TL;DR

Asia is a complex market with diverse regulations and cultures. Understanding each country's characteristics is crucial for engaging with the Web3 industry.

Asia's young, digital-native population gives it high potential to lead the Web3 market, especially through super apps and consumer apps.

On-chain data shows Asia's Web3 market growth, with metrics like stablecoin usage, developer activity, DEX trading, and Web3 social media engagement.

1. The Diversity and Complexity of Asian Markets

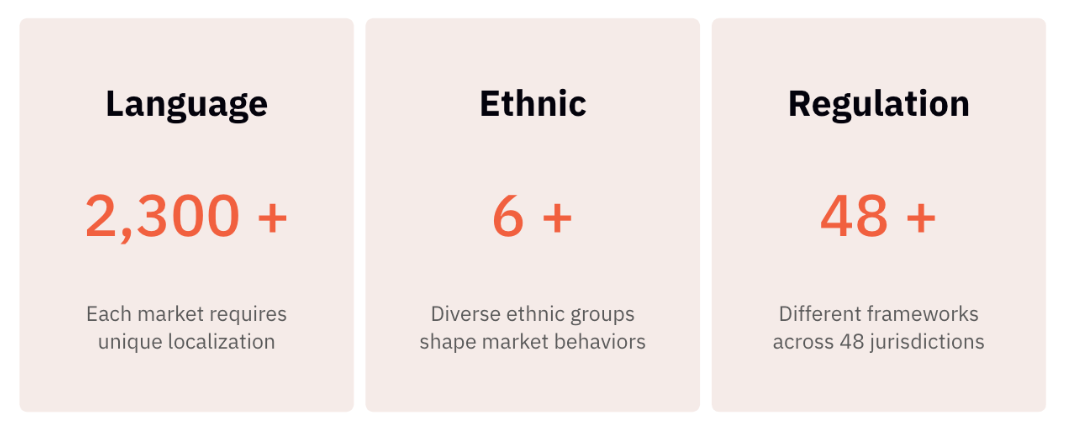

Understanding Asian markets requires recognizing their diversity and complexity. Asia includes over 2,300 languages, distinct regions (Northeast, Southeast, Southwest, and South Asia), and more than 48 regulatory frameworks. Cultural differences within Asia are often greater than those between Western nations.

This diversity also shapes Asia’s Web3 industry. In Northeast Asia, each country has a unique approach: China enforces strict regulations, South Korea combines regulation with incubation, and Japan supports Web3 through government initiatives. Asia’s unique mix demands market-specific strategies and a nuanced understanding for success.

2. Asia's Strong Foundation for Growth

Asia’s diversity poses challenges, but its importance is undeniable. It is home to over 60% of the global population and contributes 34% of world GDP, with a 3.6% growth rate that outpaces North America and Europe.

Asia leads in the Web3 industry due to three factors. First, Asia has a strong crypto user base, with 60% of global crypto users—320 million—coming from the region, driven by a young, digital-native population (Triple-A). Second, Asia excels in trading activity: KRW-based trading volume in South Korea surpassed USD in early 2024, and over half of Binance's recent web traffic comes from Asia. Lastly, Asia boasts strong technical talent, with 50 million GitHub developers and 40% of the world’s Web3 game developers.

3. Strengths of the Asian Web3 Market: Consumer Focus and Super Apps

To popularize the Web3 industry, consumer apps that are easy for the general public to use will be essential. Developing technical infrastructure alone is not enough. This mirrors how the internet grew in the past. Killer apps like email drove rapid adoption. In the same way, Web3 is expected to become popular through consumer apps that fit naturally into daily life.

Asia stands out in two ways. First, it leads in consumer-focused innovation. As of October 2024, 42% of Asia’s unicorns are B2C companies, surpassing those in North America and Europe (CB Insights). This strength stems from Asia’s large population of digital natives and advanced mobile payment systems. This consumer-driven approach positions Asia as a likely hub for new Web3 apps.

Asia’s second strength is its unique ecosystem of super apps. Leading platforms like WeChat, Alipay, Kakao, Line, and Grab started as single-service apps. They have now grown into comprehensive digital ecosystems. These super apps are part of daily life for millions, offering services across payments, commerce, entertainment, and more.

The TON blockchain highlights the potential of combining Web3 with super apps. By adding Web3 features to Telegram, a popular messaging app, user growth surged due to its convenience. These examples show that super apps can lower barriers to Web3 access. This combination will introduce new services in a familiar environment and drive Web3 adoption.

4. A Data-Driven Analysis of Asian Web3 Markets

The Asian market shows strong potential. However, relying only on expectations and indicators may be superficial. Analyzing real user activity through on-chain data is essential for deeper insights.

Japan's evolving stablecoin policy highlights the need for deeper analysis. Although the Stablecoin Guidelines were introduced in June 2022, and a 2023 law amendment permitted stablecoin issuance, no significant on-chain impact has followed. This is due to limited use cases and regulatory barriers to issuing trust-type stablecoins on public blockchains. To bridge this gap between policy and adoption, closer on-chain analysis is essential.

Next, we’ll examine on-chain data to assess whether the anticipated growth in the Asian market is materializing.

4.1. Stablecoins in Asia

he use of stablecoins in Asian markets is steadily rising. This is significant, as stablecoins are one of the most suitable product-market fits for Web3. On-chain data shows that Asia-based stablecoin transfers have surged to nearly $8 billion. Transaction volumes are expected to grow further from 2022 through 2024.

Stablecoins pegged to national fiat currencies are creating more real-world use cases. Several local currency-backed stablecoins have emerged, such as Singapore’s XSGD and Indonesia’s XIDR. For instance, XSGD connects with services like Grab, driving practical applications. This localized approach and integration with real-world services are increasing stablecoin transactions. The sustained growth suggests a structural shift in the Asian market rather than a short-term trend.

4.2. On-Chain Activity of Asian Developers

Participation of Asian developers in smart contract development is growing. On-chain data from the Ethereum mainnet and testnets (Goerli and Sepolia) confirms this trend.

In 2024, Asian developers created about 1.7 million contracts on these testnets. This figure far surpasses activity in North America and Europe. Growth has been rapid since 2022, with similar trends on the Ethereum mainnet. Asia’s share of contract creation increased from 4% in 2020 to 40% in 2024.

This shift highlights two trends. First, Asian developers are driving blockchain innovation. Second, blockchain development is expanding beyond Western origins. High testnet activity reflects active experimentation and shows Asian developers as key contributors to Web3’s future.

4.3. Asian Retail Investor Participation in DEX Trading

Uniswap transaction data shows strong participation from Asia. From 2021 to 2024, Asia consistently holds a significant share of total transactions. Trading activity has steadily risen over this period.

More noteworthy is the variation in participation rates by investor type within Asia. We observe significant shifts when we categorize deal sizes into whales ($100,000+), sharks ($10,000–$100,000), and shrimp (less than $10,000). In 2021, shrimp investors accounted for a small portion of trading volume. By 2024, their share of both the number and volume of transactions has steadily increased. This change is a positive sign that users in Asian markets are increasingly utilizing Web3 services. They participate not only on centralized exchanges (CEXs) but also on decentralized exchanges (DEXs).

4.4. Asian User Activity in the Web3 SNS Farcaster

Asian user activity on Farcaster is gaining attention in the Web3 ecosystem. DAU (Daily Active Users) analysis shows that Asian users are more active than those in North America and Europe. While English is the primary language of Web3, posts in local languages like Vietnamese, Chinese, Japanese, and Korean are steadily increasing. This indicates that Web3 growth in Asia is happening now, not just predicted. Asia is leading the way in Web3 usage.

5. Closing Thoughts

The Asian market is diverse, with unique regulations, cultural differences, and varied approaches across countries. This complexity creates both challenges and opportunities for Web3. Understanding each country’s distinct role is essential. On-chain data reveals the potential of the Asian Web3 market by capturing real user behavior.

Regional analysis based on on-chain data is crucial for the ecosystem’s growth. Advances in digital credentials and locality analysis will improve the accuracy of user behavior insights. These tools will help build a clearer understanding of the regional context and preferences in Asia’s Web3 market.

Appendix. Research Methodology

Analyzing blockchain transactions by time is simple and clearly separates data by the time of day. However, short-term data, such as one-time transactions or irregular activities, may not accurately reflect overall behavior patterns.

To address this, we focus on analyzing the wallet's long-term transaction patterns rather than the timing of individual transactions. Additionally, data reliability requires filtering out wallet addresses associated with automated bots, project teams, exchanges, and other sources that could skew the data. We used identification methods like Crypto Name Service (CNS) and credentials to separate real users from bots. We also excluded project-related addresses using labeling data from platforms like Dune Analytics.

Working hours and sleep times are defined as follows:

US: 8am-8pm ET (13:00-01:00 UTC), with sleep from 12am-6am ET (05:00-11:00 UTC)

EU: 8am-8pm CET (07:00-19:00 UTC), with sleep from 12am-6am CET (23:00-05:00 UTC)

Asia: 8am-8pm CST (00:00-12:00 UTC), with sleep from 12am-6am CST (16:00-22:00 UTC)

In our geolocation analysis, we focused on patterns of activity (8am-8pm) and sleep (12am-6am), rather than just the time of day. If a user shows less activity during late-night hours in a region, they are more likely to be from that region. We assigned a weight of 0.3 to activity hours and 0.7 to sleep hours. This method was validated against web traffic data from a partner. It showed an error rate five times lower than simple transaction time-based analysis, with an average error of less than 2%.

As attestation and digital credential services evolve, more accurate regional analysis will be possible. This will become a key tool for analyzing the Web3 ecosystem, which requires understanding both local context and user behavior patterns..

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.