Cambodia Climbs 13 Spots in Web3: Growth Amid Regulatory Shadows

Risks and opportunities created by regulatory ambiguity

TL;DR

Cambodia jumped 13 spots in the Crypto Adoption Index with a significant increase in centralized services use, but DeFi services fell.

There are conflicting stances among regulators, with the National Bank of Cambodia (NBC) taking a hardline stance on cryptocurrencies. The Securities and Exchange Regulator of Cambodia (SERC) is more open-minded and has approved the licensing of exchanges.

Lack of regulation and a high corruption index have led to concerns about illegal money flowing into the country, but this lack of clarity can be an opportunity for new blockchain projects.

1. Why is There Growing Interest in Cambodia?

Cambodia is emerging as a new hub in the global Web3 market. According to Chainalysis' latest report, Cambodia's global cryptocurrency adoption index has risen by 13 spots to 17th place from last year.

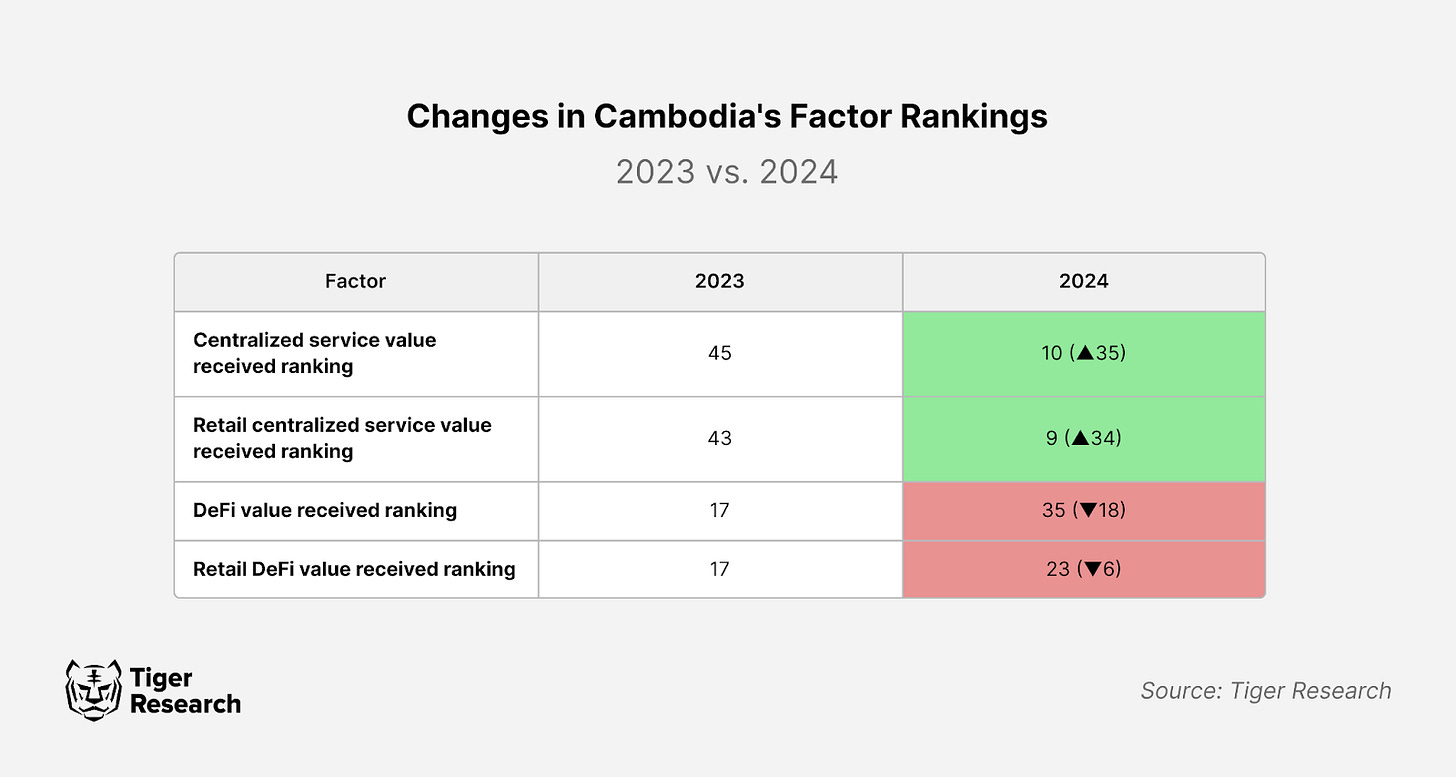

The primary driver of this growth is the increased use of centralized services. Notably, Cambodia moved up 34 spots to rank 9th in "retail centralized service value received" for transactions under $10,000 and 35 spots to 10th in "centralized service value received" indicating a rise in retail investor participation that has facilitated overall centralized service usage.

However, DeFi service usage showed a decline, with related indicators "DeFi value received ranking" and "retail DeFi value received ranking" dropping by 18 and 6 places. Although Chainalysis’ ranking is adjusted by GDP per capita (PPP) and may not reflect the absolute transaction volume level, Cambodia’s significant rank fluctuations were significant enough to draw attention.

Despite the rising interest in Cambodia, available market information remains limited. This report will analyze Cambodia’s current market conditions, identify the causes of recent changes, and explore emerging opportunities.

2. Cambodia's Macro Environment

Cambodia has recently accelerated reforms alongside political stabilization. Former Prime Minister Hun Sen handed over the position to his son, Hun Manet, in August 2023, following a 38-year rule. The Cambodian People’s Party (CPP) won 120 of 125 seats in the 7th general election, securing a dominant victory. Hun Sen retains key roles, including party leadership and Chairman of the Royal Advisory Council, to stabilize the new government’s operation.

A complete generational shift in leadership has occurred, with children of former high-ranking officials assuming key ministerial positions. This generational shift has raised expectations for change and reform.

Cambodia’s reform efforts have improved the investment climate. Qualified investment projects (QIPs) receive tax exemptions for 3-9 years, with tax deductions for R&D and human resource development. 100% foreign-owned companies can be established, and profit remittance abroad is unrestricted. This has created a favorable environment for foreign businesses to enter the Cambodian market.

These efforts have also led to the growth of Cambodia’s economy. It sustained 6-7% growth over 20 years before the pandemic and rebounded quickly post-pandemic. The country’s young demographic and growing middle class enhance its appeal as a consumer market.

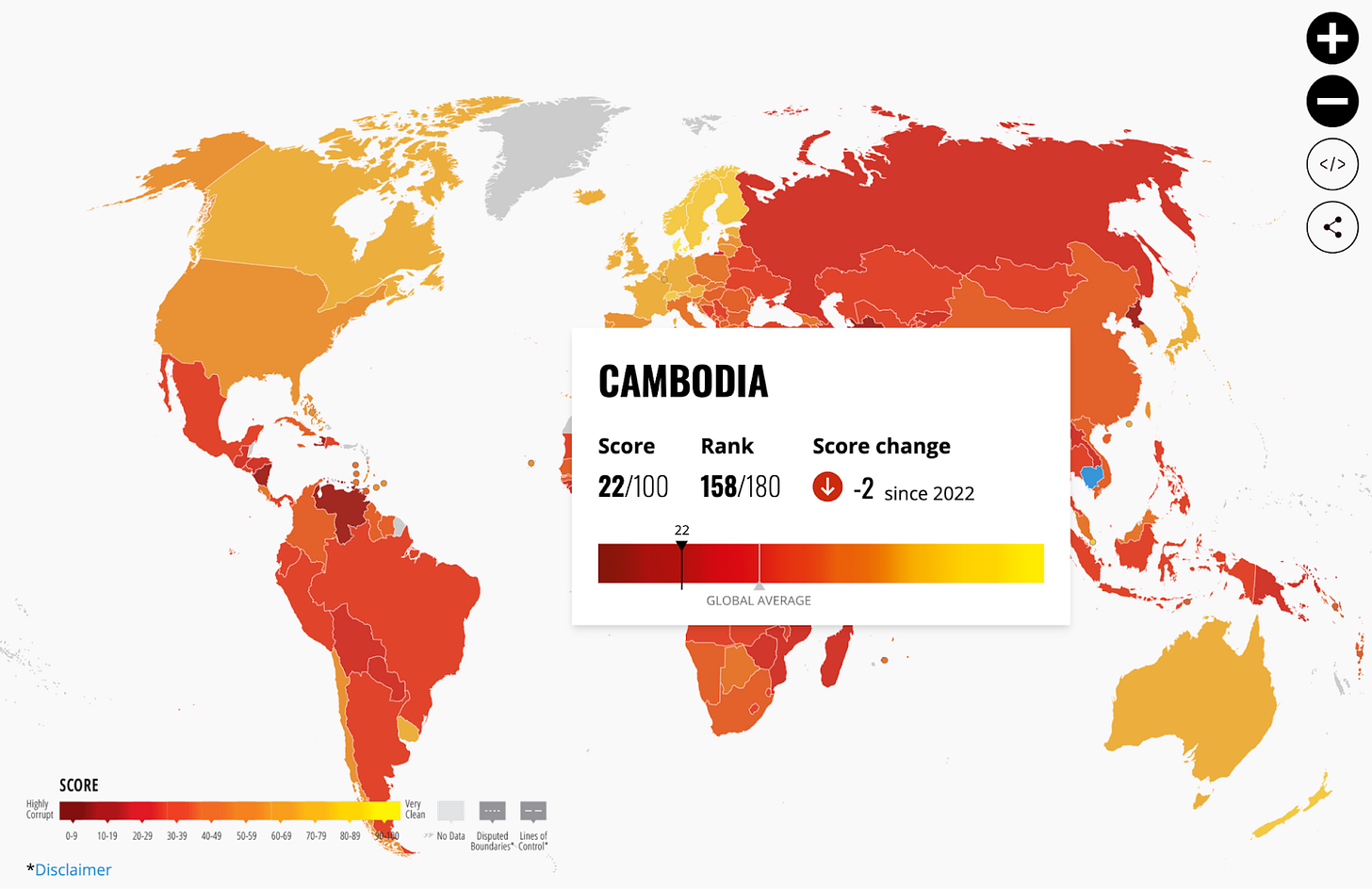

Despite these positive developments, Cambodia still faces challenges with transparency and corruption. In Transparency International’s 2022 Corruption Perceptions Index, Cambodia ranked 150 out of 180 countries. Arbitrary decisions by tax authorities continue to inconvenience foreign investors. Paradoxically, this lack of transparency presents an opportunity for blockchain to drive growth.

Cambodia offers a dynamic market environment and open investment policies, though transparency and corruption issues persist. Experimental services leveraging blockchain technology could provide a breakthrough in addressing these regulatory ambiguities and lead to rapid growth for applicable sectors.

3. Cambodia’s Blockchain Market Environment

3.1. Cryptocurrency Regulation

Cambodia does not have clear definitions or regulations for cryptocurrency but has issued statements outlining regulatory intentions. The National Bank of Cambodia (NBC) and the Securities and Exchange Regulator of Cambodia (SERC) hold differing views on crypto regulation.

Initially, both agencies opposed unlicensed cryptocurrency transactions, particularly with fiat on-off ramps through local bank accounts. While the NBC maintains a strict stance on cryptocurrencies, the SERC is gradually adopting a more open approach.

The NBC restricts only stablecoin transactions, while the SERC allows all types of securities transactions, provided that KYC regulations are followed. In July 2022, the SERC signed a regulatory MOU with Binance. In December 2022, it introduced a “sandbox framework,” granting the first exchange license.

In early August 2024, during an event organized by European Chamber of Commerce in Cambodia(EuroCham)’s Digital and Technology Committee, NBC Deputy Director Ouk Sarat revealed a draft "Cambodian Crypto Asset Regulation." The draft categorizes cryptocurrencies into two groups with differentiated regulations: tokenized assets representing traditional financial products (Group 1A) and stablecoins (Group 1B) are conditionally permitted, while non-backed crypto assets like Bitcoin (Group 2) remain banned.

3.2. Current Market Situation

Despite regulatory confusion, Cambodia's cryptocurrency adoption rate remains high. As mentioned, Chainalysis reported that Cambodia’s global cryptocurrency adoption index rose by 13 places to 17th. Notably, the national blockchain-based payment system, "Bakong," boasts a 65% utilization rate of among citizens, indicating strong acceptance of blockchain technology.

Cambodian investors primarily use Binance, with around 200,000 users on the platform. However, Binance does not support Khmer, Cambodia's official language, causing inconvenience for local users. In this context, Cambodia’s first official digital asset exchange, RGX (Royal Group Exchange), has launched with approval from SERC. Developed with technical support from a tech solutions provider called X-Codes Solutions, RGX supports trading in over 100 cryptocurrencies and offers futures trading with leverage up to 25x, catering to various trading needs.

However, RGX lacks certain technical features, such as a trading calculator, liquidation price display, and direct fiat-to-crypto trading. NBC approval for integration with the banking system and a SERC framework for issuing security tokens are required to address this problem. RGX must also improve security, customer service, UI/UX, and trust. Given the persistent global hacking incidents affecting crypto exchanges, security remains a top priority for the exchange.

In February 2024, SERC signed an MOU with Cambodian company KS Green to establish Cambodia’s first security token exchange. This exchange, set to launch by mid-May, is expected to focus on carbon credits, with the potential for tokenizing various assets like stocks, bonds, and real estate.

3.3. Illicit Crypto Funds

Cambodia’s high corruption index and limited regulatory framework have raised concerns about the inflow of illicit funds into the crypto market. According to a recent Chainalysis report, the online marketplace Huione Guarantee processed approximately $49 billion in crypto transactions since 2021.

Although positioned as a marketplace for real estate and automobile transactions, a significant portion of its transactions is suspected to be illicit, involving frequent conversions across borders, cash, stablecoins, and Chinese payment apps.

A report from the U.S. Institute of Peace suggests that similar criminal activities may be linked to transnational organizations operating in Southeast Asia’s economic zones, with Cambodia, Myanmar, Laos, and the Philippines as key locations. This substantial inflow of funds may have contributed to the rise in transaction volume within Cambodia's centralized services. Reports of such incidents are common in local crypto news, highlighting the need for a structured regulatory system to support healthy market growth.

4. Recommendations for Cambodian Market Entry

The Cambodian market currently reflects investor enthusiasm and capital influx, exploiting regulatory gaps amid differing stances from the National Bank and the Securities and Exchange Regulator. While this unstable environment can be seen as risky, it also provides advantages for industry growth. For instance, Cambodia’s openness to industry input, as demonstrated by the MOU with Binance, may be well-suited for the blockchain sector, where regulatory structures are not firmly established.

Unlike established blockchain hubs like Hong Kong, Singapore, Dubai, and Abu Dhabi, Cambodia’s minimal regulatory environment could offer opportunities for new projects. This market could appeal to founders from neighboring countries seeking to escape strict regulations, entrepreneurs wishing to test innovative business models that use blockchain technology, and those with networks in local government and regulatory bodies.

However, for large established projects, this uncertainty could present significant risks. Additionally, the market faces entry barriers, such as: 1) only 33% of adults holding bank accounts, 2) around 7.7 million adults lacking access to banking services, 3) low per capita income, and 4) language barriers that may limit the entry of certain services.

Considering these local characteristics, Cambodia presents both opportunities for financial inclusion and considerable entry barriers. A phased, long-term approach is necessary, focusing on collaboration with local financial infrastructure to manage risks while developing the market.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.