Welcome to Tiger Research Weekly.

Every Monday, we break down what moves crypto markets and explain why it matters. This week, Bitcoin drops 20% while our $200K target holds, Stream’s xUSD fallout exposes DeFi’s risk curators, and Coinbase quietly builds a full Web3 stack.

Markets move fast. Clarity matters most.

Let’s dive in.

Bitcoin fell below $100,000, declining 20%+ from October highs following $19B in leveraged position liquidations

Japan’s megabanks launched a government backed digital yen pilot to cut cross border payment costs.

The U.S. government shutdown reached 38 days, locking about $1T in Treasury accounts and draining liquidity.

Emerging signs of a resolution this week boost expectations that liquidity will return to risk assets including crypto.

Risk Curator

What they are: Risk curators control how capital flows and how much risk DeFi lending pools take. They set collateral rules, interest rates, and decide which assets to lend or borrow.

Why they matter: Poor risk curators cause bad exposure and sudden losses (as seen in Stream’s xUSD depeg). One failure quickly spreads fear across DeFi.

The challenge: DeFi collapses can spread fast. Investor trust now depends on curator credibility, but transparent verification is still missing.

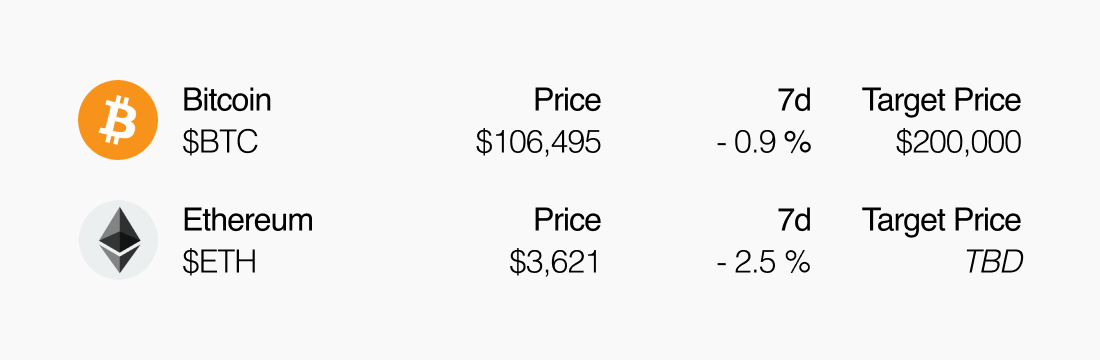

Bitcoin Drops 20%, Maintains $200K Target Price

Bitcoin dropped to $100K after macro shocks and record liquidations. The $100K zone now tests real demand and leverage reset.

Global liquidity keeps rising, institutions keep buying, and strong fundamentals support the 200K target.fundamentals stay strong.

Coinbase Built x402’s Payment Infrastructure

x402 lets AI pay for data and services without human approval.

Coinbase uses it to move the web from ads to real transactions between machines.

Coinbase Built Complete Web3 Vertical Stack

Liquifi manages tokens, Echo raises capital, and Base runs projects as one connected flow.

Their combined activity strengthens the Base ecosystem and builds value for the future $BASE token.

2025 KRW Stablecoins Status

Korea’s stablecoin market advances ahead of regulation as major players race to issue won-backed tokens.

Banks, tech firms, and global projects test networks while regulators debate control, letting first movers shape the market.