This report was written by Tiger Research, analyzing how Malaysia’s builder community has emerged as a hidden force behind global Web3 leaders. We thank Lydian Labs, host of MYBW 2025, for their support of this research.

Key Leaders Insights

1. Introduction

Tiger Research served as the official research partner for Malaysia Blockchain Week, the country's leading blockchain event hosted by Lydian Labs. The most notable aspect was the active participation of regulatory authorities, who had previously maintained a conservative stance on the crypto industry, engaging in constructive discussions for industry development.

Government involvement signals Malaysia's crypto ecosystem moving toward institutional acceptance. The event connected diverse industry participants and expanded government-private sector communication channels. Tiger Research conducted interviews with officials, experts, and local teams during the event. These conversations provided on-ground insights that strengthen this report's analysis.

2. Malaysia Crypto Market: Three Key Words You Need to Know

Malaysia's crypto market has three key features: Southeast Asia's melting pot, a breeding ground for global champions, and the world's Islamic finance center.

Malaysia is multilingual, with populations fluent in Malay, English, Chinese, and Tamil. This diversity creates natural East-West cultural integration. Malaysia also holds a strategic location. From Kuala Lumpur, major Southeast Asian cities like Ho Chi Minh, Bangkok, and Jakarta are within two hours by air. This accessibility enables collaboration across diverse cultures and accelerates business expansion.

These conditions foster globally-minded talent. Beyond language skills, people naturally develop cross-cultural understanding. Despite Malaysia's small market size, major crypto projects originated here. Etherscan, Jupiter, Virtuals Protocol, and CoinGecko all started in Malaysia and now have global reach.

Malaysia's Islamic finance integration creates unique opportunities. Malaysia runs the world's largest Islamic finance center, making Shariah compliance mandatory for crypto businesses. This requirement generates innovation rather than constraints. Malaysia first recognized cryptocurrency as Shariah-compliant, launched Shariah Bitcoin funds, and enabled crypto zakat payments. These developments connect crypto to the global Islamic finance market, projected to reach $10 trillion by 2030.

3. Malaysia's Crypto Regulation Evolution

Phase 1: Establishing Digital Asset Regulatory Framework (2019-2020)

Malaysia was among the Asian countries that quickly established regulatory frameworks for digital assets. In 2019, the Capital Markets and Services (Prescription of Securities) (Digital Currency and Digital Token) Order 2019 classified digital assets into Digital Currency and Digital Token categories. Assets meeting specific criteria became securities under Securities Commission Malaysia (SC) oversight.

The SC revised its Recognized Markets guidelines, requiring Digital Asset Exchanges (DAX) to register as Recognized Market Operators (RMO). Exchanges had to meet strict requirements: minimum paid-up capital of RM5 million (approximately $1.25 million), stringent governance standards, and local incorporation. These measures strengthened exchange stability and investor protection.

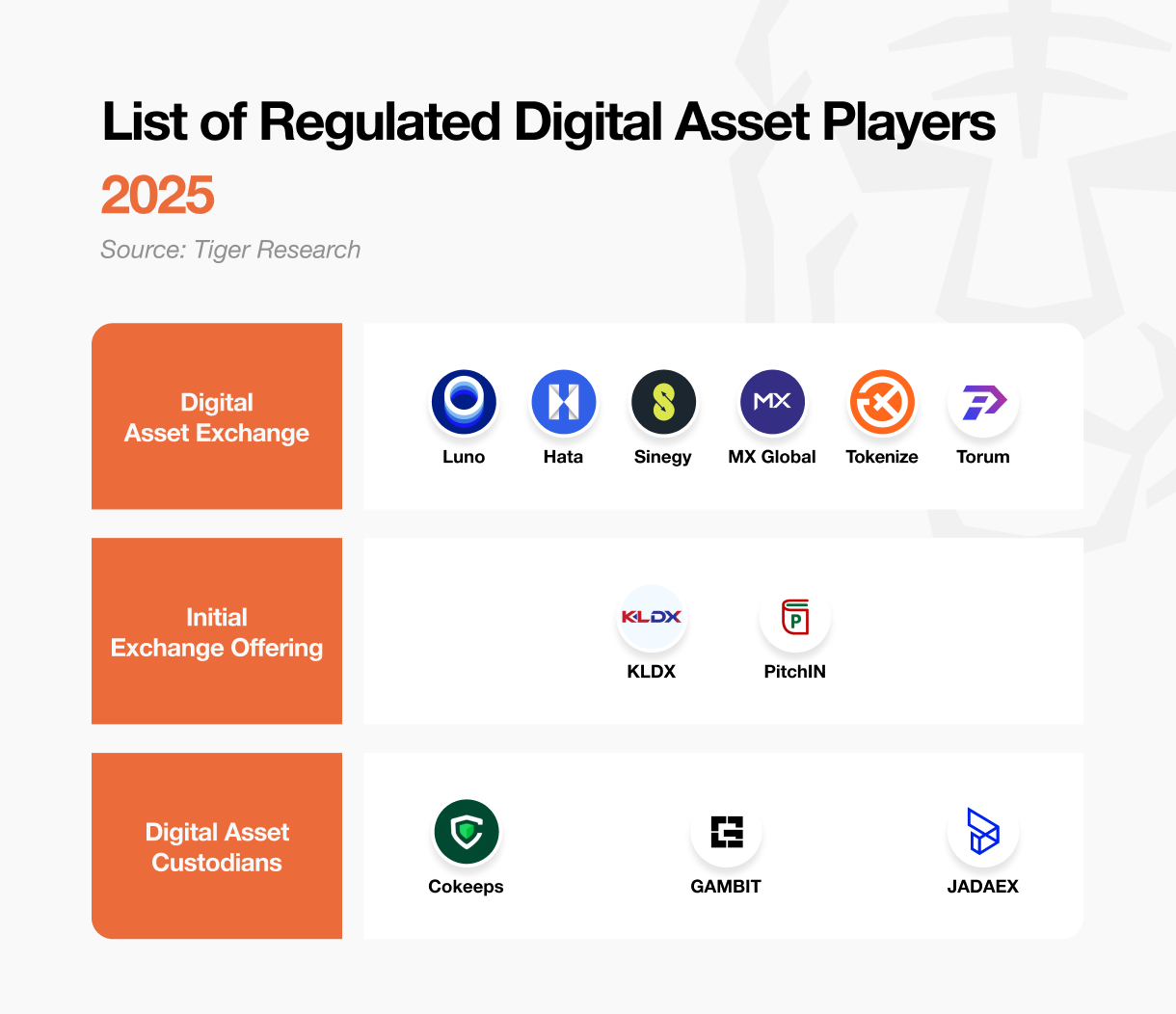

Regulated Entity Types:

DAX (Digital Asset Exchange) Operator: Provides cryptocurrency spot trading services through order book or broker models

IEO (Initial Exchange Offering) Operator: Manages token issuance and investor recruitment platforms in regulated environments

Digital Asset Custodians (DAC): Offers cryptocurrency custody and management services for institutional and retail investors

In 2020, Malaysia published detailed operational guidelines that strengthened the regulatory foundation. These guidelines classified IEO and DAC as separate business categories, each requiring RMO registration. This created tailored regulatory standards for each business type based on their specific characteristics.

As of 2025, 12 companies operate as digital asset RMOs: 6 cryptocurrency exchanges, 4 custody service providers, and 2 IEO platforms.

Phase 2: Strengthening Enforcement and Blocking Foreign Exchanges for Investor Protection (2021-2024)

After establishing the regulatory framework, the SC strengthened enforcement through active market control. Rather than stopping at rule-making, the SC actively blocked illegal elements to enhance regulatory ecosystem credibility and safety.

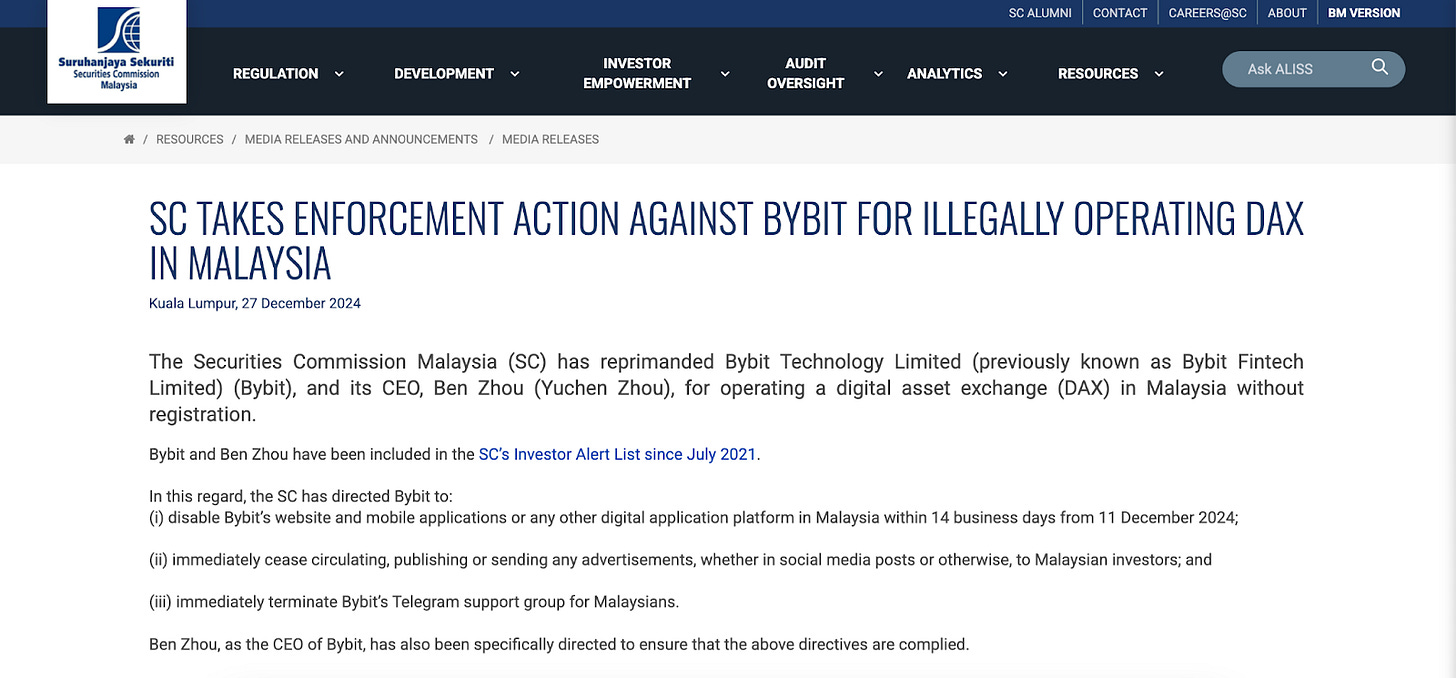

The SC pursued two core objectives: maintain regulatory consistency by blocking unregistered foreign exchanges operating illegally in Malaysia, and prevent investor harm from unauthorized platforms. The SC created an 'Investor Alert List' to warn users in advance. This list included global exchanges like Binance and Bybit. The SC repeatedly emphasized that trading on these platforms receives no protection under Malaysian law.

From 2021, the SC shifted from passive measures to direct, forceful enforcement. In July 2021, the SC ordered Binance to cease services to Malaysian users within 14 days and close all channels including its website. After 2022, as the crypto market faced global crises including FTX's bankruptcy and Terra Luna's collapse, Malaysia intensified its regulatory approach. The SC noted these incidents occurred in unregulated environments and applied similar measures to unauthorized exchanges like Huobi and Bybit.

These measures went beyond formal sanctions. Regulators implemented comprehensive blocking and market exit strategies. The SC collaborated with ISPs to block target exchanges' websites and requested Google Play Store and Apple App Store to remove exchange apps. Simultaneously, the central bank and tax authorities instructed local banks to prohibit deposit and withdrawal services with unauthorized platforms. Authorities also strengthened sanctions against individual investors. Confirmed use of P2P trading or unauthorized exchanges resulted in bank account freezes, financial product restrictions, and early recall of auto and mortgage loans.

Phase 3: Post-Trump Malaysia's Rapid Transformation (2025-Present)

Malaysia's crypto market has evolved rapidly following Trump's election. Prime Minister Anwar Ibrahim initiated cryptocurrency discussions with former Thai Prime Minister Thaksin in January, then held talks with Binance founder Changpeng Zhao (CZ) in April about developing Malaysia as a digital asset hub. These moves demonstrate Malaysia's intent to lead regional digital finance policy as the ASEAN chair. Malaysia's Web3 market has grown rapidly compared to last year, marking a turning point since Trump's election.

The government's political commitment quickly translated into concrete policy changes. Prime Minister Anwar directly launched the "Digital Asset Innovation Hub" in June 2025 as the first major outcome. Bank Negara Malaysia (BNM) leads this regulatory sandbox. The sandbox will serve as a safe testing environment. It will actively encourage digital asset experimentation and innovation. Digital Minister Gobind Singh Deo also announced the establishment of the "Digital Asset and Blockchain Working Committee" at a blockchain industry roundtable hosted by the Malaysian Digital Economy Corporation (MDEC), demonstrating the government's systematic approach.

Technical infrastructure development has accelerated alongside policy foundation building. Science, Technology and Innovation Minister Chang Lih Kang announced the official launch of Malaysia Blockchain Infrastructure (MBI) at Malaysia Blockchain Week 2025's opening ceremony. The government agency Malaysian Institute of Microelectronics Systems (MIMOS) and local mainnet project Zetrix developed this infrastructure through collaboration. The project explores practical blockchain applications from enhancing government transparency to halal certification and improving trade and supply chain efficiency.

The most notable change is the SC's regulatory relaxation. The SC is shifting from its strict approval-based review model toward significant deregulation through a Consultation paper released in June 2025. As of July 2025, only 23 cryptocurrencies that passed the SC's rigorous review can list on local exchanges. Under the new regulatory framework, exchanges can make independent listing decisions without SC pre-approval, provided they meet specified criteria.

However, Malaysian regulators aren't pursuing simple deregulation. Authorities are strengthening operational requirements like increased exchange paid-up capital and introducing self-regulatory models, while maintaining conservative positions on high-risk cryptocurrencies including privacy coins, meme coins, and stablecoins. This approach seeks balance between market autonomy and stability.

These policy changes demonstrate Malaysia's strategic intent to compete with Singapore and Hong Kong as a major Asia-Pacific Web3 hub. Combined with the Trump administration's pro-crypto policies, Malaysia is positioning itself as a key bridge connecting Western capital with Asian markets.

4. Key Sector Analysis of Malaysia's Crypto Market

4.1. Centralized Exchange

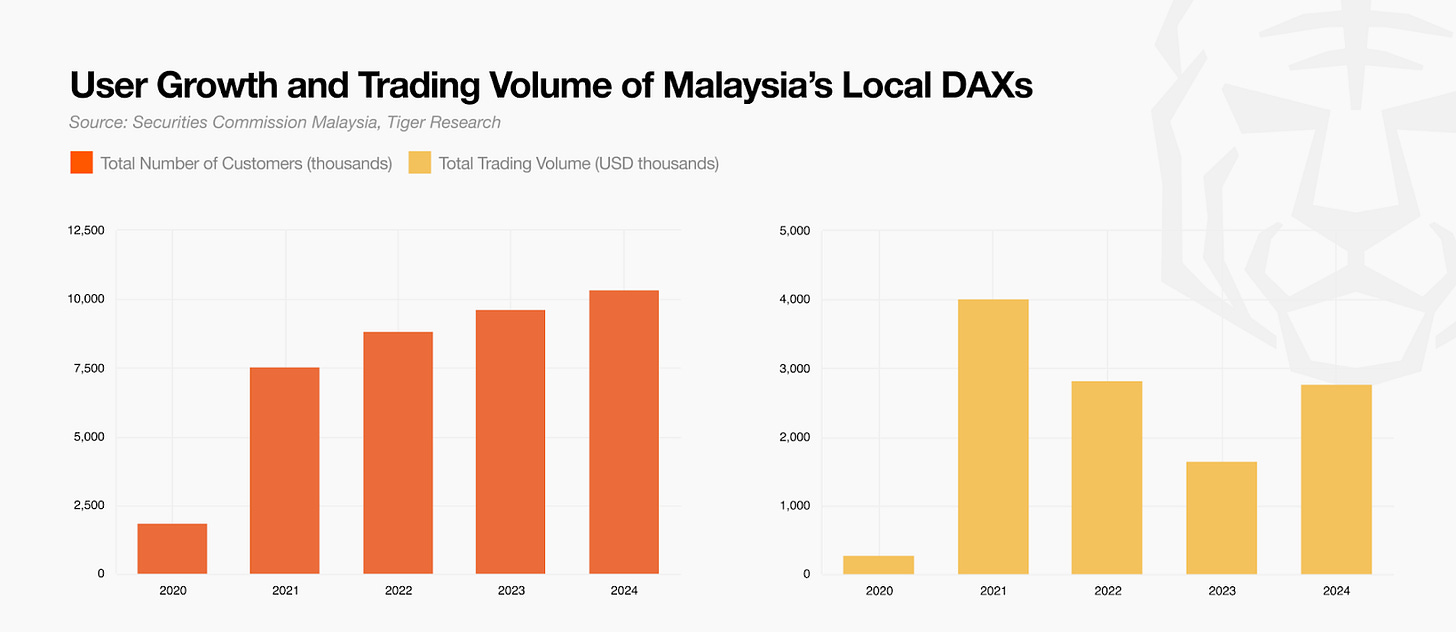

Malaysia operates six recognized local crypto exchanges. Luno dominates with over 90% of local trading volume, creating a winner-takes-all structure similar to other Asian countries like Korea and Thailand. However, newcomer Hata, which launched last year, shows rapid growth and appears to inject new energy into the market. Sinegy also ranks as a major player, providing crypto trading services for corporate and institutional investors.

Local exchanges maintain limited actual influence. Despite regulatory efforts to block unauthorized exchanges like Binance, many investors continue actively using global platforms through workarounds. An estimated 40-60% of Malaysia's total spot crypto trading volume occurs on global exchanges like Binance and Bybit.

Additionally, Malaysia's small crypto market size creates challenges for local operators. While Luno holds over 90% local market share, trading volumes remain limited. Luno's daily trading volume shows approximately a 200-fold gap compared to Korea's Upbit. According to BNM's 2024 annual report, cumulative net deposit outflows from banks to local registered DAX represent less than 1% of total banking system deposits as of end-2024 and around 0.4% of the market capitalisation of securities listed on Bursa Malaysia.

Investors prefer global exchanges due to local platforms' structural limitations. The SC's direct involvement in crypto listings requires strict approval processes. This limits tradeable cryptocurrencies to just 23 options. Low liquidity makes large-scale trading difficult. The absence of margin trading or derivatives reduces investor appeal.

Under these constraints, local exchanges pursue survival strategies by operating parallel brokerage businesses. They provide OTC trading and stablecoin on/off-ramp services outside the exchange. This particularly targets wealthy family offices and digital nomads for additional revenue. This business model emerged naturally from restrictions on major stablecoins like USDT and USDC on local exchanges. Insufficient liquidity for large transactions also contributed to this development.

Malaysia's crypto tax policy significantly influences exchange selection. Crypto profits are classified as income tax rather than capital gains tax. The government taxes only withdrawn amounts. For example, someone holds 10 BTC but withdraws only 1 BTC locally. Tax applies only to the withdrawn amount. Airdrops, staking, and DeFi earnings also face income tax. The government monitors crypto activities by sharing trading data from local exchanges. Authorities impose additional investigations and sanctions for non-reporting. This tracking system appears to be a major factor that deters investors from using local exchanges.

4.2. Stablecoin

Malaysian regulators take a conservative stance on stablecoins. Dollar-based stablecoins like USDC and USDT remain unlisted on local exchanges. While BNM hasn't issued explicit statements on this matter, this cautious approach likely stems from policy priorities. The 1998 Asian financial crisis shaped these priorities when rapid capital outflows caused severe economic disruption. This experience heightened vigilance around local currency stability and foreign exchange management.

The SC's recent consultation paper suggests this cautious approach continues. Authorities clearly identify stablecoins as vulnerable to market price volatility and potentially harmful to local financial system stability. Rather than view them as simple payment tools, regulators view stablecoins as potential macroeconomic risk factors.

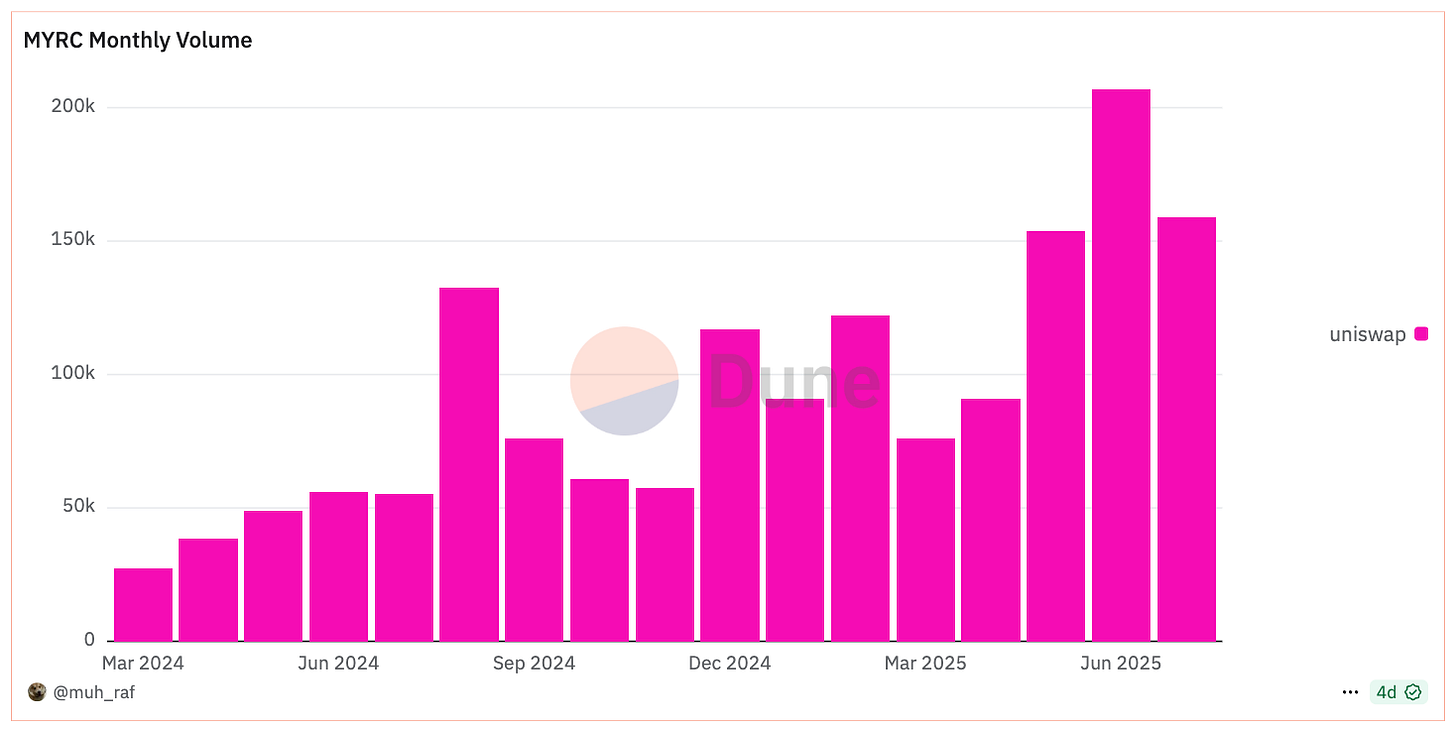

Despite regulatory caution, private sector stablecoin experiments continue. Blox develops 'MYRC,' a ringgit-pegged stablecoin. MYRC operates as a fiat-collateralized stablecoin. The token pegs 1:1 to the Malaysian ringgit on the Arbitrum and Ethereum blockchain. Users can mint MYRC through local bank account deposits via the Blox platform. They can redeem it similarly. MYRC currently undergoes beta testing. The project has achieved approximately $700,000 market capitalization with limited but active trading.

However, regulatory overlap creates project delays. Malaysia's dual oversight between the SC and BNM creates unclear responsibilities and standards. Blox has pursued this project for three years and engaged with regulators. The company remains without final approval due to uncertain regulatory positions. The absence of consistent stablecoin regulatory frameworks represents the core approval delay factor.

Signs of change emerge. Prime Minister Anwar recently announced consideration of regulatory sandboxes through the 'Digital Asset Innovation Hub.' This initiative includes ringgit-based stablecoin experiments. This central bank-led sandbox will provide fintech and digital asset companies with controlled environments. Companies can test new technologies and services in these environments.

Given persistent government concerns about capital controls, initial focus will likely target local financial ecosystem applications rather than cross-border payments. Potential use cases include 24-hour payment infrastructure. This extends beyond traditional 9-hour banking systems. Escrow services can use conditional payment functions. Recent social issues like fitness center closures affect prepaid refunds. Uncertain home renovation contract fulfillment creates opportunities. 'Programmable money' pilot implementations can address everyday financial problems.

4.3. NFT Community

Malaysia's NFT market remains in decline. Many participants who entered during the NFT boom at high prices experienced losses and exited the market. This follows patterns seen in other countries. While some holders of global projects like BAYC, Azuki, and Milady exist, activities remain mostly small-scale hobby gatherings. Malaysia lacks notable locally-grown NFT projects.

The Pudgy Penguins local community stands out as an exception in this environment. The community has built an independent ecosystem in Malaysia that goes beyond simple NFT holder networks. An open operational approach and welcoming culture drive this success. The community welcomes anyone to participate freely regardless of NFT ownership. Entry barriers remain low for newcomers.

Community members naturally connect with people from diverse backgrounds. They form meaningful relationships in a pure fun and positive atmosphere that extends beyond simple information exchange. The community regularly hosts various offline events like wine tastings, go-karting, and pickleball. Members maintain monthly gatherings even during bear markets. The community also actively engages with external communities. Members participate in other community events and collaborate through networking and referrals when requested.

The community is preparing 'MY PENGU ACADEMY,' an onboarding education program for Web3 beginners. This initiative aims to expand the community and diversify participation.

Meanwhile, local exchange Hata listed Penguin-related memecoin $PENGU on its global platform (offshore-only version). Some Malaysian community members trade this through workarounds. Given local restrictions on memecoin trading, this structure likely provides another motivation for community participation.

Malaysia's NFT market operates more on community-based activities than trading. Pudgy Penguins ranks as the most organized and scalable example among these communities. In smaller market environments, offline networks become increasingly important. Pudgy Penguins' operational approach demonstrates significant insights for this context.

4.4. Islamic Finance

Malaysia has established itself as Asia's largest Islamic finance center. The country holds the global #1 position in the sukuk (Islamic bond) market with unmatched status. This foundation stems from a population that is over 60% Muslim. Islamic finance comprises approximately 47% of the entire financial system as of 2024.

This characteristic influences the cryptocurrency industry. Malaysia became the world's first country to officially recognize cryptocurrency as Shariah-compliant assets. The country has approved 15 digital assets as Shariah-compliant. Bitcoin receives this approval. All digital asset recognized market operators in Malaysia must maintain Shariah compliance. Local exchanges Luno and Hata both follow these requirements.

Malaysian regulators interpret cryptocurrency as potentially more Shariah-compliant than traditional finance. Traditional banking systems provide loans based on deposits and collect interest. This potentially violates Shariah's prohibition on riba (interest). Cryptocurrency operates on structures that involve compensation for actual work like network maintenance and transaction verification. Bitcoin mining is considered legitimate compensation for computing-based verification work. Ethereum staking rewards contributions to network validation. These differ fundamentally from interest income.

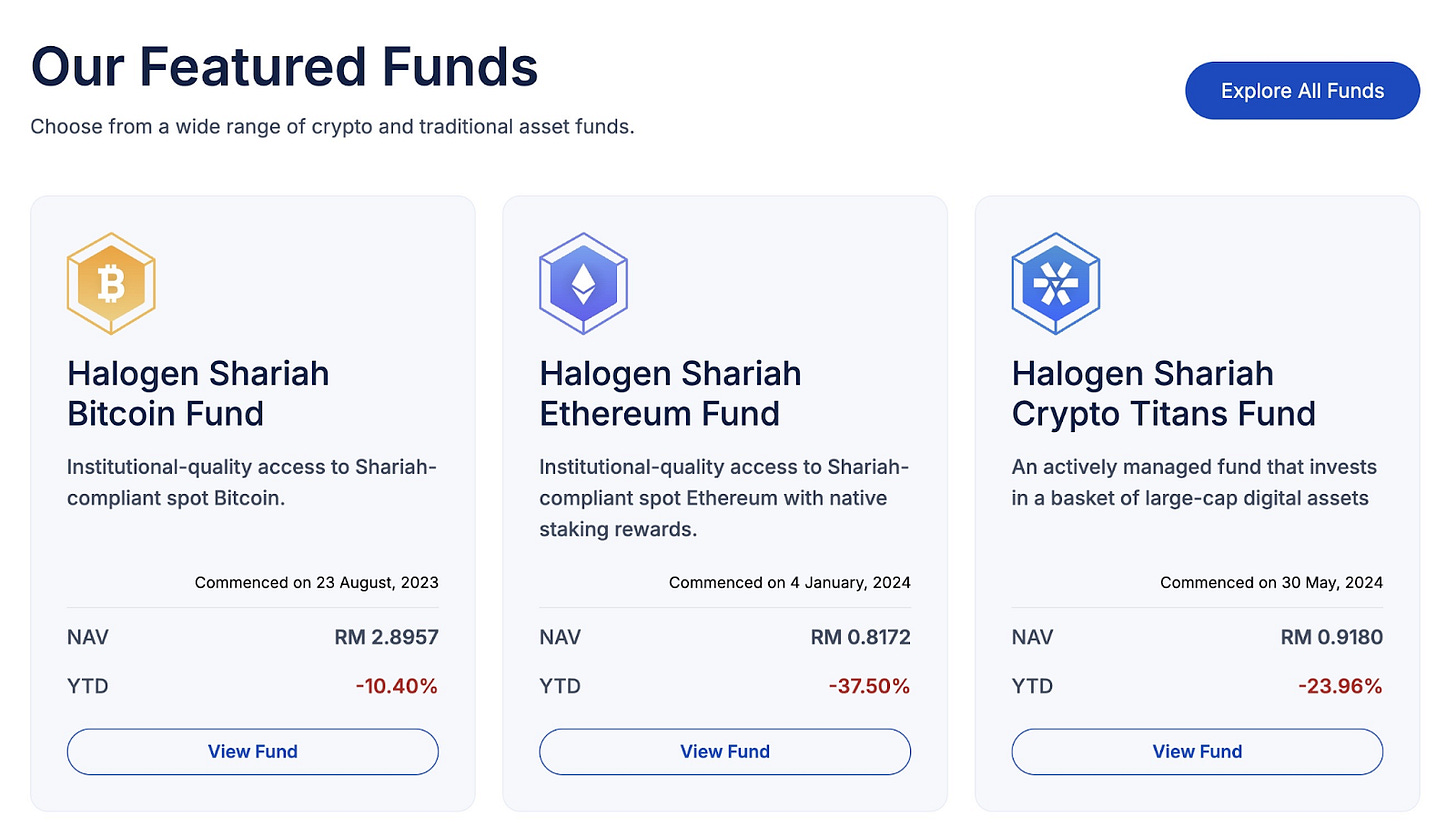

Various Islamic finance-based crypto products have emerged. Halogen Capital operates as the world's first Shariah-compliant crypto mutual fund manager. The company manages approximately $75 million in assets. The company offers Shariah Bitcoin funds, Ethereum funds, and other products.

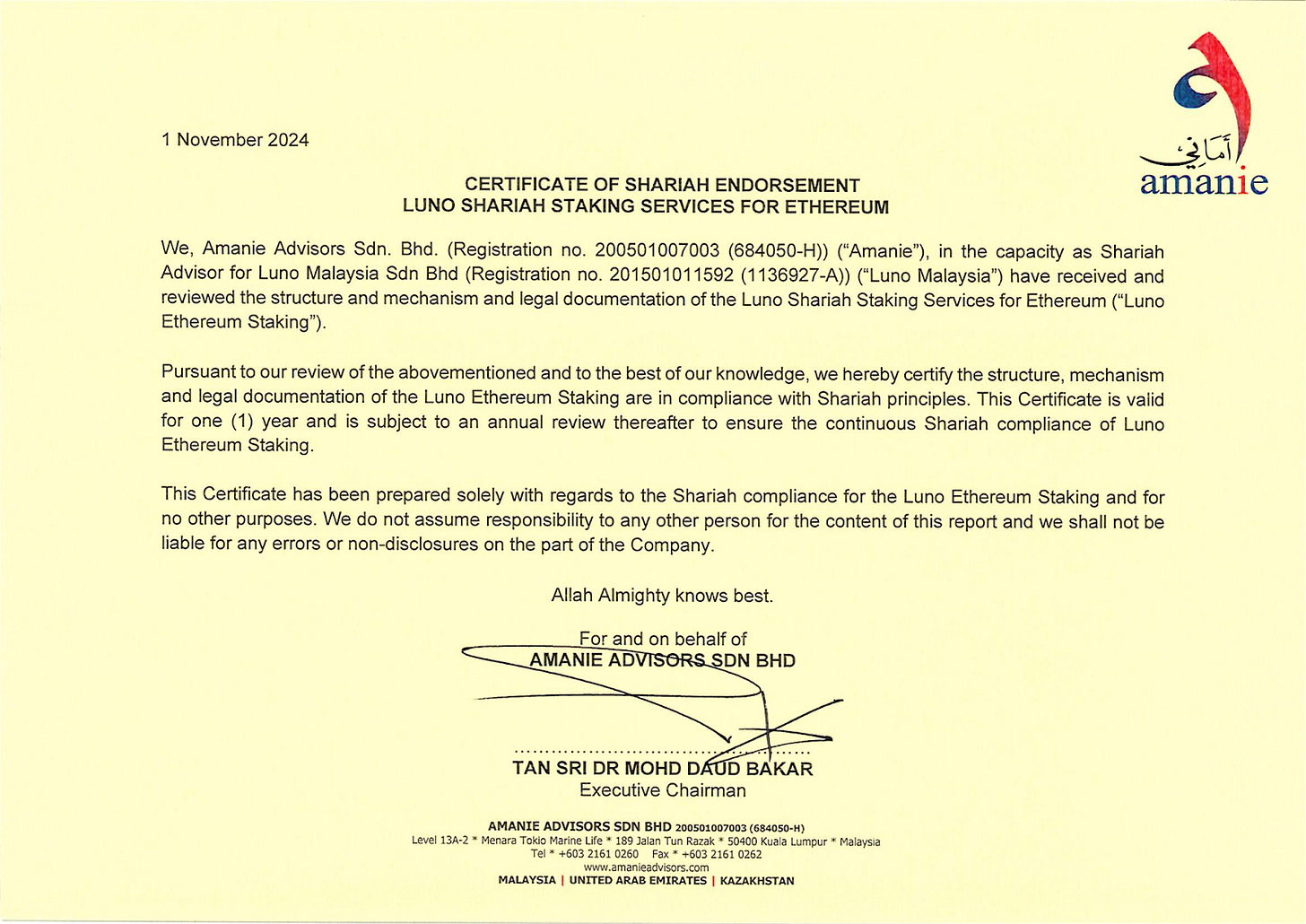

Nawa Finance operates as a Shariah-compliant DeFi protocol. The company partners with Solv Protocol to provide Bitcoin DeFi products. These products meet Shariah standards. These products received Shariah certification from Amanie Advisors. Amanie Advisors is officially registered as Shariah advisors with the SC. The products provide safe and transparent halal revenue structures. Nawa Finance has surpassed $50 million in Total Value Locked (TVL). The company demonstrates notable achievements in Shariah-compliant DeFi.

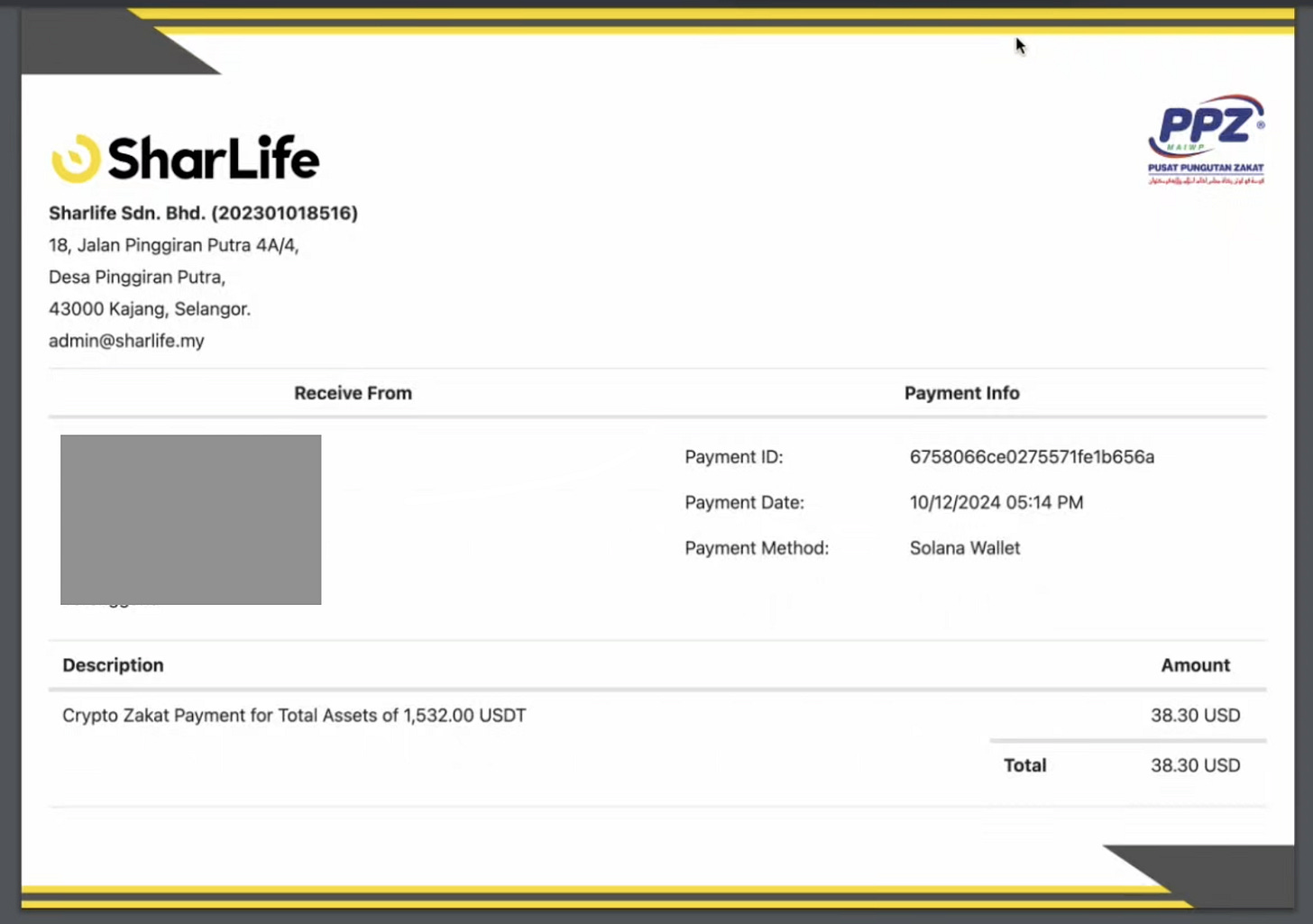

Sharlife shows innovation in Islamic charity systems. The platform enables cryptocurrency payments for zakat (Islamic obligatory charity). Sharlife collaborates with the Federal Territory Islamic Religious Council (MAIWP) to build digital charity systems.

Practical constraints exist. Cryptocurrency remains unrecognized as official payment methods in Malaysia. This limits real-world applications. The federal system creates nationwide institutionalization challenges.

Malaysia's global expansion potential remains highly valued. Expertise accumulated in Islamic finance and experience represent competitive assets in overseas markets. Malaysia develops Shariah-compliant crypto products with this expertise. Malaysia previously expanded sukuk market institutions and product models to the Middle East and Southeast Asia. This expansion was based on local success. This suggests similar expansion paths for cryptocurrency. Major Muslim countries like Saudi Arabia and Indonesia may adopt Malaysia's Shariah-compliant digital asset model. Malaysia has sufficient potential to lead global digital transformation in this sector.

4.5. Mainnet Environment

Malaysia's blockchain mainnet environment remains limited. Among global mainnets, Solana Superteam stands as virtually the only active presence in Malaysia. Superteam collaborates with various Malaysian Solana-based projects—such as Jupiter and Meteora—and focuses on supporting local builders and founders to expand the ecosystem. The organization actively runs community-centered activities including hackathons to achieve this goal. Ethereum communities like Ethereum KL also operate locally, but conduct limited activities.

IOTA stands as an exception. The project participated as an official sponsor of Malaysia Blockchain Week 2025 (MYBW 2025). IOTA conducts active marketing activities locally. The company obtained Shariah compliance certification from Cambridge IFA. Since then, IOTA has strengthened branding that targets the Islamic finance market. The company accelerates its Malaysia market strategy.

Meanwhile, the Malaysian government focuses strategically on its own blockchain infrastructure development rather than simply adopts global public chains. The government concentrates on creation of a regulatory-friendly and controllable local-centered blockchain ecosystem. They develop this through the national blockchain infrastructure 'MBI' with local mainnet project Zetrix. This shows a policy direction. The government aims to establish stable and sustainable blockchain infrastructure under national leadership rather than depend on external chains.

4.6. Bitcoin Mining

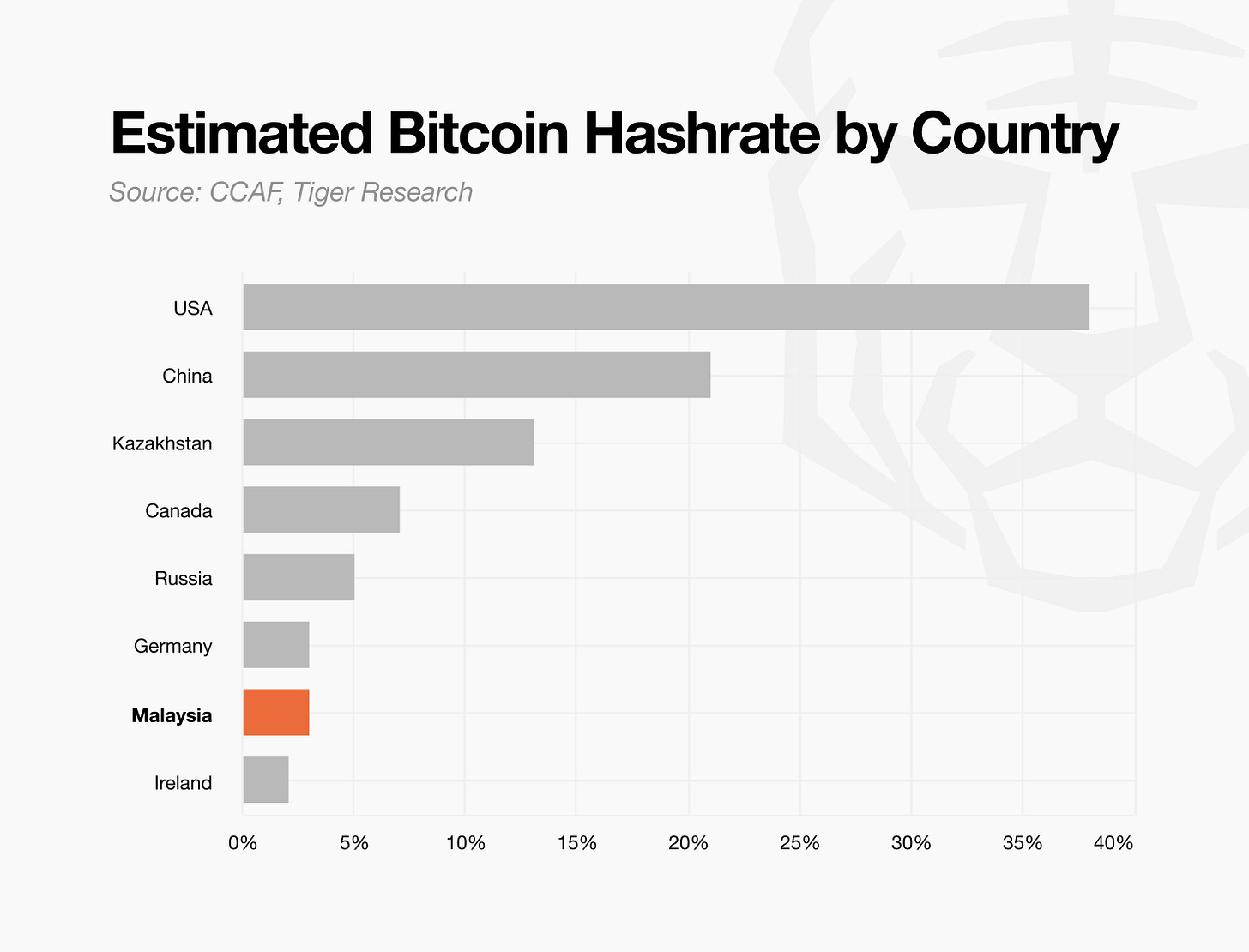

Malaysia ranks among the top 10 global bitcoin mining countries by hashrate. Large-scale mining facilities concentrate in Borneo's Sarawak and Sabah regions. These facilities base operations on extensive hydroelectric infrastructure. These regions have excess power supply relative to demand. Bitcoin mining actively utilizes surplus electricity.

Large hydroelectric plants in Sarawak produce electricity that exceeds regional demand. This surplus power will be exported to Singapore and other countries in the future. Pending the completion of submarine cable infrastructure, the mining industry utilizes this power as a priority. Local governments collaborate with mining companies. Cheap electricity drives rapid mining industry growth. This provides a stable alternative to the volatile global mining environment. China's mining ban created this instability.

However, illegal mining poses serious problems. According to Malaysia's blockchain association ACCESS, state utility company Tenaga Nasional Berhad (TNB) reported approximately RM441 million (USD 100 million) in power losses from illegal mining. Power theft cases occur frequently. Some cases have led to fires. Recent incidents include identity theft for fraudulent power contracts. Authorities have intensified crackdowns in response. They seized 985 illegal mining devices.

Malaysia's mining industry shows growth potential based on abundant renewable energy and institutional acceptance. The industry simultaneously faces social costs and regulatory issues from illegal mining. This demonstrates that Malaysia emerges as a global bitcoin mining hub while carrying challenges that require resolution.

5. Malaysia's Crypto Market: Opportunities and Challenges

5.1. Challenge Factors

Malaysia comprises multilingual populations that speak various languages. This can provide communication advantages. However, projects face complexity when they enter the market. They must tailor strategies according to different target groups. This creates entry barriers.

For example, Chinese Malaysians and non-Chinese Malaysians show distinct differences. They use different languages, community channels, and investment preferences. Shariah law influences the Malay majority. They show relatively passive attitudes toward financial investment. Chinese Malaysians actively engage in local and international stock investments. They also actively use derivatives on global crypto exchanges and on-chain trading platforms like Hyperliquid. The market segments clearly. Single approach strategies cannot address this structure effectively.

Malaysia's Web3 industry faces limitations in its developer talent foundation. Malaysia has many capable entrepreneurs. However, the developer pool remains relatively limited compared to neighboring countries like Vietnam and Indonesia. Excellent talents often move to Singapore and other external locations. They establish companies or continue careers outside Malaysia. This creates structural problems. Malaysia struggles to accumulate talent within its internal ecosystem. Malaysia produces global-level talent. However, the local Web3 ecosystem itself faces structural constraints. These constraints hinder activation. This acts as an important challenge factor for local market development.

5.2. Opportunity Factors

Despite these challenges, Malaysia's crypto market retains notable potential. The market shows particular strengths in talent-based networks. Projects like Coingecko and Etherscan originated in Malaysia and gained global influence. Malaysian talents also play key roles in various global projects including Meteora, Drift, and Pendle. These individuals form close networks throughout the global crypto industry. They create environments where they can share opportunities and collaborate.

These networks show potential to serve as foundations for Malaysia's local ecosystem development. Recently, talents who built careers overseas have increasingly returned to Malaysia. Low living costs and stable living conditions drive this trend. These returnees inject new vitality into the ecosystem through connections with local communities. Knowledge sharing and collaboration opportunities with the next generation also expand.

Major universities including Asia Pacific University (APU), Sunway University, and Taylor's University actively conduct blockchain-related academic activities. This ensures continued influx of next-generation Web3 talent. If government-level policy support aligns with these trends, Malaysia's Web3 ecosystem can grow at a faster pace.

Malaysia serves as an Islamic finance center. The market is evaluated as having unique opportunities in Shariah-based digital assets. Islamic finance currently occupies a small portion of the crypto market. However, related demand shows signs of gradual expansion. Binance's recent launch of Shariah-compliant products demonstrates this trend. Malaysia has institutionalized various Shariah products in traditional finance. The country possesses both institutional foundations and practical experience to extend this trend to digital assets. This makes Malaysia particularly noteworthy.

This foundation does not limit itself to the local ecosystem. Global demand for Shariah compliance exists. Potential markets center particularly around the Middle East region. Connection possibilities with these markets suggest favorable positioning. Malaysia can develop as a global Islamic digital asset hub in the future.

🐯 More from Tiger Research

Read more reports related to this research.[Special Report] Vietnam Crypto Market 2025: Complete Analysis of 21 Million Investor

[Special Report] Tiger Research Asia Insights: 2024 Review & 2025 Outlook

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.