ZA Bank: Asia's First Retail Crypto Banking Service

How Hong Kong's Digital Bank is Bridging Traditional Finance with Bitcoin and Ethereum Trading

This report was written by Tiger Research, analyzing ZA Bank's groundbreaking launch of Asia's first retail crypto banking service and its implications for the financial industry

TL;DR

ZA Bank’s retail crypto trading service exemplifies Hong Kong’s progressive approach to merging traditional banking with digital assets, offering users 24/7 access to Bitcoin and Ethereum trading.

Hong Kong’s regulatory framework positions the city as a regional leader in virtual asset integration while maintaining compliance and consumer trust.

The broader impact of this initiative highlights new opportunities for financial institutions across Asia to adopt similar models, blending crypto’s growth potential with the stability and trust of traditional banking systems.

1. Convergence of Traditional Finance and Cryptocurrency: A New Paradigm in the Financial Industry

The convergence of traditional banking and crypto is reshaping the financial landscape. As crypto shifts from speculative assets to core financial components, banks are integrating crypto services to meet growing consumer demands for accessibility, security, and innovation. This shift underscores a broader transformation in financial services, where traditional institutions adapt to the needs of a digital-first economy.

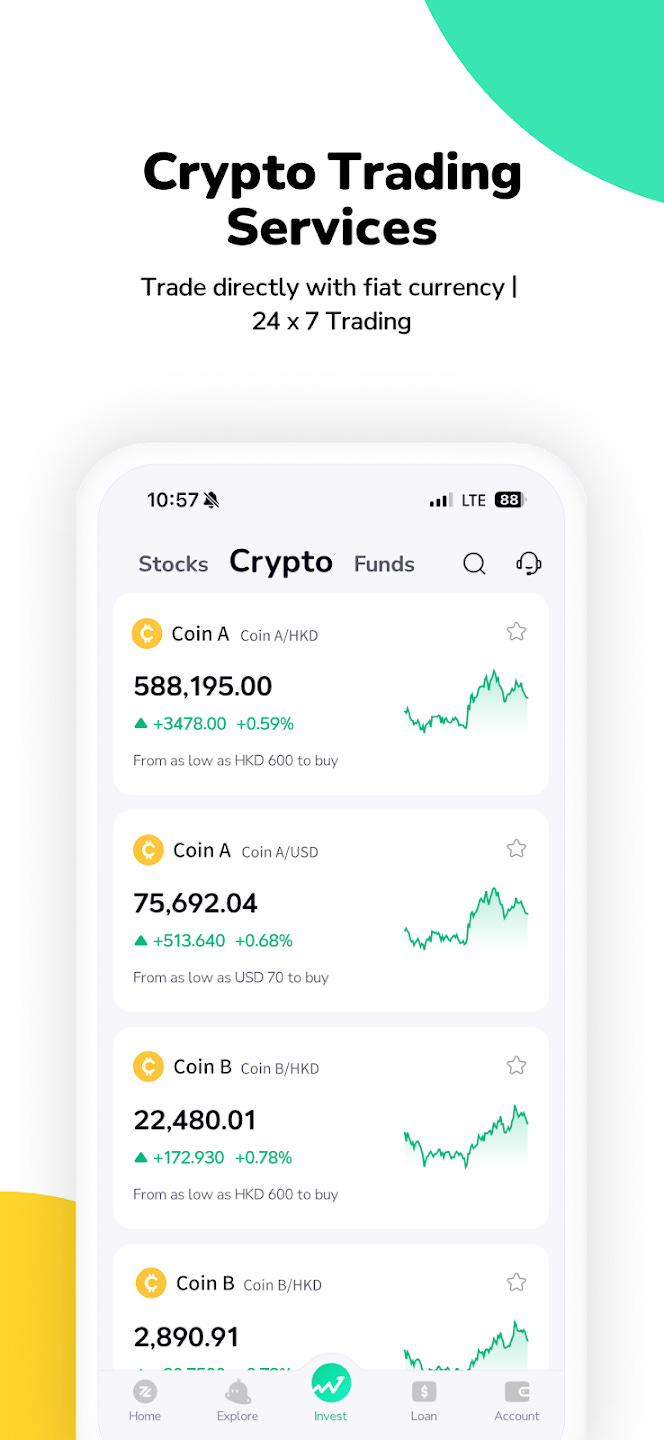

Hong Kong is actively fostering the growth of the cryptocurrency ecosystem by leveraging its well-structured regulatory framework. Within this environment, ZA Bank has introduced retail cryptocurrency trading services, creating a successful example of the fusion between traditional finance and digital assets. The bank is the first in Asia’s financial sector to allow direct cryptocurrency trading within its banking app, significantly lowering the entry barrier for retail investors into the cryptocurrency market.

Hong Kong's actions are in stark contrast to those of Toss, a leader in South Korea's digital banking sector. Toss partnered with the cryptocurrency exchange Bithumb to offer cryptocurrency trading services; however, regulatory changes forced the suspension of the service. This serves as a critical lesson: a clear legal framework is essential for the sustainable growth of digital asset businesses.

This report will analyze the significance of ZA Bank's innovative approach, examine its alignment with Hong Kong's regulatory framework, and explore the new opportunities these changes could present for the global financial ecosystem.

2. Opening a New Horizon in Retail Cryptocurrency Trading

ZA Bank's cryptocurrency trading service is currently limited to Bitcoin and Ethereum. These two cryptocurrencies have gained significant credibility within the institutional sector, evidenced by the launch of ETF products. According to a survey by the Hong Kong Association of Banks, 70% of respondents prefer trading crypto through banking apps, citing convenience and security as the primary reasons.

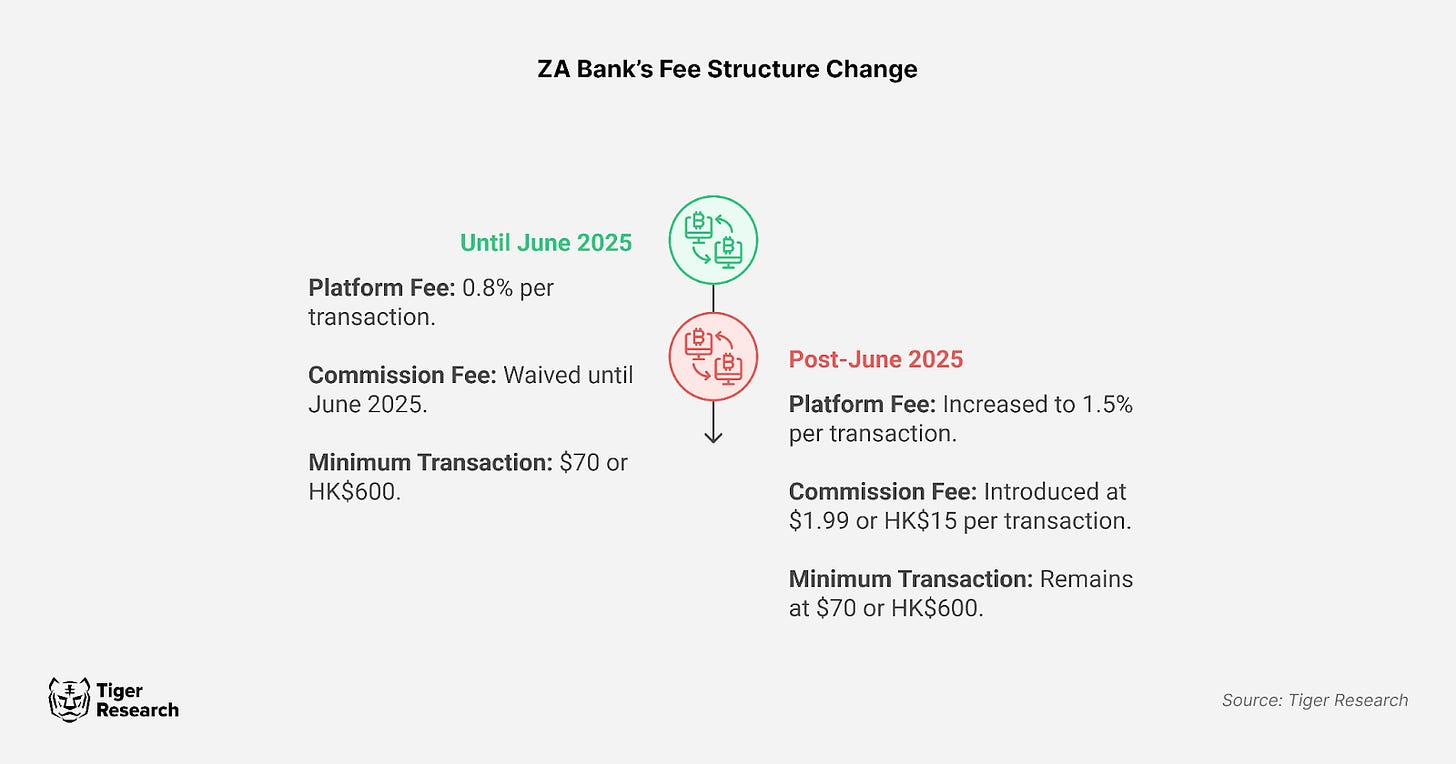

In a bold move, ZA Bank has introduced a fee-waiver policy until June 2025. During the promotional period, only a platform fee of 0.8% of the transaction amount will be charged, making it significantly easier for its 800,000 existing customers to enter the cryptocurrency market.

This strategic market entry is expected to grab the attention of new investors. By enabling transactions through a trusted financial institution, ZA Bank may encourage potential customers who were previously hesitant due to security concerns. This, in turn, is expected to contribute to the overall activation of the cryptocurrency market.

3. Harmonizing Strategic Partnerships and Regulatory Frameworks

ZA Bank has partnered with HashKey, one of Hong Kong’s top three cryptocurrency exchanges, to build the technical foundation for its crypto trading services. This strategic move ensures high levels of security and stability while meeting strict regulatory standards.

The background to this initiative lies in Hong Kong's proactive regulatory environment. In August 2023, retail cryptocurrency trading was legalized, and the Securities and Futures Commission (SFC) issued licenses to three exchanges: OSL, HashKey, and HKVAX. Following this, ZA Bank launched its services in October 2024 after completing a sandbox test.

ZA Bank’s measured approach has attracted widespread attention. With the SFC planning to issue additional licenses by year-end and advancing efforts to strengthen the crypto ecosystem, this initiative is poised to become a pivotal benchmark for other banks exploring cryptocurrency services.

4. The Impact of ZA Bank's Case on the Market

4.1. Active Entry of Traditional Finance

ZA Bank’s move distinguishes it within Asia’s financial ecosystem, marking the first instance of a retail bank offering crypto trading services. This development highlights a broader trend where traditional banks are moving toward digital asset integration, bridging the gap between conventional and decentralized finance.

Compared to Singapore’s DBS Bank, which offers crypto services exclusively to institutional clients, ZA Bank’s retail focus broadens market accessibility. While banks in Latin America and Europe have launched retail crypto offerings, these typically operate in less regulated environments. ZA Bank’s compliance with Hong Kong’s robust frameworks demonstrates how innovation and regulation can coexist, serving as a benchmark for others.

ZA Bank's bold move is likely to accelerate the adoption of cryptocurrency services by other banks across the Asian region. As demand for cryptocurrencies among general consumers continues to rise, financial institutions are considering the introduction of similar services to secure market competitiveness. However, most institutions are still in the "evaluation" phaseThis is largely due to the conservative nature of the financial industry, which tends to be hesitant about venturing into new business areas without precedents.

If ZA Bank successfully engages its customers in the cryptocurrency market and establishes a sustainable revenue model, it could become a key catalyst for other financial institutions to enter the market.

4.2. Bitcoin and Ethereum's Rise as Global Key Investment Assets

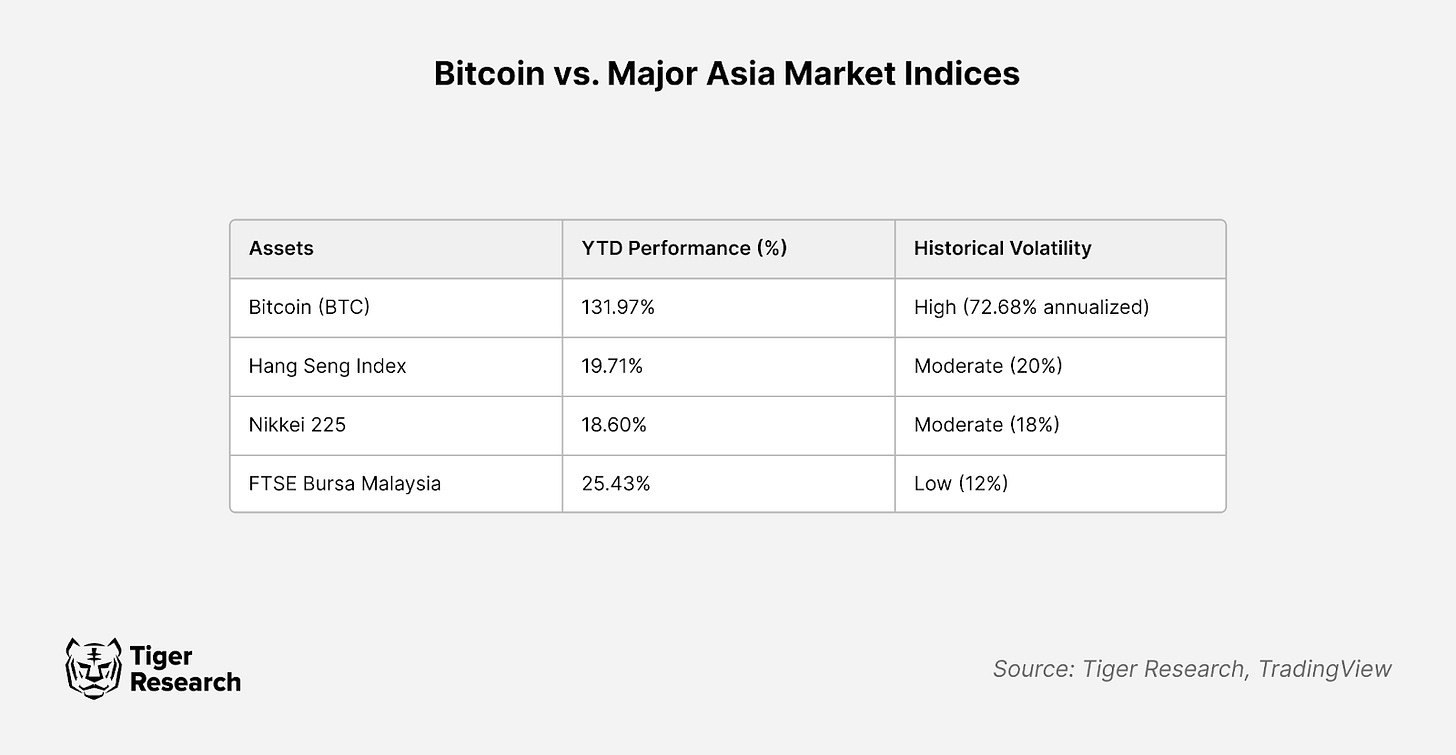

Bitcoin's year-to-date performance has significantly outpaced the major stock indices in Asia, clearly demonstrating its high-risk, high-reward nature. For ZA Bank, this performance comparison highlights the growing appeal of cryptocurrencies for investors seeking diversification.

While Bitcoin's volatility may pose challenges for risk-averse investors, its substantial upside potential provides a compelling reason for inclusion in broader portfolios. ZA Bank has addressed this market demand by offering cryptocurrency trading services. This move has attracted a diverse client base, ranging from conservative investors to those seeking exposure to new asset classes.

ZA Bank’s crypto trading service allows investors to easily access high-growth assets like Bitcoin, while still maintaining their exposure to fiat investments. As services that combine the strengths of traditional and digital finance continue to grow, Bitcoin is expected to solidify its position as a core asset in global investment portfolios, much like gold.

4.3. The Growth of Digital Banks into Comprehensive Financial Platforms

The global cryptocurrency market is evolving into integrated financial services, with centralized exchanges like Binance and OKX leading the way by incorporating Web3 wallets and consolidating fragmented services into comprehensive crypto offerings.

In contrast, ZA Bank has overcome the limitations of traditional banks’ legacy systems by offering a user-friendly UI/UX and streamlined services. Building on its established regulatory stability and positioning as a comprehensive financial platform, ZA Bank has further expanded its services by introducing cryptocurrency trading. This move presents a new growth direction for digital banks. Notably, ZA Bank's ability to seamlessly integrate cryptocurrency trading into its existing banking app sets it apart by offering a differentiated user experience.

Looking ahead, if ZA Bank expands its cryptocurrency offerings and introduces wallet services within the app, it will not only enhance trading services but could also redefine digital asset management. As a fully integrated financial platform that prioritizes regulatory compliance, security, and user convenience, ZA Bank is well-positioned to lead the future of digital finance, bridging traditional banking and cryptocurrency in a unified ecosystem.

5. Conclusion

ZA Bank’s retail crypto service marks a pivotal moment in the evolution of financial services. By integrating Bitcoin and Ethereum trading within a regulated banking environment, it addresses key consumer demands while setting a benchmark for compliance-driven innovation. This model could inspire other banks in Asia to explore crypto integration, fostering a competitive and dynamic financial ecosystem.

For decision-makers, ZA Bank’s initiative underscores the importance of strategic partnerships, regulatory alignment, and consumer-centric design. Businesses should prepare for a future where crypto services become standard in traditional banking, influencing payment systems, wealth management, and investment strategies.

As Hong Kong continues to position itself as a global crypto hub, ZA Bank’s offering highlights the potential for traditional institutions to lead the digital transformation. With thoughtful implementation and a focus on trust, security, and accessibility, the integration of crypto into mainstream finance could redefine the future of banking.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.