USDT's Survival Saga: Can the King of Stablecoins Weather the Storm?

Stablecoin giant faces pressure to adapt to changes or lose its throne

This report was written by Tiger Research, analyzing USDT's market dominance, regulatory challenges, and future prospects in the evolving stablecoin landscape, with a particular focus on the impact of EU's MiCA regulations.

TL;DR

The Regulatory Gauntlet: USDT remains the most traded stablecoin, but escalating regulatory pressures, including EU delisting under MiCA, threaten its dominant market position.

Transparency and Competition: Transparency concerns and competition from compliant rivals like USDC and DAI could erode USDT’s trust and market share unless full audits and compliance reforms are prioritized.

Global Growth Potential: Emerging markets and global adoption provide USDT with growth potential, but its survival depends on navigating regulatory landscapes and restoring confidence through innovation and transparency.

1. The Rise and Challenges of USDT

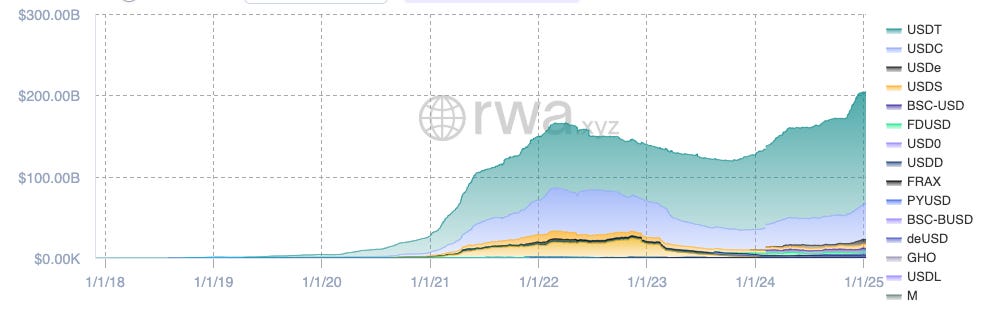

Despite these challenges, USDT remains crucial to crypto markets. Its daily trading volume now exceeds the combined volume of Bitcoin, Solana, USDC, and Ethereum. This report examines how potential EU restrictions could affect USDT, reviews its history and controversies, and considers its future in the changing cryptocurrency landscape.

Despite these challenges, USDT remains crucial to crypto markets. Its daily trading volume now exceeds the combined volume of Bitcoin, Solana, USDC, and Ethereum. This report analyzes potential EU regulatory impacts on USDT. It explores the token's history and controversies and assesses its future in an evolving cryptocurrency landscape.

2. The History of USDT: A Timeline of Growth and Controversies

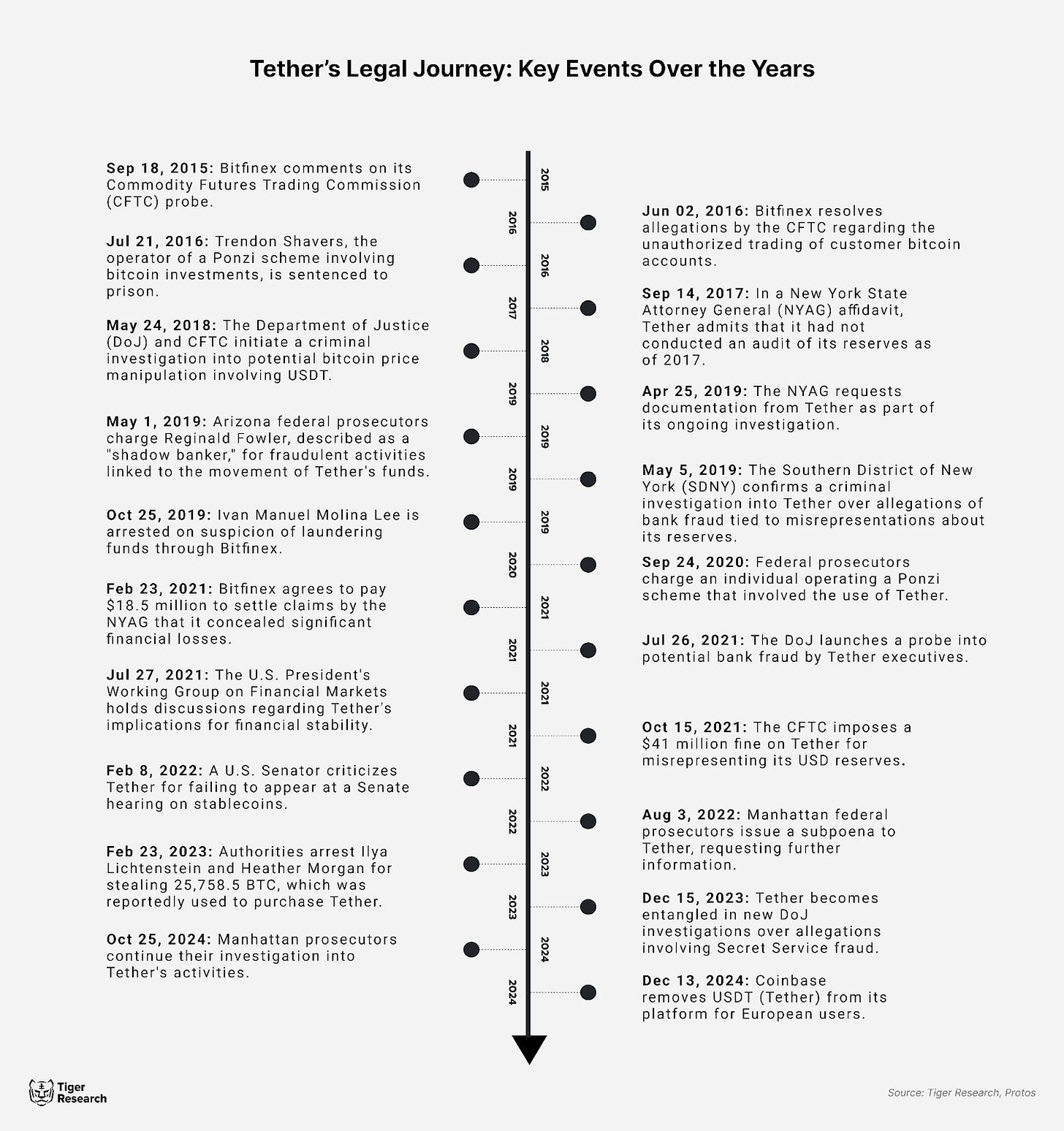

Tether faced controversy from day one. The company claimed USDT was 100% backed by dollar-based reserves. Yet markets and regulators remained skeptical due to unclear asset management and refusal to verify its reserves.

2015: Bitfinex, associated with Tether, comments on a Commodity Futures Trading Commission (CFTC) probe, marking the start of regulatory scrutiny.

2017: Allegations emerged questioning whether USDT was fully backed, sparking concerns about market manipulation.

2019: A New York Attorney General probe found Tether's reserves included unsecured loans, deepening market doubts. That year, authorities charged "shadow banker" Reginald Fowler with fraudulent handling of Tether funds.

2020: Federal prosecutors charged a Ponzi scheme operator who used Tether, exposing the currency's risk of fraudulent use.

2021: Tether settled with the NYAG, agreeing to increased transparency but admitting no wrongdoing. Additionally, the CFTC fined Tether $41 million for false claims about USD reserves.

2022: A Manhattan U.S. Attorney subpoenaed Tether for more information on its reserves, amplifying scrutiny over its financial practices. Separately, a U.S. Senator criticized Tether for failing to attend a key Senate hearing on crypto regulation.

2023: Tether faced new DoJ probes for alleged Secret Service fraud, raising fresh concerns about its compliance practices.

2024: Coinbase removed USDT from its services in Europe, citing compliance requirements related to the MiCA regulation.

USDT has kept its market dominance despite controversies. Strong demand from Asian users, especially on Binance, secured its leading position. The market grew less concerned about USDT's risks when regulatory threats failed to materialize into sanctions. Tether's effective handling of regulatory challenges built market confidence. By late 2024, USDT reached an $83 billion market cap.

The EU's MiCA regulation presents an unprecedented challenge for USDT. Unlike the fragmented regulatory landscape in the US, the EU implements comprehensive and strict standards for stablecoins. Despite Tether's past successes, MiCA brings a level of scrutiny the company has never faced.

3. The Impact of EU MiCA Delisting: The Potential Fallout and Market Shifts

MiCA regulations have reshaped Europe's crypto market since taking effect on December 30, 2023. These rules pose a major challenge for Tether. While USDT remains legally compliant, Coinbase's delisting decision has heightened market concerns.

MiCA groups crypto assets into two categories: Electronic Money Tokens (EMT) and Asset-Referenced Tokens (ART). The law puts stablecoin issuers under European Banking Authority oversight. Issuers must now secure licenses to continue operating.

Collateral asset custody requirements present the toughest licensing challenge. MiCA requires stablecoin issuers to keep most collateral with European banks. Currently, USDT holds 83% of its reserves in U.S. Treasury bonds and cash equivalents. Moving these assets to European institutions carries major risks. The EU's 100,000-euro deposit protection limit complicates matters. Large deposits with third-party banks could threaten Tether's stability.

Tether's reluctance to comply with MiCA rules puts its European trading at risk. This could lead to reduced liquidity and split markets.

Stablecoins power over 50% of European crypto trades, according to a 2024 Chainalysis report. Such high market share means regulatory shifts could disrupt the entire market. Coinbase's move to delist USDT shows the real effects of these uncertainties.

USDT's potential exit creates problems across the market. Small exchanges may lose access to key liquidity pools, limiting their trades. DeFi projects using USDT could face EU restrictions on their services. Large institutions could switch to other stablecoins, but none match USDT's liquidity and reach.

The regulatory landscape adds another layer of complexity to this situation. While no law bans USDT outright, vague requirements have split the market response. Major exchanges like Binance and Crypto.com have chosen to continue offering USDT, relying on MiCA's "grandfathering" clause for temporary regulatory relief.

The impact of EU regulations extends beyond its borders. Western countries typically align their financial regulations to maintain market consistency. A MiCA-triggered ban on USDT could prompt similar restrictions across Western nations, deeply affecting global crypto markets.

The inconsistent implementation timelines across EU member states present additional challenges. France allows 18 months for adaptation, while the Netherlands requires compliance within 6 months. These varying deadlines make it harder for Tether to maintain uniform operations across EU markets, potentially weakening its position as a leading stablecoin provider.

4. USDT’s Survival Test: Will It Remain the King of Stablecoins?

USDT faces its greatest challenge as regulations and new rivals transform the stablecoin market. While its resilience stems from unparalleled adoption and liquidity, several factors could determine its future:

4.1. Enhanced Transparency and Regulatory Compliance

Currently, Tether releases quarterly reports on its reserves. The 2024 disclosure shows 85% of assets in cash and cash equivalents, with the rest spread across other investments. Yet MiCA's strict standards demand more thorough audits than Tether's current practice.

The company is taking concrete steps toward regulatory compliance across different markets. In Europe, Tether is partnering with MiCA-compliant Quantoz to establish legal currency issuance. The company has also obtained a Digital Asset Service Provider (DASP) license in El Salvador, demonstrating its commitment to meeting region-specific regulatory requirements.

4.2. Political Strategy in the Trump Era

Tether is pushing to enter the U.S. market. CEO Paolo Ardoino announced plans in January 2025 to expand while following U.S. regulations. This commitment gained support through Tron founder Justin Sun's $75 million investment in World Liberty, given Tron's ties to Tether.

Tether's active regulatory strategy reflects USDT's key market role. Its large Treasury bond holdings make it a significant player in the U.S. economy. This alignment of interests with the U.S. government creates a foundation for potential institutional protection.

Tether has adopted a strategic approach to market entry. Rather than directly complying with strict European regulations, the company chose to leverage its relationship with the U.S. government. However, this strategy has risks. The Trump administration's "America First" stance could favor domestic providers like USDC.

These political dynamics suggest a regional division in the stablecoin market. USDT is likely to keep its lead in Asia, where Binance dominates trading. Meanwhile, USDC could control Western markets through Coinbase's influence. This regional divide reflects how geopolitics may reshape the global stablecoin map.

5. Conclusion: The Road Ahead for USDT and the Crypto Ecosystem

MiCA marks a turning point for USDT and the stablecoin market. While possible EU delisting threatens USDT's liquidity, this challenge could also push Tether to adapt and strengthen its global position.

Tether's future leadership depends on transparency and compliance. Its recent moves - partnering with Quantoz in Europe and obtaining an El Salvador DASP license - demonstrate flexibility. These efforts must now expand worldwide to meet varied regulations.

Geopolitics will also shape USDT’s future. Its U.S. Treasury holdings and focus on the American market position it as a key player, though the Trump administration’s "America First" policy may favor U.S.-based rivals like USDC in Western markets. In Asia, USDT's strong position through Binance and high demand secures its role in emerging markets.

Tether's success in 2025 hinges on managing diverse regional regulations while building on its widespread adoption. A focus on transparency, compliance, and key partnerships will help shield against future regulatory challenges.

Ultimately, USDT's journey reveals how the crypto market is maturing alongside global regulations. Meeting these challenges head-on will strengthen USDT's position and raise standards for stability in digital finance.

🐯 More from Tiger Research

Read more reports related to this research.🎯 Newsletter Pick of the Week

If you want to stay ahead of crypto trends, you've got to check out Hashtalk. It's must-read newsletter for getting the latest crypto insights before everyone else.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.