The series of acquisitions — Liquifi, Echo, and Base — reveals Coinbase’s underlying strategy to dominate the entire Web3 infrastructure stack. This report will examine how Coinbase is systematically consolidating control over the Web3 ecosystem.

Key Takeaway

Through the acquisitions of Liquifi and Echo, Coinbase has extended its ecosystem to cover the pre-token issuance stage.

With Base as the core network, Coinbase is building a comprehensive onboarding system for Web3 projects.

1. Why Coinbase Entered the Token Issuance Market

As examined in previous reports, Coinbase has steadily expanded its business scope over the past few years. The company has evolved from a simple crypto exchange into a regulated financial platform, adding custody services for client assets and payment infrastructure for digital assets.

With the launch of its own blockchain network, Base, Coinbase extended its reach into the broader Web3-native ecosystem. More recently, this expansion has accelerated through a series of acquisitions.

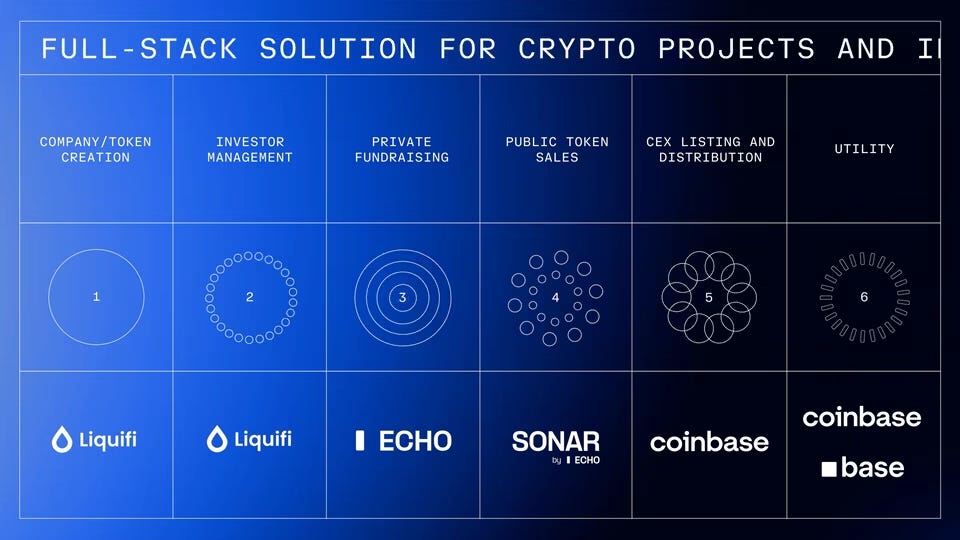

By acquiring Liquifi and Echo, Coinbase has moved further upstream in the value chain—into the pre-listing phase of token development. These two companies operate in the early stages of a project’s lifecycle, covering token creation and capital formation.

Through these integrations, Coinbase is filling a key gap in the Base ecosystem, positioning itself to support projects from inception and token generation to fundraising and eventual listing.

2. Coinbase’s Flywheel Strategy for the Web3 Ecosystem

2.1. Liquifi: From Project Formation to Token Management

Liquifi supports the entire process of token-based project creation—from legal setup to token generation and distribution management. For company formation, it connects projects with professional legal and accounting partners, enabling compliant and efficient establishment.

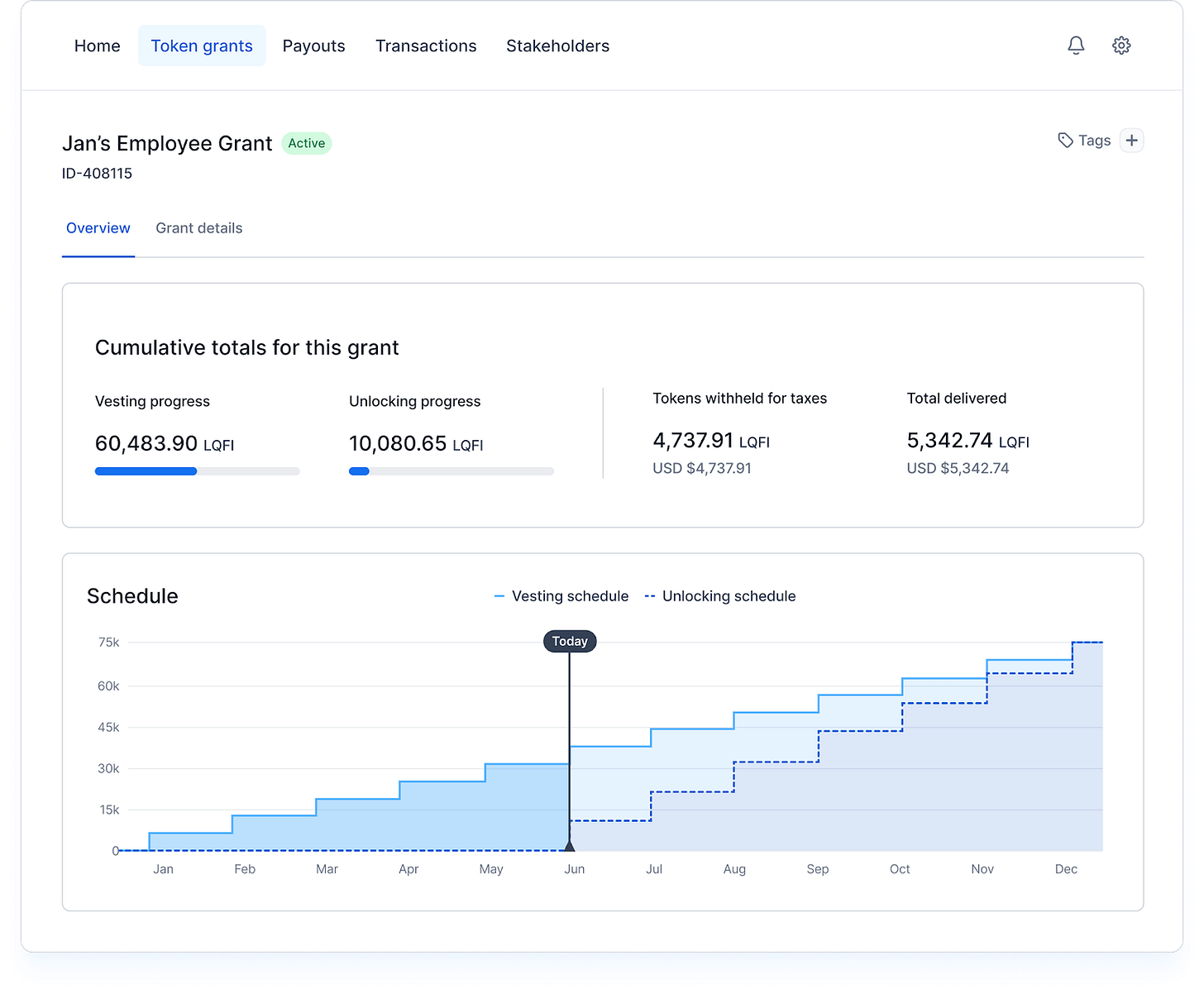

When issuing tokens, Liquifi provides tools to manage smart contract vesting and lockup schedules. Traditionally, modifying these parameters required direct edits to the smart contract, a process that became exponentially complex when managing hundreds or thousands of recipients. Each adjustment demanded additional developer time and carried the risk of human error. Liquifi eliminates this friction by allowing distribution terms to be modified without altering contract code, with calculations and allocations handled automatically.

The platform extends beyond issuance. It integrates custody solutions for token storage, airdrop execution for user distribution, and governance modules enabling holder participation in decision-making—all within a single interface.

As a result, Liquifi enables token projects to manage every operational stage—from formation and issuance to governance—through one streamlined platform.

2.2. Echo: Private and Public Token Sales

Echo focuses on the fundraising phase of Web3 projects. Traditionally, private sales required projects to sign separate agreements with each investor, creating heavy administrative and legal overhead. Echo simplifies this process through the use of Special Purpose Vehicles (SPVs), which aggregate multiple investors into a single investment entity. As a result, projects can manage funding through one consolidated contract instead of dozens of individual agreements.

For public sales, Echo operates through its platform Sonar. While the project itself manages the token sale, Sonar supports the process by handling compliance-related tasks such as identity verification (KYC) and other regulatory checks. This structure allows projects to raise capital within a compliant framework while minimizing operational burden.

By leveraging Echo, projects can reduce the complexity and regulatory risk associated with fundraising, allowing teams to allocate more resources to product development and growth.

2.3. Coinbase and Base: From Listing to On-chain Utility

Once fundraising is complete, projects that meet Coinbase’s listing standards can proceed to exchange listing. Beyond listing, projects can continue their on-chain operations directly within Base, integrating user engagement and ecosystem participation.

From the project’s perspective, Coinbase now offers a fully integrated pathway—from formation and management (Liquifi), to fundraising (Echo), and ultimately to listing and user acquisition (Base).

For Coinbase, this approach mirrors Apple’s integrated model, where both hardware and software are developed in-house to maintain ecosystem control. Similarly, Coinbase is building a vertically integrated Web3 infrastructure, designed to internalize every stage of a project’s lifecycle within its ecosystem.

3. The Base Ecosystem

Within the industry, it is widely expected that Base will eventually launch its native $BASE token. For such a token to achieve meaningful value, the underlying ecosystem must demonstrate strong project activity and growth potential. Coinbase’s recent acquisitions can be understood as efforts to build the infrastructure necessary to support that outcome—an integrated onboarding system capable of attracting high-quality projects to Base.

This system parallels Amazon Web Services (AWS) in its early role within the startup ecosystem. Just as AWS removed the technical burden of server management and enabled a surge of new online services, Coinbase aims to lower the operational and regulatory barriers for Web3 developers building on Base.

The structure creates a mutually reinforcing dynamic between Coinbase and participating projects. Coinbase provides the infrastructure—through Base, Liquifi, and Echo—that simplifies legal, technical, and fundraising challenges. In turn, successful projects strengthen the Base network’s utility and visibility.

Ultimately, the value of Coinbase’s integrated Web3 infrastructure will depend on the quality and success of the projects launched on the Base chain.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.