This report was written by Tiger Research, analyzing Vietnam's emergence as Southeast Asia's leading Web3 hub for 2025 GM Vietnam event.

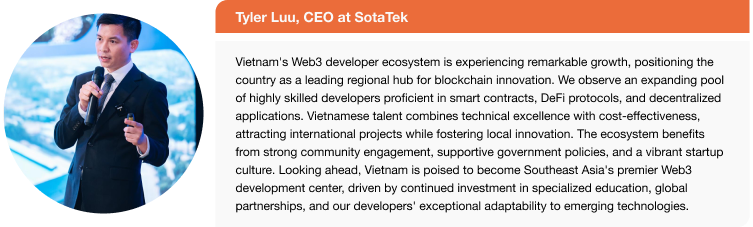

Key Leaders Insights

Key Takeaways

Vietnam’s young, tech-savvy, and mobile-first population combined with one of the highest global crypto adoption rates, makes it a natural leader for early Web3 adoption and innovation in Southeast Asia.

Vietnam’s regulatory stance is shifting from ambiguity to active development, with sandboxes and formal licensing frameworks underway, potentially turning Vietnam into a regulated crypto hub in 2025–2026.

Vietnam's crypto market is overwhelmingly retail-driven, with high trading volumes and robust P2P infrastructure, while institutional participation remains dormant but poised to grow with regulatory clarity.

Vietnam lacks a native exchange, but regulatory momentum may soon enable both local and foreign CEXs to operate under formal frameworks, reshaping the market landscape.

Vietnam has produced globally respected DeFi projects like Pendle and Kyber, proving local builders can lead on innovation, though broader user education and trust are still evolving.

The emergence of a nationally backed Layer-1 and strong private sector support signals Vietnam’s ambition to develop sovereign Web3 infrastructure.

After a boom-and-bust cycle, Vietnam’s GameFi space is maturing with a focus on quality, long-term gameplay, and infrastructure, no longer driven by short-term speculation alone.

Vietnamese teams excel in wallet development, showing technical agility and early-mover instincts, but must now compete with global giants on trust, UX, and ecosystem alignment.

Vietnam has the largest tech talent pool in Southeast Asia; with stronger blockchain education, its developer base could scale into one of the region’s most capable Web3 workforces.

Vietnam’s crypto community is not just a support base — it is the market. Success depends on community trust, localization, and long-term engagement, not just paid marketing

1. Vietnam’s Economic Landscape and Evolution into Web3

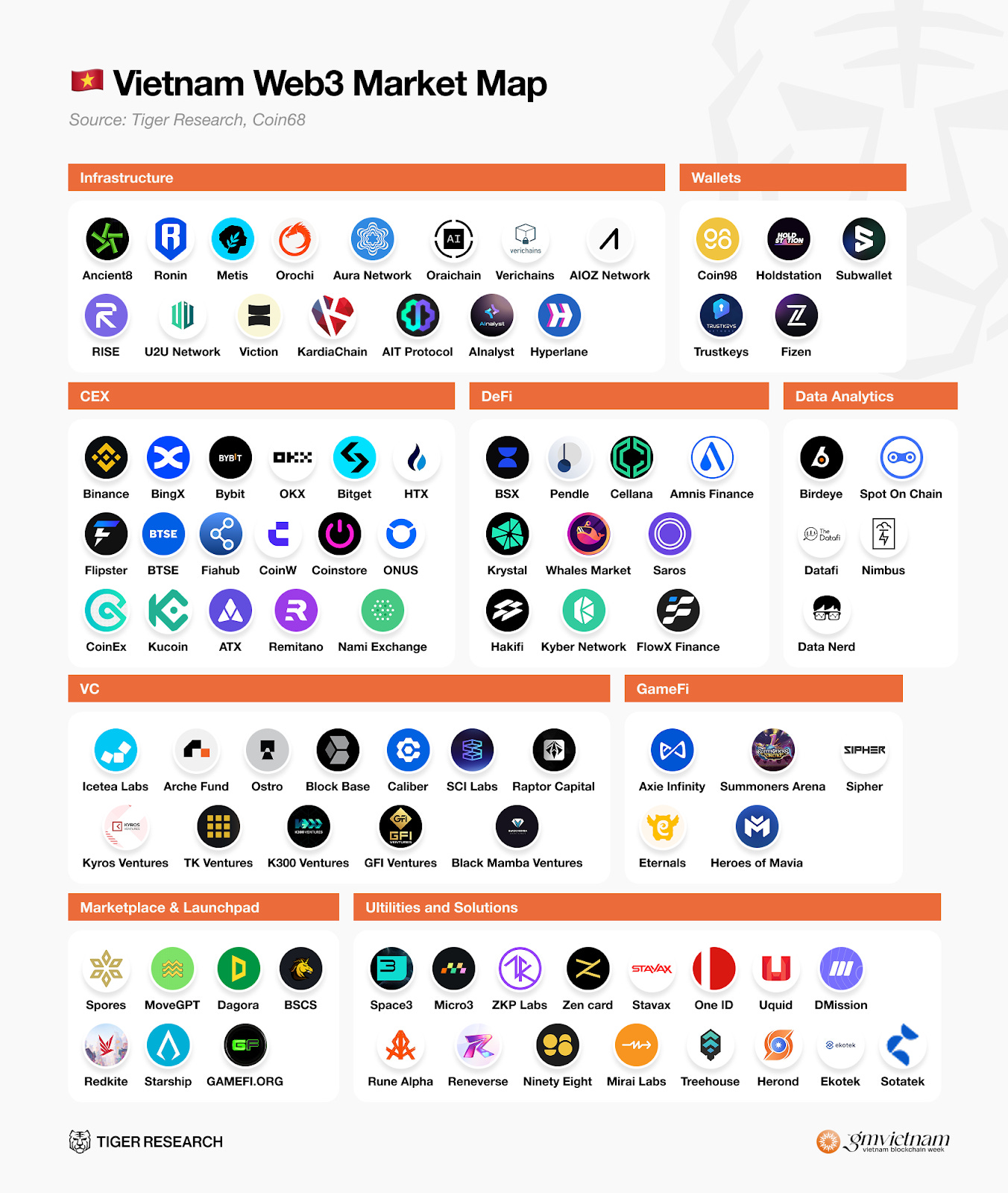

Vietnam is one of Southeast Asia’s fastest-growing digital economies — young, mobile-first, and increasingly tech-driven. With a population of 101 million, a median age under 33, and internet penetration of nearly 80%, the country is well-positioned to adopt emerging technologies early.

Its GDP growth consistently ranked among the highest in the region pre-COVID (6–7% annually), and a growing middle class is driving rapid digitization across sectors.

Crypto adoption in Vietnam is among the highest globally. According to Chainalysis and other industry reports, Vietnam has repeatedly ranked in top 5 in crypto adoption worldwide — driven not by institutional flows, but by a vibrant, retail-first user base.

As of 2024, an estimated of 21.2 million Vietnamese adults have owned or used crypto assets. Annual transaction volumes surpass $100 billion, placing Vietnam consistently in the top global rankings for retail crypto activity.

This adoption is deeply linked to broader digital trends. Vietnam’s digital economy is projected to reach $45 billion by 2025, fueled by mobile-first financial services. Building on this digital foundation, Vietnam's high mobile adoption rates and large population position the country as a key player globally.

Vietnam’s Web3 journey began with early blockchain infrastructure projects like TomoChain and Kyber Network in 2017–2018.

But the real inflection point came in 2021, when Sky Mavis launched Axie Infinity and its custom Ronin sidechain. The play-to-earn boom that followed put Vietnam on the global map, attracting millions of users and catalyzing venture capital investment into the local ecosystem.

Since then, Vietnam has emerged as a unique player in Web3, not just for its user base, but for its builder base.

Despite a lack of regulatory clarity, local teams have launched DeFi, GameFi, wallet, and infrastructure projects used globally. The convergence of a tech-savvy population, strong economic fundamentals, and early Web3 wins has positioned Vietnam as a leading crypto market in Southeast Asia, and one of the few where adoption is both wide and deep.

2. Regulatory Landscape and Policy Development

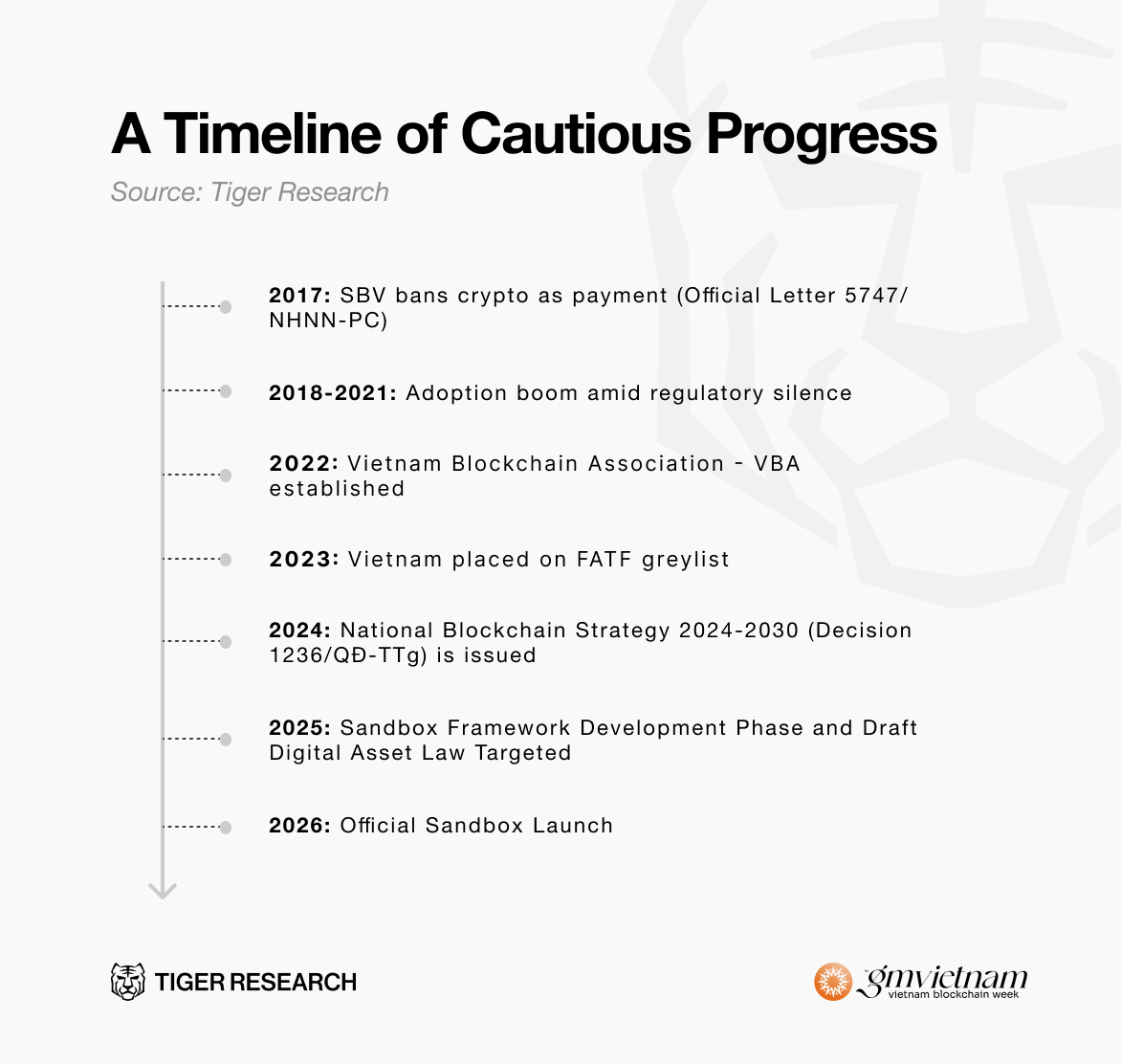

Vietnam’s regulatory stance on crypto has historically been cautious. While ownership and trading of crypto assets are allowed, cryptocurrencies are not recognized as legal tender, and using them for payments has been banned since 2017.

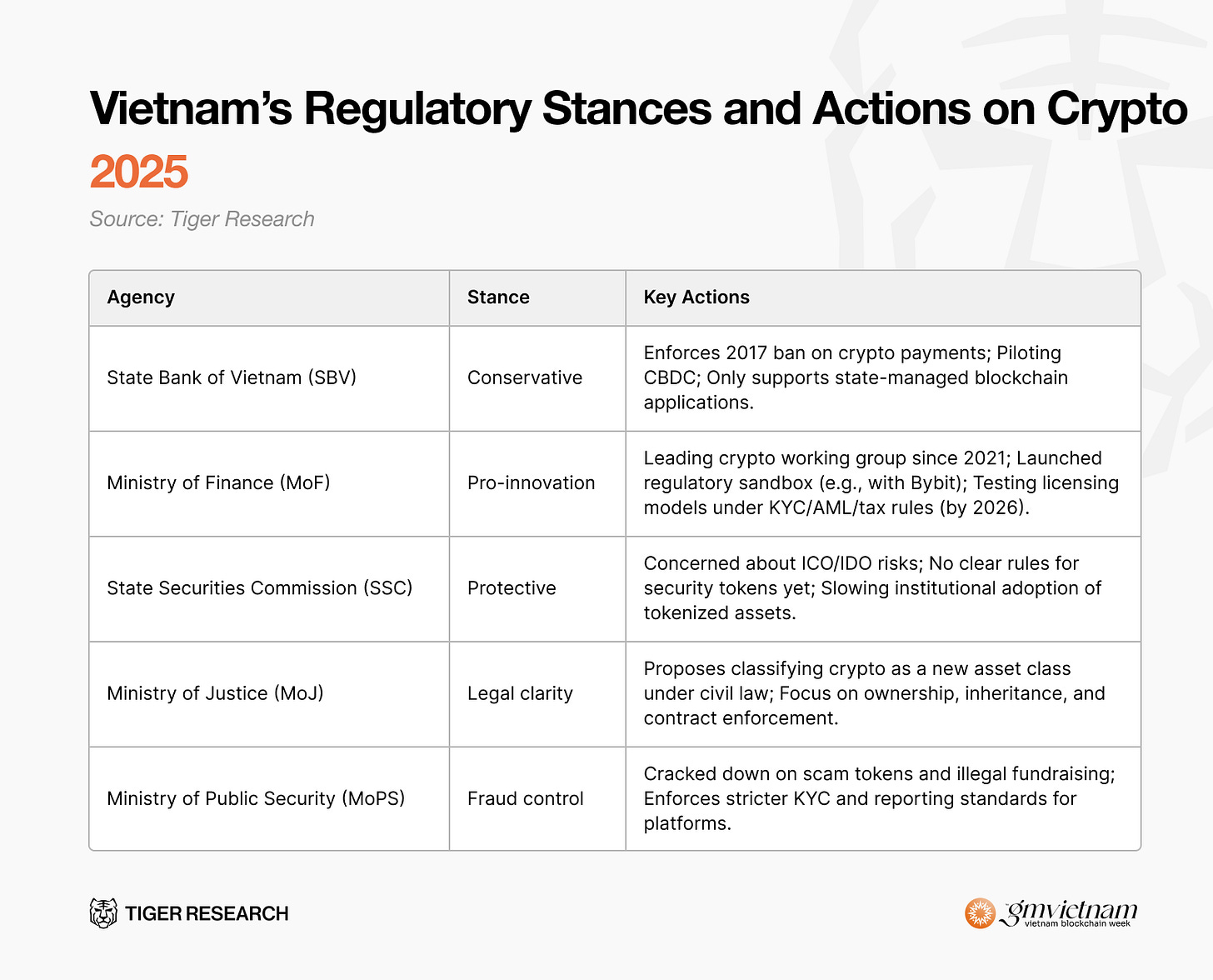

This created a regulatory “grey zone” — crypto trading remains widespread but unregulated. However, this stance is now evolving. The government has begun moving toward formal oversight frameworks, with signs of regulatory development and pilot initiatives emerging since 2021.

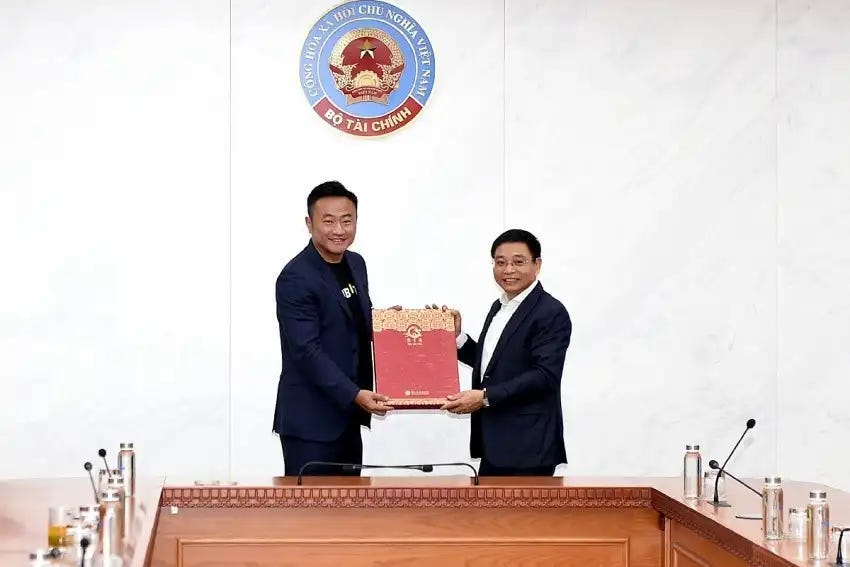

Several ministries have become actively involved in shaping regulations for crypto. Notably, the Ministry of Finance has introduced a regulatory sandbox, and other agencies are clarifying their roles and mandates to address digital asset use, investor protection, legal classification, and fraud prevention.

For businesses, this creates a short-term challenge but a long-term opportunity. Until the sandbox is live and licensing schemes are formalized, companies still operate in legal limbo. There are no official licenses, no tax clarity, and lingering uncertainty.

However, firms that engage early, follow global compliance standards, and work with regulators could gain first-mover advantages once formal regulation is in place.

Taxation is expected to follow licensing. Vietnam currently lacks a crypto tax framework, but the MoF has signaled that once exchanges are legalized, capital gains or transaction-based taxes will be introduced. P2P trading has made enforcement difficult, but licensed exchanges will make compliance easier to enforce.

In summary, Vietnam’s regulatory outlook is shifting from passive restriction to structured experimentation. The 2025–2026 period will be critical. If pilot programs succeed, Vietnam could emerge as a regulated crypto hub in Southeast Asia, offering clarity for businesses and protections for users while still supporting innovation.

3. Cryptocurrency Trading Landscape

3.1. Retail vs. Institutional Trading

Despite high global adoption rankings, Vietnam still lacks a licensed domestic crypto exchange due to regulatory uncertainty. Trading activity is almost entirely retail-driven, and it mostly happens on global centralized exchanges.

Around 17 million Vietnamese users trade on platforms like Binance, Bybit, MEXC, BingX, and HTX. In 2023, Vietnamese users ranked fourth globally on Binance by monthly trading volume, reaching over $20 billion in a single month.

Retail traders here are known for being fast-moving and risk-tolerant. Many actively trade spot, futures, and margin products, often chasing short-term opportunities and high-return campaigns.

In contrast, institutional activity in Vietnam is nearly absent. Regulatory ambiguity has kept banks, asset managers, and corporates out of the market. No licensed crypto funds, ETFs, or formal investment products are available locally.

Still, interest from the institutional side is growing quietly. Several firms are researching crypto-linked products while waiting for clearer legal frameworks. When formal regulation arrives, institutional participation could reshape the market by bringing more liquidity and a professional trading infrastructure.

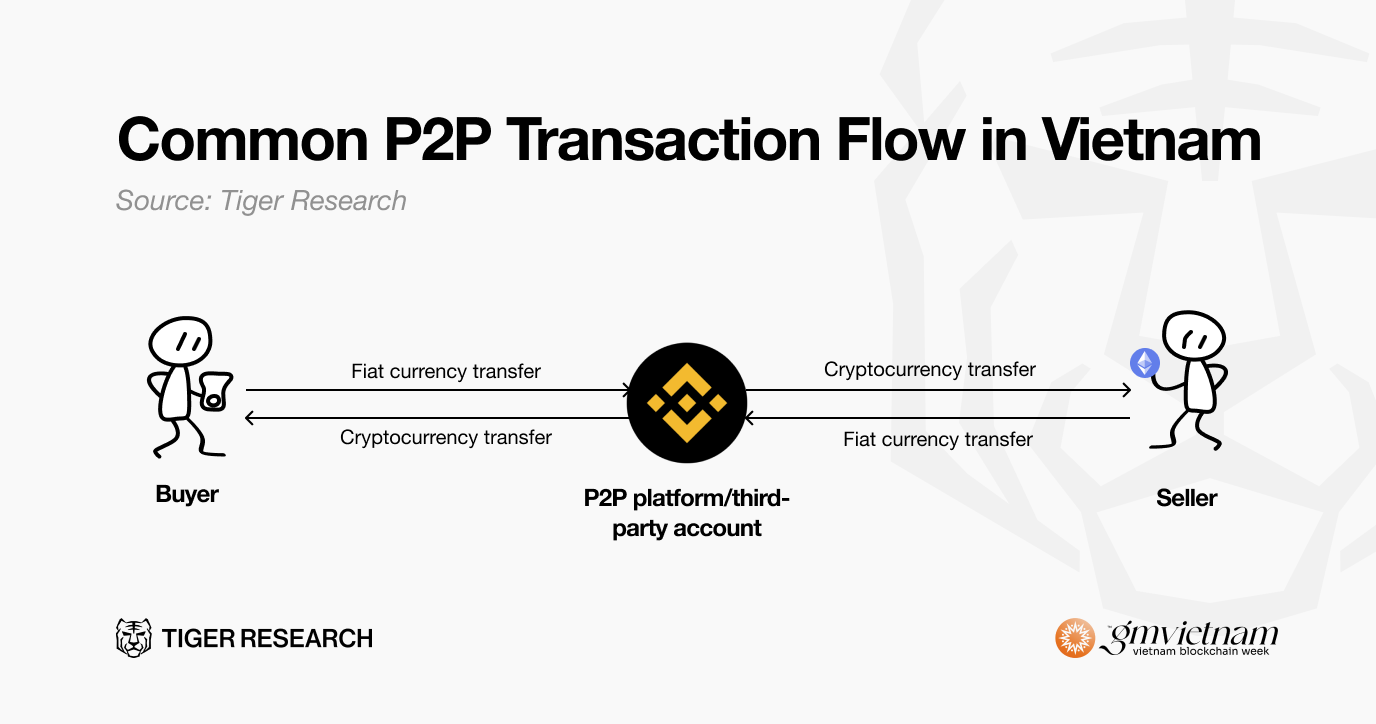

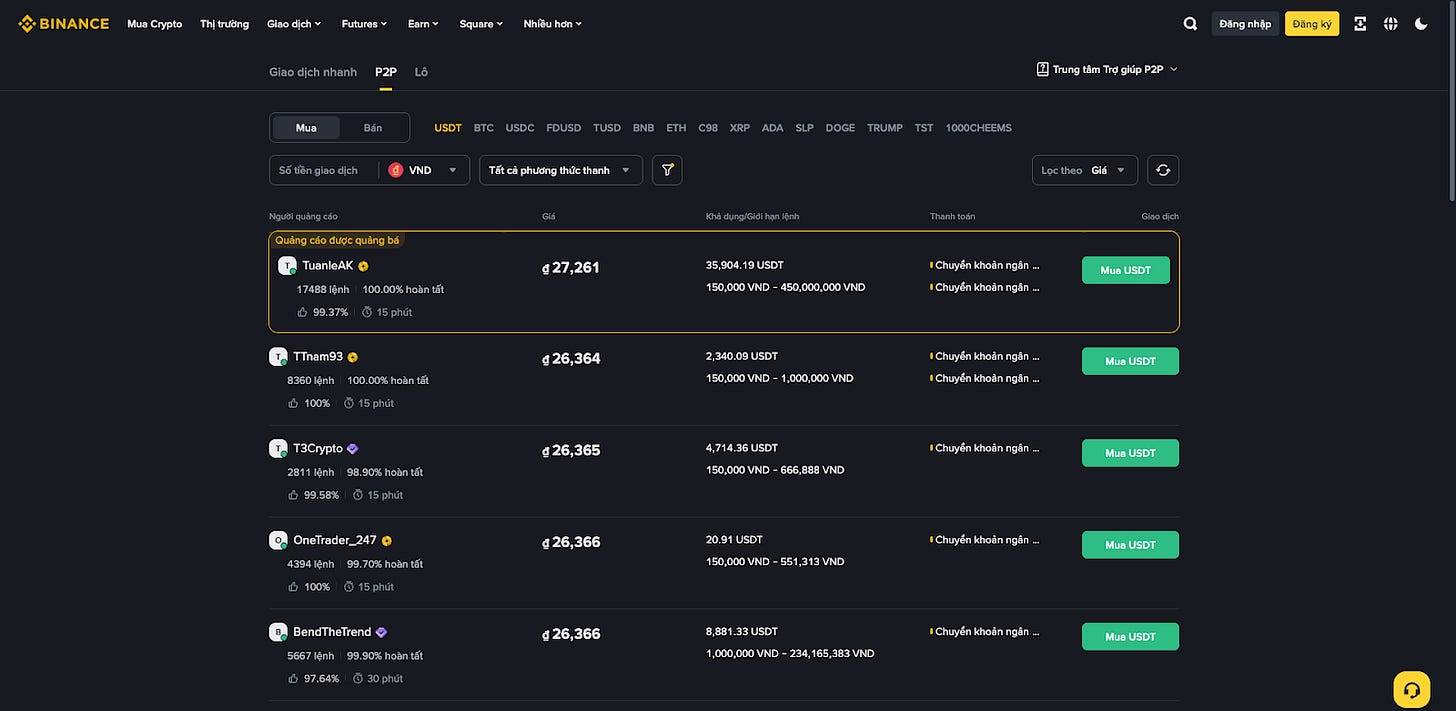

3.2. P2P Trading

Because Vietnamese users can’t trade crypto directly through local bank accounts — due to the lack of licensed exchanges or fiat onramps — peer-to-peer (P2P) trading has become essential infrastructure. Platforms like Binance P2P allow users to buy and sell stablecoins using VND via local bank transfers.

These platforms offer escrow protection and host hundreds of verified merchants. The process is fast, widely trusted, and supported by major exchanges like Binance, Bybit, and OKX, all of which have localized P2P features for Vietnam.

In addition, whales users also directly operate P2P channels. These traders often work through group chats or private deals, using the same P2P rails for larger transactions. Some also supply liquidity to other P2P participants.

Risks still exist. Fraud is an issue in informal trading groups, and some banks have flagged or frozen accounts tied to crypto transfers or money laundering. Authorities have also started tracking large fiat-to-stablecoin flows more closely.

A licensed exchange would help reduce these frictions. But even with regulation, P2P is likely to remain a core channel for Vietnamese users entering and exiting the crypto market.

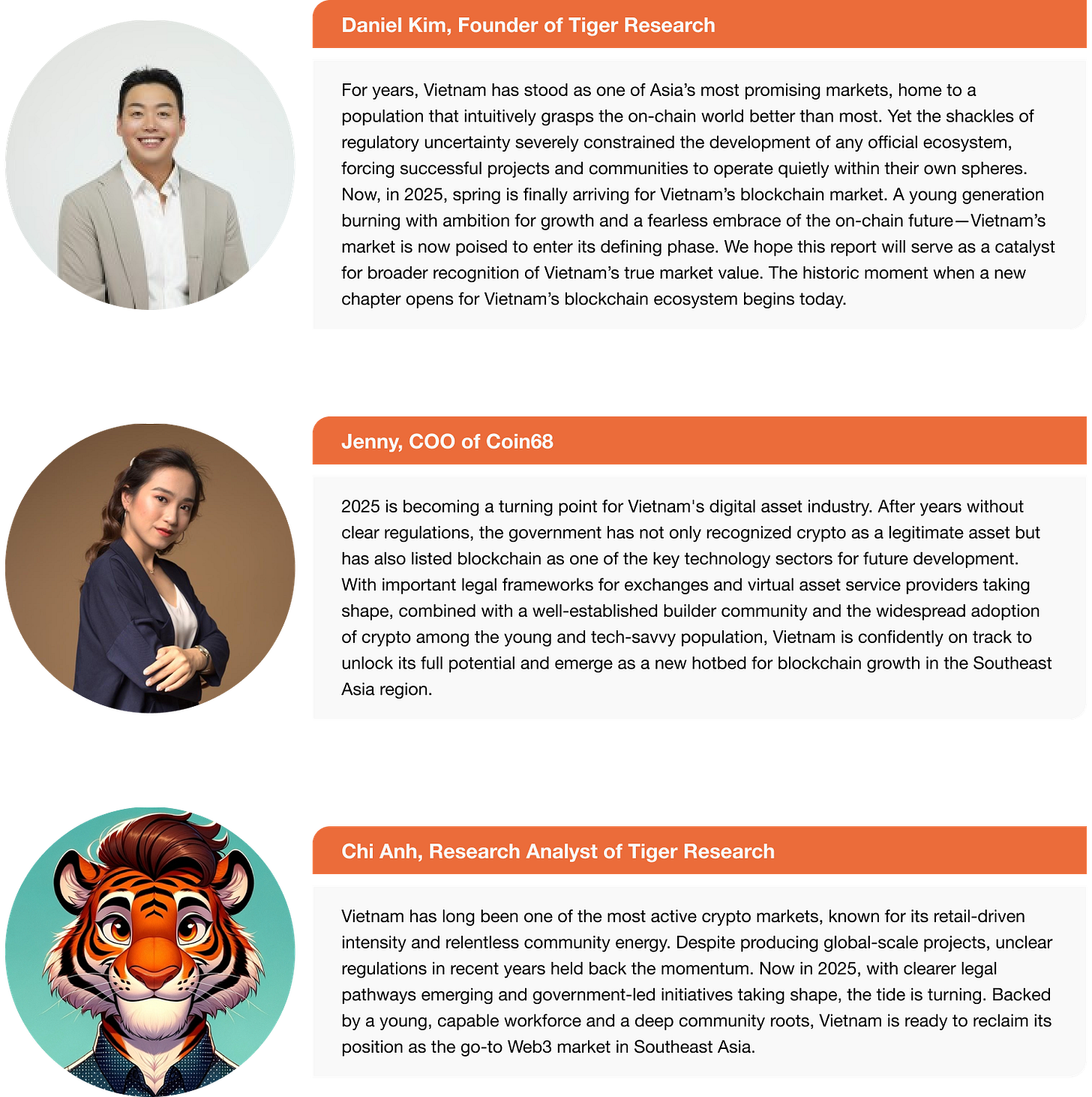

4. Sector Deep-Dives: Vietnam’s Crypto & Blockchain Ecosystem

Vietnam’s crypto ecosystem is broad and fast-evolving, with local players active across nearly every part of the value chain. From Layer-1 infrastructure and DeFi protocols to gamefi, wallets, Vietnamese builders are not just following global trends — they’re helping shape them.

This section provides a focused look into key sectors where Vietnamese teams are making meaningful contributions, offering both local context and global relevance.

4.1. Centralized Exchanges

Vietnam doesn’t have a local centralized exchange (CEX) due to regulatory uncertainty. Because of that, the CEX landscape is fully dominated by global platforms. New players like Coinstore have entered the market as well, but breaking into this space remains a challenge due to entrenched user loyalty and competition.

Binance, Bybit, MEXC, BingX, Bitget, and HTX lead the market. These exchanges have gained traction in Vietnam through localization strategies. They have added Vietnamese-language interfaces, built VND-based P2P trading, hired local teams, sponsored events, and tailored marketing to Vietnamese users.

Futures and spot products are especially popular here. Vietnamese users are among the most active globally on these platforms.

Looking ahead, two developments could reshape Vietnam’s exchange landscape. First is the emergence of a local, fully Vietnamese-run exchange — something the market has lacked due to regulatory ambiguity. A native CEX could cater more closely to local needs, integrate more deeply with domestic payment systems, and build long-term brand trust.

Second, the regulatory environment is shifting. In March 2025, the Ministry of Finance proposed a sandbox program for digital asset exchanges. If implemented, this could allow both foreign and local platforms to operate legally under a formal framework. Exchanges like OKX, BingX, or Bybit are paying close attention and preparing for that shift.

Together, these moves could push Vietnam’s exchange market from a gray zone into a more regulated and mature ecosystem — one that supports both global platforms and local innovation.

4.2. Decentralized Finance (DeFi)

Vietnam is one of the most active DeFi user markets in Asia, and most of the activity comes from a large retail user base seeking high-yield opportunities across global DeFi platforms.

Vietnam has produced a few standout projects. For instance, Kyber Network was one of the first major DeFi protocols globally, co-founded by Vietnamese engineers in 2017. It played a foundational role in Ethereum’s early DeFi ecosystem.

A more recent example is Pendle Finance, co-founded by a Vietnamese developer. Pendle created a secondary market for tokenized yield, letting users trade future yield from assets. The protocol surpassed $250M in TVL in 2024 and is now considered one of the most innovative fixed-income platforms in DeFi.

These successes demonstrate that Vietnam has the capability to build protocols at a global standard. Projects like Kyber and Pendle show what's possible when Vietnamese builders aim beyond the local market and focus on long-term innovation.

However, these are still exceptions. The market has seen too many short-term projects or slow rugs that have eroded trust, both locally and abroad. In that context, the success of serious builders offers a rare but important signal: Vietnam can create globally competitive DeFi infrastructure when the vision is right.

On the user side, while Vietnam is known for its active and risk-tolerant retail base, the number of users who truly understand and navigate DeFi in depth remains relatively small. Advanced DeFi strategies or complex protocol mechanics are still barriers for many. Yet the core motivations — high risk, high reward, and a constant drive to earn — make Vietnam an ideal market for DeFi growth.

Among all Web3 verticals, DeFi remains the sector with the strongest potential to elevate Vietnam’s presence on the global stage, both through homegrown protocols and a highly engaged user base.

4.3. Infrastructure & Layer‑1

Vietnam’s blockchain infrastructure sector has produced technically sound Layer-1 projects that gained early global attention. However, few have managed to sustain developer ecosystems or drive long-term usage at scale.

In the early years, projects like TomoChain and KardiaChain marked Vietnam’s first foray into Layer-1 development. These networks demonstrated technical feasibility and laid foundational know-how, but adoption remained modest and has since been surpassed by newer, more specialized initiatives. TomoChain has since rebranded to Viction, though its ecosystem remains relatively quiet.

A defining example of Vietnam’s Layer-1 capabilities is Ronin Network, built by Sky Mavis to support Axie Infinity. Ronin was designed as a high-throughput Ethereum sidechain to accommodate millions of daily transactions, proving that Vietnamese teams can deliver infrastructure at a global scale.

While originally gaming-focused, Ronin operates as a standalone L1 with wide recognition in the Web3 ecosystem.

A major shift came in early 2025, when One Mount Group — a leading Vietnamese tech conglomerate — committed $200–500 million to building a national Layer-1 blockchain. This chain is being designed for real-world use cases such as digital identity, financial infrastructure, and supply chain management. It reflects a strategic push from Vietnam’s corporate sector to own and control core blockchain infrastructure domestically, rather than relying on external protocols.

One Mount Group’s CEO Nguyen Thi Diu (centre) receives a commemorative medal from Party General Secretary To Lam

Vietnam is also entering the DePIN space. The most visible project here is U2U Chain, a DAG-based Layer-1 developed by a Vietnamese team. Unlike traditional blockchains, DAGs (Directed Acyclic Graphs) organize transactions in a graph structure rather than a single chain, enabling higher throughput and scalability.

In November 2024, U2U Network successfully closed funding rounds, raising a total of $13.8 million from prominent investors including KuCoin Ventures, Chain Capital, and JDI Ventures. This significant financial milestone propels U2U Network further in its mission to provide a comprehensive solution for DePIN.

To conclude, while Vietnam has not yet produced a dominant general-purpose Layer-1 beyond Ronin, the country’s users are already active across major ecosystems like Ethereum, Solana, and Sui. This makes it challenging for new Layer-1s to gain meaningful traction, especially when there’s limited financial upside or token incentives for early users.

In addition, with Vietnam’s first nationally backed Layer-1 now in development, there is renewed hope that a credible, purpose-built Vietnamese blockchain platform can emerge — one that aligns with the country’s digital transformation agenda and has true domestic adoption potential.

4.4. GameFi

GameFi is the most visible Web3 success story Vietnam has produced to date, but it has also become one of the most saturated and challenging sectors.

The 2021 play-to-earn boom put Vietnam on the global map, with Axie Infinity reaching over 2.8 million daily users at its peak and showing how Vietnamese teams could build global-scale products and infrastructure. Axie’s success attracted major VC funding and set the precedent for Web3 gaming worldwide.

Vietnamese VCs played a pivotal role in the GameFi boom and felt both the highs and lows. Many local funds generated outsized returns by investing early in projects like Thetan Arena, earning credibility and capital.

In the aftermath of that success, however, the space was quickly flooded with low-quality, short-term GameFi projects — many of which were created with the sole purpose of listing tokens and exiting. Dozens of copycat games launched in Vietnam with weak gameplay, unsustainable token models, and little to no post-launch development.

And VCs are not an exception, some of those same VCs were burned due to investment in poor projects. This created a lasting perception problem for “Vietnamese Web3 games” among both local users and international investors.

On the bright side, later projects like Sipher and Heroes of Mavia represent a shift toward higher-quality game design and long-term strategies. In parallel, former guilds like Ancient8 are transitioning into infrastructure builders, offering rollup stacks and dev tooling specifically for game developers. This “guild-to-infra” movement reflects a maturing mindset: enabling the next generation of GameFi rather than chasing the last.

Despite the downtrend of GameFi, the potential of Vietnam’s retail user base in gaming remains strong. Vietnam has one of the largest and most engaged gaming communities in Southeast Asia, especially on mobile.

For companies and developers looking to enter Vietnam’s GameFi space today, the bar is significantly higher. After a full cycle of GameFi hype and disillusionment, Vietnamese users have significantly raised their standards. Gameplay experience and financial models are now scrutinized more carefully, leaving little room for low-quality, short-term products. The market has shifted from speculative excitement to a more discerning, value-driven mindset which demands both engaging games and sustainable economies.

4.5. Wallets

Wallets are one of the few Web3 product categories where Vietnamese teams have consistently launched competitive products.

Notable examples include Coin98 Wallet, SubWallet, and Holdstation, each reflecting a different strategy within Vietnam’s wallet-building scene. Coin98 has grown into a multi-chain super app, combining wallet functionality with a broad suite of DeFi tools. SubWallet takes an ecosystem-focused approach, building specifically for Polkadot and cultivating a niche among developers and users. Holdstation, meanwhile, positions itself as the “better version of MetaMask” of emerging chains like zkSync or Berachain, gaining early momentum by focusing on on-chain derivatives and smooth user UX.

Vietnam's enthusiasm for building wallets reflects two key traits of the local builder mindset: 1) speed in capturing early infrastructure gaps and 2) a strong instinct for distribution-first products. Wallets serve as a direct access point to users and ecosystems, making them a natural fit for teams focused on scale and adoption. Vietnamese builders have consistently moved fast, often launching wallets or integrations in emerging ecosystems like Berachain or zkSync before they became widely popular. This early-mover advantage reflects both technical agility and a deep understanding of how user acquisition drives ecosystem relevance.

That said, competition in Vietnam is intensifying. Global wallets like MetaMask and Rabby dominate in the EVM space, Phantom leads on Solana, and CEX-backed wallets like OKX Wallet, Binance Web3 Wallet, and Bybit Wallet are rapidly expanding with exchange-native user funnels. The wallets landscape here competes not only on UX, but on trust, feature completeness, and ecosystem alignment.

Despite the challenges, wallets remain one of Vietnam’s strongest Web3 product categories — and a clear example of how local teams identify early narratives and build around them with speed. However, the nature of this category remains vulnerable — wallets that tie themselves too closely to a single ecosystem risk stagnate or decline if that ecosystem loses relevance.

4.6. Developer Ecosystem

Vietnam is home to the largest pool of tech talent in Southeast Asia, with over 560,000 IT professionals and 50,000–60,000 new graduates each year. The majority of developers are under 35 — young, adaptable, and increasingly engaged with emerging technologies like blockchain.

Despite the lack of formal blockchain training in most universities, many Vietnamese developers have become proficient through self-learning and community support. Platforms like YouTube, GitHub, and local bootcamps have filled the gap.

While RMIT Vietnam offers blockchain-related electives, more technical education is still needed across the board. VBI Academy, a grassroots initiative, has been one of the few offering free, hands-on blockchain development programs to train smart contract developers locally.

Developers can often be found through community hubs like Open Guild (Polkadot), SolanaSuperteam (Solana), or at meet-ups and even hackathon events. Local Facebook groups and Discord servers also play a growing role in connecting builders with projects.

Vietnamese developers have contributed to protocols across the Web3 spectrum, and with successes seen in different sector, there is little doubt about the quality of local talent. What’s missing is a stronger educational foundation. With proper training and structured programs, Vietnam’s developer base could scale into one of the most capable in the region.

As the government rolls out its digital transformation initiatives, the ecosystem is becoming more conducive to long-term developer growth. Vietnam is well-positioned to become a regional hub not just for using blockchain, but for building it.

5. Community landscape

The Vietnamese crypto community isn’t just an audience — it’s the engine. This community plays a central role in how products gain traction, narratives spread, and reputations are built.

Vietnam’s Web3 growth has never been institution-led. It’s grassroots, social, and hyper-reactive. According to Kyros Ventures, 76% of Vietnamese crypto holders make decisions based on referrals — often from Telegram groups, Twitter threads, or conversations with friends.

Trust comes from community proof, not credentials. Projects are expected to earn their place, not buy it. Many local teams learned this firsthand: community support can generate powerful early momentum, but once sentiment turns, no amount of paid promotion can reverse it. In Vietnam, the same crowd that builds you can also break you.

This influence stems from a cultural alignment with speculation and early-stage opportunity. Vietnamese users are active, agile, and willing to move fast. Profit is a major motivator, but so is recognition, reputation, and the collective excitement of being early. This has created one of the most engaged and retail-driven crypto communities in the world.

Crypto communities in Vietnam tend to organize around four core types:

Trading-focused groups, especially for spot and futures trading. (Ex: TCCL, Margin ATM, Pho Tai Chinh)

Airdrop-hunting groups, which monitor new campaigns and coordinate airdrop strategies. (Ex: HC Gem Alerts, Airdrop Hidden Gems)

News and education-focused groups, which curate updates, share research, and explain complex ideas. (Ex: Upside, 5 Phut Crypto, Coin68, ThuanCapital, Bigcoin)

All-rounder communities, which combine all of the above and often serve as the main point of contact for retail users entering the space. (Ex: HC Capital, Tradecoinvietnam, Nghien Crypto)

Telegram is the beating heart of this ecosystem, where sentiment shifts, drops trends, and new projects either take off or get buried. But that dependence came into sharp focus when Telegram was banned nationwide. While most users quickly resumed activity through VPNs and proxies, the disruption exposed the fragility of relying on a single platform. During that time, some groups have started branching out to Discord as alternatives.

As for Twitter (X), once a secondary platform, it is now gaining ground, especially as monetization tools push more local KOLs to build public personas. But influence here is layered and informal. Relationships matter, and surface-level KOL campaigns can backfire without community context. Promotion alone doesn’t work; trust must be earned, maintained, and defended.

Two behaviors dominate day-to-day crypto life in Vietnam: airdrops and trading. Many treat airdrop participation as a structured routine — tracking new campaigns, sharing strategies, and coordinating entries across wallets. Simultaneously, futures and CEX trading drive constant discussion, with users actively pursuing volatility and rewards. For a large segment of the market, these activities are the reason to stay engaged. They reflect Vietnam’s high risk appetite, speed, and hunger for asymmetric upside.

But the community is maturing. Past bull cycles have produced both winners and harsh lessons. Today’s users are more discerning — skeptical of hype, quick to detect red flags, and increasingly focused on project fundamentals. Many KOLs have adapted, shifting from blind promotion to content that prioritizes education, due diligence, and sustainable engagement.

For global projects entering Vietnam, it’s critical to understand: the community is not a marketing lever — it is the market. Builders need to localize messaging, show up in native channels, and offer Vietnamese-language support. Superficial outreach won't cut it. Projects that invest in long-term trust, show real value, and build relationships will find not just users, but partners.

🐯 More from Tiger Research

Read more reports related to this research.[Special Report] APAC Web 3 Powerhouse : Inside Vietnam's Blockchain Market

[Special Report] Tiger Research Asia Insights: 2024 Review & 2025 Outlook

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.