

Purchase a cryptocurrency listed in local exchanges, such as TRON, for the purpose of converting the assets to fiat currency.

Deposit the purchased crypto to their local exchange wallet.

Trade the deposited crypto for KRW and transfer to their bank acocunt account.

Coinone's situation is somewhat different. Despite listing USDT on its KRW market, it did not have the same effect as Bithumb because there was no reason for Coinone to attract global customers. The main difference is that Bithumb had a strong incentive in the form of free trading fees, whereas Coinone did not.

Uncertainties remain

As recently stated by Bank of Korea Governor Lee Chang-yong, the proliferation of stablecoins is seen as a challenge to traditional fiat currencies. This in turn emphasizes the need for the introduction of central bank digital currencies (CBDCs). He also pointed out that stablecoins, being pegged to fiat currencies, exhibit less volatility and have international usage. This gives them the potential to influence the already existing financial system and diminish the demand for traditional fiat currencies. Furthermore, he highlighted the concern that the unstable value of unregulated stablecoins could pose risks to the stability of the current financial system.

Currently, the Bank of Korea is accelerating its CBDC development by partnering with information technology firm LG CNS to develop a system for CBDC utilization testing. This can be interpreted as a response to the increasing proliferation of stablecoins. CBDCs are digital currencies issued and managed directly by central banks. Unlike stablecoins, they have the potential to increase the efficiency of monetary policy while maintaining the stability of the financial system.

In addition to CBDCs, there are still uncertainties related to the listing of stablecoins in Korean exchanges. Concerns about the instability of stablecoins have been ongoing since the Terra-Luna incident. The possibility of government sanctions also cannot be ruled out. USDT was recently implicated in a 16 billion KRW (approx. 12.4 million USD) financial crime in Korea.

In this situation, how Coinone and Bithumb respond and come up with solutions is very important. Their compliance and interpretation of the law will likely influence other exchanges' listing decisions in the future, which could have a significant impact on the entire cryptocurrency market.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.