TL;DR

The negative stance of U.S. regulators toward the Web3 market and the lack of clarity in regulation have led many Web3 companies to turn their attention to Asia, particularly Japan, where the government and market have recently adopted a proactive stance.

Japan's Web3 market is a great opportunity for global Web3 companies due to 1) state-led regulatory reform and industry-friendly policies, 2) long-standing experience of key infrastructure companies, and 3) an underdeveloped Web3-related ecosystem.

However, in order to achieve long-term success in the Japanese market, it is important to fully understand 1) the unique language and cultural characteristics of Japan and 2) the conservative and cautious nature of doing business in Japan before setting a long-term strategy.

Asia's regulatory environment: A contrast to Western countries

One of the key issues currently impacting the Web3 market is the regulatory environment. Regulatory policies in different countries are having a major impact on the global strategies of Web3 companies. In particular, as U.S. regulators are 1) confrontational about the Web3 market and 2) showing an uncertain regulatory direction, many projects are moving to Asia, which has a comparatively supportive environment for the Web3 industry and clearer regulatory standards.

Especially among Asian countries, Singapore, Hong Kong, and Dubai, are among the city-states that have been home to many Web3 companies due to their Web3-friendly environments and relatively clear regulations. Recently, many eyes have turned to Japan, as the country has been making aggressive changes to overhaul its Web3 regulations. Many Web3 companies are realizing the potential of the Japanese market again, with Mitsubishi UFJ Financial Group holding strategic discussions on stablecoins and tokens.

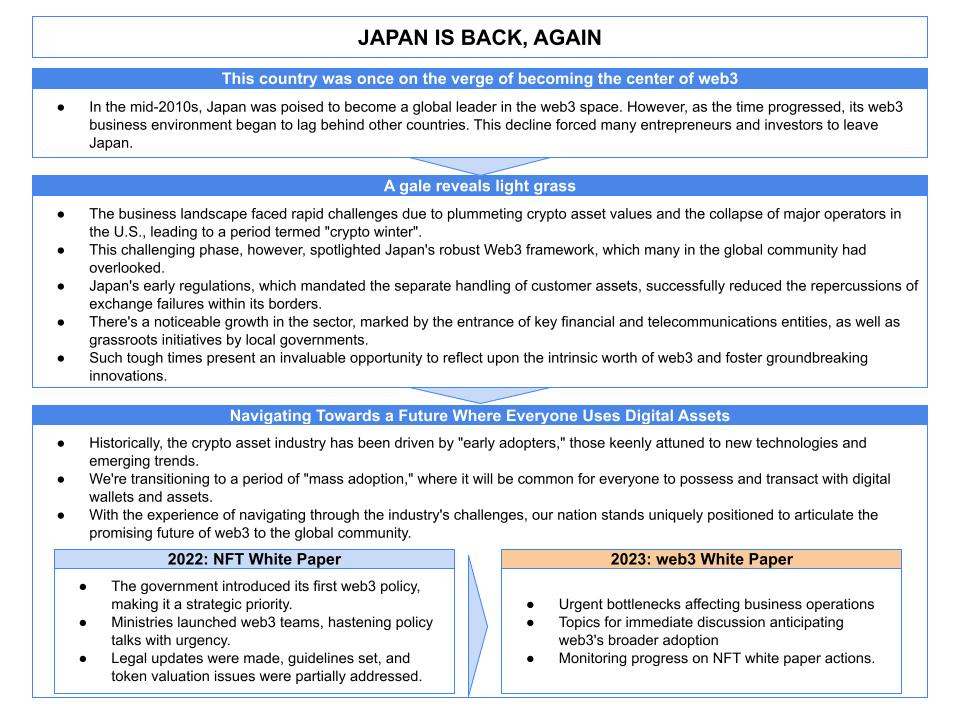

JAPAN IS BACK, AGAIN

In April 2023, the LDP released the "Japan 2023 Web3 White Paper" under the slogan "JAPAN IS BACK, AGAIN". In it, Japan clarified its regulatory direction to revitalize the cryptocurrency and Web3 industries, particularly focusing on 1) tax reform, 2) token review/issuance/distribution, and 3) NFT-related regulatory improvements.

Regarding the taxation of tokens, the income tax on profit from token value appreciation will be adjusted lower than its original maximum of 55%, and it is expected that holding tokens issued by the company or tokens of other companies that are not intended for short-term trading will be exempt from tax. Regarding token examination/issuance/distribution, the government plans to refine the examination criteria to include tokens from foreign companies, and revise stablecoin-related regulations. In addition, the government will take a strong stance against negative uses of NFTs, such as gambling and money laundering.

Specific support for Web3 revitalization at the national level and regulatory improvements such as the above are said have made Japan an oasis for Web3 projects currently mired in regulatory uncertainty. In addition, the fact that these policies are industry-friendly is expected to have a positive impact on the actual business environment. For these reasons, Japan seems grabbing the interest of the global Web3 market.

Japanese market: One step ahead of the market

Historically, the development of the Web3 industry in Japan has been one step ahead of the global market. In 2014, Japan was leading the Web3 market with the cryptocurrency exchange "Mt. Gox" having the largest trading volume in the world. At that time, the global market was still in its infancy, and the Web3 market was just beginning to take off.

However, with the $500 million hack of the exchange, the Japanese Web3 market went into a deep recession and Japanese regulators took a conservative stance. On the other hand, the global market during this period showed a frenzied growth centered on DeFi and NFTs. However, this growth also faltered with the FTX and Terra incidents.

Since then, while Western countries are currently experiencing negative sentiment and an unfriendly regulatory environment, Japan has been building momentum on a national level with the slogan "JAPAN IS BACK, AGAIN" to lead the Web3 market once more.

Having experienced market fluctuations at a faster pace, Japan has learned many lessons from past crises and global changes. This has led to a more solid foundation than other countries. Against this backdrop, it is expected that Japan will be able to effectively derive the necessary regulations and support measures to revitalize the Web3 market, for which Web3 companies have high hopes.

The void left by enterprise-focused Web3 attempts

Japan's substantial Web3 efforts are centered on large corporations and include security token offerings (STOs) and stablecoins. In particular, major financial institutions are taking the lead in STOs, with SBI Holdings gaining market attention by tokenizing its bond issuance. Mitsubishi UFJ Financial Group has also unveiled Progmat, a solution that issues stablecoins and supports tokenized securities and utility tokens.

However, there is a paradox in the midst of all this conglomerate-driven movement. It is the absence of new Web3-related startups and lack of investment. Although various projects and initiatives are being undertaken under the leadership of large companies, it is the participation and innovation of SMEs and startups that will lead to the overall revitalization of the Web3 industry. Currently, the number of new Web3-related startups in Japan is low, and investment is limited.

Therefore, global projects that are native to Web3 currently have a great opportunity in the Japanese Web3 market. While the Japanese Web3 industry is largely driven by large corporations, this corporate-centric structure is not always able to meet the diverse needs of the rapidly changing Web3 environment. Therefore, projects that specialize in Web3 and have global competitiveness will be able to enter the Japanese market and fill the gap that has been left unfilled.

Conclusion

The Web3 industry has attracted attention from around the world as the center of change and innovation. At the center of this space is Japan, showing new signs of revitalization through various attempts and changes, and is attracting attention as a new outpost for global Web3 companies.

By building trust in Web3 through government initiatives and providing a supportive and regulatory environment backed by experience, Japan has become a new land of opportunity. In particular, the corporation-centric environment will be a great opportunity for global Web3-native projects.

However, there are a few things that global Web3 companies should be aware of as they navigate the Japanese market. Japan has language and cultural barriers. This requires a deep understanding and appropriate response from foreign players if they want to achieve success. In addition, Japanese entrepreneurs are traditionally cautious and conservative, which can slow down the adoption of innovative ideas and business models. These limitations must be taken into account when organizing a Japanese market entry strategy for global Web3 companies.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.