TL;DR

The South Korean cryptocurrency market is notable for its high trading volumes and enthusiastic investor participation. Despite regulatory constraints, it is a market with global reach.

Phenomenons such as kimchi premiums and fishing net pumping, are evidence of the unique characteristics and volatility of the Korean market which also stimulates the desire of international projects to enter the Korean market.

However, these characteristics are expected to be gradually mitigated with the gradual introduction of regulations. As such, it will be interesting to see how regulators move to strengthen the safety and soundness of the market in the future.

South Korea, crazy for crypto

The momentum of the cryptocurrency market has captivated South Korean investors, resulting in the daily trading volumes of cryptocurrency exchanges in the country surpassing traditional securities market, named 'KOSPI'. This trend underscores the significant interest in cryptocurrencies among the South Korean population.

The number of participants in the cryptocurrency market is as high as the trading volume. The Financial Intelligence Unit's (FIU) 'Survey Results of Virtual Asset Businesses in the First Half of 2023' revealed that South Korea's cryptocurrency exchange users number 6.06 million, representing approximately 12% of the nation's total population. This statistic reflects the significant portion of South Koreans engaged with the cryptocurrency market.

Moreover, the interest in cryptocurrencies among Koreans is on an upward trajectory, suggesting that the forthcoming 2024 survey report will likely document an even higher number of market entrants.

A restrictive market with high trading volume

The South Korean cryptocurrency market operates within a regulatory framework that limits market participation largely to the domestic population. Notably, individuals wishing to trade on major South Korean currency exchanges must meet specific criteria, including holding local residency, possessing a cell phone registered with a local telecommunications provider, and maintaining a real-name account for trading purposes. These regulatory measures mean domestic cryptocurrency exchanges practically cater exclusively to domestic users, consequently limiting trading volumes to the local populace.

Despite regulatory constraints, the trading volume within the South Korean cryptocurrency market exhibits a significant impact on par with the global market. South Korea's largest cryptocurrency exchange, Upbit, has achieved trading volumes that momentarily positioned it as the second highest globally in terms of spot trading volume. Moreover, a Bloomberg report highlighted that the Korean Won (KRW) constituted 42.8% of all Bitcoin/fiat transactions in November 2023, surpassing the dollar's 40% share. This data reaffirms the intense engagement and influence of the South Korean crypto market on a global scale.

Characteristics of the Korean crypto market

The trading dynamics within the South Korean cryptocurrency market are distinguished by their uniqueness, deeply rooted in the nation's rich cultural and regulatory landscape. This distinctiveness is critical to comprehending the market's operations and tendencies.

(The following is based on publicly available data from major Korean currency market exchanges and detailed data by cryptocurrency provided by Bithumb Exchange)

1) High altcoin trading volume

The South Korean cryptocurrency market distinguishes itself as the most vibrant hub for altcoin trading compared to any other country. As of March 21, 2024, the combined altcoin trading volume on leading South Korean exchanges, Upbit and Bithumb, constitutes approximately 78% of their total trading volume, with Bitcoin trades making up a mere 16%. This level of altcoin activity significantly surpasses that observed on major global platforms like Binance and Coinbase, where altcoin transactions are roughly 1.5 times greater than those of Bitcoin.

The preference for altcoin trading within the South Korean cryptocurrency market may mirror the aggressive investment strategies favored by Korean crypto investors. Data from the Korea Securities Depository and Settlement Service indicate a marked increase in retail investments into volatile foreign ETFs, with figures more than doubling in 2023 compared to the previous year.

Given that altcoins are typically defined by their low market capitalization, significant price volatility, and swift shifts in trading volumes—attributes that stimulate speculative interest—it's reasonable to deduce that the substantial altcoin trading volumes align with the broader investment patterns observed among South Korean investors.

2) Memes and themes

The trend of narrative-based investments is becoming increasingly prevalent within the South Korean investment community. Notably, there has been a significant surge in the number of holders of AI-related cryptocurrencies on Bithumb, mirroring the growing popularity of AI technology. Similarly, the dramatic rise in holders of meme coins, such as Floki and Shiba Inu, further shows the keen interest among Korean retail investors in aligning their investment portfolios with specific themes or trends.

Specifically, the 80% surge in the number of Floki holders on Bithumb, compared to the 10% average increase across the broader cryptocurrency market, distinctly points to an overheated investment climate.

In contrast, the scenario with Dogecoin highlights certain market anomalies; many investors faced losses during the previous bull run. As a result, temporary price spikes were often followed by sell-offs and a subsequent decrease in the number of holders, underscoring the volatile and unpredictable nature of investments in the crypto space.

3) Kimchi Premium

A significant characteristic of the South Korean cryptocurrency market is the "Kimchi Premium," which refers to the price premium observed on South Korean crypto exchanges. As of March 21, 2024, the kimchi premium was approximately 10% and rising. However, it seems relatively moderate compared to the 20%+ premiums seen during past bull runs. This moderation in the premium is likely attributable to the recent inclusion of stablecoins like USDT and USDC on local exchanges, which appears to have played a role in alleviating some of the price premium pressures.

Yet, 10%+ price premiums are nothing to laugh at. Even stablecoins have exhibited a premium exceeding 10%, which surpasses the USD/KRW exchange rate. This can be attributed to structural challenges within the Korean cryptocurrency market, particularly the constraints on arbitrage opportunities via forex or international crypto exchanges.

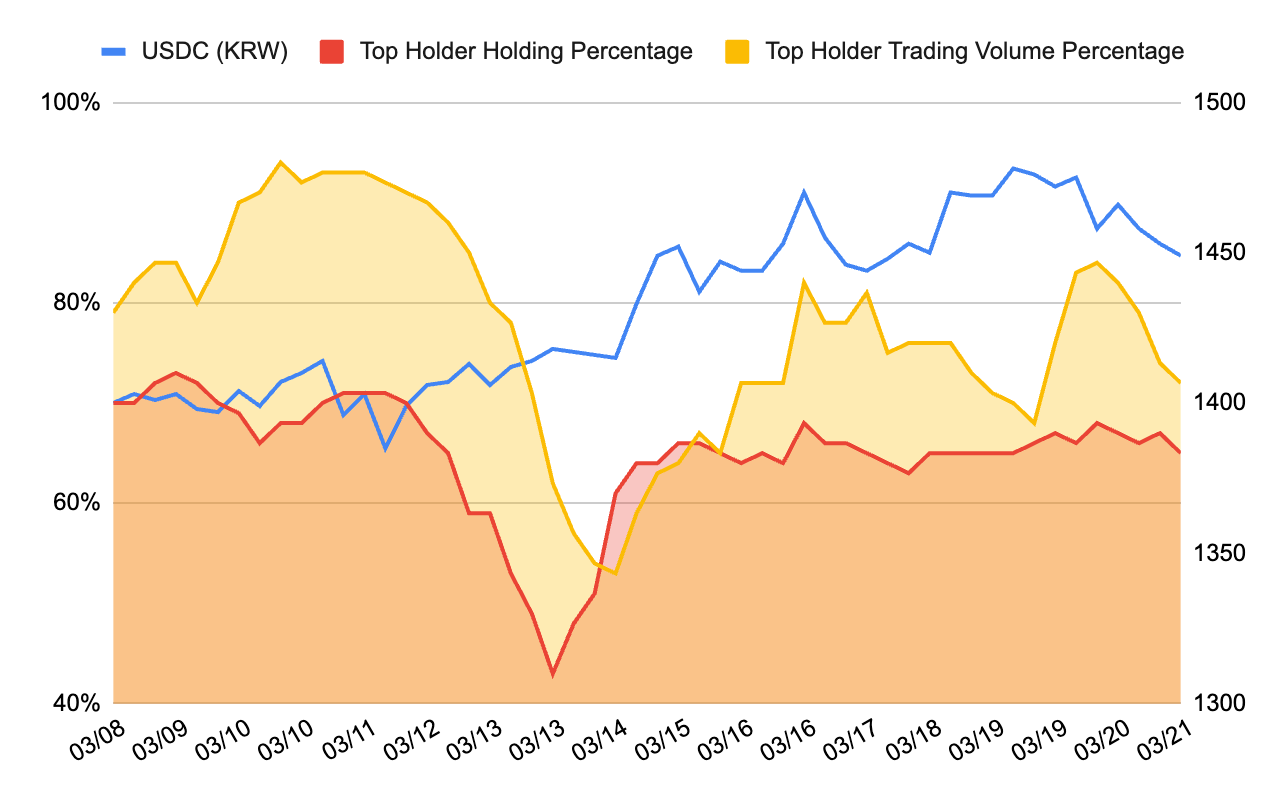

Some have criticized the marketing methods employed by local cryptocurrency exchanges. As these exchanges offer benefits to users based on trading volume, it has led to speculation that stablecoins, such as USDT and USDC, are being cyclically traded, influencing their market prices. Notably, on Bithumb, where membership benefits are tied to trading volume, the top 10 holders of USDC represent over 50% of the circulating supply and account for more than half of the trading volume.

4) Fishing Net Pumping

In our previous analysis, "Explaining Fishing Net Pumping in Korean Crypto Trading," we highlighted the recurring issue of "fishing net pumping" within the Korean cryptocurrency market which can be found frequently to this day.

This phenomenon involves well-capitalized speculators exploiting periods when deposits and withdrawals are suspended on an exchange to artificially inflate the price of a specific cryptocurrency. Interestingly, retail investors perceive these manipulated price surges as opportunities for potential gains, pushing many to adopt finishing net pumping as an investment strategy.

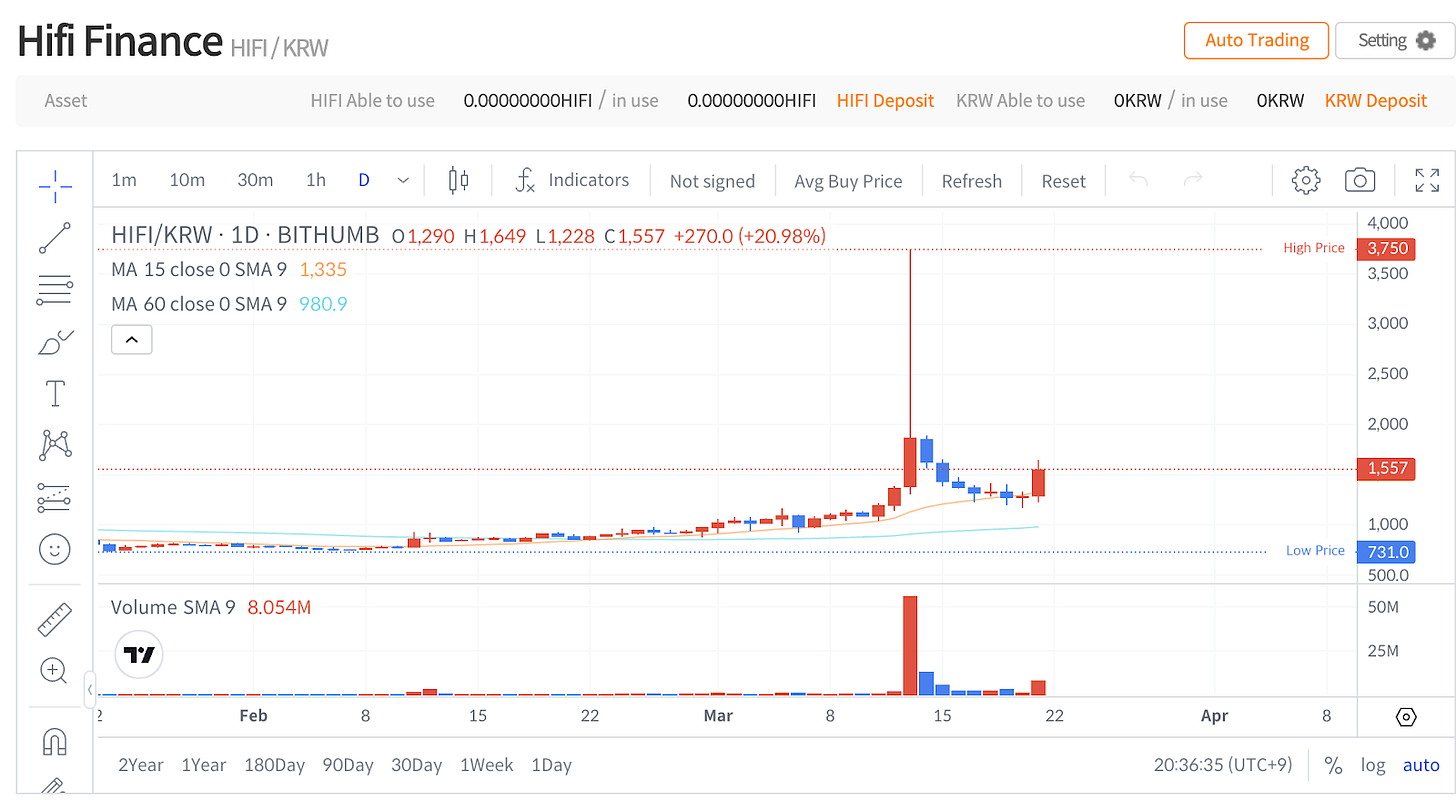

One instance is the cryptocurrency “Hifi Finance (HIFI)”. On March 13, 2024, the cryptocurrency, which operates on the Ethereum network, experienced a dramatic price surge, exceeding 120% within a single day. This surge was attributed to fishing net pumping which occurred amidst a temporary halting of transfers in anticipation of an Ethereum network update. The price of HIFI escalated from 2,400 to 3,700 KRW, resulting in a price differential from the global market of more than 120%

An examination of the data reveals that the top 10 holders of HIFI on Bithumb possess over 70% of the total volume, contributing to more than 40% of the trading volume. This significant concentration strongly suggests the presence of "fishing net pumping" activities.

Furthermore, the influx of new participants during such events surges by more than 2.5 times compared to the preceding day. This trend indicates that retail investors view "fishing net pumping" scenarios as advantageous opportunities, underlining the speculative appeal of such market dynamics to a broader investor base.

Conclusion

The South Korean cryptocurrency market, known for its substantial trading volumes and fervent investor engagement, has garnered significant interest globally. This environment has fostered a speculative atmosphere, with the characteristics outlined in this report representing just a segment of the market's dynamics. Albeit risky and aggressive, this behavior works as a key factor in attracting foreign projects seeking listings in Korea.

This may not be the status quo in the future, as the gradual implementation of regulatory measures is expected to usher in a period of stabilization for the South Korean cryptocurrency market. Such regulatory changes aim to safeguard the market's integrity and health. However, for international projects, the once-coveted liquidity of the Korean market may lose some of its allure in the face of these new regulations.

It is imperative for stakeholders to closely monitor the evolving trends and shifts within this market. Understanding how the South Korean cryptocurrency landscape adapts and evolves in response to regulatory changes will be crucial for both domestic and international participants looking to navigate its future dynamics.

Get 20% off your SEABW ticket today!

Join us at the biggest blockchain event of the year in Southeast Asia! This is your chance to connect with industry leaders, explore innovative blockchain solutions, and engage in valuable networking opportunities. The event runs from April 22nd to 28th in Bangkok.

Exclusive Offer for Our Readers: Use code TIGERR20 to receive 20% off your general admission tickets. Tickets are limited — secure yours now to ensure your spot at this event. (Discount automatically applied through the link below).

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.