Web3 Gaming: It's Not Over Till It's Over

The Crisis and Opportunity of Web3 Gaming Beyond the Market Spotlight

This report was written based on insights from Mike Kang, our advisor at Tiger Research, examining the current state and future potential of Web3 gaming, from early P2E models to the integration of AI and blockchain technologies.

TL;DR

Web3 gaming saw rapid growth starting with Axie Infinity in 2018, but currently holds only single-digit market share in the cryptocurrency market, while AI-related projects dominate with over 70% share.

As of 2023, 29 out of the top 40 gaming companies, including Nexon and Krafton, have expanded into Web3 business to overcome market growth limitations.

For sustainable growth of Web3 gaming, the market needs impactful success stories first, and it's worth examining promising projects that can deliver such results.

1. The Rise and Fall of Web3 Gaming

Axie Infinity, launched in 2018, marks the starting point of Web3 gaming. As a pioneer of the P2E (Play-to-Earn) system, the game captured market attention with its NFT-based 'Axie' characters that players could collect and develop. It opened new horizons for Web3 gaming by guaranteeing true digital property rights for game items through blockchain technology and enabling secure marketplace transactions.

In 2022, The Sandbox emerged as a UGC (User-Generated Content) platform. Similar to Roblox, it introduced a new paradigm where gamers could create content and monetize their work using blockchain technology. Through continuous development, it maintains an innovative business model that protects creators' intellectual property rights and enables revenue generation.

Most recently, Hamster Kombat drew industry attention as a Telegram-based T2E (Tap-to-Earn) game with 950 million MAU. It successfully lowered entry barriers by combining simple tapping mechanics with marketing tools.

Currently, AI-related projects dominate the cryptocurrency market with over 70% of market interest, while the gaming sector follows with single-digit market share. This concentration of interest has led to an undervaluation of Web3 gaming's innovation and growth potential.

This report aims to analyze in depth why many gaming companies entered the Web3 gaming market and why the sector has since lost momentum.

2. Stalled Gaming Industry Growth: Traditional Gaming Companies' Web3 Ventures

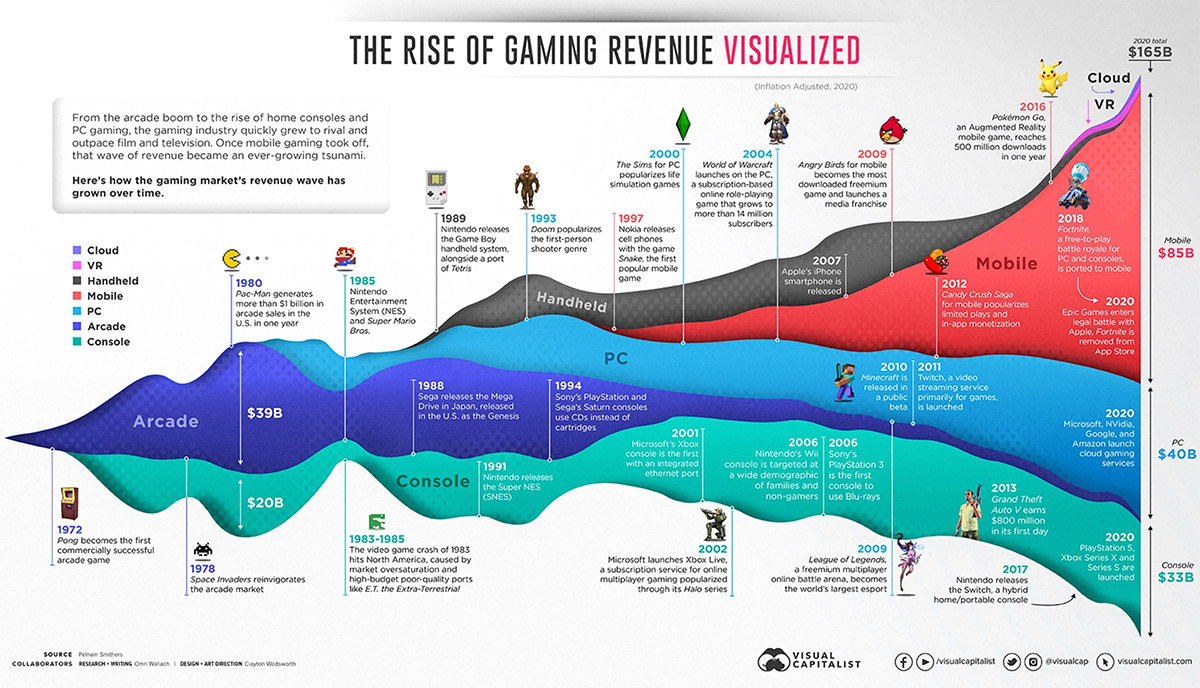

Mobile gaming transformed the gaming industry. According to Newzoo, global gaming revenue grew from $70.6 billion in 2012 to $187.7 billion in 2024. Notably, the rise of smartphones made games more accessible, driving revenue to 18% in 2012, reaching 49% 2024 – an approximately 2.7 times increase from 2012.

Also, the mobile gaming market is expected to reach $110.9 billion by 2025 and $181.9 billion by 2030, according to Mordor Intelligence. However, industry experts warn that the market may be nearing its peak growth potential.

The gaming industry is seeking new directions as mobile gaming growth slows. While cloud gaming and AR/VR initially showed promise, high development and infrastructure costs limited their adoption.

Web3 gaming has since emerged as an appealing alternative. Its ability to generate quick returns with lower development costs has sparked industry-wide interest in its growth potential.

In particular, Axie Infinity demonstrated Web3 gaming's potential in Southeast Asia, a traditionally challenging market for conventional games. With a smaller team and lower development costs, it reached 2.7 million daily active users and a $3 billion valuation. This success showed companies that Web3 gaming could expand their market reach and create new growth opportunities in an increasingly competitive industry.

Consequently, major gaming companies rushed to enter the market. As of 2023, 29 out of the top 40 gaming companies, including Take-Two Interactive, Nexon, and Bandai, are pursuing Web3 initiatives. Nexon successfully completed the second test of MapleStory's Web3 version, while Krafton is accelerating the development of its Web3 game 'Overdare' in preparation for market entry.

3. The Disconnect Between Gaming Industry and Web3 Ecosystem: An Uneasy Coexistence

The dramatic decline of Axie Infinity exposed the structural problems in the Web3 gaming ecosystem. User numbers plummeted from 1.48 million in March 2022 to 800,000 in April. The AXS token value also crashed by around 96%, falling from its peak of $164.90 to $7.11, shattering market expectations. While many analysts focused on sustainability issues, the core issue was a deeper mismatch between the gaming industry and the Web3 ecosystem.

Game development is a long-term project requiring substantial time and capital investment. AAA games typically need 3-7 years of development time and cost between$50 million to over $200 million. For example, "Red Dead Redemption 2" took 8 years to develop with an estimated $500 million development budget and around $300 million in marketing costs. Games naturally tend to lose users over time, making initial quality and continuous updates essential. While P2E games tried to break this formula, most have since lost their appeal.

Gaming platform businesses also require long-term development. Steam, currently dominating the PC gaming market, launched in 2003 amid skepticism from gamers. Nonetheless, the platform grew steadily by continuously adding games and improving its platform, finally capturing 70% of the downloadable PC gaming market by 2011. It was an eight-year journey to establish market dominance.

In contrast, the Web3 market shows a distinctive pattern of initial excitement followed by a quick decline. Interest in new meta and investment opportunities surges and fades quickly. This short-term attention economy of Web3 directly conflicts with gaming's long-term development needs, making sustainable growth difficult.

4. The Revival of Web3 Gaming: Awaiting Success Stories

While early Web3 games have struggled, the technology's potential in gaming remains compelling. Features like in-game trading, digital ownership, and player-driven economies align naturally with blockchain capabilities, keeping gaming companies interested in the space.

Three key challenges need to be addressed for sustainable market growth: building a stable ecosystem, designing balanced token economics, and ensuring quality gameplay. Moreover, the industry needs success stories from established companies to overcome the negative perception created by early project failures.

4.1. Major Success of Large-Scale Games

In this context, there are high expectations for the launch of major Web3 games like MapleStory and Overdare. Both games have been carefully developed by established gaming companies over a long period, so their performance will be worth watching. MapleStory, in particular, is expected to successfully onboard loyal users by leveraging its existing IP.

4.2. Integration with AI

Krafton's upcoming game OverDare is gaining attention for its AI integration. At CES 2025, they showcased their 'Co-Playable Character' technology that enables NPCs (Non-Player Characters) to interact naturally with players. Though not yet released, Overdare will provide a UGC (User-Generated Content) platform where users can create and trade their own content. This aligns with the market's current interest in 'AI-agents' and could offer a solution to the 'attention economy' challenges faced by Web3 games.

4.3. All-Out Effort in Accessible Markets

However, regulatory clarity is as crucial as technological innovation. Even established IPs like MapleStory face service restrictions in Korea, and several countries lack clear regulatory frameworks for blockchain gaming.

Kaia, formed by the merger of Klaytn and Finschia, presents an interesting case. Its integration with LINE messenger, which has 200 million users, shows promise in Asian markets with more flexible Web3 gaming regulations, such as Taiwan, Thailand, Indonesia, and Japan. Some services like Mini Universe are already public, and their performance will be worth monitoring.

While Web3 gaming currently receives limited market attention, it could serve as a bridge between emerging technologies like AI and the metaverse. The industry awaits innovative projects that can turn these possibilities into real achievements.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.