SEA Blockchain Developer Ecosystem

Focus on Vietnam, Philippines, Singapore, Thailand, and Indonesia

TL;DR

The Southeast Asian developer market can be an important base for the Web3 industry due to its low wages and large population.

Blockchain developers make up a small percentage of the overall developer pool, due to the relatively low stability and difficulty of learning the technology.

It's important to understand the unique developer landscape in each country and approach it with a customized strategy. Cooperating with a team that can communicate in the local language is essential.

Web3 markets grow with the active participation of various ecosystem participants. The most common way to encourage such growth is by rewarding participation with tokens with the shared goal of mutual growth. This is especially prominent in the infrastructure sector such as L1 and L2 blockchain protocols, as it is important for software developers (hereinafter referred to as developers) to build new standards and services on top of the infrastructure which in turn encourages participation of general users. Therefore, many Web3 projects are attempting to establish developer hubs in each country and hold various events to attract participation.

Compared to other regions, the Asian market can be an important base for the Web3 industry, mainly due to 1) relatively low developer salaries and 2) a large population compared to Europe and North America. In the U.S., entry-level developers can be paid upwards of $60,000. In comparison, developers can be hired for around $10,000 in places like India and Vietnam. Furthermore, the number of developers in these countries is continuing to grow, giving them the advantage of a large labor pool at a relatively low cost.

The state of developers in Southeast Asia

Currently, there is no single source of information on the number of developers in each country in Southeast Asia. The chart above is an estimate based on publicly available data from various sources for the purpose of showing the growth trend of the number of developers in each country. Some countries such as Malaysia had limited publicly available data. Thus, the report will focus on the five major countries shown above.

Based on the chart, Vietnam has the most developers, followed by the Philippines, Singapore, Thailand, and Indonesia. Vietnam has been known to have a high number of developers, as covered in our previous special report. It is noteworthy that Indonesia does not have a high number of developers relative to its population, which can be attributed to 1) a low conversion rate of IT majors to developers (30%) and 2) insufficient investment in technology R&D.

Blockchain developer environment in each country

Overall, the level of developers in the Southeast Asian market is on the rise, but it falls short of taking on advanced fields such as artificial intelligence and blockchain technology. With a low median age and lack of experience in leadership positions in global projects, there are relatively few people who can take on managerial roles for entire teams. However, the number of C-level managers is increasing across the country and efforts are being made to increase the level of developers at the national level, which indicates future improvement.

Yet, blockchain developers still represent a small percentage of the total developer market. This is a common setting in other global countries as well, where 1) blockchain companies are smaller and less stable than their other local companies, and 2) developers must go through another learning curve for a new technology, resulting in high switching costs. Therefore, it is necessary to understand the local developer environment in each country and build corresponding strategies.

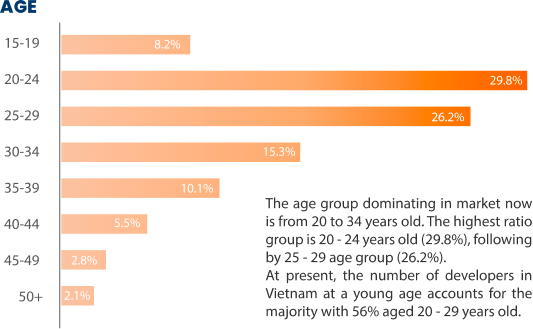

Vietnam: Concentration of young developers

Vietnam's developer market is heavily skewed toward a younger workforce with 56% of developers under the age of 30. While this means that senior developers are hard to find, it also means young developers face low sunk costs when considering the transition to blockchain development. In addition, the global success of Axie Infinity in the past has encouraged many young developers to move into the blockchain space.

Vietnam has more university courses and communities around blockchain development than other countries. It is also worth noting that Vietnam has a lack of regulatory clarity, which means that community-based initiatives have more influence than local companies.

Philippines: Growth centered around major companies

With a clear regulatory environment, the Philippines is advancing its blockchain industry around major companies, such as SCI Ventures and Acudeen. On the education front, there are well-established Web3 education platforms such as Bitskwela, and blockchain courses offered by major educational institutions also play an important role in skill acquisition. Additionally, venues such as Blockchain Space Manila serve as educational events and focal points for the blockchain community.

Singapore: Developers attracted by stable jobs

Singapore's Web3 developer market shows a high concentration of developers due to the clarity of regulations and the presence of global blockchain companies. Singapore has a strict and organized regulatory framework for blockchain technology and cryptocurrencies. This provides a stable and predictable environment for companies which directly translates into job security for developers. However, not that many new entrants consider the market as viable as is too established to create a new local developer community compared to other countries.

Thailand: An ecosystem based on partnerships between institutions and businesses

Thailand is a market characterized by partnerships between organizations and companies, as covered in our previous reports. The recent election of pro-crypto Prime Minister Srettha Thavisin is expected to further strengthen this trend. The Thailand Blockchain Community Initiative, which involves 14 Thai banks and several large corporations, is one of the most prominent examples. Thailand is also a country with a digital nomad-friendly environment such as Chiang Mai and Koh Phangan.

Indonesia: A developing ecosystem

As covered in our previous special report on the Indonesian market, the country's blockchain industry is in its infancy compared to other countries. It also does not have a large pool of developers, so it relies on outsourced developers from India, Vietnam, and elsewhere. The developer community is also still nascent, with BlockDev.id being the largest community and growing the Indonesian developer market. In addition, the Indonesian Blockchain Association (Asosiasi Blockchain Indonesia) is gradually becoming the centerpiece of the ecosystem, and continuing development.

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.