Web3 IPOs: The New Silk Road of Fundraising

Web3’s Bold Move Toward Regulatory Clarity and Market Access

This report by Tiger Research analyzes why Web3 companies are shifting from token-based fundraising to IPOs, and how this transition impacts their growth strategies and the broader industry ecosystem.

TL;DR

Web3 companies strategically implement IPOs to establish formal regulatory frameworks. This approach builds credibility with institutional investors and regulatory bodies. It also facilitates their integration into traditional financial markets.

Token-based fundraising methods reveal structural limitations including extreme price volatility, regulatory uncertainty, and liquidity management burdens. These issues highlight the increasing necessity for transition to IPOs as a more stable and long-term funding model.

IPO activities are expected to increase among centralized exchanges (Bithumb, Kraken), stablecoin issuers (Circle, Paxos), and Web3 solution providers (Chainalysis, Nansen). These companies will likely use IPOs to expand accessibility to institutional investors and strengthen their global competitive position.

1. From Tokens to Stocks: The IPO Trend in the Web3 Industry

Circle, the issuer of stablecoin USDC, filed for an Initial Public Offering (IPO) with the U.S. Securities and Exchange Commission. This action has sparked growing interest in IPOs across the Web3 industry.

Web3 companies have previously favored token-based fundraising methods. They directly approach retail investors through ICOs (Initial Coin Offerings) and IDOs (Initial DEX Offerings). They also sell future token rights to institutional investors through SAFT (Simple Agreement for Future Tokens). These approaches accelerated early growth in the Web3 industry. However, extreme token price volatility and regulatory uncertainty create ongoing concerns for institutional investors. The token-based model significantly hinders institutional investors from realizing returns on their investments.

IPOs have emerged as an alternative option against this backdrop. Web3 companies can secure more stable, long-term funding through IPOs. They can reduce legal uncertainties through proactive regulatory compliance. Companies also gain access to a broader, more diverse investor pool. They can establish standardized enterprise valuation frameworks. This report analyzes the key factors driving Web3 companies to transition from token-based models to IPOs. It examines the impact of this shift on the industry ecosystem and future outlook.

2. Why Web3 Companies Choose IPOs

2.1. Regulatory Trust as a Strategic Asset

Web3 companies use IPOs as 'regulatory compliance certification marks.' Food companies gain consumer trust through quality certification. Similarly, IPOs allow Web3 companies to demonstrate their regulatory compliance efforts clearly to the market. This strategy works especially well in sectors where trust drives competitive advantage, such as stablecoin issuance or custody services.

Circle's persistent pursuit of an IPO demonstrates its strategic importance. Circle attempted a SPAC listing in 2021 without success. Now it pursues an IPO again in early 2025. Circle obtained a New York BitLicense and published reserve reports regularly since 2018. These actions built stablecoin credibility. Yet Circle achieved only limited trust without formal market verification. An IPO allows Circle to formalize its credibility through SEC's standardized disclosure framework. This approach provides Circle with a 'market entry passport' unlike Tether. It enables collaboration with global financial institutions. It grants access to broader traditional markets.

Coinbase demonstrates the strategic value of regulatory compliance through IPOs. Coinbase maintained strict regulatory compliance before its IPO. After going public, the company expanded rapidly. It formed strategic partnerships with BlackRock. It provided ETF custody services. It collaborated with over 150 government institutions. This growth indicates that institutional investors officially recognized Coinbase's regulatory compliance efforts through its IPO. This recognition created a key competitive advantage in building trust.

2.2. The Dilemma of Token-Based Fundraising

Token-based fundraising played a crucial role during the Web3 industry's early growth stage. It provided fast and efficient funding methods. However, companies face unique complexities after token issuance. They must rely on centralized exchanges (CEXs) to expand investor accessibility. Exchanges use opaque and subjective listing criteria. This creates significant uncertainty. Companies must provide direct liquidity or secure market making partnerships after listing. Traditional IPO processes follow standardized procedures and clear regulations instead.

Price volatility presents another major problem. Large unlock events cause serious market price fluctuations. Keyrock reports that 90% of unlock events push prices downward regardless of their type or size. Team token unlocks cause steep average price drops of 25%. These price crashes make it difficult for institutional investors to realize returns on their investments. They strengthen institutional investors' negative perceptions.

These trends change the cryptocurrency venture capital market tangibly. Decentralised.co reports global cryptocurrency venture capital investment dropped by over 60% from 2022 to 2024. Singapore's ABCDE Capital recently halted new project investments and fund raising. These actions demonstrate visible market shifts.

Companies struggle to connect token-based business models with operational activities. Aethir and Jupiter achieve significant revenue in the Web3 industry. Yet these business achievements rarely link to token prices. They often blur business focus. Fireblocks and Chainalysis primarily provide centralized services rather than tokens. Token issuance lacks organic fit and clear justification for these companies. Designing and proving token utility presents a major challenge. This diminishes focus on existing business. It creates additional regulatory and financial complexities. Web3 companies therefore find IPOs an attractive alternative.

2.3. Expanding Investor Accessibility

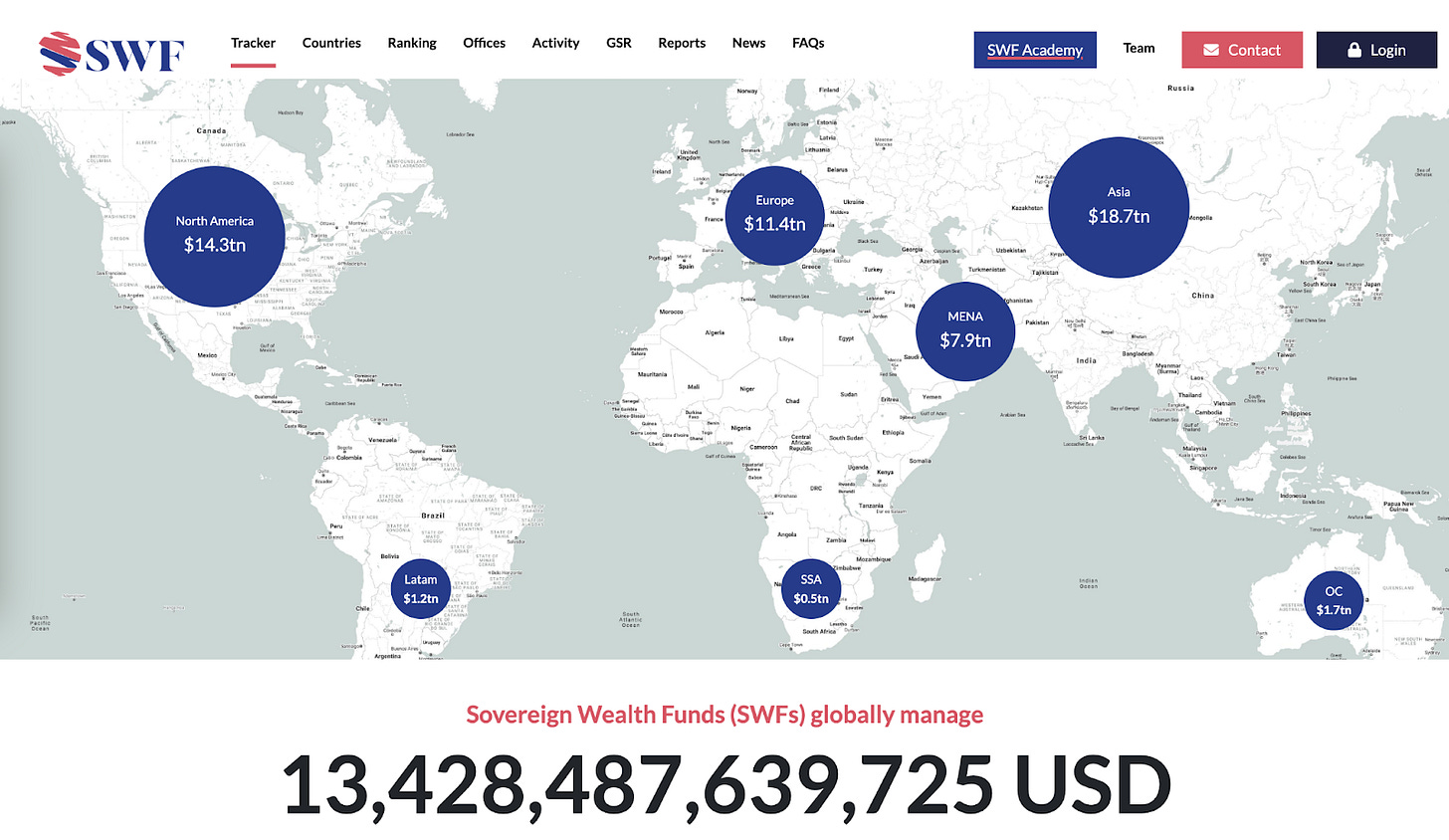

IPOs offer Web3 companies their greatest advantage: access to large institutional capital unavailable through token-based funding. Traditional financial institutions, pension funds, and mutual funds cannot invest directly in cryptocurrencies due to internal compliance policies. These institutions can invest in stocks of companies listed on regulated securities markets. Global sovereign wealth funds manage approximately $13 trillion in assets. This reveals the potential capital pool that Web3 companies can access through IPOs.

IPOs create effective indirect investment routes even in countries with strict cryptocurrency regulations like Korea and Japan. Korean institutional investors cannot directly invest in Bitcoin ETFs. They can participate indirectly in cryptocurrency markets through listed companies like Coinbase or MicroStrategy. Japanese investors can bypass high cryptocurrency trading taxes. They gain efficient cryptocurrency investment opportunities through Metaplanet stocks. This expanded accessibility will likely promote participation from diverse investors. It provides legal and stable investment vehicles within regulatory environments.

2.4. Role as a Flexible Funding Instrument

IPOs enable companies to secure large-scale capital effectively. Coincheck and Coinbase successfully raised funds through IPOs and pursued aggressive business diversification. Coincheck acquired Next Finance Tech using funds secured after its Nasdaq listing. Coinbase expanded its global competitiveness by acquiring FairX (derivatives exchange), One River Digital (asset management), and BUX Europe (EU market entry). While the exact contribution of IPO proceeds to these acquisitions remains undisclosed, they likely provided an important foundation for these expansion strategies.

IPOs also allow companies to use their stock as acquisition currency. Companies can execute M&A deals using stock consideration. This approach reduces reliance on cash or volatile cryptocurrencies. A listed company can achieve efficient capital management and build strategic partnerships by using its shares as payment in acquisitions. Listed companies can continue accessing diverse capital market instruments after their IPO. They can utilize new share issuances, convertible bonds, and rights offerings. These tools enable ongoing flexible and efficient fundraising that aligns with their growth strategies.

3. Future Outlook for Web3 Industry IPO Market

IPO activity in the Web3 sector will intensify in the coming years. This trend reflects both the accelerating institutional integration of Web3 and the growing success cases like Coinbase, which have secured substantial capital through public offerings and expanded globally. Centralized exchanges, custody service providers, stablecoin issuers, and Web3 solution firms will lead this IPO momentum.

3.1. Centralized Exchanges and Custody Providers

Exchanges like Bithumb, Bitkub, and Kraken, alongside custody providers such as BitGo, represent prime IPO candidates. These firms build competitive advantages through regulatory compliance and asset security. They need IPOs to boost institutional credibility and market strength. Their revenue closely ties to crypto market cycles. IPO funds will help them diversify and develop new ventures for stable revenue.

3.2. Stablecoin Issuers

Following Circle, compliant stablecoin issuers like Paxos will likely pursue IPOs. The stablecoin market values transparent reserves and regulatory clarity. IPOs demonstrate compliance frameworks and build market trust. Global regulations like Europe's MiCA and the U.S. Stablecoin Act continue to evolve. IPOs will give these issuers strategic advantages in this changing landscape.

3.3. Web3 Solution Companies

Web3 analytics firms like Chainalysis and Nansen also represent prime IPO candidates. These companies provide specialized services to government and institutional clients. They need IPOs to enhance market credibility and strengthen their global leadership position. The capital raised through IPOs will fund technology advancement, international expansion, and talent acquisition to build sustainable growth foundations.

4. Closing Thoughts

The rise of IPOs in the Web3 industry signals a clear shift toward mainstream capital markets. Web3 companies use IPOs not only to raise funds, but also to formalize regulatory compliance, attract institutional investors, and boost global competitiveness. With declining crypto venture capital investments, IPOs now offer a stable and flexible fundraising alternative.

However, IPOs may not suit every Web3 company. Even companies pursuing IPOs likely will not abandon token-based fundraising entirely. IPOs provide broader capital access, stronger credibility, and easier entry into global markets. Yet they require substantial investment in regulatory compliance, internal controls, and public disclosures. Token models, on the other hand, enable rapid early-stage fundraising and foster active community ecosystems.

Companies can strategically combine both models. Exchanges can use IPOs to build institutional trust and expand globally. At the same time, they can utilize tokens to increase user engagement and loyalty. Web3 companies must carefully choose the optimal mix of IPO and token issuance based on their business model, growth stage, and market strategy.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.